A few clients have asked us recently for our thoughts regarding the potential for additional funding relief for single-employer DB plans. While we certainly aren’t Washington insiders, our common reaction was that we did indeed expect relief because 1) relief provided under prior legislation is scheduled to begin phasing out this year, 2) rates are even lower now than they were when past funding relief was provided, and 3) the federal deficit is at an all-time high and pension funding relief is (curiously) viewed as a source of additional revenue. Given that reduced tax deductible contributions into DB plans lead to higher taxes, contribution relief is viewed as an easy way to increase revenue without a natural political opponent. The initial proposal is now out, and the relief being introduced is indeed quite significant.

House Ways and Means Committee Chairman Richard Neal introduced the Emergency Pension Plan Relief Act of 2021 (“EPPRA”), which includes an extension of funding relief for single-employer defined benefit plans that was originally provided as part of the Moving Ahead for Progress in the 21st Century Act (“MAP-21”) in 2012.

MAP-21 set a floor for funding rates at 90% of the 25-year historical average of the PPA segment interest rates. (Technically, it also set a ceiling at 110% of the 25-year average, but given the secular decline in rates over this time period, the ceiling is irrelevant.) The floor was set to drop to 85% of the 25-year average the following year and continue to drop by 5% until it reached 70%, thereby effectively phasing out funding relief. However, subsequent legislation, including the Highway and Transportation Funding Act of 2014 (“HATFA”) and the Bipartisan Budget Act of 2015 (“BBA”), extended the 90% floor, such that eight years later, we have yet to see MAP-21 funding relief actually begin to be phased out. Under the current version of the rules, funding relief is scheduled to begin being phased out this year. However, now rates are even lower than they were in 2012 (when rates were considered far too low to be used for funding requirements), so it appears that it is time once again for Congress to step in and make sure that doesn’t happen.

The proposed legislation goes quite a bit further than prior relief. It would actually raise the floor to 95% of the 25-year average retroactively to 2020 and delay the start of any phase-out until 2026. Additionally, it would establish a 5% minimum for the 25-year average. Further, it would more than double the time period over which deficits are amortized from 7 years to 15 years after wiping out amortization bases for plan years before 2020.

