By simply de-risking their pension plan, companies can realize most of the benefits of annuity purchases without incurring the upfront liquidity costs or committing to an irreversible decision. Along with the reduction in pension volatility, de-risking should improve credit ratings for some companies with large pension plans relative to their core businesses. The desire to de-risk pension plans is understandable given this implied credit rating “cost.”

Is Annuitization the Answer?

For a company struggling with the outsized effects of pension volatility on its balance sheet, the landmark annuity purchases by GM and Verizon may have looked like attractive examples to follow. However, in their recent report, Pension Terminations: No Free Lunch1, Moody’s was quick to point out that there is a potentially offsetting credit rating impact to annuity purchases:

Pro: The company is relieved of the credit risk implications of a risky pension plan as well as the distraction from core operations.

Con: An upfront liquidity drain impacts the company when it fully funds the plan and pays the premium demanded by the insurer.

Moody’s concludes that in most cases annuity buyouts will be credit risk neutral because the liquidity drain will mostly offset the benefits of the eliminated volatility.

In fact, companies (and ratings agencies alike) should not overlook the fact that established pension risk management techniques to “de-risk” plans can offer most of the benefits of annuity purchases without incurring any of the upfront liquidity costs. Past discussions of pension de-risking strategies have focused on their role in managing pension risk in a vacuum. This focus has been correct as asset allocation is generally in the purview of plan fiduciaries. This paper demonstrates that along with the reduction in pension surplus volatility, de-risking through decreased allocations to risky assets in favor of liability hedging assets may improve credit ratings for firms with large pension plans relative to their core businesses.2

