Originally published on September 21, 2021. Revised on October 19, 2021.

Uncertainty regarding the future cost of goods and services can create challenges for investors. Inflation can materially impact the real value of inflows for investors’ portfolios. Treasury Inflation Protected Securities (“TIPS”) are specifically designed to address this uncertainty by explicitly protecting investors against unexpected inflation. Investors need to clearly understand important nuances of the asset class and its market sensitivities in order to structure a portfolio to meet their particular inflation hedging objectives.

This primer provides an overview of:

• TIPS mechanics

• Return Considerations

• CPI-U and its Relation to TIPS

• TIPS’ Role in Institutional Portfolios

Introduction

Most investors’ ultimate goal is to grow their savings over time to finance future consumption of goods and services. If the prices of those goods and services rise, investors will be able to purchase fewer of them with a given dollar of investment income. Inflation, therefore, erodes the real value of the cash flows generated from financial assets. Uncertainty regarding the cost of future spending goals creates challenges for investors. Treasury Inflation Protected Securities (“TIPS”) are specifically designed to address this uncertainty by explicitly protecting investors against unexpected inflation.

TIPS Market Structure

TIPS were first auctioned by the U.S. Treasury in January 1997. As of June 30, 2021, the market value of Treasury Inflation Protected Securities outstanding was approximately $1.6 trillion, representing roughly 7.4% of marketable Treasury debt outstanding. TIPS are issued with maturities of 5, 10, and 30 years. The Treasury issues new 5-year TIPS in April and October, and reopens in June and December. New 10-year TIPS are auctioned in January and July, and reopened in March, May, September and November. New 30-year TIPS are auctioned in February and reopened in August. Reopened securities have the same maturity date and coupon as the most recent originally issued security.

TIPS Mechanics

Like traditional Treasuries, Treasury Inflation Protected Securities pay a semiannual coupon and return principal upon maturity. Unlike traditional Treasuries, the principal of TIPS is adjusted based on changes in the Non-seasonally Adjusted Consumer Price Index for All Urban Consumers (“CPI-U”). Because the fixed coupon rate is applied to the adjusted principal, the dollar value

of the coupon effectively changes with inflation as well.

The inflation adjustment is measured by an index ratio published by the U.S. Treasury, which is the ratio of current reference CPI-U index level to the base reference CPI-U index level as of the issuance date. The adjusted principal is calculated by multiplying the original principal (par amount) times the security’s index ratio. The adjusted principal increases with a rise in CPI-U, (i.e., inflation) and decreases with a fall in CPI-U (i.e., deflation). At maturity, the investor receives the greater of the adjusted principal or the original principal, in the event of deflation. The deflation floor only applies to the principal. The coupon payments can fall below the coupon amount at issuance in the event of deflation.

The deflation protection provided by the floor on the principal amount returned at maturity can impact TIPS’ pricing. Specifically, TIPS with an index ratio near 1.0 may trade at a higher price/lower yield than a similar TIPS with a higher index ratio/more accrued inflation, if the market is concerned about future deflation. Throughout the history of the TIPS program, market pricing has only assigned value to the deflation floor for newly-issued TIPS. As positive inflation accretes over the first few years of a TIPS’ life, the index ratio rises sufficiently that a significant amount of deflation would be required for the index ratio to fall back to 1.0.

CPI-U is published once monthly as of the first day of the month and is usually released during the second week of the month. TIPS index ratios are calculated daily based on an interpolated CPI-U number that would apply to the calendar date three months prior. For example, the 4/1 CPI-U print would be used to calculate the index ratio as of 7/1. The 7/15 index ratio would be calculated based on a linear interpolation between the 4/1 and 5/1 CPI-U prints. Due to the lag with which CPI-U accrues to the index ratio, inflation surprises (difference between consensus and actual inflation) are initially reflected by the market in the price of TIPS. For example, assume CPI-U print came in 0.1% above consensus estimates. Because the TIPS index ratio won’t adjust for that information for three months, the market price of TIPS will likely increase by 0.1%. This can distort the measure of real yield on TIPS, especially for shorter maturity TIPS. In our example, a 0.1% increase in price will cause the yield of a 10-year TIPS to decrease by 1 basis point (0.1% ÷ ~10-year duration), but will cause the yield of a 1-year TIPS to decrease by approximately 10 basis points (0.1% ÷ ~1-year duration).

