The LIBOR transition continues. As we have outlined in previous notes, we are six years into a global effort to replace LIBOR with more robust reference rates. Though progress has been made, we can’t say at this point whether the transition will be successfully completed before the end of 2021, the deadline after which UK regulators will stop requiring banks to submit responses to LIBOR surveys.

The transition effort in the US is being led by the Alternative Reference Rate Committee (ARRC), a diverse group of market participants convened by the Federal Reserve. After much deliberation, ARRC selected the Secured Overnight Financing Rate (SOFR) as the preferred LIBOR successor for US dollar markets. SOFR is a volume-weighted median of borrowing rates from the Treasury repo market, based on an average of $1 trillion in daily transactions.

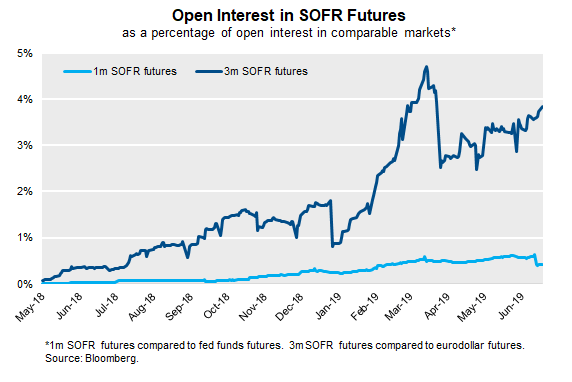

Officials like to say that the transition is “ahead of schedule” relative to the ARRC paced transition plan. While the infrastructure of a SOFR derivatives market has been established, uptake has been minimal and liquidity in SOFR derivatives remains anemic. Open interest in 1-month and 3-month SOFR futures remains less than 5% of the open interest in the comparable federal funds futures and Eurodollar futures. Participation in the SOFR overnight index swap (OIS) market has been even lighter, with very little trading activity at longer tenors.

Earlier this year, NISA established a LIBOR Transition Working Group to manage the transition process, follow news from ARRC and regulatory agencies, and monitor the development of SOFR derivatives markets. The Group is led by members of our Legal and Portfolio Management teams, and includes members from across the firm. The Group’s first order of business was to take inventory of LIBOR exposure in client portfolios and review legal documents for fallback language in the event of LIBOR cessation. Early results of that examination have been generally positive and we believe our clients have relatively little LIBOR exposure that is problematic. In short, most of our clients’ LIBOR exposure expires before the end of 2021 and clients will generally have time to wait and see how SOFR markets develop before taking any action.

Interest rate swaps are the largest single source of LIBOR risk in the US dollar market, representing $81 trillion of the $200 trillion in gross notional LIBOR exposure catalogued by ARRC. With that said, most of our clients have transitioned their synthetic exposure away from interest rate swaps to Treasury-based derivatives in recent years, for reasons that include the negative level and increased volatility of longer tenor swap spreads and the introduction of the ultra-long Treasury futures contract. If clients with LIBOR swaps want to remove LIBOR exposure from their portfolio, there are options for doing so today. Treasury futures are of course one alternative, or clients can switch from LIBOR swaps to fed funds OIS.

LIBOR is, however, still commonly referenced in certain total return swap (TRS) transactions, including TRS on equity and high yield indices (Treasury TRS, on the other hand, now most commonly reference fed funds). TRS generally have maturities inside of one year, though they can extend further. All TRS currently in NISA client portfolios mature before the expected LIBOR cessation deadline at the end of 2021.

Swaptions, which reference LIBOR swaps as the underlying security, present a unique challenge because at present there exist few alternatives for achieving interest rate options exposure. CME Group lists options on Treasury futures, but only options on the active Treasury future contract are liquid, meaning that the longest expiry option is 3 months. Many of NISA’s clients have expiries out to two years (though again, all are set to expire before the end of 2021). We believe the lack of suitable alternatives to swaptions to be a key shortcoming of the LIBOR transition process to date.

Regulators and ARRC members hope that liquidity in SOFR derivatives markets will develop sufficiently in the next couple years such that market participants will be able to transition LIBOR exposure directly to SOFR derivatives markets in an orderly and cost efficient manner. The NISA LIBOR Working Group will be closely monitoring conditions in these markets. We will seek to keep you updated on the transition process in the coming months and years, but please do not hesitate to contact us with any particular questions or concerns you may have.