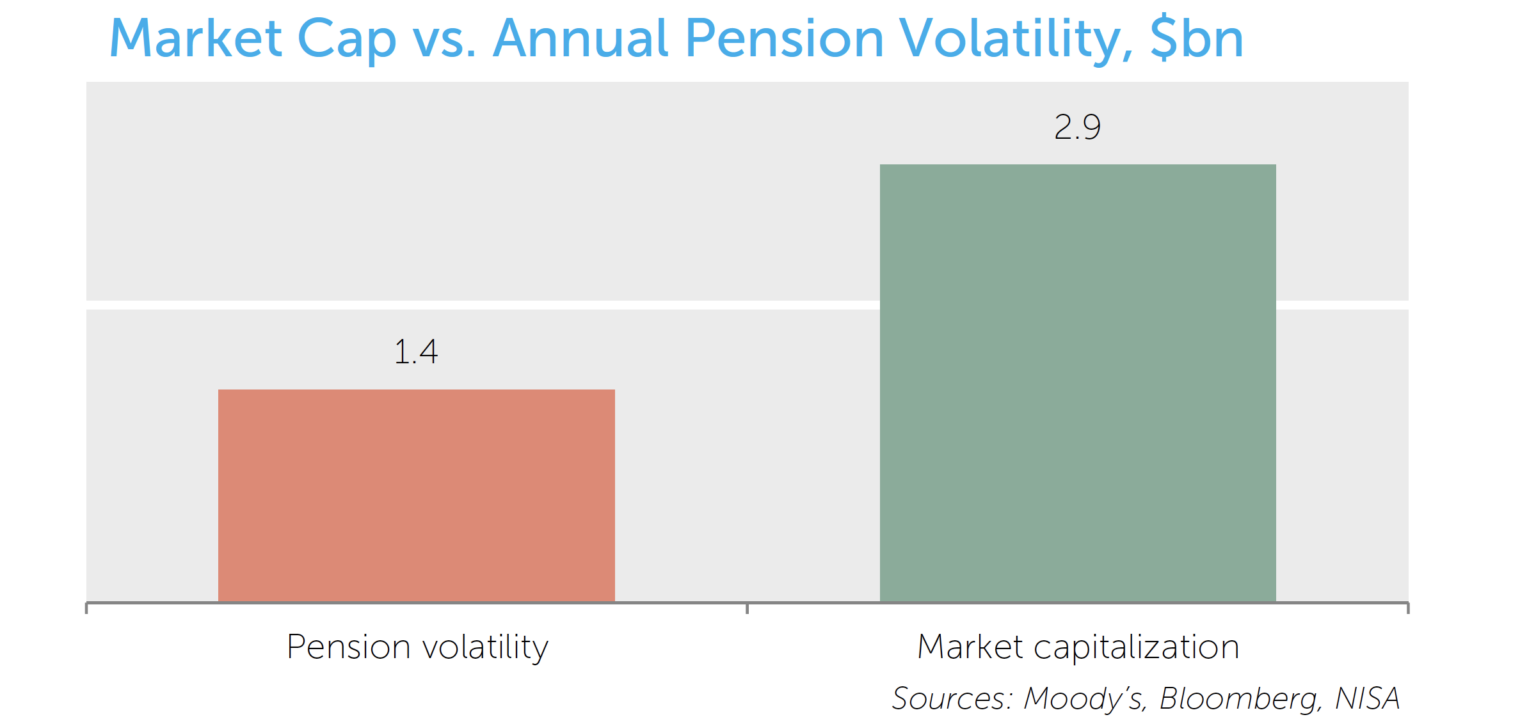

To illustrate this point with real data, we highlight one firm, US Steel3, to show 1) how pension volatility contributes to total firm volatility, 2) how pension de-risking can reduce total firm volatility, and, 3) the potential credit rating change associated with lower pension volatility and lower total firm volatility.

Pension Risk: Substantial but Manageable

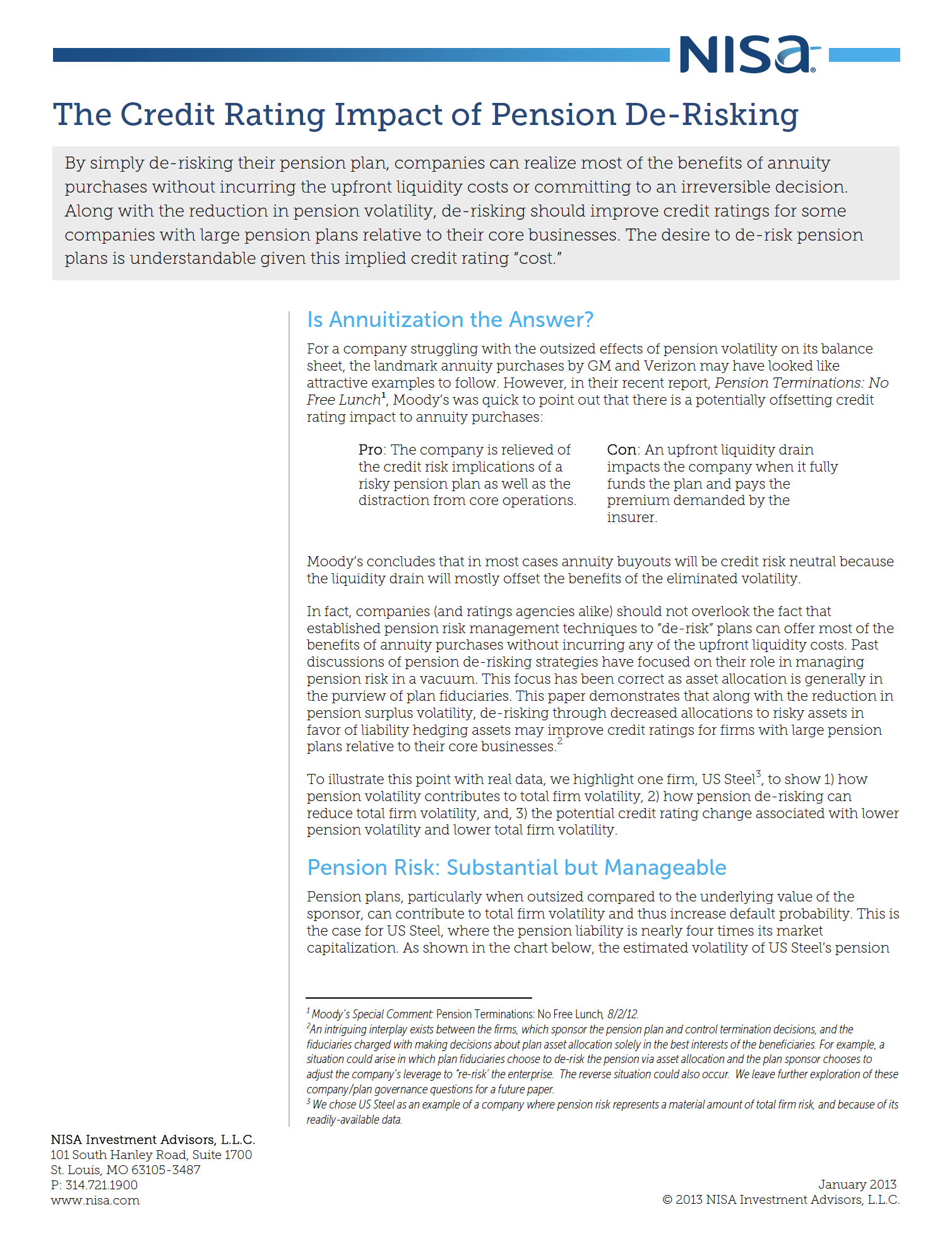

Pension plans, particularly when outsized compared to the underlying value of the sponsor, can contribute to total firm volatility and thus increase default probability. This is the case for US Steel, where the pension liability is nearly four times its market capitalization. As shown in the chart below, the estimated volatility of US Steel’s pension implies that a one-standard deviation event impacting funded status would erode nearly half of its market capitalization.4

