Markets Look Past Payrolls Miss, Remain Focused on War

Nonfarm payrolls declined by 92,000 in February, the largest monthly decline of the cycle if we look past the government layoffs from October. The

Nonfarm payrolls declined by 92,000 in February, the largest monthly decline of the cycle if we look past the government layoffs from October. The

This article broadens investment skill beyond market forecasting to include structuring skill—encompassing engineering, market-making, operational and access capabilities. Learn how allocators can evaluate managers

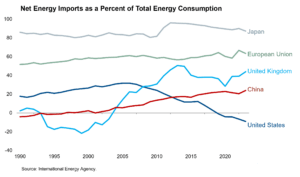

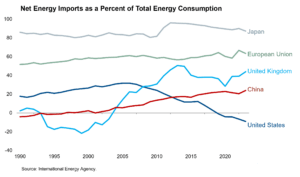

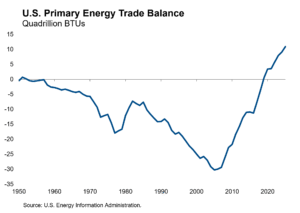

The war in Iran will have significant impacts on the combatants involved, the people in the region, and global geopolitics. The impact on the

as an institutional asset manager

under management

employees

$298 billion in physical assets + $172 billion in derivatives notional value as of 12/31/2025.

David G. Eichhorn, CFA

Chief Executive Officer and Head of Investment Strategies

NISA was named a 2025 Best Asset Manager for Institutional Investors in the United States by Crisil Coalition Greenwich, part of Crisil Ltd., a company of S&P Global, recognizing asset managers who stand out by delivering exceptional client service and helping institutional investors achieve their goals.

Crisil Coalition Greenwich named NISA a 2025 U.S. Institutional Best Asset Manager on Dec. 18, 2025 (formerly “Quality Leader”). NISA paid standard data and logo‑use fees. Rankings reflect aggregated participant feedback. See www.greenwich.com for methodology and previous rankings.

NISA’s culture fosters personal and professional growth with access to both experience and expertise. See if a career at NISA is right for you.