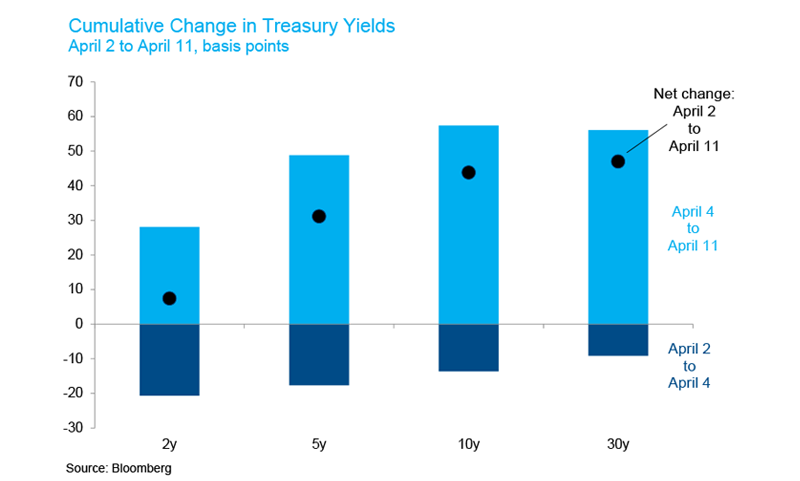

The rise in long-term Treasury yields last week surprised market participants and may have played a role in President Trump’s decision to temporarily pause the highest tariffs. The price action has been extreme: 10-year and 30-year Treasury yields registered their largest weekly increases since 2001 and 2008, respectively. It is indeed unusual and a bit unnerving to see Treasury yields rising by such magnitudes during a week that included a 12% equity drawdown and the VIX trading above 50. The yield curve bull steepened (yields falling most at the front end) on April 3 and 4 in the initial response to the tariff announcement. That was the reaction we would have expected to such a negative shock to sentiment and the growth outlook. Last week’s bear steepening reversed that expected pattern and then some. For the bond nerds out there, this bear steepening has the hallmarks of a real term premium shock, though it’s too early to draw firm conclusions.

Technical Factors

There were some indications of deleveraging in the Treasury market, including anecdotal reports and the volatility in swap spreads. Many commentators have wondered if an unwind of the basis trade is contributing to the Treasury selloff – a reasonable question given that exposure to the basis trade is thought to be so large. We do not see evidence of a disorderly basis trade unwind, particularly as the basis itself has only widened modestly (implied financing rates on most Treasury futures contracts have only risen by 20-30 bps versus SOFR, far less than other stress episodes like March 2020). It seems more accurate to say that a general deleveraging of Treasury positions and perhaps swap spread positions has exacerbated the volatility under modestly strained liquidity conditions.

Foreign Buyers’ Strike

Foreign investors own one third of Treasury debt outstanding, split roughly evenly between private investors and foreign official institutions. Given that this economic shock was caused by a trade war replete with inflammatory rhetoric, it is reasonable to ask whether our trading partners might utilize the leverage afforded by their Treasury holdings. Auction statistics are imprecise, but the weak demand from direct bidders at the 3-year and 10-year Treasury auctions caused some concern in this regard early in the week. However, direct bidders returned at the well-supported auction on Thursday, April 10.

We have long doubted that foreign governments would weaponize their Treasury holdings, since it would be a self-defeating tactic for their own portfolio valuations and in some cases their exchange rate policies. That said, President Trump’s tariff policy announcements represent the most aggressive trade war escalation in a century, so the risk is higher now than it has been in the past. If China or others did pursue a disorderly liquidation of their Treasury holdings, we are confident that the Federal Reserve would quickly intervene to restore market functioning. We still consider that a small tail risk, but we won’t be shocked if we later find out that China skipped the 3-year Treasury auction as a warning shot. The Treasury Department has full transparency on auction bids, so the White House already knows if that occurred. Investor class data released on April 23 will reveal the total auction allocation to foreign investors.

Macro Fundamentals: Stagflation

Tariffs inject a stagflationary impulse into the economy. That is the economic condition that can cause stocks and bonds to decline in price at the same time (a positive stock-bond correlation). A new generation of bond investors learned this painful lesson during the post-pandemic inflation crisis, and some might have sold Treasuries last week in fear of similar dynamics playing out in the months ahead. This explanation is not particularly satisfying to us today because we expect that tariff-induced inflation will be short-lived and an ensuing recession would be disinflationary. Since post-pandemic inflation has not yet fully returned to target, we are certainly mindful of the risk that tariffs could re-ignite broader inflation. We took some comfort that others shared that transitory inflation view when breakeven inflation rates initially declined after April 2, but TIPS liquidity deteriorated later in the week making it harder to assess the true state of inflation expectations.

Though the Fed also expects tariff inflation to be transitory, they will have to wait for a period of time (perhaps a few months) to confirm that fact and also to confirm that inflation expectations remain anchored. By paralyzing the Fed initially, tariffs could prevent short-term Treasury yields from declining as they might in a more traditional disinflationary recession. We expect that we will eventually arrive at that disinflationary recession and reinforce the “safe haven” characteristics of Treasury bonds, but it could be a bumpy ride for the stock-bond correlation in the meantime.

Macro Fundamentals: Fiscal Policy

Fiscal policy news was somewhat lost in the shuffle during the week. The monthly budget update released on April 10 showed a $1.3t deficit in the first half of the fiscal year, $245b higher than the same period last fiscal year. DOGE cuts have yet to materialize as outlays increased in both February and March relative to the same months a year earlier, driven by (you guessed it) entitlement spending and interest expense. Meanwhile the Senate and House advanced a reconciliation package that will further increase deficits in the decade to come. It is unlikely that these developments would have catalyzed a sudden increase in yields during a normal week in the Treasury market, but they did not help restore confidence in the Treasury market last week.

Dollar Disfavor

Price action in the foreign exchange market provided perhaps the most concerning signals for the long-term economic outlook. The 50 bp increase in the spread between the 10-year Treasury and the 10-year German bund last week was the largest weekly increase since the euro was introduced, and yet the dollar depreciated by 3.5% against the euro. That is an astounding currency movement that directly contradicts the traditional relationship between yield differentials and exchange rates.

A similar pattern of rising yield differentials and depreciating exchange rates was observed against most other G10 currencies. The combination of lower risk asset prices, higher government bond yields and a depreciating currency is a troubling pattern more reminiscent of an emerging market economy in distress rather than the world’s reserve currency provider in a flight-to-quality episode. It is far too early to reach any grand conclusions about the role of the dollar in the international monetary system, but this one week’s worth of evidence provides an early warning about the damage that is being done to the long-term credibility of U.S. economic policymaking.

This Is Why We Hedge

We realize these are heady topics, and we are not being alarmists, but financial markets have exhibited extraordinary levels of volatility and surprising correlations last week. This shock didn’t come out of the blue: the catalyst was the known unknown that was at the front of investors’ minds all year. Naturally, moves like these are likely to trigger shifts in asset allocations, whether rebalancing, tactical or strategic – though all else equal, Treasuries look more attractive relative to a week ago.

We can tell you one class of investors that has not been selling Treasuries this week — corporate pensions. We say that with some authority, as we are fortunate to count 32 of the 50 largest U.S. corporate retirement pensions[1] among our clients. Those corporate pensions that have embraced an LDI strategy have insulated themselves and their beneficiaries from the storm that engulfed the Treasury market this week.

[1] Source: Based on data from Pensions & Investments, pionline.com, as of September 30, 2024; published on February 10, 2025.