For many companies, this pension volatility has already put such a dent in the balance sheet that no theoretical construct is necessary to prove that pension risk matters to the firm’s creditors and shareholders. Nonetheless, it is helpful to decompose total firm volatility into the firm’s stand-alone operating volatility, pension surplus volatility, and the correlation between the two. We calculate these volatilities incorporating implied volatility from current option prices, thus providing a forward-looking risk estimate.5 Using this approach, based on standard credit risk models, we can explore the reduction in total firm volatility for US Steel by both de-risking the pension plan via asset allocation changes and eliminating it entirely via an annuity buyout.

The chart above illustrates that most of the risk-reducing benefit of an annuity purchase can be realized through de-risking alone, leaving only the residual pension volatility deriving from longevity risk and hedge tracking error. For US Steel, total firm volatility is nearly identical in the de-risked and annuity purchase cases ($1,129mm and $1,089mm of remaining firm volatility, respectively).

Pension Risk Down, Credit Rating Up?

Intuitively, the link between firm volatility expectations and risk to the firm’s creditors is logical. Smaller expected fluctuations in firm value should provide more comfort to bondholders that the equity “cushion” will protect them. Further, it seems self-evident that this additional comfort to bondholders should be factored into the company’s credit rating.6 Whether this lower firm volatility is achieved through pension de-risking or other means should not matter.

The credit rating impact of lower pension risk can be quantified using a distance-to-default model, which estimates changes in default risk based on changes in firm volatility. This change in default risk can then be mapped to implied credit rating changes. We believe it is a reasonable assumption that changing a firm’s pension risk is unlikely to have any effect on the operations of the company.7

