Veteran Fedwatchers like to quip during tightening cycles that “the Fed will keep hiking until something breaks.” They are only half joking. The path of past tightening cycles is littered with the roadkill of market participants who got caught on the wrong side of a duration and/or convexity bet. Well now something has finally broken, and the FOMC has to make a decision tomorrow. Will the risk of a systemic banking crisis cause the Fed to pause their ongoing tightening campaign? Or will they keep hiking after something breaks?

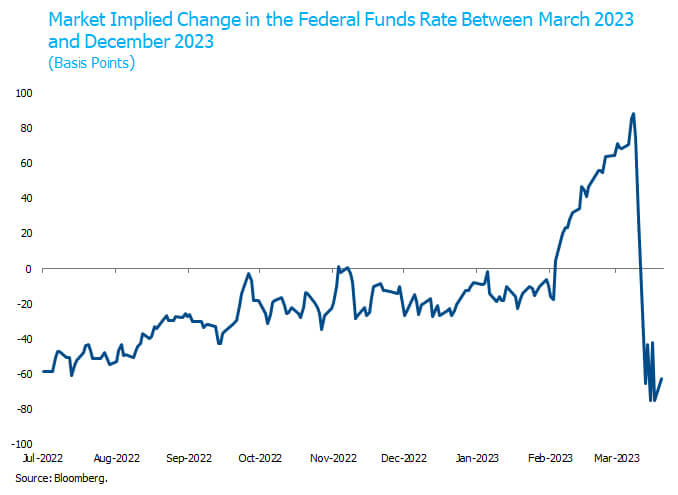

As of March 8, the day before the Silicon Valley Bank (SVB) crisis broke, interest rate markets were pricing 89 basis points of rate hikes between March and December of this year. As of yesterday’s close, markets were pricing 63 basis points of net cuts. Clearly market participants think that the banking turmoil has profound consequences for the path of policy. Let’s run through the Fed’s decision matrix to consider whether markets are right to expect such a drastic change in the policy path.

The fundamentals demand further hikes

The data received since the last FOMC meeting strongly support the case for additional rate hikes. The February CPI report reaffirmed that inflation is proving stickier than expected, with core CPI and Chairman Powell’s preferred supercore measure (core services ex-shelter) both running above 5% annualized over the last three months. Robust job growth and retail sales in February also reflect an economy that is still overheating despite the Fed’s best efforts to cool it down. Monetary policy expectations have been very sensitive to economic data since late January and indeed before the banking turmoil, FOMC officials were publicly debating between a 25- or 50-basis-point hike at the March meeting.

Financial stability concerns counsel caution

Obviously, the circumstances have changed in the last two weeks. The failure of the nation’s 16th and 29th largest banks has brought financial stability concerns to the forefront for the first time in this tightening cycle and taken cross-asset volatility to the highest levels since 2008. Given that rate hikes and the unrealized losses on bank’s bond portfolios were a necessary (though not sufficient) condition for the current tensions, it is natural to wonder if the Fed will pause rate hikes out of a Hippocratic desire to avoid making matters worse. First, do no harm.

Price stability is still job #1

The problem with that approach is that inflation is still doing great harm to the American people every day. As Powell has said at the opening of the last four FOMC press conferences: “without price stability, the economy does not work for anyone.” Even more important than the high cost of realized inflation, the Fed remains fearful of the risk that inflation expectations could de-anchor. If the Fed allowed this to happen as it did in the 1970s, the social welfare impact would almost surely be higher than even a severe regional banking crisis. Reasonable people can disagree on that last sentence, but bear in mind that a de-anchoring of inflation expectations would cause a spike in longer-term nominal interest rates and exacerbate stress on the banking system.

