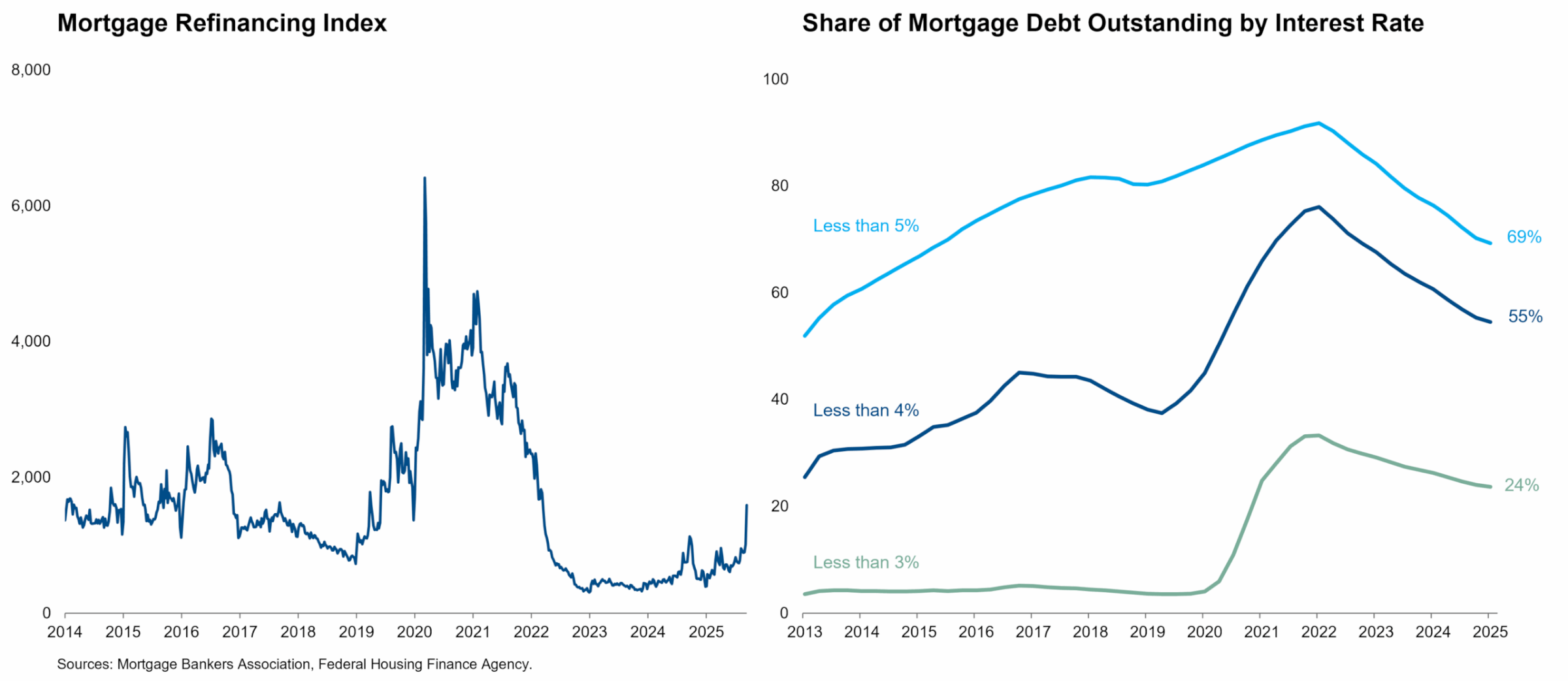

Mortgage applications rose by 29.7% in the week that ended September 12, driven by a surge in refinancing as mortgage rates have fallen to their lowest level in more than two years. The MBA Mortgage Refinancing Index jolted awake last week after hibernating near a quarter-century low for most of 2023-2024. That hibernation followed a historic surge in refinancing activity as millions of borrowers took advantage of the Fed’s ultra-loose policy stance during and after the pandemic.

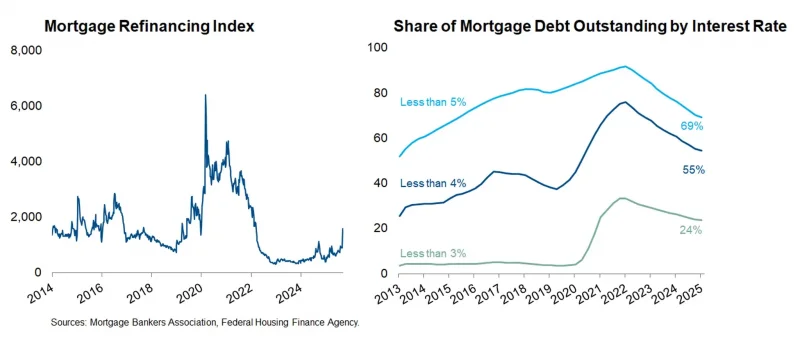

As of Q1 2022, 76.1% of all mortgage debt outstanding carried an interest rate below 4% and 33.3% carried an interest rate below 3%. Those low-rate shares have declined steadily since 2022 as a less fortunate cohort of homebuyers borrowed north of 7% in the last couple of years. The recent refinancing spike shows that they are finally getting some relief.