Seasonality is another important technical factor in the TIPS market. The bonds are indexed to non-seasonally adjusted CPI-U and many components of the index, including apparel, motor fuel and other travel-related expenses, exhibit predictable seasonal patterns throughout the year. The index tends to rise faster in the first half of the year than the second. Seasonality can impact TIPS returns throughout the year and cause small pricing differences between bonds that mature in different months as TIPS investors factor future seasonality into bond valuations.

TIPS Return Considerations

Because the principal value of Treasury Inflation Protected Securities is adjusted for CPI-U, a TIPS investor is compensated for realized inflation. Therefore, a TIPS yield is a “real” yield. In contrast, the yield of a traditional Treasury security does not reflect an adjustment for realized inflation and is referred to as a nominal yield. Traditional Treasuries are often referred to as nominal Treasuries to distinguish them from TIPS. Inflation erodes the real value of the cash flows earned by nominal Treasury investors. TIPS investors are protected against this real value destruction.

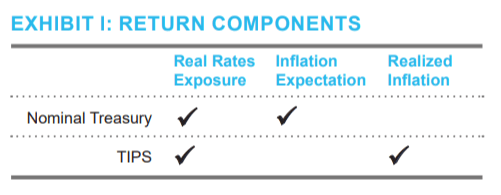

The difference between the yield on a TIPS and a comparable maturity nominal Treasury security is called the break-even inflation rate because it reflects the rate of inflation that would have to be realized over the life of the bond for an investor to be indifferent between owning the TIPS bond or owning a nominal Treasury bond of the same maturity. For example, assume an investor can choose between purchasing a 5-year nominal Treasury bond yielding 2.5% or a 5-year TIPS yielding 0.5%.

The difference between the two yields is 2.0% and if average annual inflation over the next five years exceeds 2.0% (i.e., the break-even rate), the investor would earn a higher return by owning the TIPS, and vice versa. The break-even inflation rate primarily reflects the market’s expectation of inflation. Liquidity and risk premia also impact the break-even inflation rate. These are secondary considerations in normal times, but can become very important during times of market stress, when TIPS liquidity often deteriorates substantially more than nominal Treasuries.

