December 18, 2025

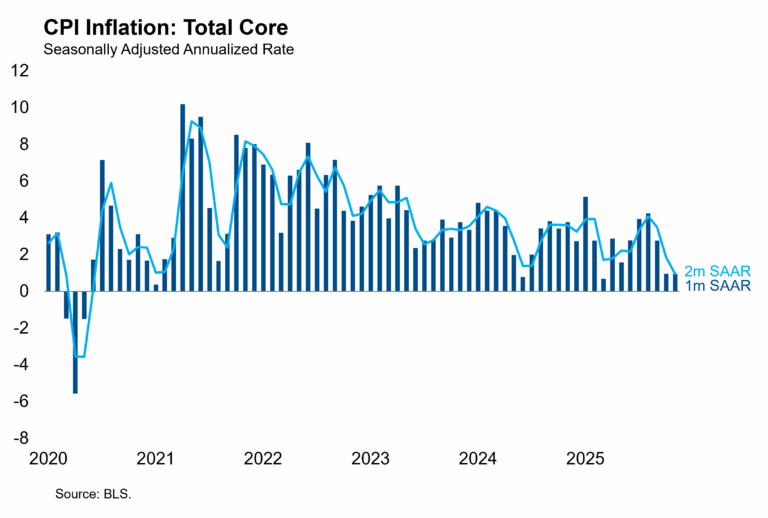

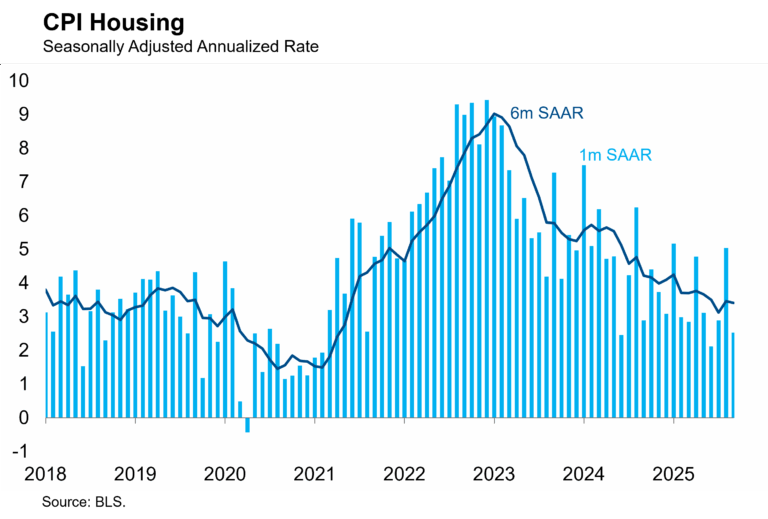

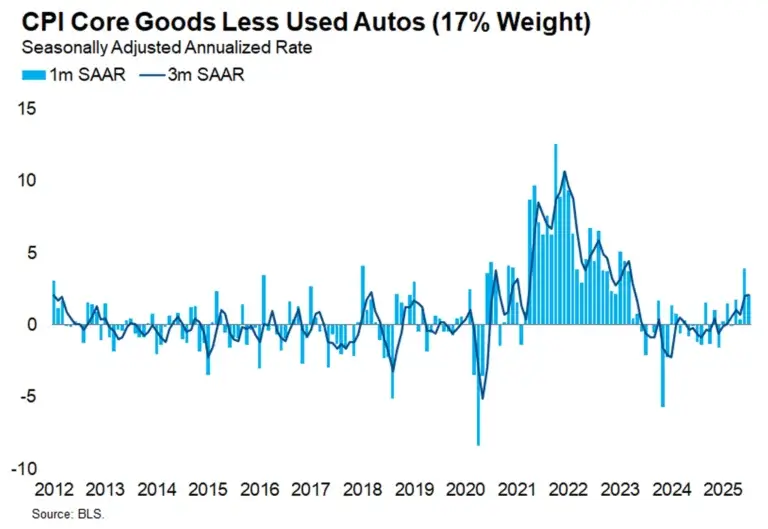

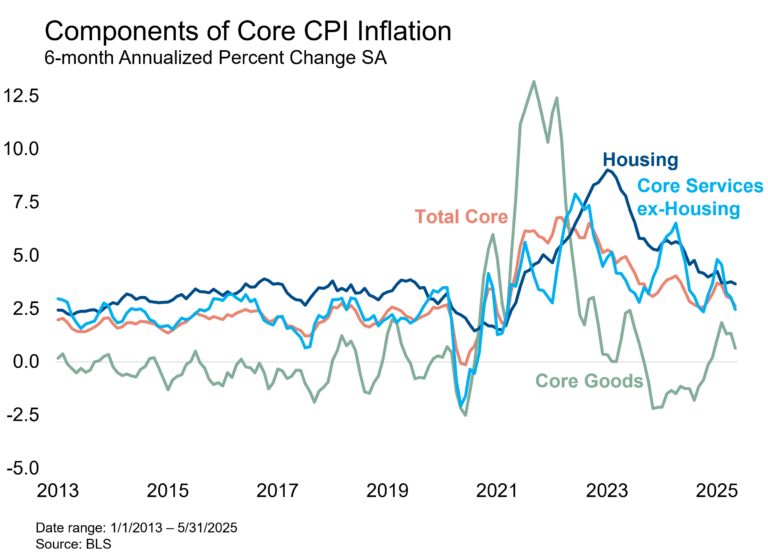

Heavily Distorted CPI Print Reveals Little Useful Information

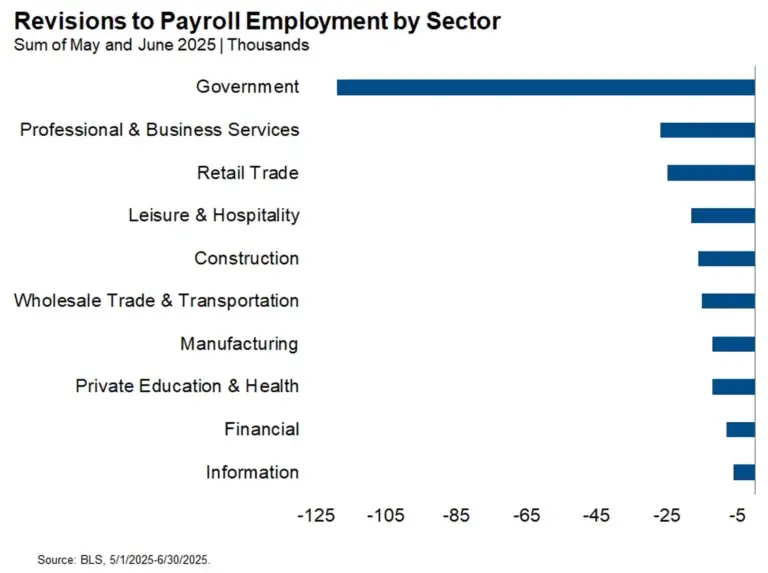

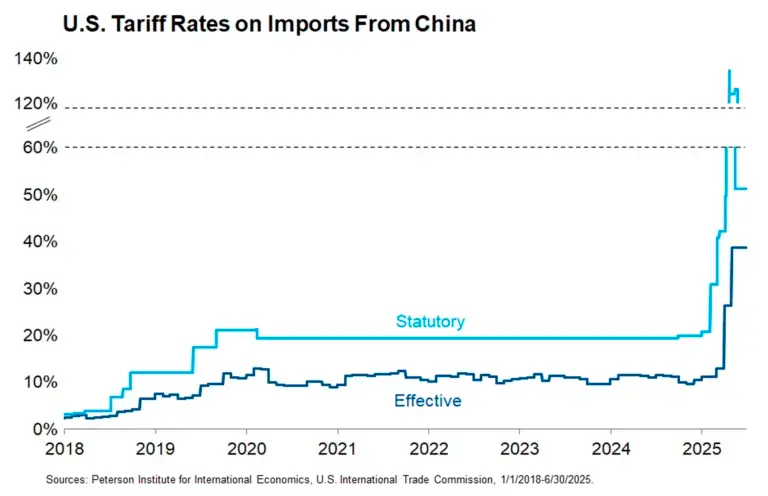