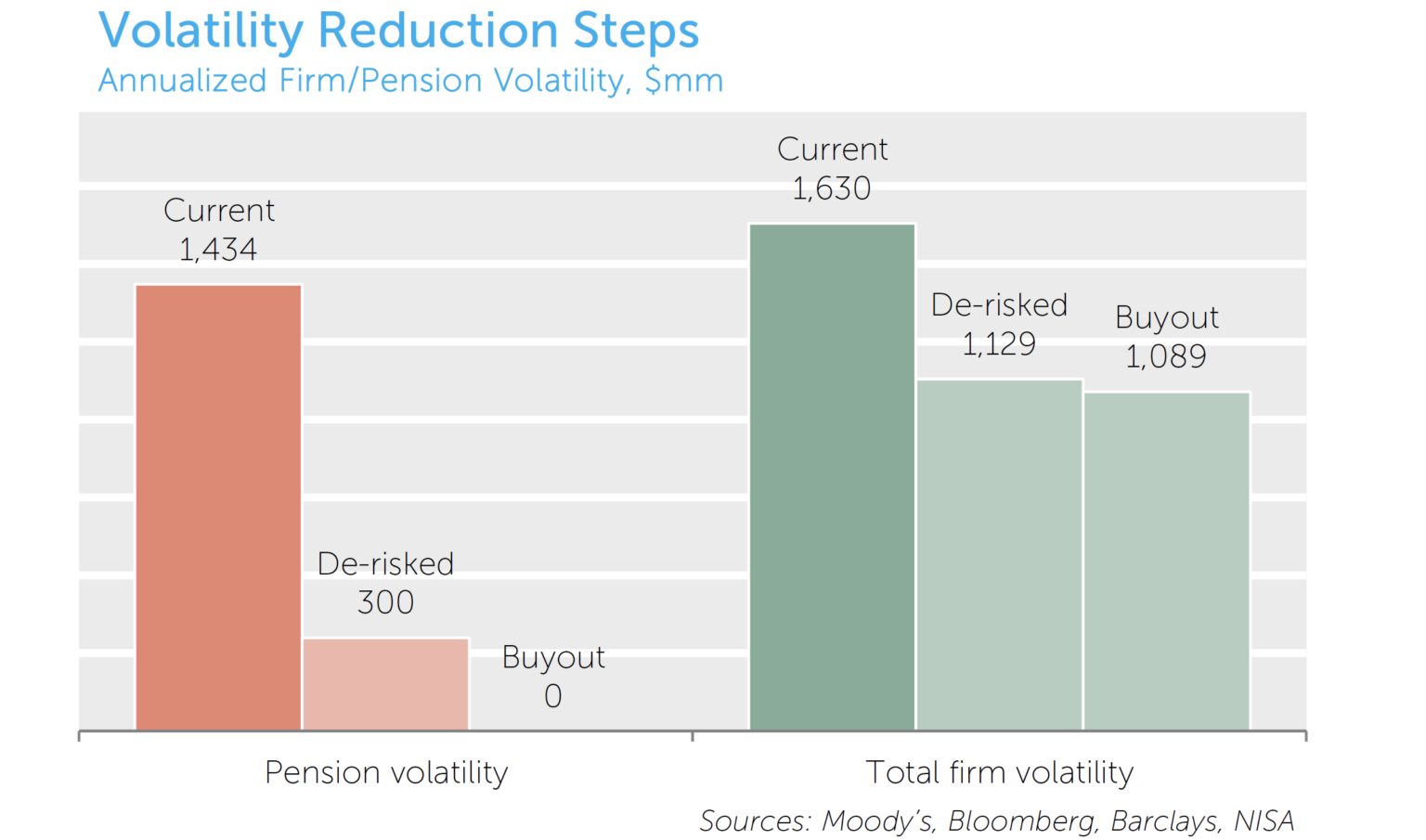

Indeed, when comparing US Steel’s current firm volatility to the de-risked volatility, the company’s estimated one-year probability of default falls from 3.6% to 0.5%, resulting in an implied rating improvement of two full notches from BB to BBB-. Returning to the Moody’s piece, we apply this same approach to all of the firms Moody’s lists as having large pensions compared to market capitalization. The chart below shows that the distance-to-default model implies that the majority of these firms could realize an improvement of one or two notches in their credit rating from pension de-risking alone.

These results highlight the double-sided cost of pension volatility for many companies. Not only has the historical volatility of the pension plan impacted its current balance sheet, but the company continues to pay an indirect price for bearing the prospective volatility of the pension asset allocation decisions through a lower credit rating.

Conclusion

For many companies, pension plans are a major source of volatility which can create significant uncertainty and distract from core business operations. While pension risk transfer strategies like annuitization-based buyouts may completely relieve the company of pension risk, there may be material liquidity costs to that approach which ratings agencies will not overlook.

This analysis demonstrates that by simply de-risking their pension plan, a company can realize most of the benefits of annuity purchases without incurring the upfront costs or committing to an irreversible decision. Along with the reduction in pension volatility, de-risking should improve credit ratings for some firms with outsized pension plans relative to their core businesses. The desire to de-risk is understandable in light of this implied credit rating “cost.”

APPENDIX

This appendix will walk through the calculations used in the US Steel example in much greater detail. Standing on the shoulders of giants9, we use a distance-to-default (D-to-D) model to quantify the default risk of firms of varying riskiness. The D-to-D approach models the bonds as a type of option on the firm. Specifically, equity owners have the right to put the firm to bondholders in the event the value of the total assets of the firm falls below that of the debt of the firm – that is when the equity value of the firm falls to zero. This approach makes clear the relationship between the firm’s asset volatility and its credit risk. The more volatile the firm’s assets, the greater the risk the equity “cushion” is exhausted, thus causing a default. The output of a D-to-D model is an estimate of the firm’s default likelihood. This default likelihood can be mapped to an implied rating by an empirical analysis of the relationship between observed ratings and calculated default likelihoods for a cohort of securities. With this model, our task of estimating the link between credit risk and pension risk is simplified to calculating the total firm volatility before and after pension de-risking.