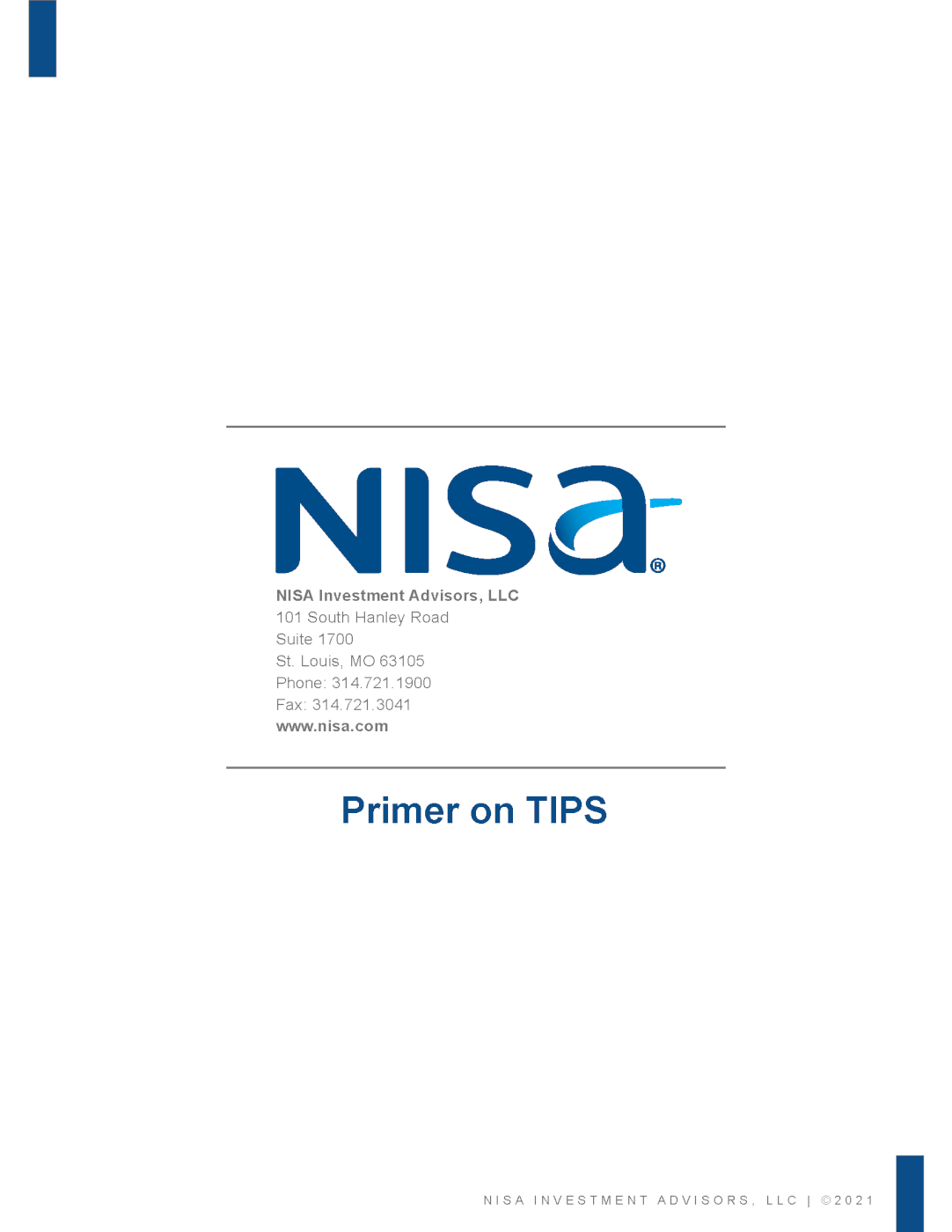

The relationship between TIPS and nominal Treasuries described above (i.e., Nominal Yield – Real Yield = Break-even Inflation) can be rearranged as: Nominal = Real + Break-even Inflation. Nominal Treasuries are exposed to the risk of changes in real yields and inflation expectations, while TIPS are only exposed to the risk of changes in real yields. TIPS are not directly exposed to inflation expectations. It follows logically that the difference between expected inflation and realized inflation is unexpected inflation, which is the primary risk that most TIPS investors are seeking to guard against. A comparison of TIPS yields and nominal Treasury yields as of June 30, 2021 is illustrated in Exhibit II.

Changes in inflation expectations impact the relative performance of TIPS versus nominal Treasuries. An increase in expected inflation widens the breakeven inflation rate and causes TIPS to outperform nominal Treasuries, and vice versa. TIPS investors are not directly exposed to break-even inflation rates. If an investor wanted pure long exposure to the changes in break-even inflation rates, one would have to buy TIPS and short a comparable maturity nominal Treasury against it. Of course, if an investor reallocates assets away from nominal Treasuries to buy TIPS, they may have a sort of mental exposure to break-even inflation rates because a rise in breakeven inflation rates means that TIPS have out performed the nominal Treasuries that were previously owned. But that out performance will not show up directly in the investor’s investment returns.1

