| The advent of investable risk premia indices brings beta overlay to a new level. These tools allow investors to adjust the pre-packaged factor weights of traditional asset classes toward a different weighting scheme based on priced factors and investors’ preferences. |

Portable Alpha

For some time now, investors have recognized that separating alpha and beta can be desirable. Because alpha is not equally accessible in all markets, investors will pursue alpha in markets they believe provide attractive opportunities. When this quest for alpha results in undesirable beta exposures, an overlay may be deployed to bring the portfolio back in line. Portable alpha (or portable beta for that matter) is born!

When we begin porting beta, the natural question is: “To what target?” Investors generally start by reminding themselves what the beta portfolio was intended to do in the first place: provide efficient, market-based, risk-adjusted return. In a simple, one-factor world, exposure to the market portfolio is sufficient. In a multi-factor world, however, the answer is less clear. Equilibrium capital market theory suggests that the market portfolio provides an optimal risk/return package, at least so long as the investor is similar to the marginal investor that is setting the market price of risk.

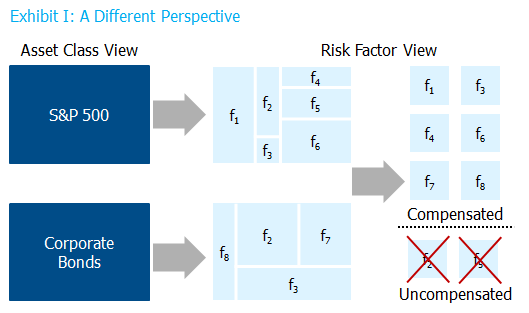

But consider this: If investors can decompose the underlying “priced factors” of various asset classes and investment strategies, then they can potentially build more desirable (e.g., higher Sharpe ratio) portfolios from the markets’ fundamental primitive components. In the mindset of so-called “risk-premia” investing (and the various other monikers by which these strategies are known), many of the underlying priced factors might be better described as concepts or investment strategies rather than asset classes or fundamental exposures; examples would include value factors, momentum factors, carry patterns/term structures, etc.

Traditional asset classes offer a somewhat random pre-packaging of the fundamental priced factors. It is, of course, possible that this pre-packaging results in the preferred risk-return combination when compared to building a portfolio of priced factors from the ground up… but it may not. Risk premia strategies—i.e., Beta Overlay 2.0—may be the new frontier of porting to a decidedly different concept of “beta.”

Traditional asset classes offer a somewhat random pre-packaging of the fundamental priced factors. It is, of course, possible that this pre-packaging results in the preferred risk-return combination when compared to building a portfolio of priced factors from the ground up… but it may not. Risk premia strategies—i.e., Beta Overlay 2.0—may be the new frontier of porting to a decidedly different concept of “beta.”

While not a new concept, risk premia investing is on the verge of being (re-)born. The combination of (1) the increasing challenge to meet return objectives, (2) technology-enabled ways to identify risk factors, and (3) derivative strategies designed to deliver isolated risk premia are just a few of the reasons for increased innovation in this area. I’m planning a few more posts on this topic in the near future. In the meantime, please feel free to reach out to discuss this topic directly.