After two years of pandemic firsts, we thought we’d used the adjective “unprecedented” for the last time in this cycle. Then the Federal Reserve did something on Monday that we’ve never seen them do before: intentionally leak a monetary policy action through the financial press two days prior to a Federal Open Market Committee (FOMC) meeting. We don’t know exactly what happened behind the scenes, but it now seems clear that someone at the Fed called a number of financial journalists and signaled their intention to raise the federal funds rate by 75 basis points later today.

There have been instances in the past where certain journalists seemed to have an informed source on upcoming policy actions, but we cannot remember such a clear policy signal being communicated through the press, and certainly not during the Fed’s self-imposed pre-FOMC blackout period. This distinction is in contrast to foreign central banks, including the European Central Bank, which regularly leaks policy signals through the financial press.

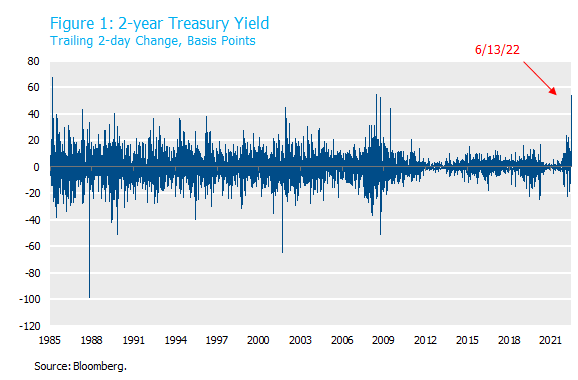

The Fed is partly a victim of circumstance. The May CPI report that was released during the blackout period on Friday morning , showed a most unwelcome re-acceleration of inflation and directly contradicted the consensus view that inflation had peaked. Two separate surveys showing an increase in consumer inflation expectations further highlighted the risk. Financial markets responded immediately, with the 2-year Treasury yield increasing by 20 basis points on Friday and then another 20 on Monday morning. After the multiple press reports signaled the Fed’s leak on Monday afternoon, the 2-year yield had increased by a total of 55 basis points, which ties June 2008 as the largest 2-day increase since 1985 (Figure 1).

Inopportune timing notwithstanding, the Fed’s uncharacteristic behavior demonstrates that they recognize the gravity of their current predicament. Jay Powell means business. He is pulling out all the stops to prevent inflation expectations from de-anchoring. If the Fed has to choose between imposing a harsh recession today or allowing inflation expectations to de-anchor and then spending~25 years to restore their credibility, they will choose the recession every time.

They still hold out hope for a middle path where they can reduce inflation without imposing a recession and maintain their credibility throughout. That middle path grew a lot narrower with Friday’s CPI data. Powell’s actions this week made it clear: he’s willing to be as tough as Paul Volcker if the only alternative is to repeat the mistakes of Arthur Burns.

Despite all of the excitement over the past few days, we conclude with two optimistic observations (lest we be accused of fear-mongering).

First, long- and even medium-term inflation expectations remain well anchored. It is still fair to describe the Fed’s actions as a pre-emptive strike to prevent a de-anchoring of inflation expectations, rather than a corrective action to restore credibility. Surely the risk of de-anchoring is higher today than it’s been in decades, but we reject claims that the Fed has already lost their credibility. The TIPS and inflation swap markets are currently pricing year-over-year headline CPI to decline to 7.8% by December, 5.3% by April, and 3.30% by November 2023. These markets have just as bad of a forecasting record as everyone else in the past year, so we wouldn’t put a ton of weight behind these point forecasts, but we can say that every available market-based measure of long-run inflation expectations remains well-anchored. The 5-year / 5-year forward breakeven inflation rate, and indeed every 1-year forward beyond 2025, are at or below levels consistent with the Fed’s 2% core PCE inflation target.

Second, with the 2-year yield higher by 55 basis points in two days, we take it as a positive sign that the 30-year yield increased rather than decreased during the same period. The 2s30s curve has flattened to zero which surely signals elevated recession risks, but it has not inverted significantly in the past few days as you might fear in response to a hawkish policy shift of these historic proportions. Treasury market participants seem to be expressing the view that the roughly 250 basis points of rate hikes priced in the next four meetings is an appropriate response by the troubling CPI data, rather than a policy mistake that will cause a recession.

Given the degree of overheating in the U.S. economy today, avoiding a recession might simply be too much to ask. Indeed there has never been a time in postwar U.S. history when CPI inflation was above 4% and the unemployment rate was below 5% that was not followed by a recession within in the next two years. If the Fed is able to pull a rabbit out of the hat in this instance, we’ll relish the opportunity to use “unprecedented” one last time.