Balancing act

This is the FOMC’s challenge tomorrow: to balance their pursuit of financial stability and price stability under conditions of extreme uncertainty with regard to both. A de-anchoring of inflation expectations is a small tail risk with an extremely high cost. Given that the Fed has tightened so aggressively and that the peak of inflation is likely behind us, the most likely path to a de-anchoring at this stage of the cycle would be for the Fed to declare premature victory in the fight against inflation. Would pausing tomorrow constitute such a mistake? Probably not, because the Fed could resume hiking later if circumstances change. But if the banking turmoil spooked the Fed into ending the tightening cycle and then failed to cool the economy, market participants might very well conclude that the Fed has made a dovish policy mistake.

Furthermore, recall that one of the Powell Fed’s defining characteristics has been to abandon the doctrine of pre-emption, whereby the Fed would start to tighten policy when the unemployment got low because it anticipated that inflation would rise. Instead the Fed would wait to see the whites of inflation’s eyes, or even let inflation overshoot a bit under the FAIT framework. It would seem inconsistent now to pre-emptively pause or cut rates because they anticipate the banking turmoil will cause a recession and disinflation.

As for the uncertain financial stability outlook, we view it as a binary factor for the Fed. To the extent they are concerned about a systemic banking crisis, they should pause, especially if they believe additional rate hikes would exacerbate risk to the banking industry. If they believe that risk is low, they should proceed with rate hikes to fight inflation and protect against a de-anchoring of inflation expectations. The FOMC decision will depend on a judgment call about the relative risks to price stability and financial stability.

As we described last week, it remains very difficult to predict the degree of uninsured deposit flight that will take place in coming months, and therefore the future course of this episode. While we acknowledge that uncertainty, our base case is that the banking turmoil moderates to a lower level than experienced over the past two weeks. Banks will remain under stress, and a number of additional small to midsize banks may fail or be taken over, but we do not expect this to devolve into a full-scale systemic banking crisis. We think the specific ALM mismatch that brought down SVB was unique when combined with their concentrated deposit base. There are a few regional banks with large unrealized losses on their securities portfolio that we are monitoring, but nothing close to the size of SVB when assessed relative to their equity base. The largest U.S. banks continue to have ample liquidity and broadly diversified deposit bases.

One important aside here. Normally when we are considering the Fed’s reaction function with regard to their dual mandate, we have access to the same information as they do. The Fed gets the CPI and payrolls data at (more or less) the same time we do. In the current case, the Fed has access to confidential bank supervisory data that the public cannot see. We suspect Powell is getting a daily update on the details of deposit flows throughout the banking system. If the Fed pauses tomorrow because they are observing rampant deposit flight, we hope that Powell will share that information at the press conference.

Banking turmoil will leave a mark

Even if our base case plays out and the banking turmoil moderates, it will leave a lasting mark on the economy through two primary channels. First financial conditions have tightened significantly. Market-based financial conditions indices probably understate the degree of tightening because they include the stimulative effects of lower Treasury yields. In our opinion, risk sentiment around both boardrooms and kitchen tables has deteriorated in the last two weeks in ways that are not captured by financial conditions indices. This means slower growth in household consumption and business investment.

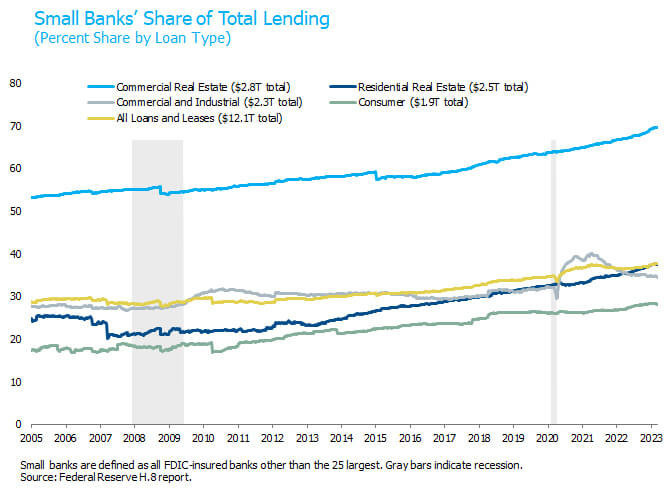

Perhaps the more significant economic impact will come through reduced bank lending, particularly by small and midsize banks. Per the Federal Reserve H.8 data which break out bank lending activity between the 25 largest and all others, small banks accounted for 38% of all loans and leases as of March 8. This is up from a 28% market share before the financial crisis. Despite what you may have heard about bank concentration, small banks have increased their market share in the last 15 years. One sector stands out. Small banks account for 70% of all commercial real estate loans.

