In our previous post, we outlined a framework for evaluating asset allocation decisions and suggested that asset owners could enhance returns by separating investments into headline exposure (“overlay”) and committed capital (“underlay”) components. To better understand this approach, it may be helpful to provide some rationale of market drivers and explore some applications.

It’s important to note that the practice of isolating and extracting exposures from traditional asset classes is not new. Many would agree that the practice has been mainstream to one degree or another for quite some time. With that said, we believe certain market developments make now a favorable time for asset owners to reconsider their approach: derivatives markets are growing in accessibility and expanding in breadth; a rising demand for high quality collateral; and a rethinking of the role and effectiveness of active management in certain asset classes.

Market Developments

The derivatives marketplace has become increasingly welcoming to institutional asset owners in the last several years. We have seen an increase in both (i) the number of instruments, exposure types, and dealer participants, and (ii) the willingness of investors to use derivative strategies. In addition, certain exposures – “betas” – that were previously only attainable in the physical space are now available synthetically, including highly customized fixed income and equity betas and a variety of factor based strategies.

Another development is the market’s pronounced demand for high quality collateral. In response to regulatory changes affecting banks, money market funds, and other entities, the demand for liquidity and high quality assets (e.g., US Treasuries) has grown. As a result, asset owners with high quality capital can generate a premium by supplying the market with liquidity and high quality assets, while at the same time maintaining the appropriate market beta through the derivatives market.

Before we dive into an example, perhaps some guiding principles on how to select the overlay and underlay could be helpful. The overlay will generally be in asset classes which are inexpensive to finance synthetically and in which the asset owner has less confidence in managers’ alpha. The underlay is generally placed in asset classes which are hard to obtain synthetically and in which the asset owner has a high confidence in managers’ alpha.

So far, so good. But what are some ways we see these tools used in practice? Let’s take a look at two strategies that we believe hold promise for asset owners.

Enhanced Beta – Passive Equity Replacement

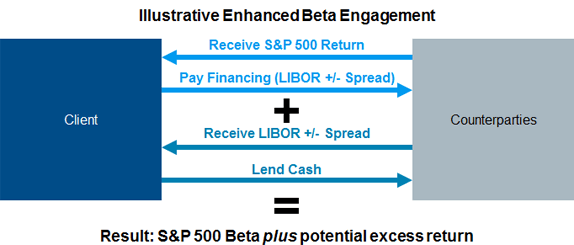

A strategy where we have seen increased client interest is something we call enhanced beta. Enhanced beta, in many respects, is a close cousin of passive equity. The strategy is passive with respect to market beta but enhanced with respect to strategies surrounding the cash underlay. While additional return on the underlay often comes from investing in spread product (e.g., short duration credit securities), we think enhanced beta works best with an underlay that focuses on harvesting a liquidity premium or taking advantage of market dislocations – that is, strategies other than simply dialing up the beta of the portfolio with credit-sensitive assets. We think the most effective underlay strategies avoid taking on material amounts of credit/beta risk; examples include cash-and-carry positions, hedged, high-quality foreign bill positions, and other collateral enhancement strategies. Importantly, the underlay aims to provide enough return to overcome the financing cost of the chosen derivative position together with a stable source of enhancement above the desired index return.

The diagram below illustrates a strategy that couples synthetic S&P 500 exposure with such an underlay, resulting in a structure that delivers the desired beta exposure and potential excess return.

This kind of engagement is particularly suitable for larger asset owners that have significant allocations to passive equity and can capitalize on liquidity premiums. We believe the underlay can be a powerful and uncorrelated alpha engine that does not require the acceptance of market risk and one that can be ported to a variety of beta markets.

A Twist on Portable Alpha

The most common form of portable alpha traditionally has been an investment in a hedge fund coupled with an overlay to achieve exposure to some market beta. While this certainly remains a suitable application of portable alpha, we have identified some related strategies that we believe will both enhance return and potentially achieve other objectives in a simple and effective way.

Suppose an asset owner likes the alpha generated by a developed international equity manager, but is concerned about allocating more physical assets to the manager because additional international market beta is not desired. In markets where the asset owner hasn’t experienced positive alpha – large cap domestic equity perhaps – the physical allocation could be reduced and the domestic market beta added back with an overlay. This would allow the physical allocation to the developed international manager to be increased. At the same time, the (now) excess market beta (to international markets) would be removed with derivatives. This structure allows the asset owner to maintain the desired market betas and potentially increase alpha. The principle is to invest physical assets in pursuit of promising sources of alpha while using the synthetic market to maintain the appropriate (or policy) market beta.

Another example could be a corporate pension plan trying to incorporate a hedge element into the portfolio. Take, for example, a defined benefit pension plan interested in hedging both the interest rate and spread risk of its liability, but which has a limited allocation to fixed income (e.g., 40%) and a meaningful portion of the remainder allocated to large cap domestic equity. While the asset allocation achieves a partial victory (i.e., some amount of rate and spread hedge), obtaining more long credit exposure synthetically is difficult because an effective derivatives market for corporate bonds has yet to materialize in any meaningful way.1 The plan could, however, invest more than 40% of its physical assets in long credit and use an overlay to obtain the necessary equity market beta (e.g., S&P 500). This strategy allows the plan to (i) meet its hedge objectives with respect to spreads and rates, (ii) maintain its desired equity market beta, and (iii) potentially earn additional alpha from a long credit manager.2

By incorporating strategic plan objectives, taking advantage of the availability of synthetic instruments, and changing confidence surrounding managers’ alpha, asset owners can thus unlock this new twist on the traditional portable alpha strategy.

While these strategies hold a lot of promise, they have a lot of moving parts, and inexact implementation could undermine their value. Our next post will explore this subject and explain how thoughtful implementation and structuring can lead to a successful strategy.

1While CDS markets exists they are ineffective at hedging longer maturity corporate spread exposure.

2Asset owners can also adjust their overlay for any correlation between the over and underlay. In this example, the correlation between Long Credit spreads and S&P 500 exposure.