$470 Billion Under Management

We develop customized strategies with the flexibility to adjust assets to market events

for some of the world’s leading organizations.

Allocators We Serve

- Corporations and Institutions

- Corporate, Public and Multi-employer Pensions

- Foundations and Endowments

- Governmental/Public Entities

- Healthcare Institutions

- Insurance Companies

- Nuclear Decommissioning Trusts (NDTs)

- Outsourced Chief Investment Officers (OCIOs)

Portfolios

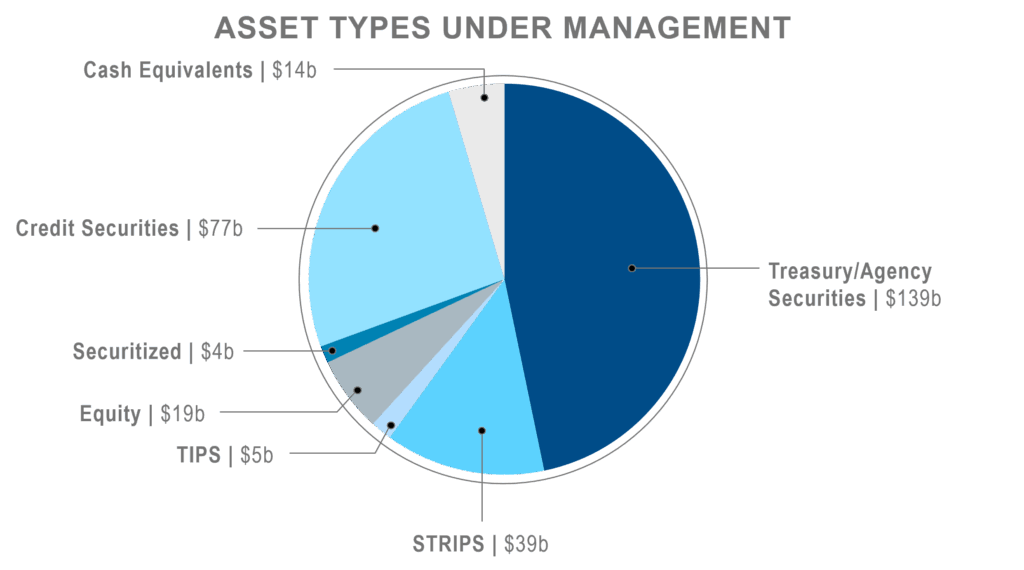

Each of our portfolios includes exposures that we manage against a variety of benchmarks. As of December 31, 2025, NISA manages $298 billion in physical assets, of which 94% are fixed income portfolios comprised mostly of U.S. Treasury and investment grade credit securities.

Derivatives Portfolios

NISA manages $172 billion in derivatives notional value in separate account portfolios.

Liability Driven Strategies | $104b

- Liability Hedging

- Glidepath Management

Beta Strategies | $55b

- Rebalancing/Cash Securitization

- Portable Alpha

- Commodity Index Replication

- Currency Hedging

Systematic Strategies | $13b

- Alternative Risk Premia

- Tail Risk Strategies

Absolute Return

- Liquid Hedge Fund Alternatives

- Alternative Risk Transfer

2025 Assets Under Management is as of 12/31/2025.

The data supplied by NISA are based on trade date and calculated according to NISA’s pricing policies. NISA maintains the data only for its portfolio management, guideline verification and performance calculation purposes and the data may differ from the recordkeeper. NISA does not provide pricing, recordkeeping, brokerage or any related services. You should compare and verify the information on this report with the information on the statement from the recordkeeper. A summary of NISA’s Pricing and Valuation policy is available upon request.