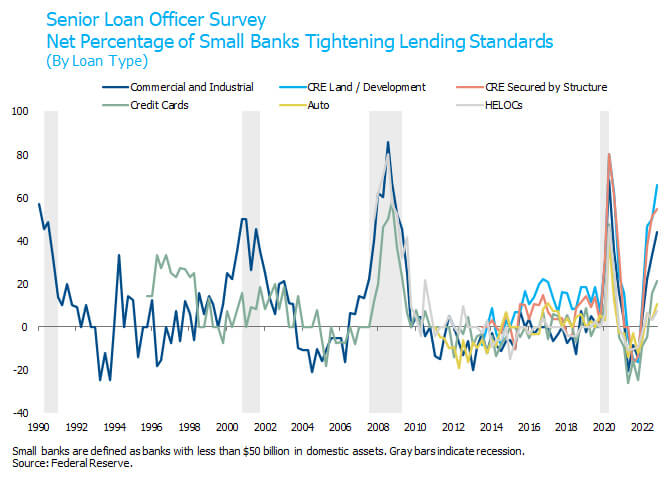

We agree with the consensus that the recent banking turmoil will cause banks, and small banks in particular, to contract lending more than they would have otherwise. Where we differ from the consensus is that we already expected a contraction in bank lending, particularly in commercial real estate where small banks are most important. The Fed’s Senior Loan Officer Opinion Survey (SLOOS) shows that small banks had already drastically tightened their lending standards as of January. Note also that banks have tightened standards much more for commercial real estate (CRE) loans than for business and consumer loans – not surprising given the negative outlook for urban office buildings amidst an uncertain remote work paradigm. We should also caution that a commercial real estate recession could impair the asset side of bank balance sheets and extend banking sector stress – though hopefully this dynamic won’t catch bankers or their regulators by surprise.

History shows that bank lending typically contracts when the SLOOS data shows a tightening of this magnitude. The banking turmoil will exacerbate and pull forward this contraction, but we already expected it to happen. We maintain our view that the most likely outcome for the U.S. economy is a recession that begins in Q4 2023 or Q1 2024. The banking turmoil gives us greater conviction in that recession call, and possibly pulls it forward by a few months.

We expect hikes to continue

However, we reject the notion that the recent banking turmoil will plunge the economy into a deep recession in the next few months and cause the Fed to cut rates by more than 50 basis points by yearend. The economy has continued to show impressive resilience in the face of the Fed’s aggressive tightening campaign. We believe that resilience is explained in part by labor hoarding, excess savings, pent-up demand and echo stimulus (state tax rebates, continued student loan payment deferrals, Social Security COLA, etc.). These factors will fade eventually, but not abruptly in the next few months.

Against that backdrop, we anticipate that the Fed will hike by 25 basis points tomorrow but pair the action with dovish rhetoric to provide them flexibility to pause at a future meeting if the banking turmoil worsens. If the banking issues subside as we expect, we anticipate at least one more rate hike at the May FOMC meeting. The banking turmoil may reduce the terminal rate but it won’t stop the Fed from hiking again. We continue to believe inflation will remain stubbornly high and prevent the Fed from cutting rates in 2023, even if a recession begins before yearend.

Finally, let’s remember that the Fed is not standing idly by in response to the banking turmoil. They have taken forceful actions directly targeted at the critical risk of uninsured deposit flight, and promised to do more if necessary. BOE Governor Bailey and ECB President Lagarde have demonstrated in recent months that central bankers can simultaneously pursue financial stability and price stability. We believe that Powell will show us tomorrow that he too can walk and chew gum at the same time.