Like an Olympic skier recovering after a near crash, the labor market has regained its footing. Nonfarm payrolls increased by 130,000 in January, the fastest growth in 13 months, and the unemployment rate fell by a tenth to 4.3% despite an increase in labor force participation. This report confirms the hints of stabilization that we saw in the December data, though we believe it is still too early to talk about a reacceleration that would raise concerns about wage inflation. This report reduces the urgency for further monetary easing. We maintain our view that the Fed will cut rates twice this year, in September and December.

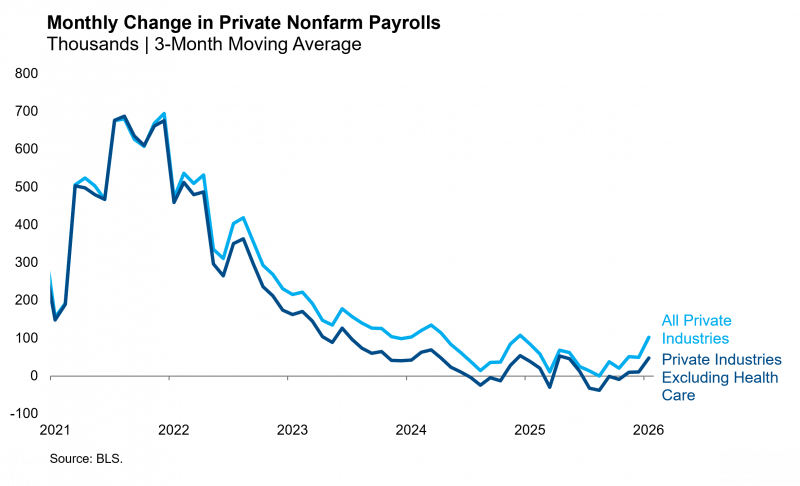

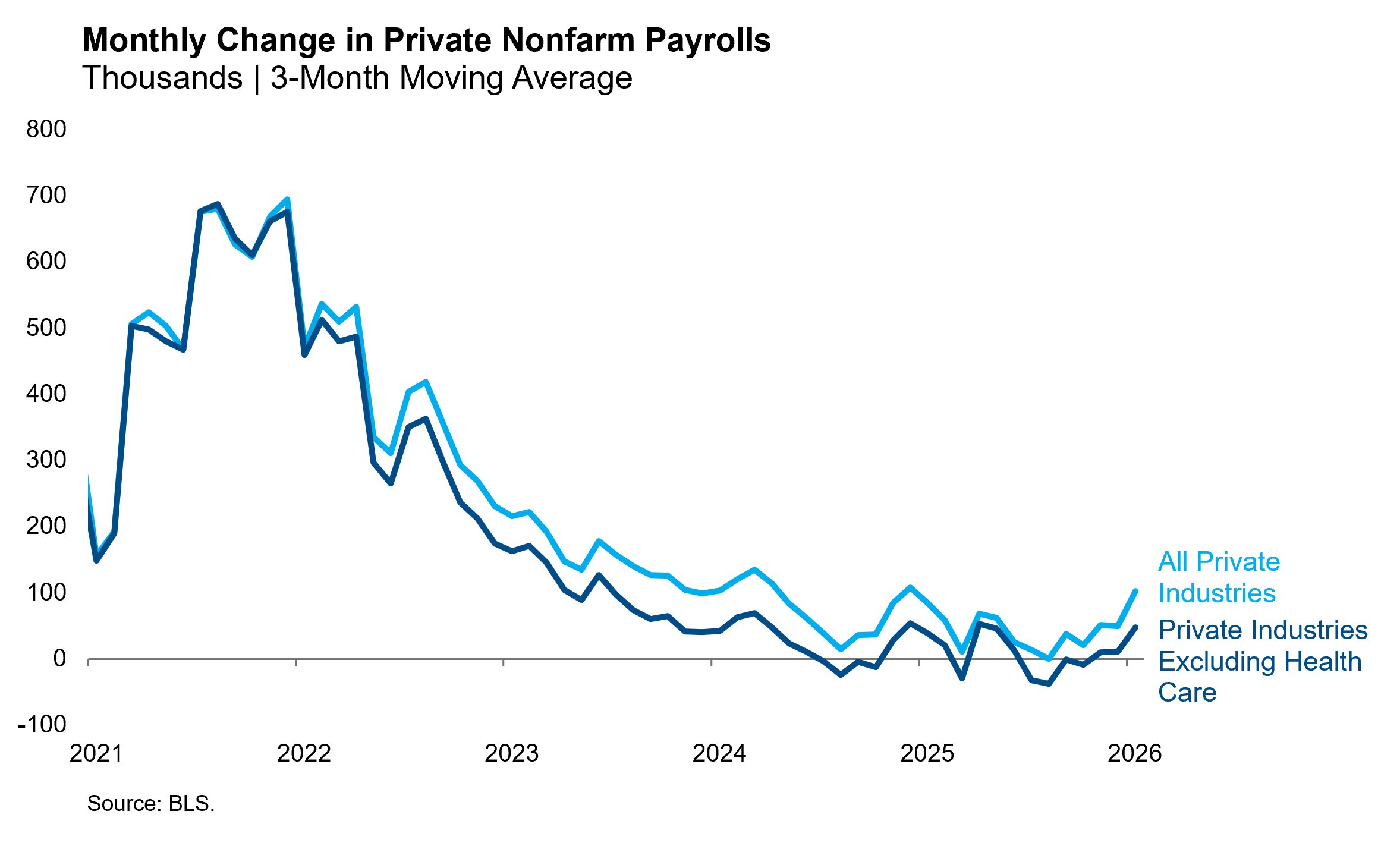

The establishment survey reported a 34,000 decline in federal government payrolls as another month of deferred resignations took effect. The Trump administration has now overseen twelve straight months of declines that has reduced federal payrolls by a cumulative 324,000 or 11%. Private payrolls increased by 172,000. Private job creation was still narrower than we’d like, as health care accounted for almost half of private payroll growth. That said, the 3-month moving average of private payroll growth does appear to be rebounding from the low in August 2025, even when excluding health care. Annual benchmark revisions were included in this report, giving us a more accurate view of the path of payroll employment last year. As we discussed in our recent webinar, we assess that private employers effectively froze hiring after the tariff shock of April 2025 but have regained confidence over the past six months as the administration has moderated trade policy. This has allowed the economy to get back on track towards the soft landing that was nearly achieved by early 2025.

