In a post earlier this week, we explained how the Fed’s new flexible average inflation targeting (AIT) framework is motivated by a desire to prevent the zero lower bound constraint from de-anchoring inflation expectations to the downside. The logic of the new framework is intuitive. If the zero lower bound prevents the Fed from providing as much monetary stimulus as is required, then the economic recovery will be slow and inflation will undershoot the Fed’s 2% target for an extended period. The AIT framework endeavors to offset this undershooting by engineering an inflation overshoot later in the economic cycle. The overshoot will therefore make up for the prior undershoot and achieve an average inflation rate of 2% across the business cycle. The language in the Longer-Run Statement is simple:

In order to anchor longer-term inflation expectations at this level, the Committee seeks to achieve inflation that averages 2 percent over time, and therefore judges that, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.

Average is in the eye of the beholder

Sounds pretty straightforward, right? Unfortunately the devil is in the details. The FOMC deliberately left phrases like “persistently,” “moderately,” and “for some time” undefined in order to retain flexibility. The new policy is decidedly discretionary. This leaves important questions up to the individual judgment of each FOMC member. A cacophony of Fedspeak since the Jackson Hole announcement has made clear that opinions differ in material ways. Some members interpret a moderate overshoot to mean 2.25% year-over-year core PCE inflation, others say 2.75%. Several have noted that it depends on the nature of the inflation dynamic and even the outlook. What is the source? How volatile and broad-based are price increases? Will it persist?

FOMC members also disagree on the timing of the inflation undershoot and overshoot. If inflation runs below target for many years as it did during the last cycle, will the Fed endeavor to make up for the whole period? That could require a multiyear overshoot to get the average inflation rate for the cycle back up to 2%. Some FOMC members have said they would tolerate a sustained overshoot, others have argued that a few quarters above 2% would be enough. The Fed considered and rejected a price level target, which would require a complete makeup of all past inflation misses. The flexible AIT framework stops short of that standard, but we don’t know by how much.

As varied as these opinions are, they aren’t even the ones that matter! The inflation overshoot in this economic cycle may not arrive for several years, by which time turnover will have changed the composition of the Committee and possibly even its Chairman. Credibility is crucial in central banking. By rejecting a rules-based AIT regime and leaving the framework to the discretion of a future FOMC, the Fed risks undermining its credibility.

The fullest possible employment

Ironically given all the attention paid to the average inflation target, the most credible component of the new framework might relate to the employment side of the Fed’s dual mandate. The new Longer Run Statement also amends the full employment objective to a one-sided test. High unemployment will continue to justify accommodative monetary policy, but a low unemployment rate will not, in and of itself, justify a restrictive policy stance. In making this change, the Fed is acknowledging with the benefit of hindsight that the December 2015 rate hike was a mistake. That rate hike arrived as core PCE had fallen all the way down to 1.2%, but was justified by a Phillips Curve logic that a sub-5% unemployment rate would inevitably cause inflation, despite the well-known shortcomings of that theory. The Fed’s repudiation of pre-emptive policy tightening is a significant step that signals monetary policy will be more dovish in this cycle than the previous.

Market participants adopt a ‘wait-and-see’ attitude

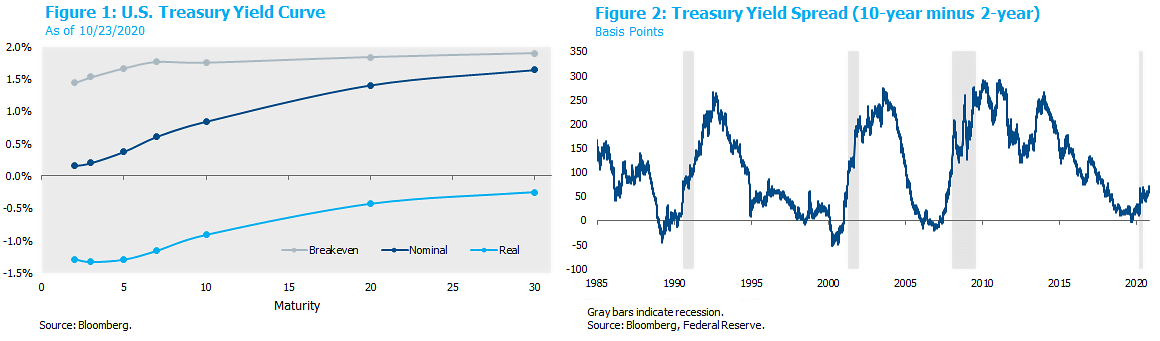

The Fed is promising to keep the nominal policy rate low for an extended period in hopes of raising breakevens. That will necessarily push real yields lower. Market participants have gotten the first part of that message. Short rate markets are not pricing the first rate hike until 2024, a sharp contrast from the early stages of the previous recovery when interest rate markets projected that the Fed would deliver a full percentage point of rate hikes by the middle of 2010. This time around, real yields are deeply negative through the 10-year tenor (Figure 1). The yield curve signals doubt, however, that this policy will succeed in delivering 2% average inflation across the cycle. While TIPS breakevens have staged an impressive rebound from their 11-year lows in March, they remain below the Fed’s target at all tenors. Low inflation expectations and the zero lower bound constraint have also conspired to keep the nominal yield curve about 200 basis points flatter than in recent recessions (Figure 2).

We share the market’s skepticism. The new AIT framework demonstrates that the Fed is willing to tolerate an inflation overshoot, but do they have the ability to engineer it? The Fed has already cut the policy rate to zero and convinced the market it will stay there for a very long time. QE is the only tool left in the Fed’s toolkit. The lesson from the last cycle is that QE is more likely to cause asset price inflation than consumer price inflation. If inflation does overshoot in this cycle, it will probably require some catalyst other than monetary policy. Overly aggressive fiscal policy, deglobalization, or a shift towards supply chain resiliency are all potential candidates, but these would have to overcome the disinflationary trends that have persisted for several decades. We’ll be writing more about the inflation outlook in coming months but for now, suffice to say that we believe the Fed’s new AIT framework alone is not a sufficient condition to generate an inflation overshoot in this cycle. Making up is hard to do!

One counterpoint to all this: for investors that are concerned about rising inflation, protection is cheap right now. An unanticipated increase in the price level would have major implications for the shape of the nominal yield curve, interest rate volatility, the dollar, and commodity prices. We are closely monitoring the inflation outlook embedded within these markets and are happy to help clients structure hedges to achieve their strategic and tactical objectives.

Concluding thoughts

The Longer Run Statement declares that “the inflation rate over the longer run is primarily determined by monetary policy.” This isn’t quite the same as Milton Friedman’s maxim that “inflation is always and everywhere a monetary phenomenon” but it does rely on the same logic. After 40 years of forcefully deploying monetary policy to reduce inflation expectations, the Fed has adopted a new framework in hopes of raising them just a bit. It will take many years to test whether this strategy will succeed in re-anchoring inflation expectations at 2%. In the near term, we do not believe the Fed’s new communication strategy has enough credibility to engineer the desired inflation overshoot, and will be on the lookout for catalysts other than monetary policy. If an overshoot does occur in this cycle and the Fed stays dovish in response, the new AIT framework may gain the credibility it currently lacks and cause a structural shift higher in inflation expectations. True to our Show-Me State roots, we’ll believe it when we see it.

Download the PDF

To download a PDF version, please click here.