The JOLTS data for July appeared consistent with the labor market status quo. There was little to no change in the rates of hiring, quitting or layoffs across the private and government sectors. The July payrolls report has rightfully increased attention on the downside risks to the labor market, but the JOLTS data show that there was no significant deterioration in July. No sign of an increase in layoffs that risks crossing the tipping point into recession. No drop in hiring or openings that suggests a sudden decline in labor demand. Just a labor market where demand is gradually cooling and the supply of immigrant labor is falling as a matter of policy choice. These dynamics have contributed to a gradual decline in the rate of job creation to a level uncomfortably close to zero.

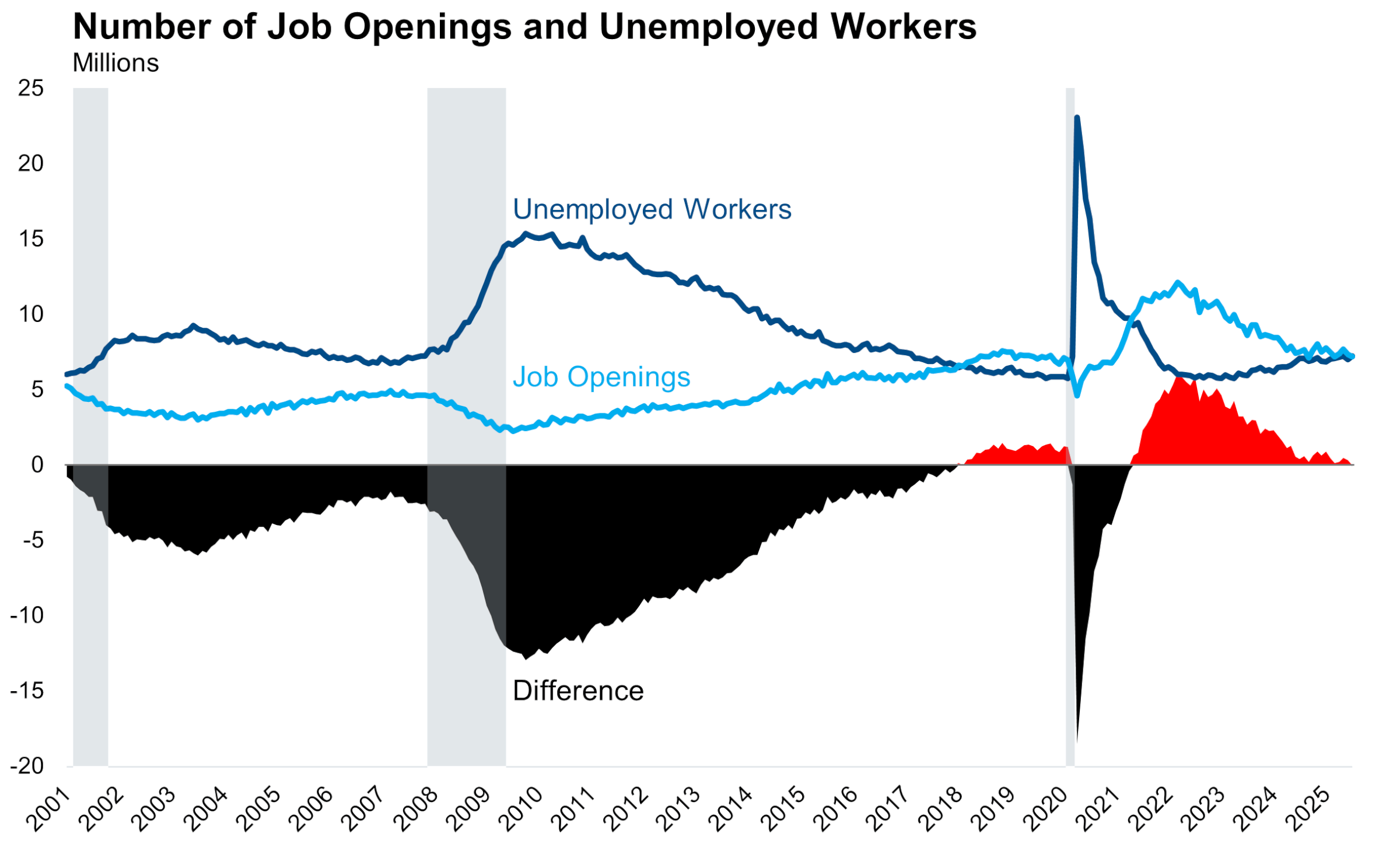

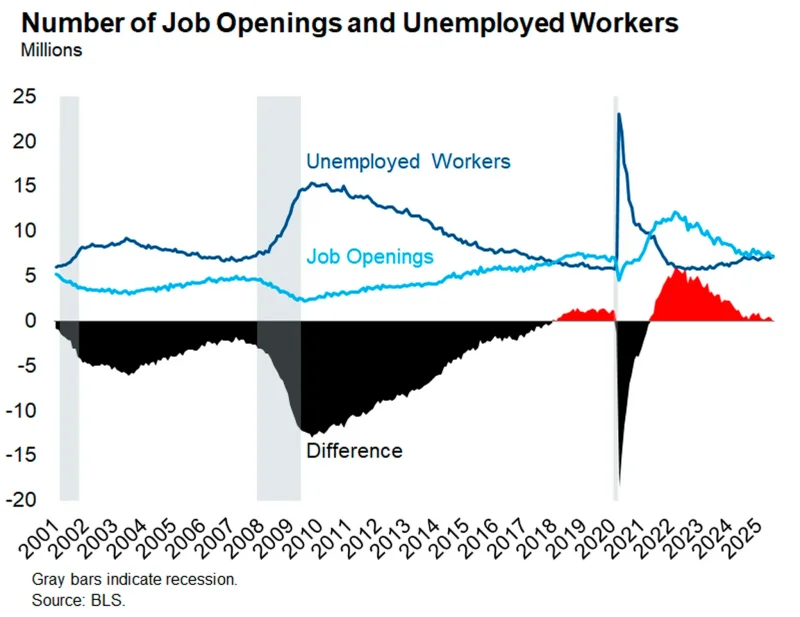

The labor market did, however, cross one notable rebalancing milestone in July. For the first time since April 2021, there are more unemployed workers than job openings in the United States. We’ll spare you a lengthy discussion about skills mismatches, geographic mobility, and the Beveridge Curve – all of which inform the interpretation of this national figure. The simple fact today is that there are no longer enough jobs to employ every American looking for a job. This is just a psychological level – there is nothing magical about the ratio of openings to unemployed falling below 1. Indeed, the ratio is more often below 1 than above it in the series history. But this month does represent a milestone on the journey of rebalancing the labor market from the historic shortage of 2021 to something more normal today. Whether that journey leads to a stable equilibrium or a recession remains to be seen. The next mile marker arrives with the August payrolls report on Friday.