A starkly divided FOMC lowered the policy rate by 25 bps today to a range of 4.00-4.25%, resuming the easing cycle that had been paused since January due to inflation concerns. This was an FOMC meeting unlike any other, with one governor serving under the protection of a temporary restraining order delaying her termination and another having been sworn in about an hour before the meeting began. Those irregularities notwithstanding, the results of the meeting were fairly close to the expectations that were actively managed by Fed communications over the last month. We maintain our view that the Fed will deliver two additional cuts at the remaining two meetings this year and then reassess the state of inflation and the labor market.

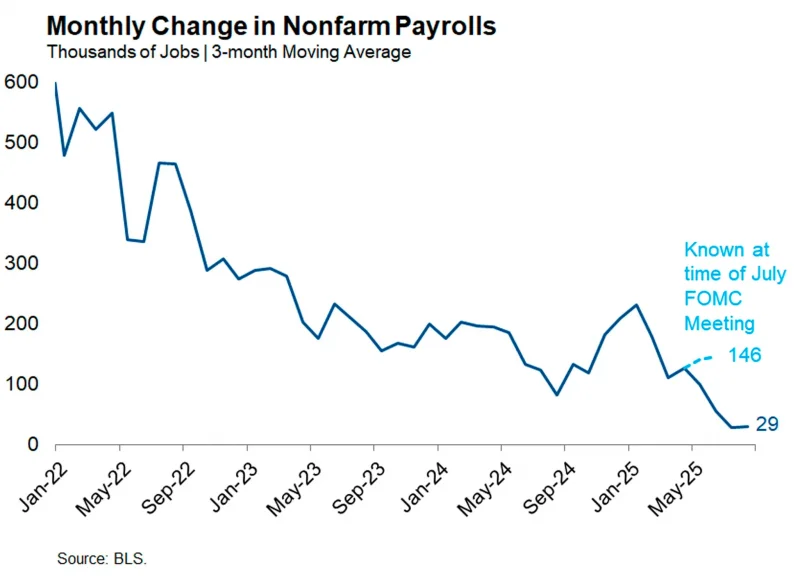

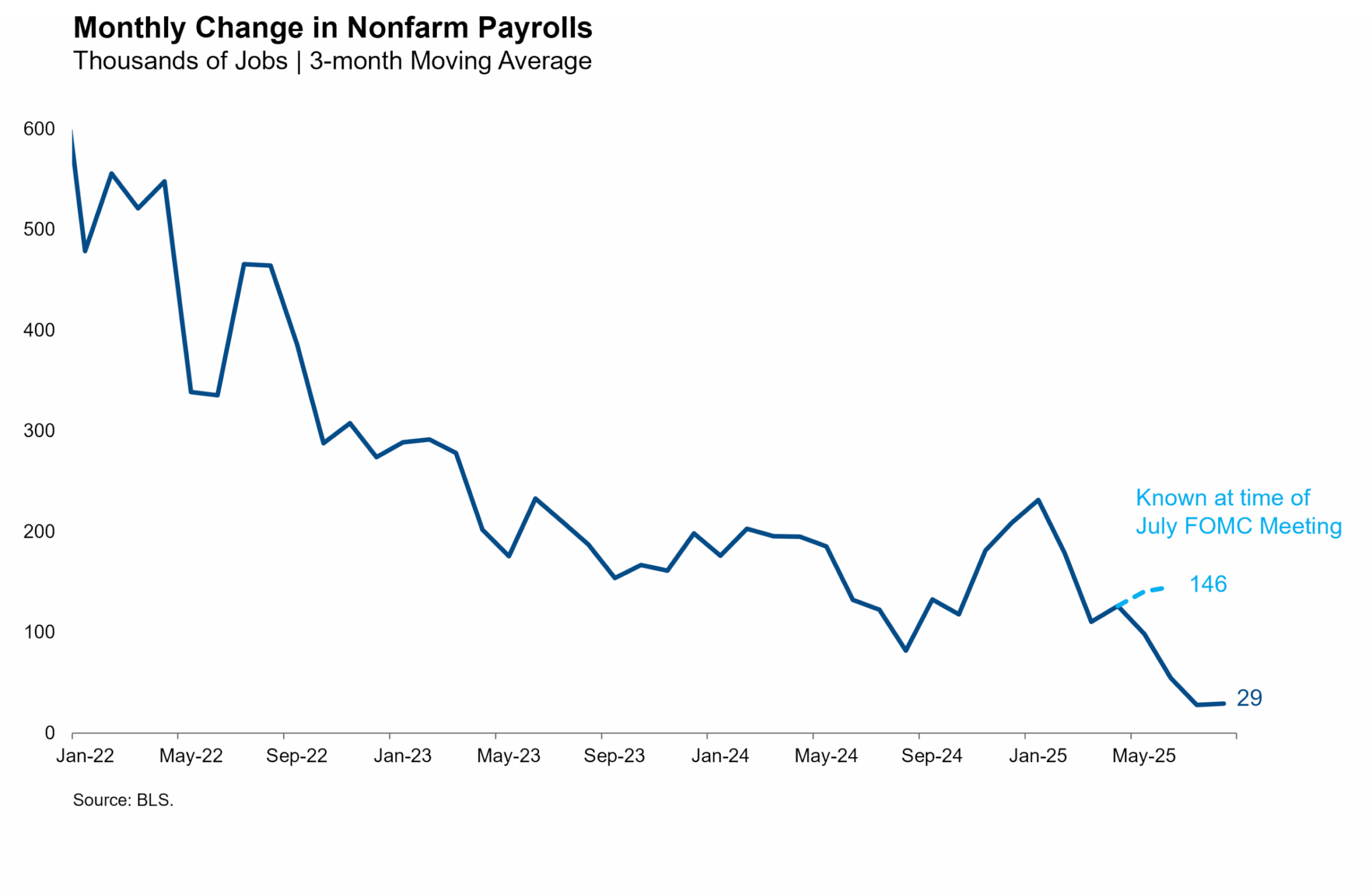

Today’s action confirms the dovish shift in the Fed’s reaction function that has occurred in response to the moderate stagflation that is now apparent in the U.S. economy. Tariff inflation is arriving more slowly than initially expected, and the Fed may not have clarity on the size and scope of those price effects until mid-2026. Meanwhile, the downside risks to the labor market we’ve been monitoring since last year have now materialized. As Powell mentioned, when the FOMC last met in July, they thought payroll growth was running at 146,000. Due to the historically large revisions of the last few months, the current estimate of that pace is just 29,000. This combination has shifted the balance of risks from inflation to employment, and the Fed has now resumed easing to protect against further deterioration in the labor market.