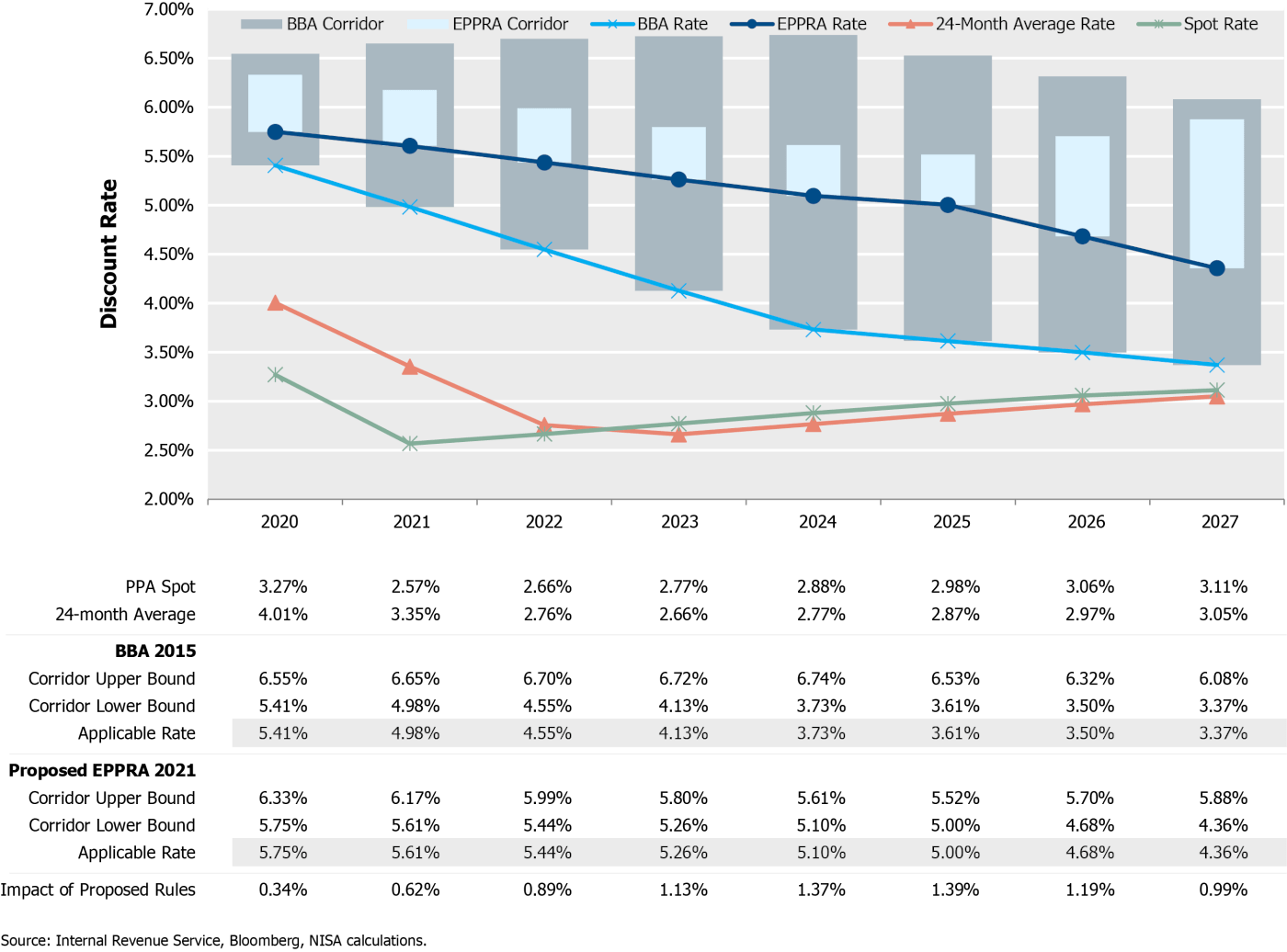

The chart below compares the projected funding discount rate for an illustrative 14-year duration liability under the current rules and the new proposed rules, as well as the PPA spot curve and 24-month average segment rates. The proposed rules would increase the 2020 funding rate by approximately 34 basis points relative to current rules. That wedge widens to approximately 140 basis points in later years as the current rules would begin to phase out funding relief.

The 25-year average is applied to each of the three segment rates independently. Currently, the 25-year average of the first segment rate, which applies to the first 5 years of liability cash flows, is 3.90%, so the 5% minimum would apply immediately. The 25-year average of the second segment rate, which applies to liability cashflows from 5 to 20 years and, therefore is more impactful on the liability value, is forecast to fall below 5% in 2025.

The magnitude of the disconnect between funding rates based on the 25-year average and current economic reality is stunning. As of 12/31/2020, a plan that is 70% funded based on the PPA spot discount curve (which is similar to discount rates used to value liabilities for accounting purposes) could be 100% funded based on EPPRA rates and have no required contribution.

Ultimately, adjustments to the discount rate to extend funding relief may not have as meaningful of an impact on contribution activity as one would guess. The adjusted rates do not impact the liability value used to determine PBGC variable rate premiums, which is based on PPA spot or 24-month average segment rates. Plan sponsors have actually accelerated contributions in recent years despite available funding relief in order to mitigate PBGC variable rate premiums, which have increased more than 5X since MAP-21 was enacted, from 0.90% to 4.60%. The variable rate premium is the charge that is assessed on the unfunded portion of the liability.

Plan sponsors have recognized that the economics of the liability are inescapable and will eventually catch up with the plan, even if funding rules allow them to delay contributions for now. Most importantly, in our experience, very few plans have altered their derisking and hedging plans in response to changes to funding rules.

We are not opposed to providing funding relief for corporate pension plans – there may well be justified reasons for doing so. However, perpetuating shenanigans with the funding discount rate obfuscates the economic reality of the commitment the plan has made to its beneficiaries and violates basic tenets of finance, in our opinion. Using a 25-year average rate to determine funding requirements was misguided in 2012 when it was initially introduced, but was intended to be temporary. Repeatedly postponing the phase-out of this methodology serves to falsely validate it as a reasonable measure of the size of the liability.

Rather than tinkering with inputs to value the liability, an output-based approach that simply lowers the funded status threshold that triggers required contributions, and/or further extends the shortfall amortization period for required contributions, would achieve approximately the same result while maintaining the economic integrity of the liability valuation1. It’s time to stop denying that rates are low and revise funding rules in a manner that is closer to the reality of our “new normal.”

Originally published on February 9, 2021. Revised on February 19, 2021.

1For example, changing the minimum funded status threshold to trigger required contributions in 2020 from 100% to 70% based on current market rates would have approximately the same impact as the proposed adjustments to the discount rate.