The recent volatility in bond markets has prompted quite a few inquiries from clients. Here we consolidate our thoughts on the most frequently asked questions.

What exactly happened in the Treasury market last month?

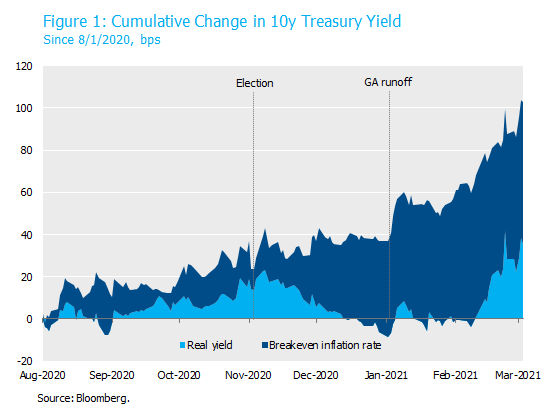

Treasury yields have been rising steadily since last summer but an important shift occurred in mid-February. Between August 1 and February 12, all 64 basis points of the increase in the 10-year nominal Treasury yield was accounted for by the breakeven inflation rate. The 10-year real yield was unchanged over that period at -1.02% even as the breakeven inflation rate rose from 1.58% to 2.22%. In the eight trading sessions after President’s Day, that pattern reversed: the 10-year real yield rose by 41 basis points and the breakeven rate declined by 9 basis points. This sudden shift sent swaption-implied interest rate volatility to the highest level since March 2020 and caused Treasury market liquidity to deteriorate substantially at the end of February.

How have risk assets performed?

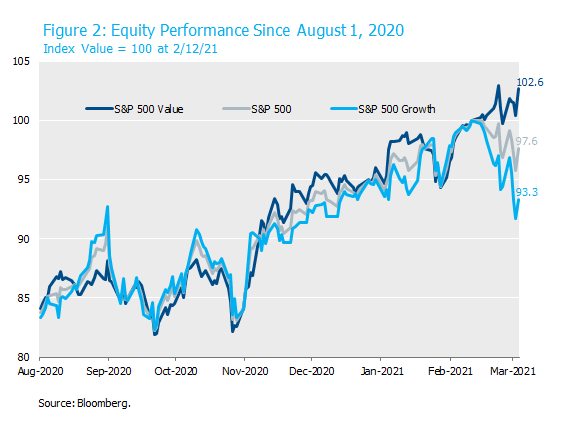

Fairly well at the headline level, but the still waters belie some moderate churn below the surface. The option-adjusted spread on the Bloomberg Barclays Long Credit Index is only a few basis points wider since mid-February, supported by negative net new issuance over the trailing five months as rising Treasury yields contributed to strong demand including from pension funds that have de-risked as funded status has improved. The S&P 500 has only declined by 2.4% since reaching an all-time high on February 12, but growth stocks fell by 6.7% while value stocks rose by 2.6% over the same period (Figure 2). As breakeven inflation drove nominal yields higher between August 1 and February 12, equity dispersion was much lower as growth and value stocks returned a roughly equivalent 17% return.

The last six months demonstrate that risk assets can perform well in a rising nominal rate environment if that rise is caused by breakeven inflation rates recovering back towards levels consistent with the Fed’s inflation objectives. We have described this as a “good Treasury selloff” from the Fed’s perspective. We believe risk assets can also withstand rising real interest rates if the cause is higher real growth expectations, which would presumably translate to higher corporate earnings. On the other hand, if real interest rates were to increase primarily because monetary policy expectations shifted to a less accommodative stance, that could spell trouble, for growth stocks in particular. That risk assets have held up relatively well despite the sharp increase in real rates suggests to us that the rate rise is being driven more by the growth outlook than monetary policy expectations. So far.

Why did it happen?

We did not observe any discrete catalyst for rise in real interest rates, in contrast to the 2013 taper tantrum that was sparked by a communications error by Chairman Bernanke. From our perspective, the 2021 episode can be attributed to several factors. As the pace of vaccination has increased and more investors have come around to the view that consumer spending is likely to skyrocket this summer, the outlook for real growth has improved. We are even more optimistic than the consensus on the growth outlook, though it’s hard to see how this factor could explain such a large and sudden increase in real yields. We believe that a hawkish shift in monetary policy expectations also explains part of the increase in real yields, as will be discussed below.

