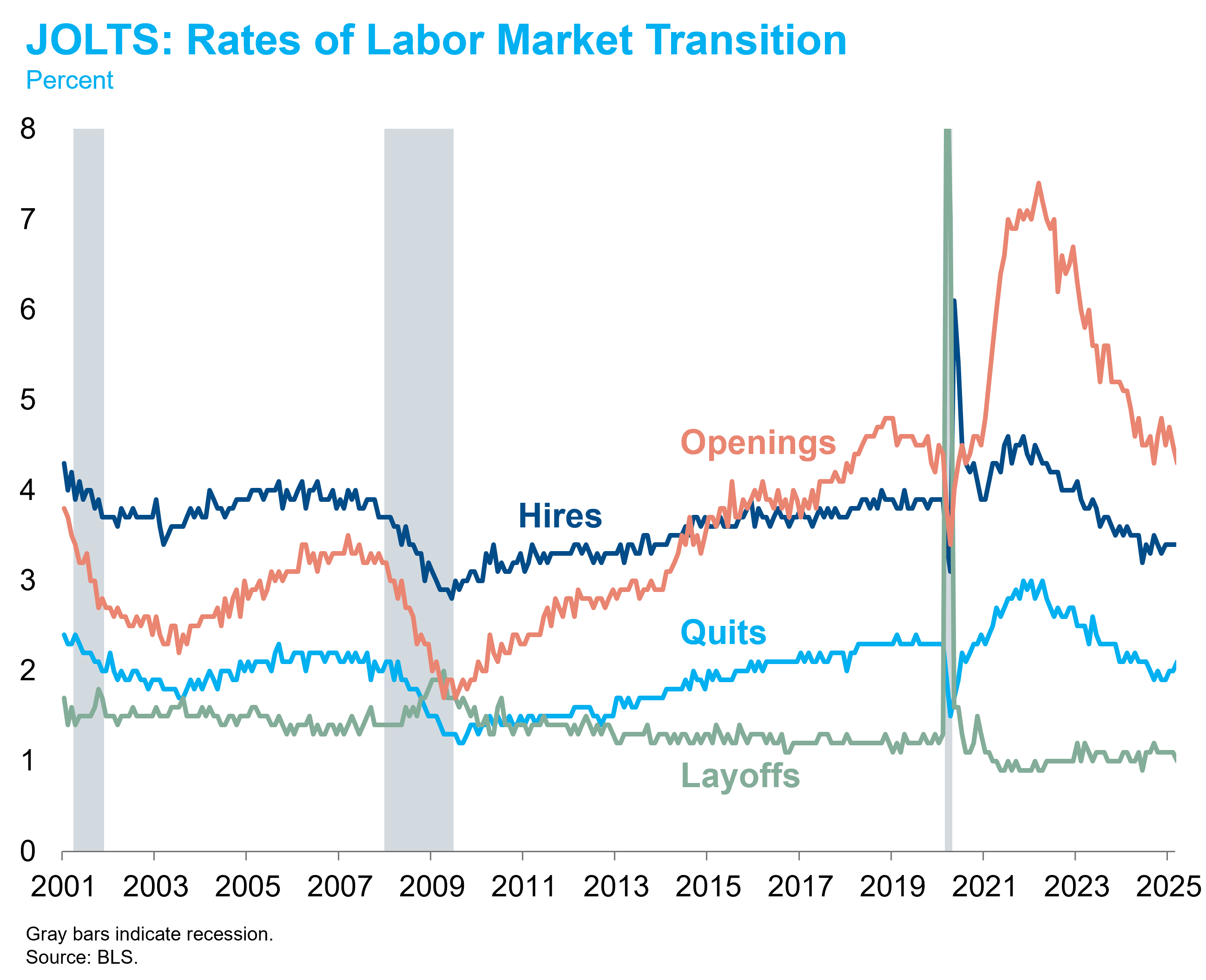

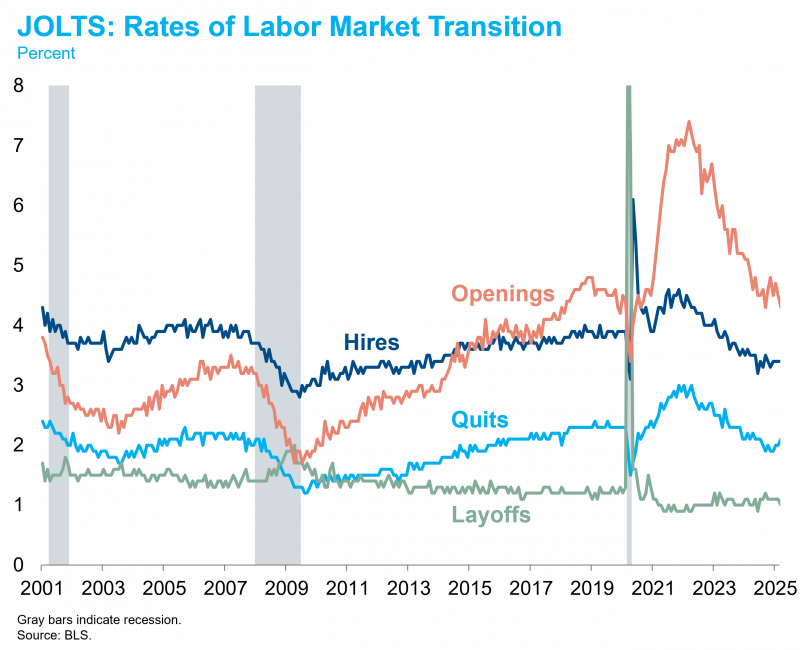

This morning brought the first of two labor market data releases for the week. The Job Openings and Labor Turnover Survey (JOLTS) data released today showed a continuation of the trend that has been underway for several years. Since the extreme labor shortage of the pandemic peaked in late 2021, labor demand has been cooling as labor supply rebounded strongly. This cooling labor demand has so far taken the form of a reduction in the number of job openings and the rate of hiring, as shown in the chart below. The falling quits rate shows that workers recognize the softening in the labor market.

A decline in openings and hires is a typical pre-recessionary pattern, as you can see ahead of the 2008 recession. By the time the layoff rate spikes, the economy is already in the middle of a recession. We were still on the good side of this tipping point in March as the layoff rate remained near cycle lows. But the depressed hiring rate leaves the labor market vulnerable to a shock. Employers have already pulled back on hiring, so any sudden desire to reduce labor costs could require layoffs. The question is whether the trade war escalation in April will be enough of a shock to commence that layoff cycle and a recession. It will take more than one month to answer that question, but we’ll be closely watching the April payrolls report that will be released on Friday morning.