Assumptions:

P = Pension Funded Status (Assets – Liabilities) Value

C = Core Operating Company (Firm ex Pension) Value

Step 1: Calculate Total Firm Volatility

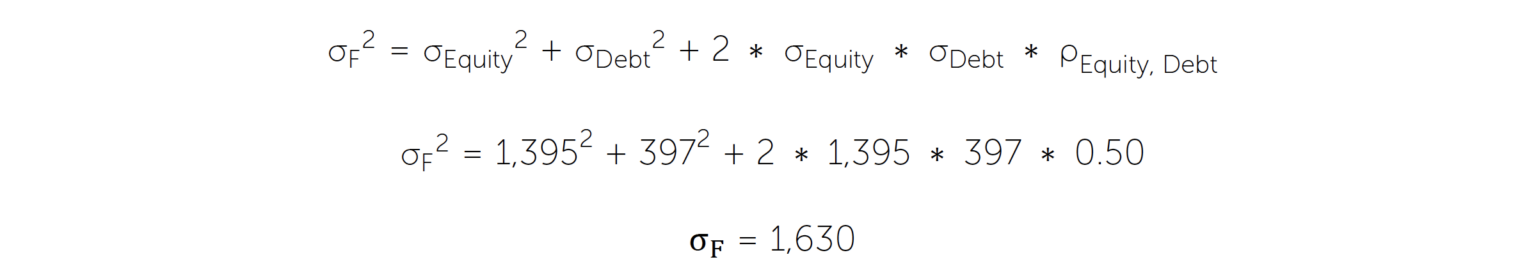

Using market data, we can estimate the volatility of a firm’s outstanding debt and equity as well as the correlation between the two. Applying this data, we calculate the total firm volatility for US Steel (amounts in millions):

- Changes in pension deficits directly affect a firm’s market value. That is, a one dollar increase in pension deficit represents an additional liability of the firm, thus

decreasing the total market value of the firm (debt plus equity) by exactly one dollar.

- Standard deviations to default = market cap / annual firm volatility.

- Probability of default is based on the assumption that firm risk is normally distributed.

- This analysis solely analyzes the impact of pension risk on total firm volatility. All other factors that may affect a firm’s total volatility are assumed to be unchanged.

- Market cap: Current market cap (Source: Bloomberg 10/31/12)

- Debt outstanding: From Bloomberg, short-term debt + long-term debt + operating lease adjustment (10/31/12).

- Pension liability (PBO): From Moody’s Special Comment: Pension Terminations: No Free Lunch (8/2/12).

- Funded status: From NISA’s PSRX (10/31/12).

- Pension asset and liability volatility: From NISA’s PSRX using forward-looking option-implied volatilities (10/31/12). The volatility of US Steel’s pension based on their actual asset allocation and liability data may be different.

- Firm-specific equity volatility: One year ATM option-implied volatility from Bloomberg (10/31/12).

- Firm-specific debt volatility: Historical 24-month return volatility for outstanding bonds. Calculated using Barclays POINT10 (10/31/12).

- Correlation between firm’s debt and equity: Historical 24-month correlation (10/31/12).

- Correlation between pension assets and pension liability: Historical 24-month correlation (10/31/12).

- Correlation between pension and firm: Historical 24-month correlation between pension surplus and firm market value (10/31/12).

P = Pension Funded Status (Assets – Liabilities) Value

C = Core Operating Company (Firm ex Pension) Value

Step 1: Calculate Total Firm Volatility

Using market data, we can estimate the volatility of a firm’s outstanding debt and equity as well as the correlation between the two. Applying this data, we calculate the total firm volatility for US Steel (amounts in millions):

