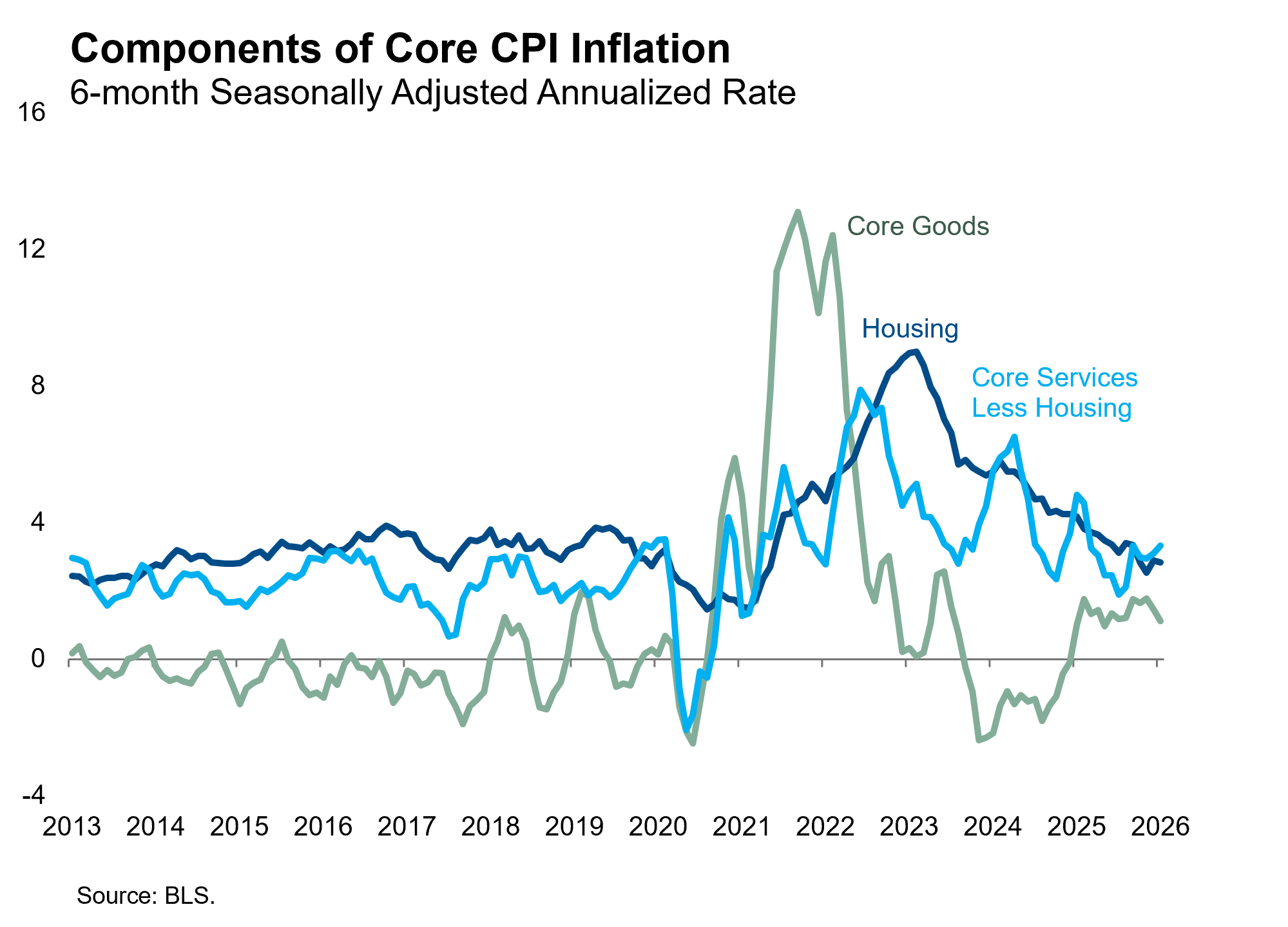

Core CPI increased by 0.295% in January, slightly below consensus expectations. The release was consistent with our broader inflation outlook for 2026 and does not change our expectations for monetary policy. We anticipate continued disinflation in core services, with housing on a steady downtrend and non-housing core services on the noisier downtrend it has exhibited in the last few years. We expect core goods inflation to remain elevated in the first half of the year and then stabilize near zero as tariff passthrough concludes. This pattern would cause core CPI to decelerate from the high 2s to the low 2s in the second half of the year. Combine that inflation dynamic with a labor market that is stabilizing but not generating elevated wage inflation, and the economy will be back on track to a soft landing and additional rate cuts later this year.