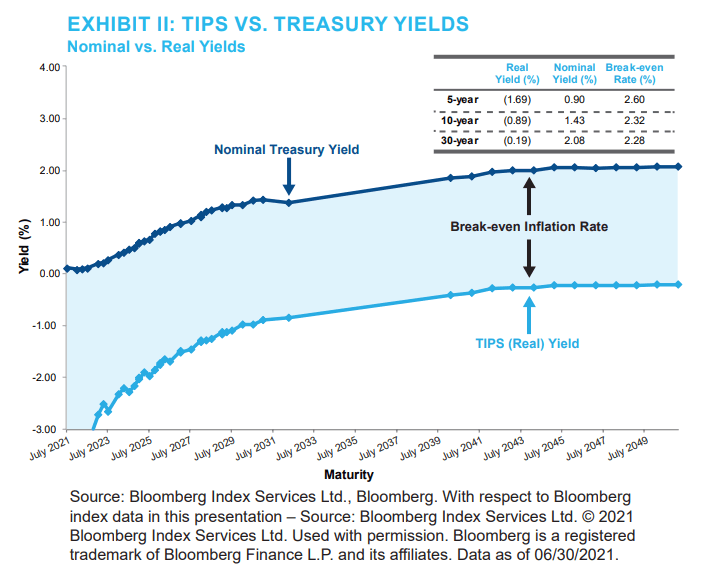

The price of TIPS moves inversely with changes in real rates, in the same way that the price of a traditional Treasury bond moves inversely with changes in nominal rates. The interest rate sensitivity of a TIPS is measured by its real rate duration, which is the approximate percentage change in price for a one percentage point change in real rates. For most bond security data providers, the real duration for TIPS is not the same field as the duration for nominal bonds. For example, Barclays Live users may reference the “Modified Adjusted Duration” field for the duration of a nominal bond. However, the “Modified Adjusted Duration” field will not have the appropriate real duration for TIPS.2 Rather, users should reference “Real OAD”. The real durations for on-the-run TIPS as of June 30, 2021 are indicated in the table below.

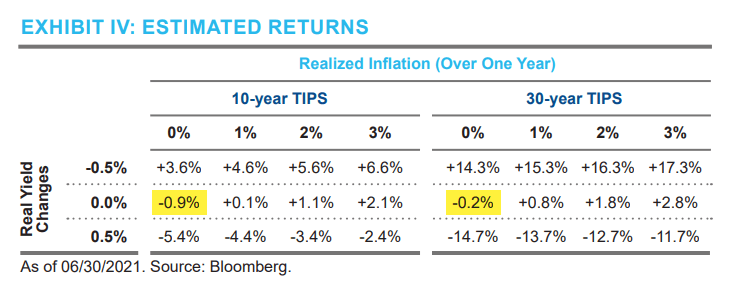

While TIPS sensitivity to changes in real rates varies by maturity, inflation changes accrue to all TIPS equally.3 The table below compares estimated returns for a 10-year and 30-year TIPS for various real rate changes and inflation levels. As indicated by the highlighted cells, if realized inflation is 0% and real rates are unchanged, the return will be equal to the securities’ real yields, which are negative as of June 30, 2021.

INFLATION SENSITIVITY (CPI-U)

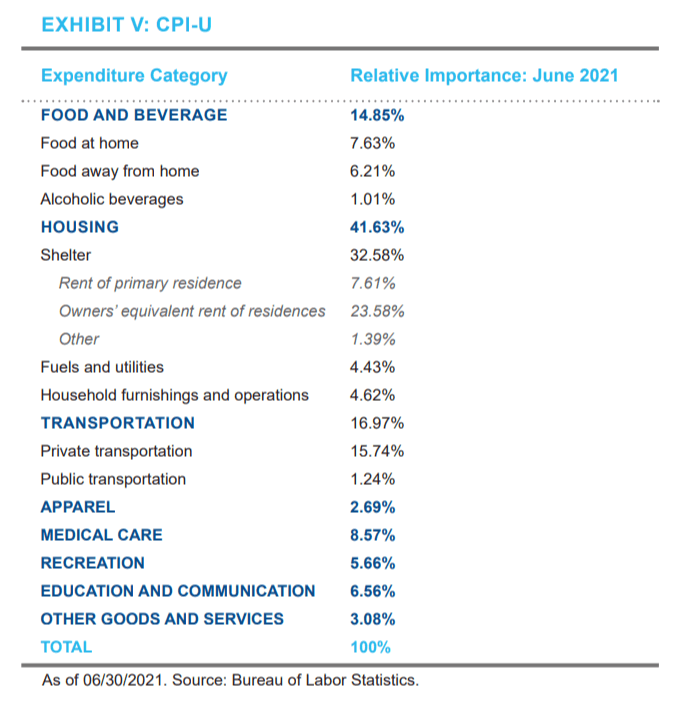

CPI-U, the inflation measure to which TIPS are linked, measures the average change in the prices of goods and services purchased for consumption for urban households. It is compiled from

expenditure information and is intended to be a market based average consumption basket. It uses household surveys that cover the spending patterns of about 93% of the total U.S. population (Source: Bureau of Labor Statistics). The relative importance of the components of CPI-U are shown below.