Step 2: Calculate Core Operating Volatility

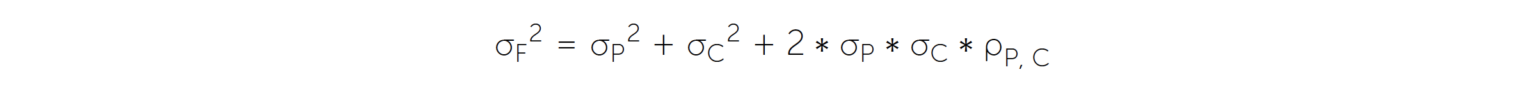

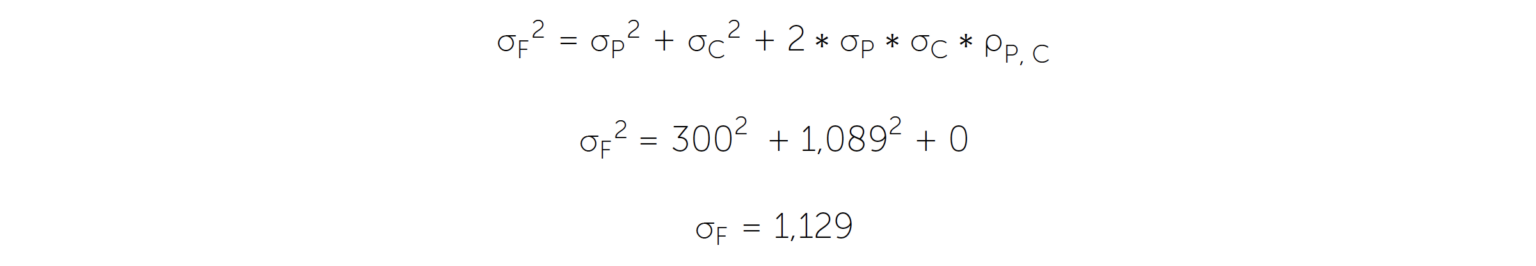

Conceptually, the total firm volatility (σF) depends on: (1) pension surplus volatility (σP), (2) core operating volatility (σC) and (3) the correlation between the pension and core operating business performance (ρP, C):

Conceptually, the total firm volatility (σF) depends on: (1) pension surplus volatility (σP), (2) core operating volatility (σC) and (3) the correlation between the pension and core operating business performance (ρP, C):

