Funding rules originally intended to provide contribution relief for corporate pension plans are now having the exact opposite impact, leading to tough decisions for many plans.

In February 2021, a NISA Perspectives post titled “Another Extension of Funding Relief?[1]” detailed the Emergency Pension Plan Relief Act of 2021 (EPPRA) that was proposed by the House Ways and Means Committee and included an extension of funding relief for corporate defined benefit plans. In that post, we made the case for an output-based approach to funding relief that simply lowers the required funded status threshold and/or extends amortization periods used to determine minimum required contributions, as opposed to the more convoluted approach of measuring the liability in a manner that ignores current economic reality.

In 2021 we said:

“We are not opposed to providing funding relief for corporate pension plans – there may well be justified reasons for doing so. However, perpetuating shenanigans with the funding discount rate obfuscates the economic reality of the commitment the plan has made to its beneficiaries and violates basic tenets of finance, in our opinion. Using a 25-year average rate to determine funding requirements was misguided in 2012 when it was initially introduced, but was intended to be temporary. Repeatedly postponing the phase-out of this methodology serves to falsely validate it as a reasonable measure of the size of the liability.”

The primary changes to pension funding segment rates proposed by the EPPRA included:

- Tightening the corridor around the 25-year average, originally introduced by MAP-21 legislation in 2012, to +/- 5%

- Delaying phase-out of the corridor to 2026

- Establishing a 5% floor on the 25-year average

Rules proposed under EPPRA were signed into law on March 11, 2021 as part of the American Rescue Plan Act (ARPA) of 2021. The rules were subsequently modified on November 21, 2021 through the Infrastructure Investment and Jobs Act (IIJA), which further delayed the phase-out until 2031.

Given the long-term secular decline in interest rates, it was certainly rational for plans to prefer funding rates based on a 25-year historical average, as opposed to current market rates. In our February 2021 post, we estimated that as of 12/31/2020, a plan that was 70% funded on an accounting basis could be approximately 100% based on the new funding rate rules and have no required contributions. The funding discount rate used to determine contributions made in 2021 was estimated to be 225 basis points above the 24-month average segment rates and 300 basis points above PPA spot rates.

A commonly cited reason for the original introduction of stabilized funding rates under MAP-21 and subsequent extensions thereafter was that current market rates were “artificially” low and therefore led to liabilities being valued too high.

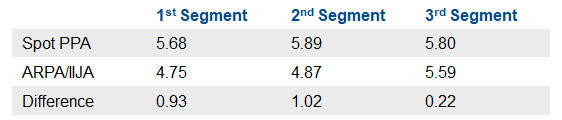

Be careful what you wish for, because rates aren’t low anymore. Figure 1 below compares PPA spot segment rates to rates calculated based on the ARPA/IIJA methodology as of September 30, 2023. Spot rates for each of the three segments are above ARPA/IIJA rates.

Figure 1: Spot PPA Rates vs. ARPA/IIJA Rates as of September 30, 2023

Sources: Internal Revenue Service, Bloomberg and NISA calculations.

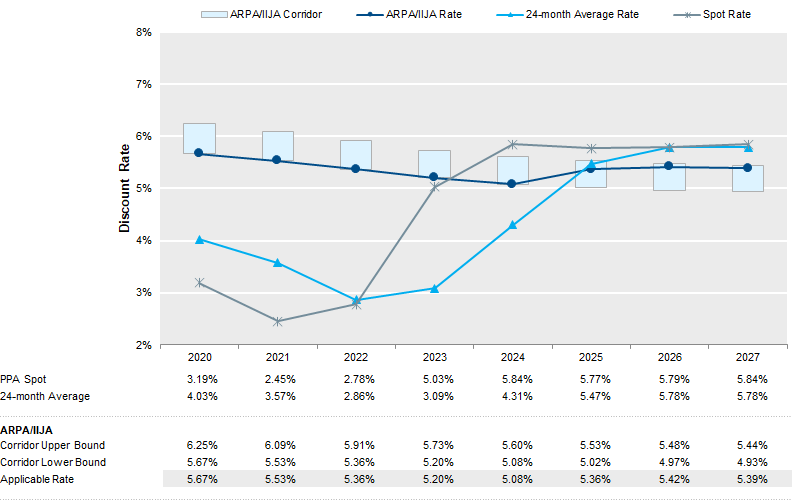

Figure 2 is an update of an illustration included in our February 2021 Perspectives post and is based on an illustrative plan with a duration of 10 years as of September 30, 2023. At the time of our February 2021 post, we estimated that the new rules could increase the rate used to determine 2023 funding requirements by 113 basis points relative to the previous version of the rules and by 249 basis points relative to the PPA spot segment rates, given the latest available market rates at that time.

Given the meteoric rise in rates in 2022, the funding rate determined under ARPA/IIJA rules to determine contribution requirements for plan year 2023 was only 17 basis points above PPA spot rates for this illustrative plan. ARPA/IIJA rate that applies to 2024 contribution requirements is expected to be significantly below PPA spot rates based on current rate levels[2]. Therefore, a plan that is fully funded on an accounting basis may be required to make contributions based on stabilized funding rates.

Figure 2: Impact of Stabilized Funding Rates[3]

Sources: Internal Revenue Service, Bloomberg and NISA calculations.

While plans can choose to switch from stabilized funding rates to PPA spot rates, there is no guarantee that they could subsequently switch back, leaving room for potential regret if rates subsequently fall back below the 25-year average. That said, we think making the switch at this time is appropriate for many plans, particularly plans that are hedging most of their liability’s interest rate risk. However, plan managers should be aware that this decision may have implications for Pension Benefit Guaranty Corporation (“PBGC”) premium calculations.

As described in our November 2022 Perspectives post, ”Look Beyond the Obvious Impact of Rising Interest Rates[4],” the chosen funding valuation methodology determines the choices available for calculating PBGC premiums. Plans that use stabilized rates for funding calculations have the option to use 24-month average rates or spot rates to calculate PBGC premiums, while plans that use spot rates for funding calculations must also use those rates for PBGC premium calculations[5], and therefore forego some optionality. Of course, at current rate levels, spot rates are preferred for both.

The economics of a liability are inescapable and appropriately priced based on current market rates. Funding relief based on a set of convoluted rules to adjust the discount rate ignores this reality and has created an irony in which the rules accomplish the exact opposite of the intended effect. However, given prior precedent, it seems reasonable to expect that Washington will once again step in to revise funding relief rules. Perhaps this presents an opportunity to begin unwinding rules originally introduced in 2012 and replace with a more straightforward and economic approach. That is, mark liabilities and assets based on market pricing but smooth contribution requirements to the extent desired by policy makers.

[1] https://www.nisa.com/perspectives/another-extension-of-funding-relief/

[2] PPA spot segment rates are projected forward based on NISA-estimated PPA spot discount curve, i.e., not reflecting monthly averaging, as of September 30, 2023, which is similar to discount rates used to value liabilities for accounting purposes.

[3] To reflect the most common lookback period that applies to the use of each of these rates, PPA Spot rates are as of end-of-year, 24-month average rates reflect a four-month lookback (i.e., as of the end of August), and ARPA/IIJA rates reflect rates as of the end of September. Rates are projected forward based on NISA-estimated PPA spot discount curve as of September 30, 2023.

[4] https://www.nisa.com/perspectives/look-beyond-the-obvious-impact-of-rising-interest-rates/

[5] Technically, plans that use the full PPA yield curve for funding purposes have the option to also use those rates for PBGC premium calculations or the largely equivalent PBGC spot segment rates.