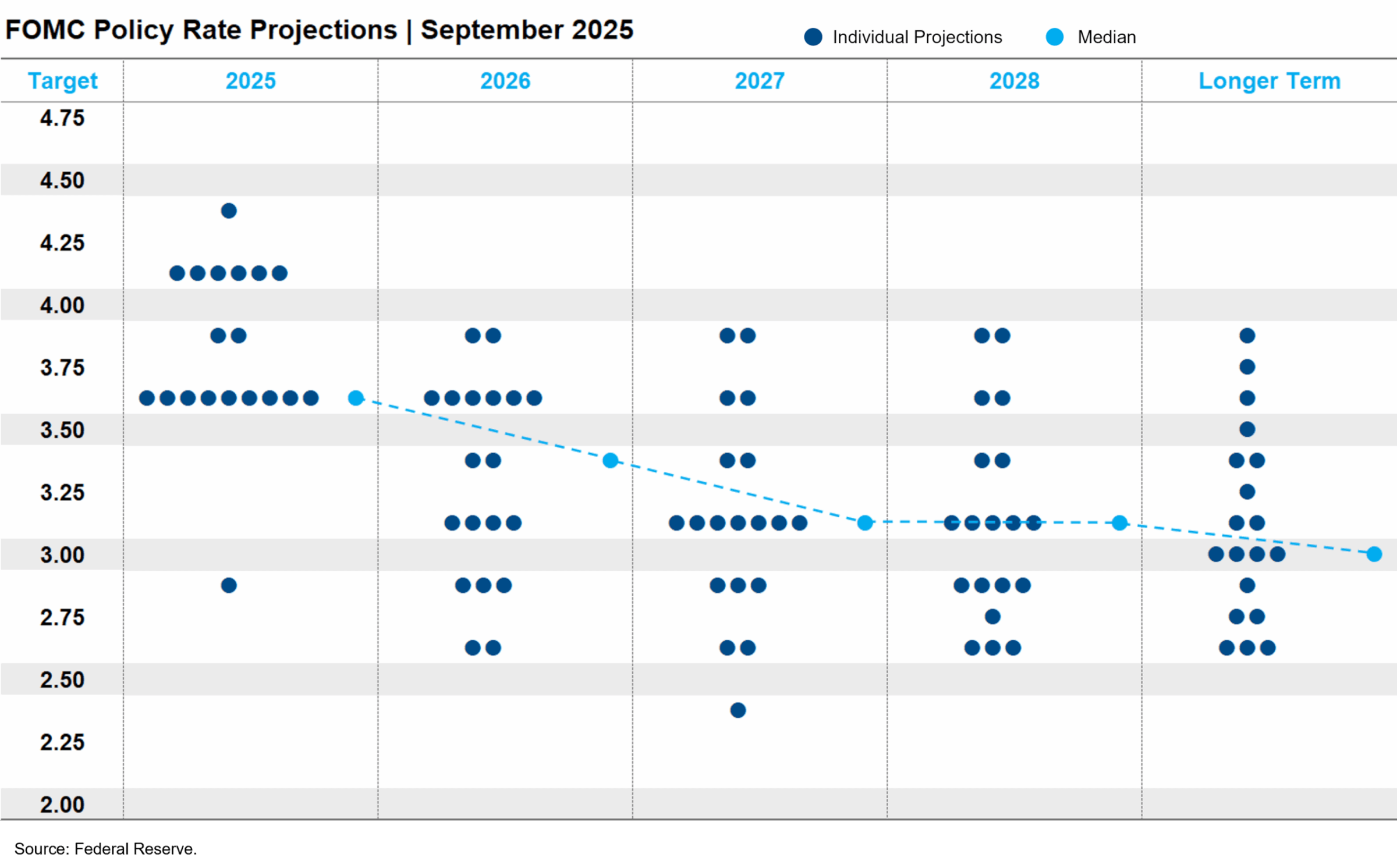

We were also struck by the stark divisions that persist within the Committee. Today’s vote yielded just one dissent, from newly installed Governor Miran in favor of a 50-bp cut. We were a bit surprised that President Schmid did not dissent in the other direction, though the 2025 dot at 4.375% is a soft dissent and probably belongs to him. Though the median 2025 dot declined to show two additional cuts after today, it was a fragile median. While ten participants project two or more additional cuts this year, two project one additional cut and seven project no additional cuts.

This division is perhaps unsurprising considering the extraordinary challenge that stagflation presents to a central bank. Even the moderate stagflation we are experiencing today forces the Fed to pick one side of their mandate because their tools cannot simultaneously address both. Chairman Powell has led the Committee to act in pursuit of the dovish path, betting that tariff-induced inflation will prove temporary. This seems appropriate given the sudden downgrade to the labor data, but there is risk in the other direction as well. The Summary of Economic Projections released today shows that Fed participants themselves expect to miss their inflation target for a sixth consecutive year. If this stagflationary tension persists into 2026, the Committee division will continue, and Powell’s successor may have a hard time wrangling a consensus.