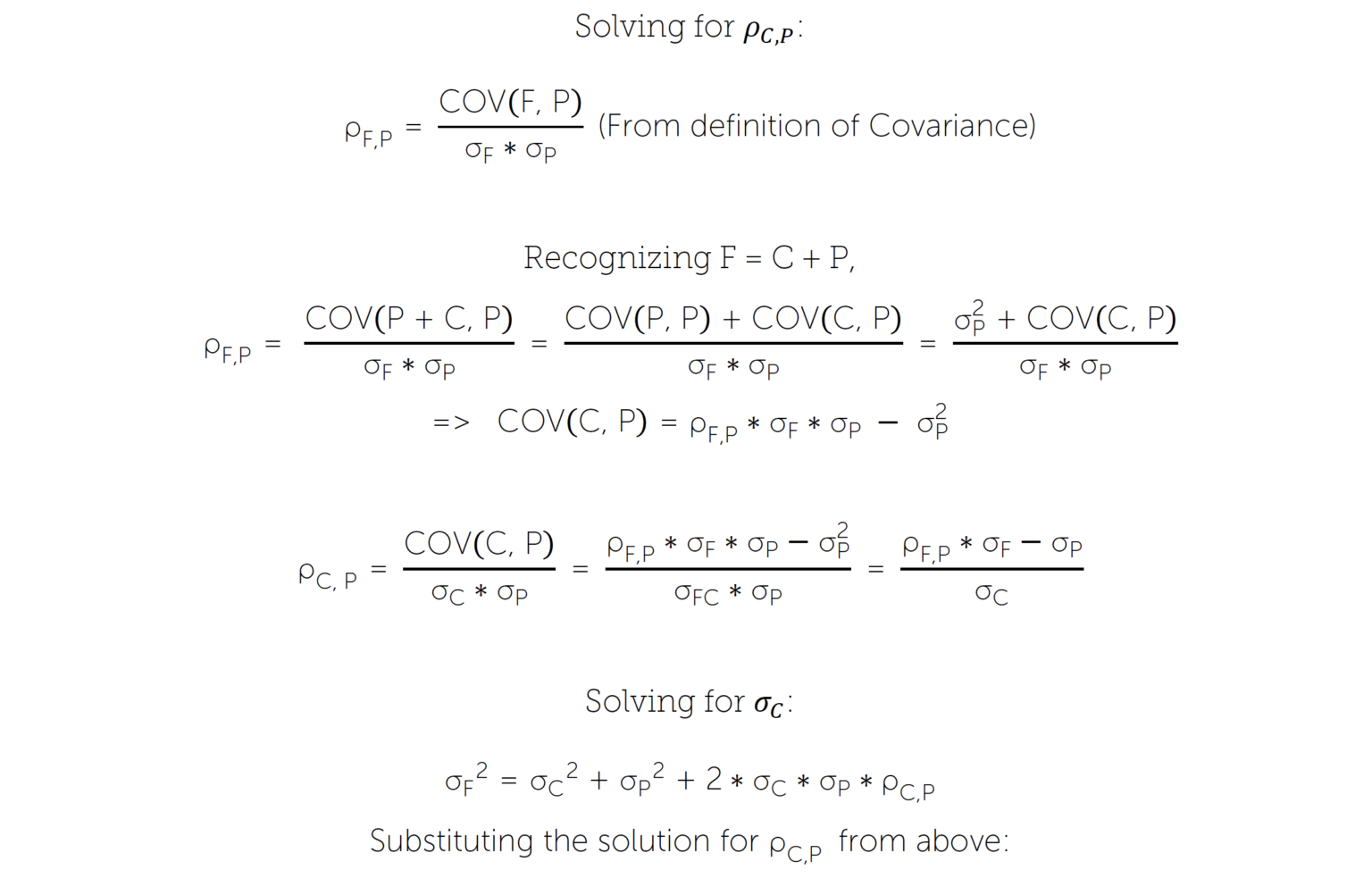

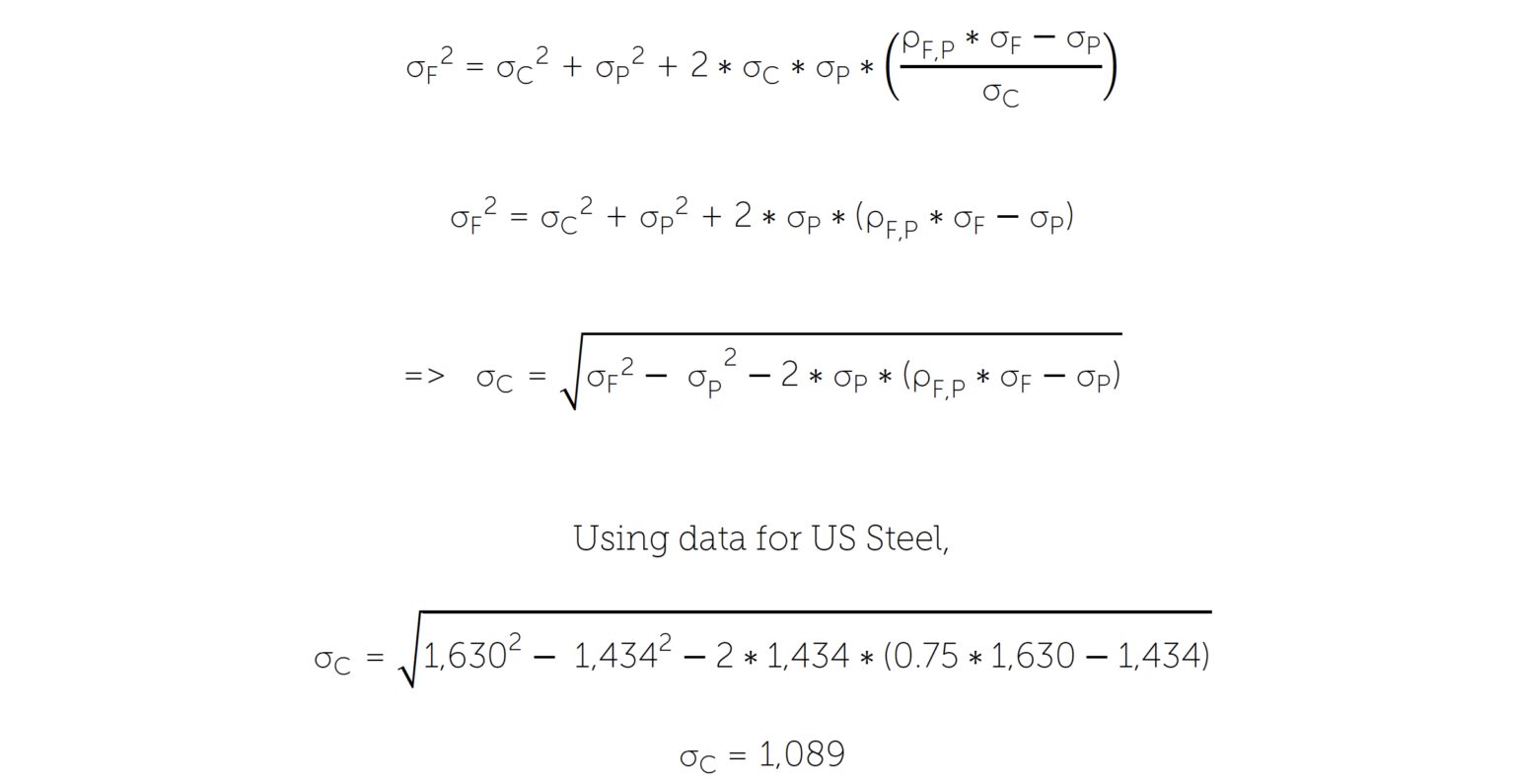

However, we do not observe all of these variables directly. We are able to observe the volatility of the firm, pension surplus volatility, and the correlation between pension surplus and the overall firm. The algebra below shows how we can solve for the core operating volatility and its correlation to the pension surplus:

Step 3: Calculate De-Risked Pension Volatility

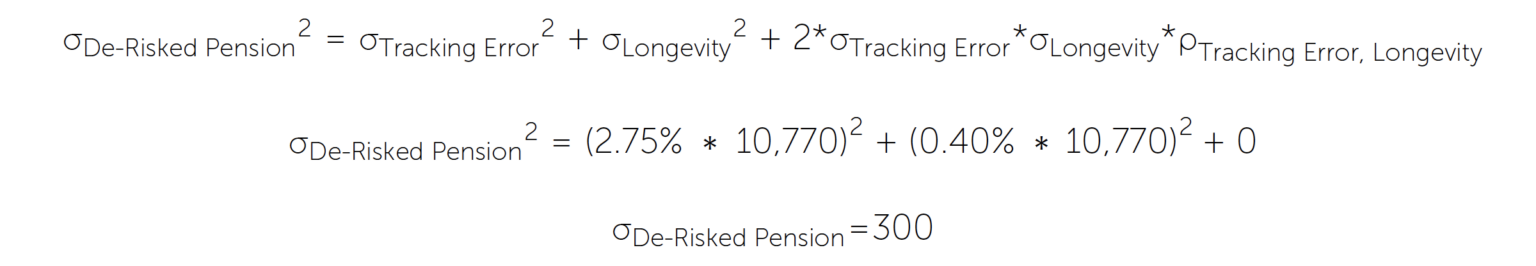

Once the pension is de-risked, the only sources of surplus volatility are tracking error and longevity risk. Based on NISA’s experience analyzing pension risk, we assume a 2.75% tracking error to the liability measured with a high quality corporate discount rate and a 0.40% annualized longevity risk. These risks are assumed to be uncorrelated. The tracking error assumption is intended to reflect a reallocation of all plan assets towards liability hedging assets:

Once the pension is de-risked, the only sources of surplus volatility are tracking error and longevity risk. Based on NISA’s experience analyzing pension risk, we assume a 2.75% tracking error to the liability measured with a high quality corporate discount rate and a 0.40% annualized longevity risk. These risks are assumed to be uncorrelated. The tracking error assumption is intended to reflect a reallocation of all plan assets towards liability hedging assets:

Step 4: Calculate De-Risked Firm Volatility

Adding the volatility of the de-risked pension to the volatility of the operating company:

Adding the volatility of the de-risked pension to the volatility of the operating company:

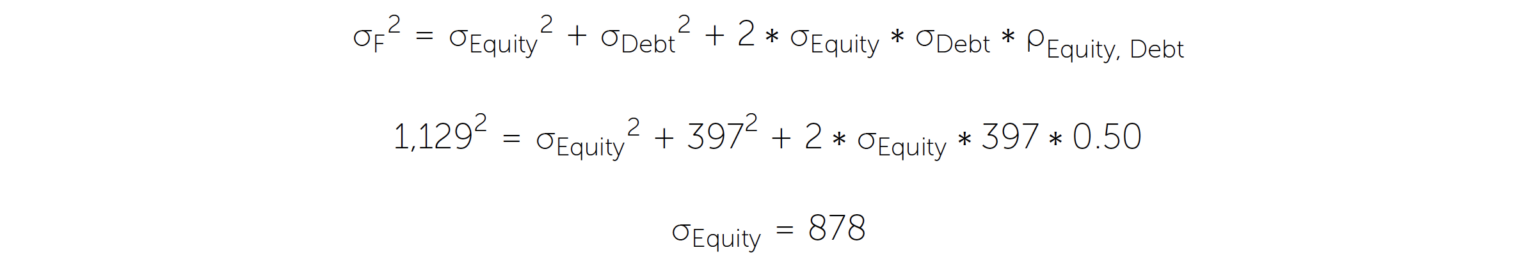

Step 5: Calculate De-Risked Equity Volatility

In order to estimate the volatility of equity after de-risking, which would not otherwise be needed, but is a required input of the Bloomberg DRSK function, we assume the firm’s debt volatility and its correlation to equity has not changed.

In order to estimate the volatility of equity after de-risking, which would not otherwise be needed, but is a required input of the Bloomberg DRSK function, we assume the firm’s debt volatility and its correlation to equity has not changed.

Step 6: Use Bloomberg’s DRSK Function

By entering US Steel’s equity volatility into Bloomberg’s DRSK function before and after de-risking, we estimate the credit rating would improve from BB to BBB-.

By entering US Steel’s equity volatility into Bloomberg’s DRSK function before and after de-risking, we estimate the credit rating would improve from BB to BBB-.