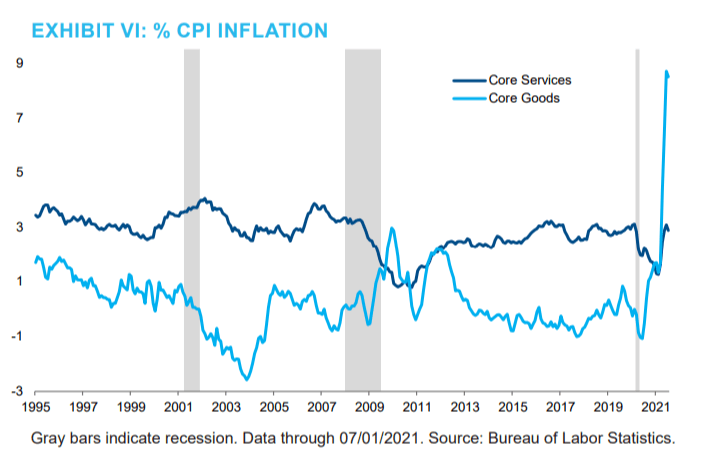

There can be a lot of dispersion in inflation levels among various categories of goods and services, as well as across geographical locations. For example, services prices have typically grown

significantly faster than goods prices, which have been in outright deflation for most of the last 25 years since China joined the WTO and put downward pressure on the prices of manufactured products. That changed during the pandemic as supply chain disruptions caused goods prices to surge while demand plummeted for many services categories including restaurant dining,

hotel rooms and airline tickets.

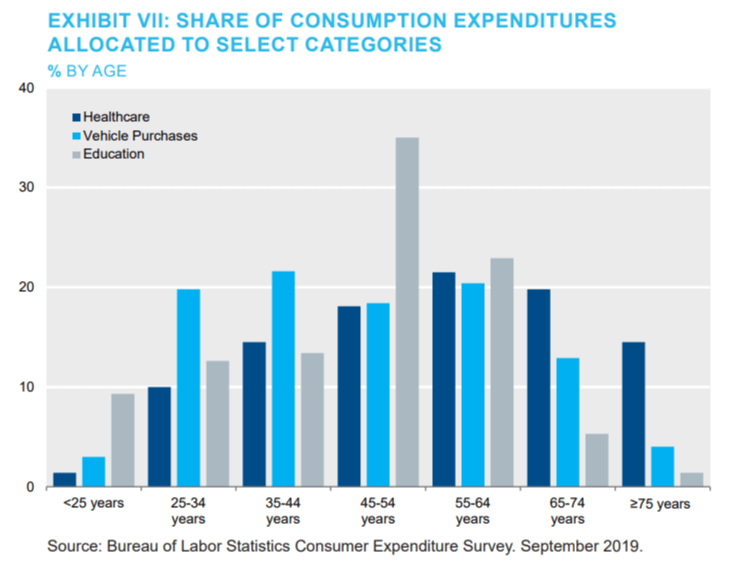

While CPI-U reasonably reflects price changes for all U.S. consumers in aggregate, it may not be a reasonable

measure of price changes experienced by an individual. The degree to which TIPS effectively protect an investor’s

purchasing power, depends largely on how closely that person’s consumption basket matches that reflected in CPI-U.

Spending patterns vary greatly by income level and age. For example, younger Americans spend more money on cars

while older Americans spend more on healthcare. Education spending is concentrated among middle-aged parents

funding their children’s college education.

TIPS Role in Institutional Portfolios

In addition to protecting purchasing power for individual investors, TIPS provide a reliable hedge for institutional investors with liabilities or investment objectives that are sensitive to inflation. Because TIPS do not offer a market risk premium the way many other asset classes do, their inclusion in a portfolio comes at an opportunity cost. Investors must balance their need for inflation protection with return objectives when sizing the allocation to TIPS in their portfolio.

Many pension plans offered by state and local governments provide some form of an automated cost-of-living-adjustment (COLA) to their retirees’ pension benefit to offset inflation.4 While the form of the COLA varies, many are linked to CPI-U. Just as inflation creates uncertainty for individuals with regards to retirement savings, inflation-linked COLA provisions create uncertainty with regards to pension costs. TIPS, by design, provide a good hedge for this uncertainty.

