The Federal Open Market Committee (FOMC) left the federal funds rate target unchanged today as expected, maintaining the wait-and-see posture they have adopted since trade policy uncertainty spiked in the springtime. Today’s outcome does not materially change our outlook for monetary policy or the U.S. economy. Our modal expectation remains that the next phase of the easing cycle will begin with a 25-bp cut in January and proceed at a quarterly pace to a terminal rate just below 3%.

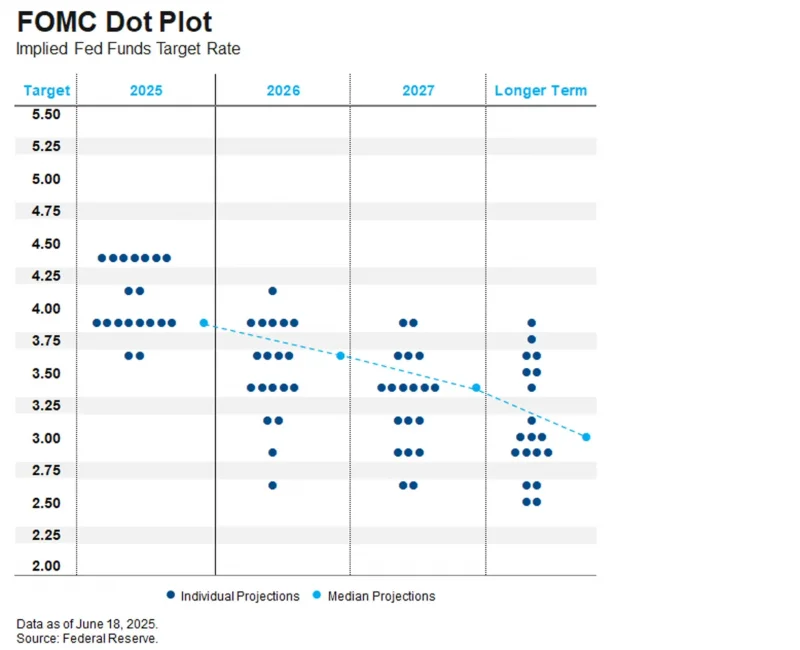

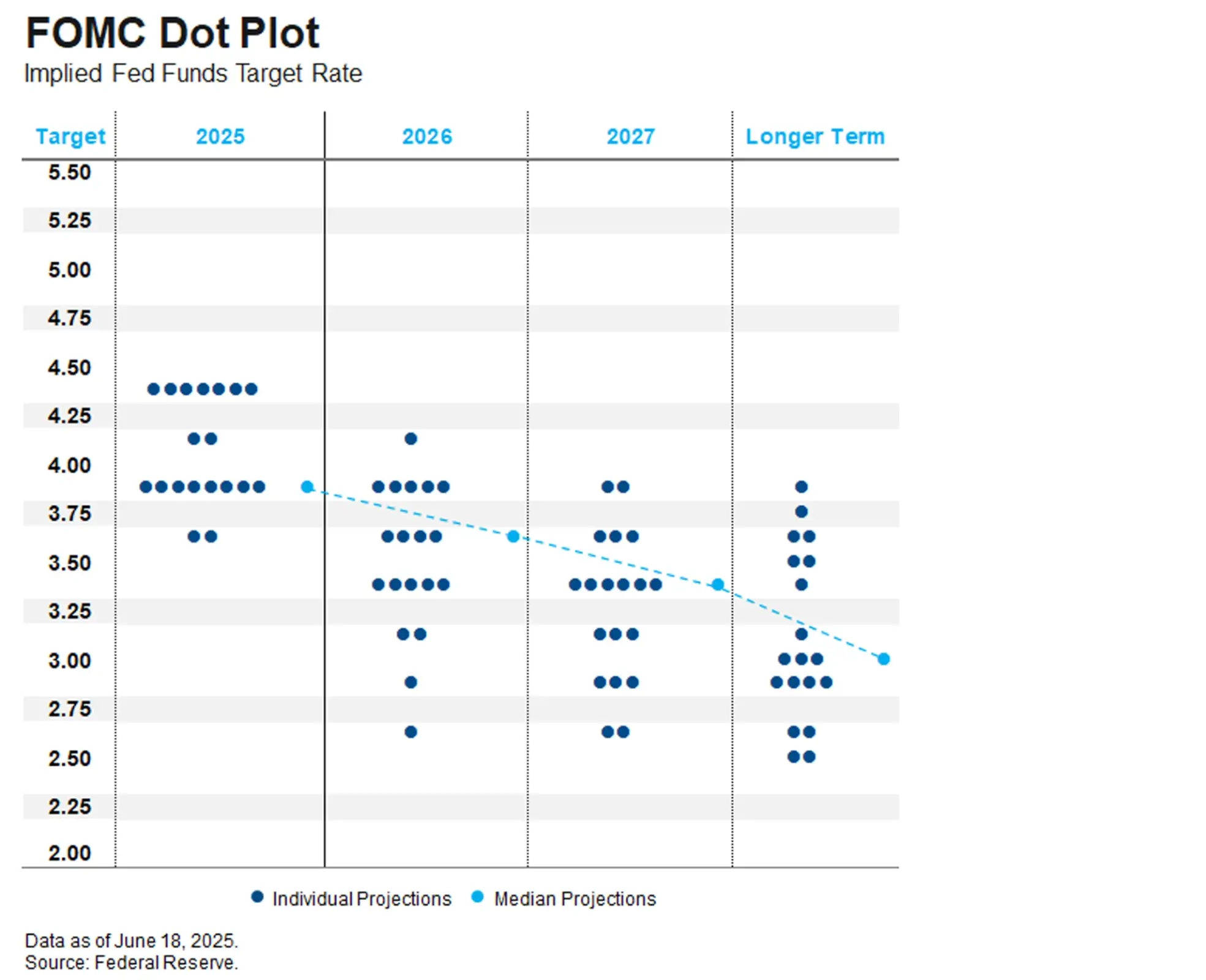

The Summary of Economic Projections (SEP) shifted in a moderately stagflationary direction. The 2025 median real growth projection fell by three tenths to 1.4%, and the 2025 median core PCE inflation projection rose by three tenths to 3.1%. The dot plot shifted slightly in a hawkish direction, but not enough to change the closely watched median dot for 2025, which still shows two cuts this year. Four FOMC participants raised their 2025 dots causing the average dot to rise by about 5 bps. The dot plot for 2025 is fairly bimodal, with seven participants projecting zero cuts this year and nine participants projecting two cuts (and two pairs projecting different outcomes). Thus the 2025 median is a fragile one: it would only take one participant raising their dot to move the median to one cut, and three participants raising their dots to move the median to zero cuts.

Chairman Powell’s tone at the press conference was similar to the May FOMC meeting. Real activity continues to expand at a robust pace, and the labor market is in good shape with a historically low unemployment rate and “healthy” levels of job creation. He did, however, acknowledge the tipping point risk that we have highlighted: the low hiring rate means that any increase in layoffs would cause the unemployment rate to rise quickly.

In response to a question about the pass through from tariffs to consumer prices, Powell expressed an inflation outlook similar to our own. He saw isolated pockets of tariff inflation in the May CPI report – specifically citing personal computers and audiovisual equipment – though this was offset by cooler readings in services and other core goods components. He also stated that the Fed expects tariff inflation to appear more clearly in the next few months, and, that most of the tariffs will ultimately be passed through to consumer prices.

We liked Powell’s description of the pass-through dynamics: it’s basically a game of hot potato between manufacturers, exporters, importers, retailers and consumers who are all trying to avoid bearing the cost of the tariffs. At today’s FOMC meeting, Powell acknowledged the extreme uncertainty from this unprecedented trade shock:

“That process is very hard to predict. And we haven’t been through a situation like this. And I think we have to be humble about our ability to forecast it. So that’s why we need to see some actual data to make better decisions.”

And therein lies the logic of the wait-and-see policy stance. Inflation data through May have continued to make significant progress towards the Fed’s 2% objective, but the Fed can’t afford to cut until they assess the inflationary impact of tariffs. Ironically, as the president continues to bash Powell, we figure today’s meeting probably would have produced a rate cut if not for the inflationary risk from tariffs.