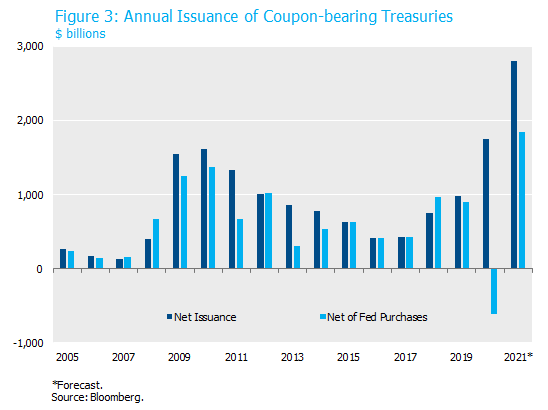

Finally, it’s possible that the Treasury market is starting to price a higher fiscal risk premium as investors contemplate the supply implications of government spending that continues at a torrid pace fully twelve months into the pandemic. Market participants have well understood that Treasury supply net of Fed purchases is going to increase by a record amount this year (Figure 3), so it’s not clear why this risk would be priced into Treasury yields so suddenly in February. It is worth noting that the level of real rates has been well correlated with the perceived odds of unified Democratic control throughout the election cycle (Figure 1).

How has the Fed responded?

Most Fed speakers in the last few weeks have repeated the party line that rising longer-term rates are a positive sign reflecting higher expectations for real growth and inflation, though most of them have glossed over the shifting dynamic between real rates and breakevens since mid-February. Other central banks including the ECB, the Reserve Bank of Australia and the Bank of Korea have responded with dovish language and even policy action to counteract rising real yields. We believe the lack of pushback from the FOMC officials has led some market participants to reassess the Fed’s reaction function at the margin.

Importantly for the Fed, the increase in interest rates has not been limited to the long end of the yield curve. Short rate markets have pulled forward the pricing of the first rate hike from 2024 to 2022 even though the TIPS market is pricing inflation to fall well short of the overshoot the Fed desires under their new average inflation targeting framework. In our estimation, financial markets are expressing doubt about the Fed’s commitment to achieving the aggressive employment and inflation objectives presented under the AIT framework. If that lack of credibility persists, it could reduce inflation expectations and undermine the effectiveness of the policy before it even has a chance to work.

Where do we go from here?

We are in a stage of the business cycle that can be volatile for financial markets. The Fed has acted aggressively and pushed real interest rates to their lowest level in U.S. history. They have indicated they are unlikely to provide further accommodation unless the economic outlook deteriorates substantially. Likewise, the peak of the fiscal policy impulse for this economic cycle will probably occur in the second quarter when the third round of stimulus checks are disbursed. After we get through the initial reopening, which we believe will occur this summer, the question will become whether the economy can stand on its own as fiscal and monetary policy stimulus begins to fade. Equity investors will be watching to see if corporate earnings can grow sufficiently to justify the multiple expansion that has occurred over the past 12 months. The challenge for the Fed is to withdraw monetary accommodation and allow real interest rates to rise soon enough to prevent overheating but not so quickly as to derail the recovery.

It’s possible that the Fed will perfectly tailor their monetary policy tightening along with the pace of the economic recovery and achieve central bank nirvana with full employment, price stability and financial stability. We hate to be the bearer of bad news, but that path to nirvana is narrow and the Fed has never walked it. When push came to shove, every Fed Chair since Greenspan has erred on the side of withdrawing accommodation too slowly. These actions contributed to a tech bubble and a housing bubble in the previous two economic cycles. It’s possible that Yellen and Powell had timed it perfectly in the latest business cycle, but it was interrupted by the exogenous shock from the pandemic so we’ll never know.

If the Fed removes accommodation too fast, real rates will rise and financial conditions will tighten. If they get it just right, growth-sensitive assets will continue to perform well even as real interest rates rise gradually. If they are too dovish, real rates will stay too low for too long and risk overheating the economy in the form of high inflation or, more likely, an asset bubble. The discounting of those three possibilities in the midst of this most unusual economic environment may cause continued volatility in financial markets. We think the odds of the Fed making a hawkish policy mistake are quite low for at least the next 2-3 quarters, but we are carefully watching their ongoing response to this latest bond tantrum to inform that thesis.

To download a PDF version, please click here.