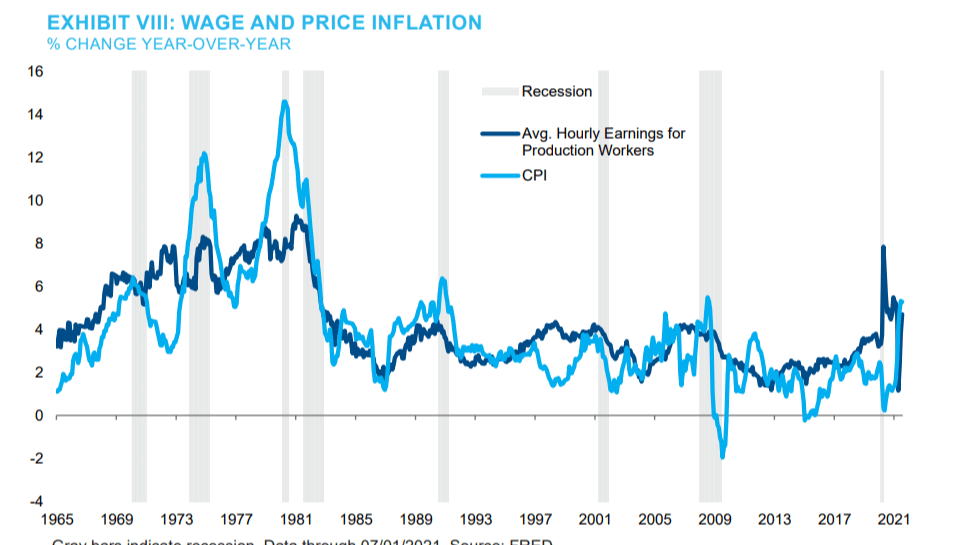

Most U.S. corporate pension plans do not have COLA provisions, and therefore do not have a direct sensitivity to inflation.5 However, plans may have indirect exposure to inflation due to its relationship with salary levels. Pension benefits are often a function of salary and years of service. Though wages are not directly counted in CPI-U, wage growth has typically risen during times of high CPI inflation. TIPS may therefore play a limited role in non-frozen plans where the plan liability increases due to higher wage growth.

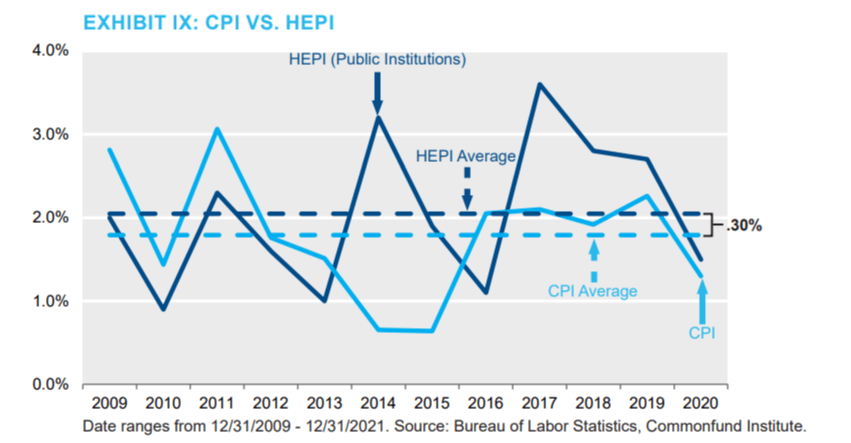

Endowments are naturally sensitive to long-term inflation, as their goal is to maintain and grow real purchasing power over time. Some endowments are also sensitive to short-term inflation shocks as spending policies and benchmarks may be directly linked to inflation. Similar to spending by individuals, there can be differences in the cost of inflation faced by endowments and the cost of inflation measured by CPI-U, creating basis risk for a TIPS-based inflation hedge. The chart in Exhibit IX below compares changes in the Higher Education Price Index (HEPI)6 with CPI-U. While the two measures are correlated, HEPI has averaged 0.3% higher than CPI.

Summary/Conclusions

Various assets classes are considered to provide potential protection against inflation (e.g., gold, commodities, real estate, etc.), but only TIPS offer an explicit inflation-linked real return backed by the full faith and credit of the U.S. government. It is important for investors to clearly understand what they are getting when considering a tactical or speculative use of TIPS. For example, investors seeking an asset that will perform well when inflation expectations spike should look elsewhere, as TIPS do not provide exposure to expected inflation. In contrast, TIPS are a suitable

asset class for investors seeking to keep pace with realized CPI prints.

