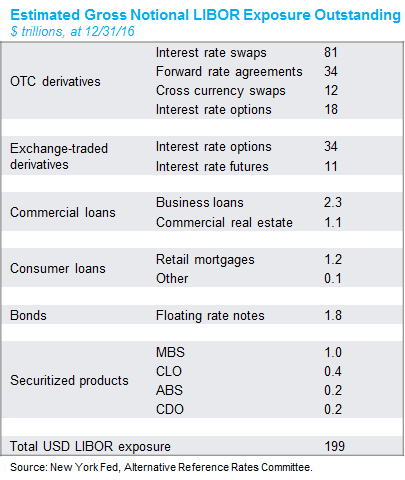

The LIBOR transition continues. A global effort has been underway since 2013 to reduce dependency on LIBOR, the benchmark interest rate discredited by a series of manipulation scandals and long criticized for reflecting bankers’ estimates of their borrowing costs rather than actual transactions. US dollar LIBOR has grown since the 1980s to underpin $200 trillion in financial securities ranging from interest rate swaps to adjustable rate mortgages, so the transition will be lengthy and complicated (see table below).

Since our last update, a number of significant developments have occurred:

- In April, the Federal Reserve Bank of New York began daily publication of the Secured Overnight Financing Rate (SOFR), the reference rate selected by the Alternative Reference Rates Committee (ARRC) as the preferred successor to LIBOR. The Secured Overnight Financing Rate is an index of overnight Treasury repo rates based on roughly $800 billion in average daily transaction volume.

- In May, SOFR futures began trading on the Chicago Mercantile Exchange (CME), with a 3-month contract and a 1-month contract.

- In September, the CME Group began clearing overnight index swaps (OIS) that reference the Secured Overnight Financing Rate.

- In October, the Financial Accounting Standards Board announced that SOFR derivatives are acceptable for the application of hedge accounting, providing accounting benefits to issuers and other hedgers.

- Since July, several companies and agencies have issued over $14 billion of floating rate notes linked to the Secured Overnight Financing Rate.

- Over the last year, ARRC has led efforts to improve fallback language included in a variety of financial contracts to better address contingencies related to the cessation of LIBOR publication.

Taken together, these developments represent material progress along ARRC’s paced transition plan to promote a shift from LIBOR to SOFR as the benchmark for US dollar interest rate markets (similar processes are underway in various other jurisdictions around the world). In essence, the groundwork for a SOFR market has been laid. Now we just have to wait for volumes to pick up. Next steps include mandated SOFR discounting by clearinghouses and the development of a term SOFR rate. ARRC hopes these efforts will increase SOFR liquidity beyond a tipping point that will create positive network effects and incentivize wholesale adoption of the new reference rate.

Unfortunately, creating a financial market from scratch is something of a chicken-or-egg problem. Investors prefer to trade liquid securities, but liquidity requires robust trading volume. SOFR derivatives volumes remain anemic thus far, with SOFR futures averaging below 1/100th of the volumes for comparable Eurodollar and fed funds futures. ARRC likely takes some comfort from the robust SOFR-linked issuance observed thus far. The Fannie Mae and World Bank SOFR-linked floating rate notes were heralded as landmark developments. But in a sign that we’re still in the early innings, the World Bank promptly swapped their interest expense from SOFR back to LIBOR. Old habits die hard.

From NISA’s perspective, while this initial progress is encouraging, the ultimate success of the transition from LIBOR to SOFR remains highly uncertain. The Secured Overnight Financing Rate is undeniably a more robust benchmark rate than LIBOR, mostly because the rate is based on actual transactions rather than a survey. But given the vast amount of legacy LIBOR-linked securities and the infrastructure surrounding them, as well as legitimate questions about the design of SOFR derivatives, there is no guarantee of a smooth or complete transition. A segmentation of liquidity between SOFR derivatives, fed funds OIS – and possibly a “zombie LIBOR” that lives on beyond the end-date of 2021 – remains entirely possible. Rest assured, interested regulators and market participants, including NISA, will be closely monitoring the transition and the development of liquidity conditions in the SOFR derivatives market.

Download the PDF

To download a PDF version, please click here.