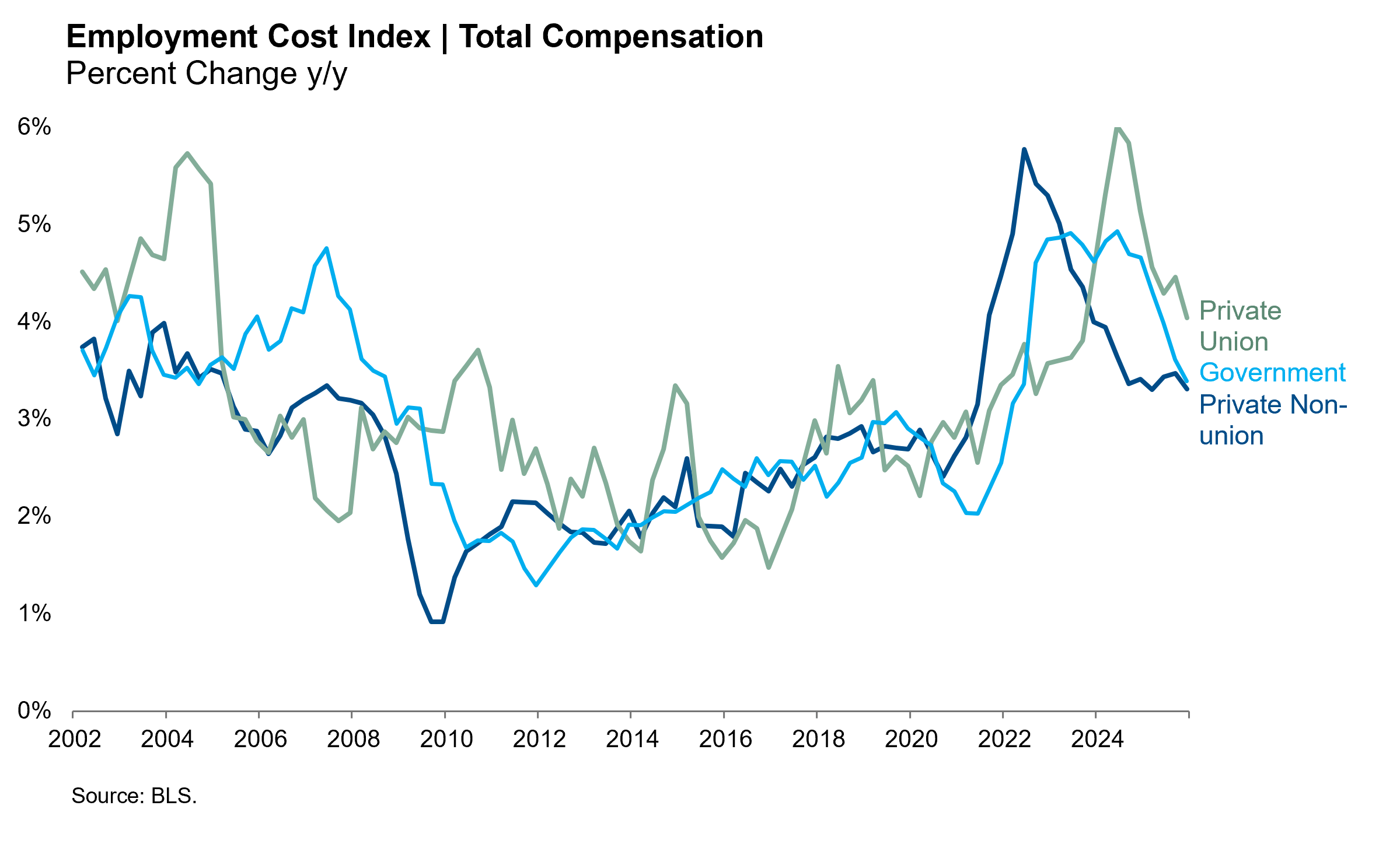

Average hourly earnings rose 0.4% in January, but this follows softer prints in the prior two months, so the 3-month moving average actually declined. We prefer the Employment Cost Index as a more robust measure of wage inflation. Those data were recently reported for the fourth quarter and showed a continued deceleration in wage growth across the public and private labor markets. It’s possible that the combination of recovering labor demand and falling immigrant labor supply will combine to reignite wage inflation, but we think that dynamic is unlikely to become evident in the first half of the year. For now, we assess that the labor market is merely stabilizing in the low hire, low fire equilibrium that prevailed before the tariff shock.

From the Fed’s perspective, stabilization is an improvement. The three insurance cuts they delivered last year were motivated by fears that the labor market was tipping over into a layoff cycle and a significant decline in private employment. The January payrolls report further diminishes those concerns and reduces the urgency for additional monetary easing. The Fed’s primary focus will now shift from the labor market back to inflation. The next rate cut will arrive when a majority of FOMC voters determine that tariff passthrough is complete and disinflation is on a sustainable path back to their 2% objective. We maintain our view that goods inflation will remain elevated through midyear, and the next cut will arrive in September.

That could put incoming Chairman Warsh in the politically awkward position of presiding over a hold at his first two meetings in June and July (assuming he is confirmed on schedule). If he’s lucky, inflation will decelerate quickly enough that the economic fundamentals justify a June cut. If not, he may be secretly hoping that Senator Tillis delays his confirmation until the fall.