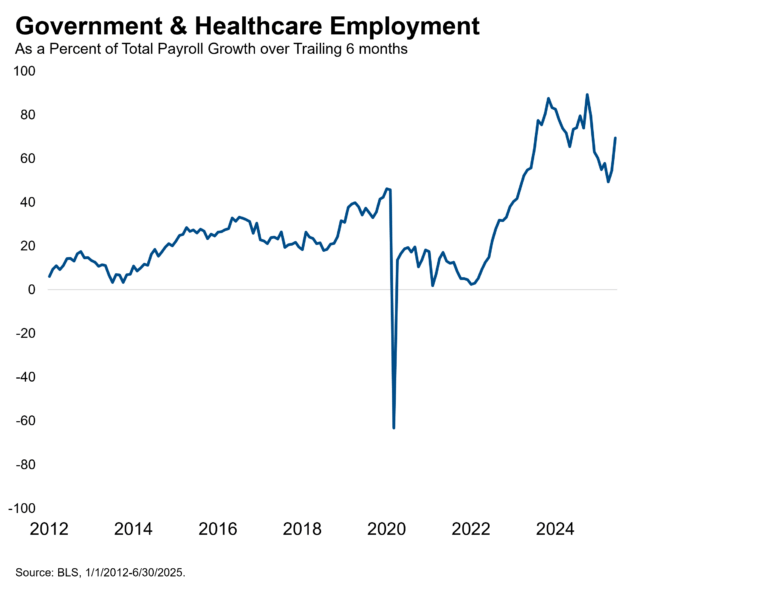

The BLS today released a heavily distorted CPI report that included some information for both October and November. The BLS stopped collecting price data when the government shutdown began on October 1 and did not resume collection until November 14. Because the data are missing, the agency did not publish...