January’s steep drop in equity prices and rise in bond prices mean that many institutional investors are thinking about the same thing: rebalancing. With such a divergence in returns between equities and bonds, asset owners are understandably looking to get their portfolios back in line with their allocation targets.

The problem is that not all asset classes are that easy to buy and sell. Asset classes with less liquidity and higher transaction costs require investors to pay dearly to execute those rebalancing trades – if they can trade at all.

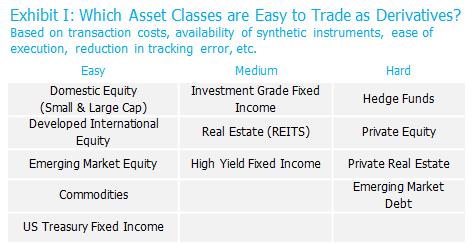

This is where derivatives may be able to help. Instruments like futures and swaps exist for a broad menu of asset classes. The transaction costs associated with a derivative’s “synthetic” exposure to an asset class may be significantly less than trading the underlying assets in the physical market. The table below categorizes some common asset classes based on how difficult or costly we believe they are to trade in derivative markets.*

Source: NISA analysis.

Pairing two derivative trades can be particularly useful when rebalancing, since every asset class overweight has a corresponding underweight. Take a pension plan that is underweight commodities and overweight equities. Combining a short position in equity futures with a long position in commodity futures rebalances the plan without touching the physical portfolios. If and when markets reverse or diverge further, the plan can simply roll back or increase those derivative positions accordingly to stay on their target allocations.

In some cases, the ideal derivative exposure may not be available. But, a plan sponsor may still be able to trade the component parts of the asset class to meet their rebalancing objective. For example, selling corporate bonds is a trade that can be expensive, slow to execute, or both. But we believe corporate bonds can be broken into their Treasury-like interest rate component and their equity-like spread component. Both of those components are easy to trade as derivatives, leaving the actual corporate bond portfolio intact and avoiding the transaction costs of the physical market.

Rebalancing seems simple until you actually have to do it. Ultimately, it boils down to a tradeoff between the transaction costs of trading to your policy allocation and the tracking error associated with deviations from it. And while there are other considerations with derivatives – e.g., collateral, counterparties, etc. – in a time of heightened volatility, derivatives can be a great addition to the toolkit of institutional investors.**

*The use of derivatives introduces additional requirements and risks to the portfolio.

**See “Rebalancing Revisited: The Role of Derivatives,” published in the September/October 2007 Financial Analysts Journal for more discussion on the role of derivatives in rebalancing.