While TIPS are well-designed to protect purchasing power and hedge inflation-sensitive liabilities, the nuances of TIPS can be complex. Among other considerations, investors should evaluate the appropriate maturity of TIPS, relationship between TIPS and nominal bonds, specific inflation hedging needs, and return requirements when building a strategic allocation to TIPS. TIPS portfolios are commonly benchmarked to broad published indices, such as the Bloomberg Intermediate TIPS Index, Bloomberg Full TIPS Index, or Bloomberg Long TIPS Index. Custom portfolios can be also be constructed to meet unique inflation hedging objectives and real rate sensitivities.

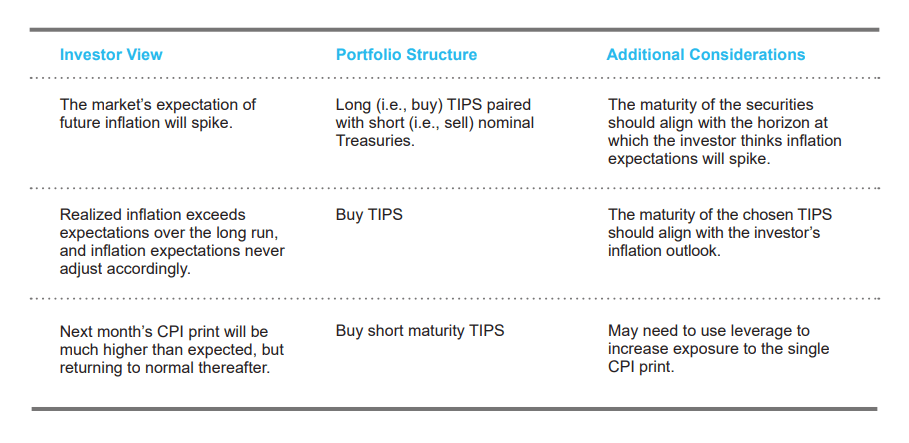

Appendix: Speculative Inflation Hedging

Details regarding the particular speculative inflation view that an investor wishes to express will impact the appropriate portfolio structure.

Disclosure Information

By accepting this material, you acknowledge, understand and accept the following:

This material has been prepared by NISA Investment Advisors, LLC (“NISA”). This material is subject to change without notice. This document is for information and illustrative purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action, including without limitation as those terms are used in any applicable law or regulation. This information is provided with the understanding that with respect to the material provided herein (i) NISA is not acting in a fiduciary or advisory capacity under any contract with you, or any applicable law or regulation, (ii) that you will make your own independent decision with respect to any course of action in connection herewith, as to whether such course of action is appropriate or proper based on your own judgment and your specific circumstances and objectives, (iii) that you are capable of understanding and assessing the merits of a

course of action and evaluating investment risks independently, and (iv) to the extent you are acting with respect to an ERISA plan, you are deemed to represent to NISA that you qualify and shall be treated as an independent fiduciary for purposes of applicable regulation. NISA does not purport to and does not, in any fashion, provide tax, accounting, actuarial, recordkeeping, legal, broker/dealer or any related services. You should consult your advisors with respect to these areas and the material presented herein. You may not rely on the material contained herein. NISA shall not have any liability for any damages of any kind whatsoever relating to this material. No part of this document may be reproduced in any manner, in whole or in part, without the written permission of NISA except for your internal use. This material is being provided to you at no cost and any fees paid by you to NISA are solely for the provision of investment management services pursuant to a written agreement. All of the foregoing statements apply regardless of (i) whether you now currently or may in the future become a client of NISA and (ii) the terms contained in any applicable investment management agreement or similar contract between you and NISA.

1This statement assumes that the benchmark for the reallocated assets also changes. If the benchmark for the assets remained unchanged, the relative performance of a decision to tactically rotate between TIPS and nominal Treasuries would show up in reported performance.

2The “Modified Adjusted Duration” field for a TIPS represents the empirically estimated effective exposure to nominal rates.

3While inflation accrues to all TIPS equally, deflation does not due to the fact that the adjusted principal cannot fall below the original principal.

4Source: NASRA Issue Brief: Cost of Living Adjustments, June 2021.

5COLA provisions are common for UK and European corporate pension plans.

6HEPI is an inflation index published by Commonfund to measure the operational costs of colleges and universities. For more information, visit commonfund.org.