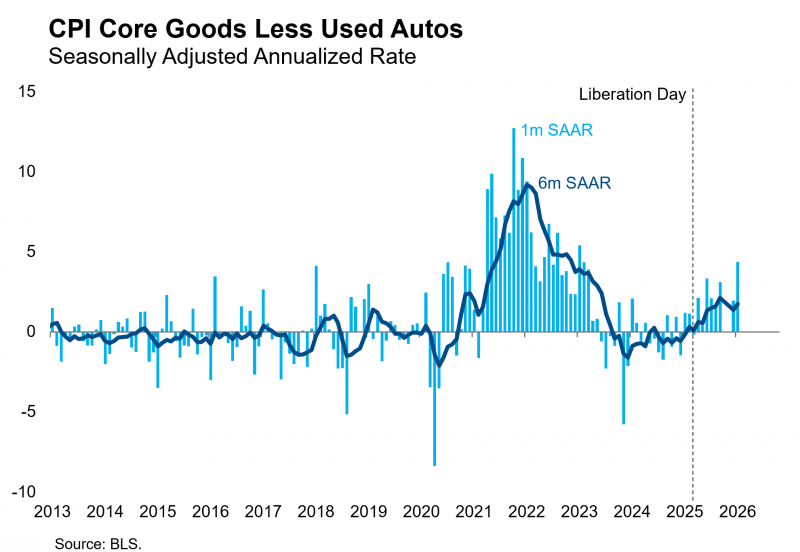

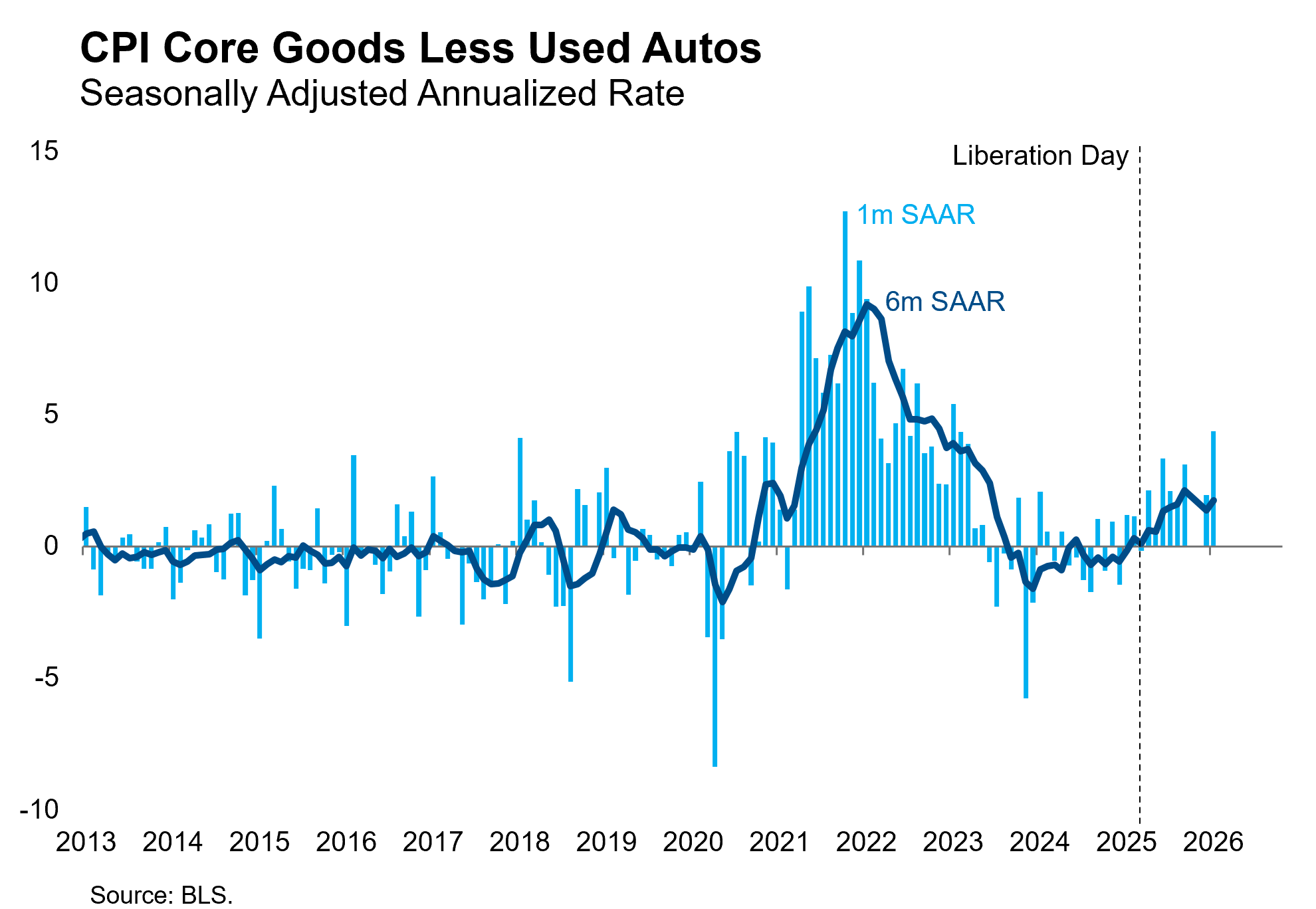

All of those dynamics were evident in the January CPI print. Housing prices rose 0.197% in the month, the coldest monthly print since 2021. Core services less housing rose 0.591% in the month, an elevated reading that was biased higher by noisy categories like airfare and car rental. In recent years, core services have exhibited a strong January effect (where sellers concentrate annual price increases into the first month of the year), so we’ll want to see a few more months before getting worried about upside risk to this cyclical component. The lack of wage inflation also provides comfort regarding the outlook for non-housing services inflation, since labor is a larger share of production costs in that sector relative to goods. Core goods prices rose 0.041% in January but were biased lower by a sharp decline in used car prices. Stripping out this volatile component reveals a 0.358% increase in core goods less used autos, the highest monthly pace since the pandemic inflation crisis.

Finally, it bears repeating that this January CPI report is just the second clean monthly reading since the shutdown heavily distorted the October and November reports. In the case of housing, those distortions will linger until April. While the Fed will welcome this muted January CPI print, we expect they will want to see several more months before gaining confidence that inflation is on a sustainable path back to their 2% objective. For that reason, we think they are unlikely to cut at Chairman Powell’s final two meetings in March and April. It’s possible that disinflation will proceed more quickly than we expect and allow incoming Chairman Warsh to deliver a cut at one of his first two meetings in June or July, but our base case remains for two cuts in September and December.