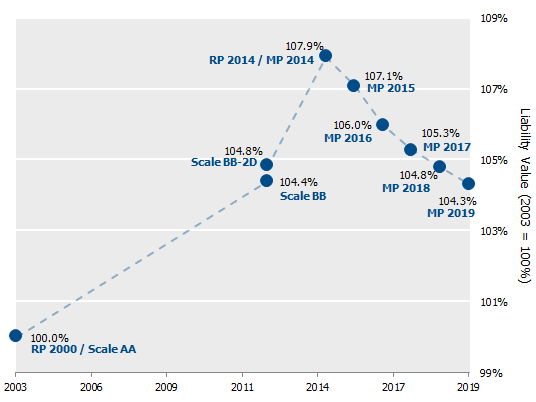

For the fifth year in a row, the updated Society of Actuaries mortality tables have reduced the size of pension liabilities:

While this short note is becoming a little repetitive (as evidenced by our Groundhog Day movie reference from last year), it provides a good opportunity to highlight some key points about longevity. What can we conclude from the new data?

- Liabilities shrink for the 5th year in a row. By our estimates, the new assumptions reduce typical pension liabilities by 0.5%, a 3.6% drop in present value since the peak of longevity optimism corresponding to the release of MP-2014. The cumulative impact of the reductions is that approximately half of the increase in the decade-long MP 2014 update has been reversed.

- Longevity risk cuts both ways. Expected increases in the lifespan of pensioners is not longevity risk – an allowance for future improvements (drops in death rates) is already factored into the SOA’s standard tables. For the fifth time in a row, these new assumptions demonstrate that mortality can be an upside reward (macabre, I know) to pension funded status as well as a downside risk. Two critical questions plan sponsors face are 1.) Will this allowance be adequate over the long-term, and 2.) Given the overwhelming evidence of wide gaps between higher and lower socio-economic groups, how dangerous is it to assume all participants are ‘average’?

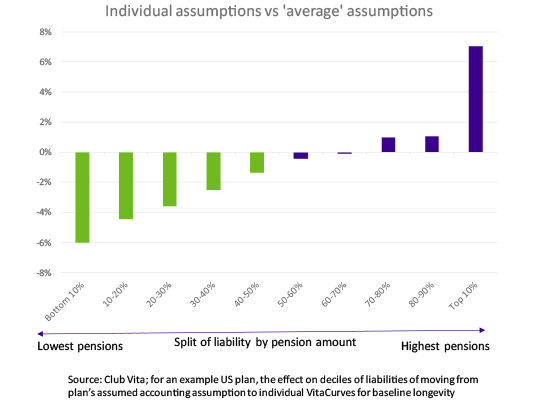

- Small balance annuity purchases are ripe for mispricing. Along the lines of question #2 above and as we have pointed out before, the range of mortality assumptions within a plan can be extremely large. The chart below, produced by Club Vita, a provider of longevity risk informatics, shows that participants with the lowest pension amounts are associated with the shortest lifespans. Plan sponsors participating in small balance annuity purchases run the risk of misestimating the price of the transaction by 6%, based on this data.

While the SOA “standard” mortality tables may be very suitable for accounting statement purposes (consistent, reasonable, etc.), extreme care should be taken before using these assumptions to determine the true economic value of liabilities. Indeed, economic liability valuations may be significantly below the standard mortality table assumption – particularly for low benefit participants.

End Note

Are you interested in exploring mortality assumptions for your plan in greater detail? NISA is building resources to address some of the questions above and would welcome conversations on the topic.