Returns will be hard to come by in 2016. That is perhaps the least controversial prediction we can offer for the New Year. Though modest, we do have one suggestion for potentially improving an investor’s overall return: consider substituting Treasury Floating Rate Notes (FRNs) for T-bills/Short Term Investment Fund.

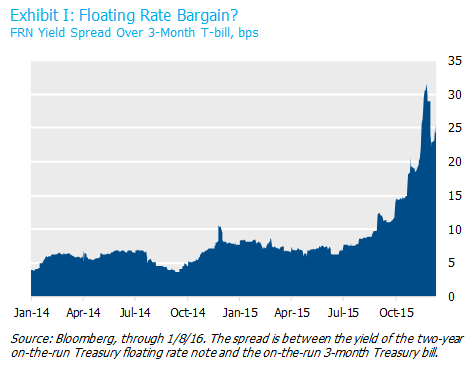

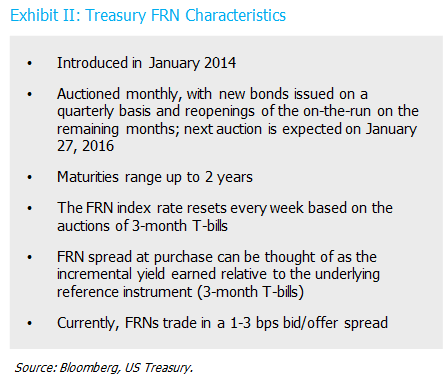

FRNs have several features that make them attractive as cash equivalents. They are Treasury quality, have near zero duration, and, because their index rate resets every week based on the auctions of 3-month Treasury bills, respond quickly to changes in short term interest rates. Interestingly, they have been trading at a substantial discount to T-bills, with yields reaching as much as 30 bps above 3-month T-bills in the last few weeks, though they have traded in the low-to-mid 20 bps more recently.1

In theory, this spread between FRNs and T-bills reflects two (typically opposing) forces. First, FRN buyers should generally receive a liquidity premium spread, because FRNs have longer maturities and higher transaction costs than T-bills. Second, FRN buyers should generally pay a term premium (FRN rates reset with the weekly T-bill auction, but based on a longer term T-bill). Notwithstanding these forces, however, the main driver of the T-bills/FRN spread may be the unique role played by T-bills in the market. Whether for regulatory or institutional reasons—for example, money market funds limited to holding less than one-year securities—investors may be driven toward buying T-bills without considering their FRN cousin, thus creating a “specialness” for T-bills, resulting in lower yields.

The bottom line is that—if you can bear a modest liquidity give-up relative to T-bills—we believe that FRNs currently offer a good opportunity for picking up a little extra yield.

1 Technically, this yield difference is known as the discount margin, but we will refer to it as the spread for simplicity’s sake.