The September Employment Situation Report produced a mixed bag of signals that leaves the debate about a third rate cut in December unresolved. The report contained contrasting elements that provide ammunition to both the hawk and dove camps at the Fed. The BLS has delayed the publication of the next jobs report until after the December FOMC meeting, so policymakers will have to rely on second-tier and alternative data sources as they consider whether to act again.

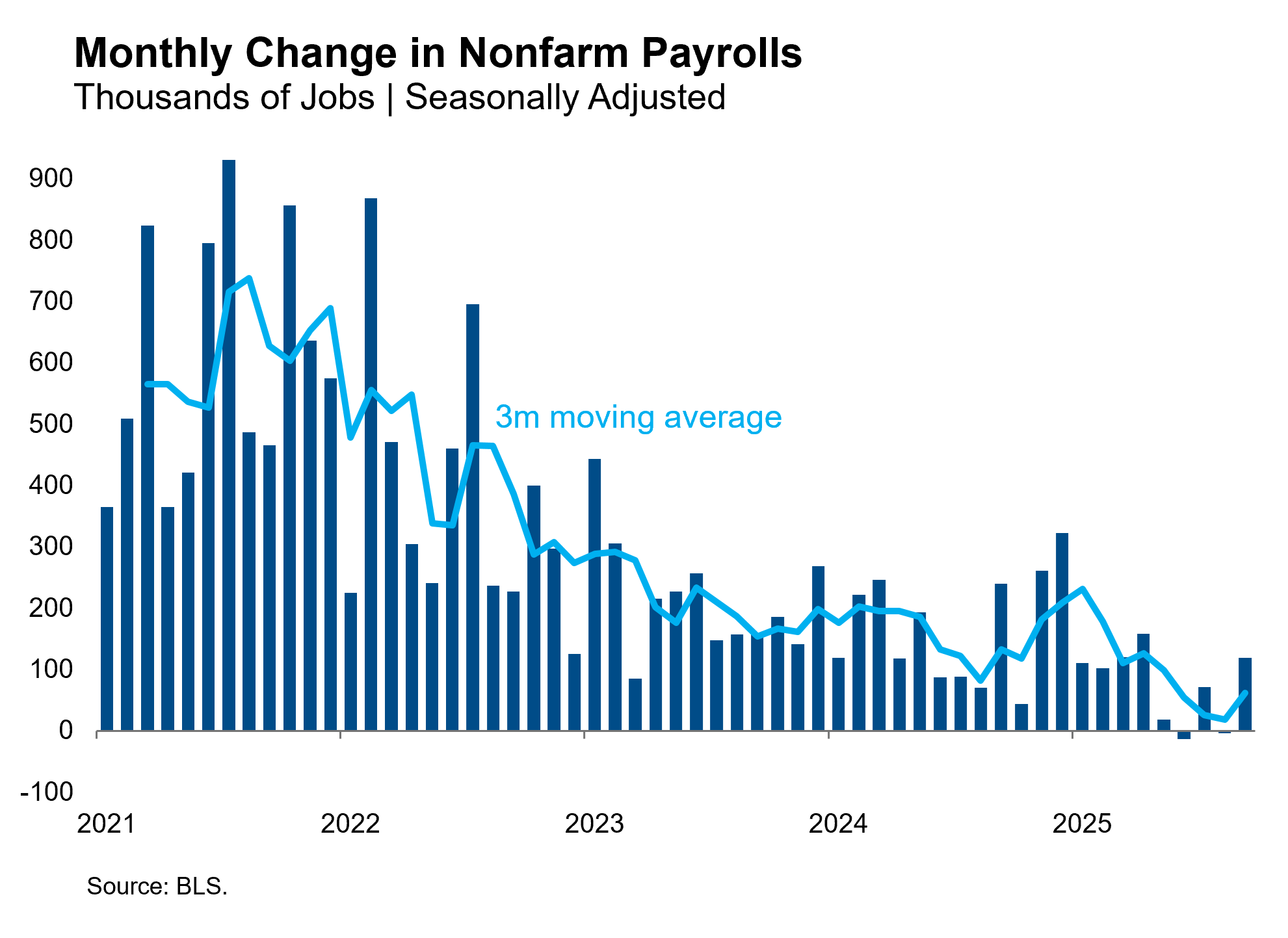

The hawks will focus on the establishment report, which showed nonfarm payroll gains of 119,000 in September, a strong rebound from the summer months. The August figure was revised down to -4,000, joining June as the second negative monthly print of the cycle. The 3-month moving average rose from 18,000 in August to 62,000 in September. Though job creation was strong in the month, it remained somewhat narrow as all private sector employment growth came from two sectors: healthcare and leisure/hospitality.

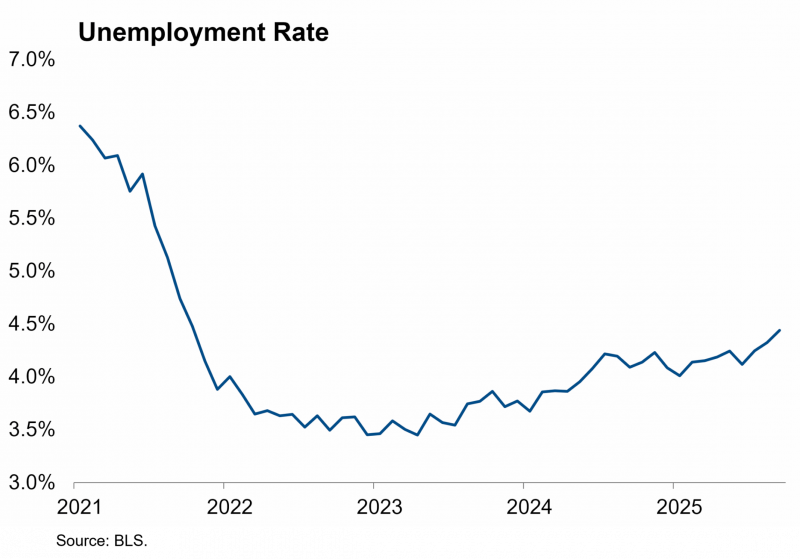

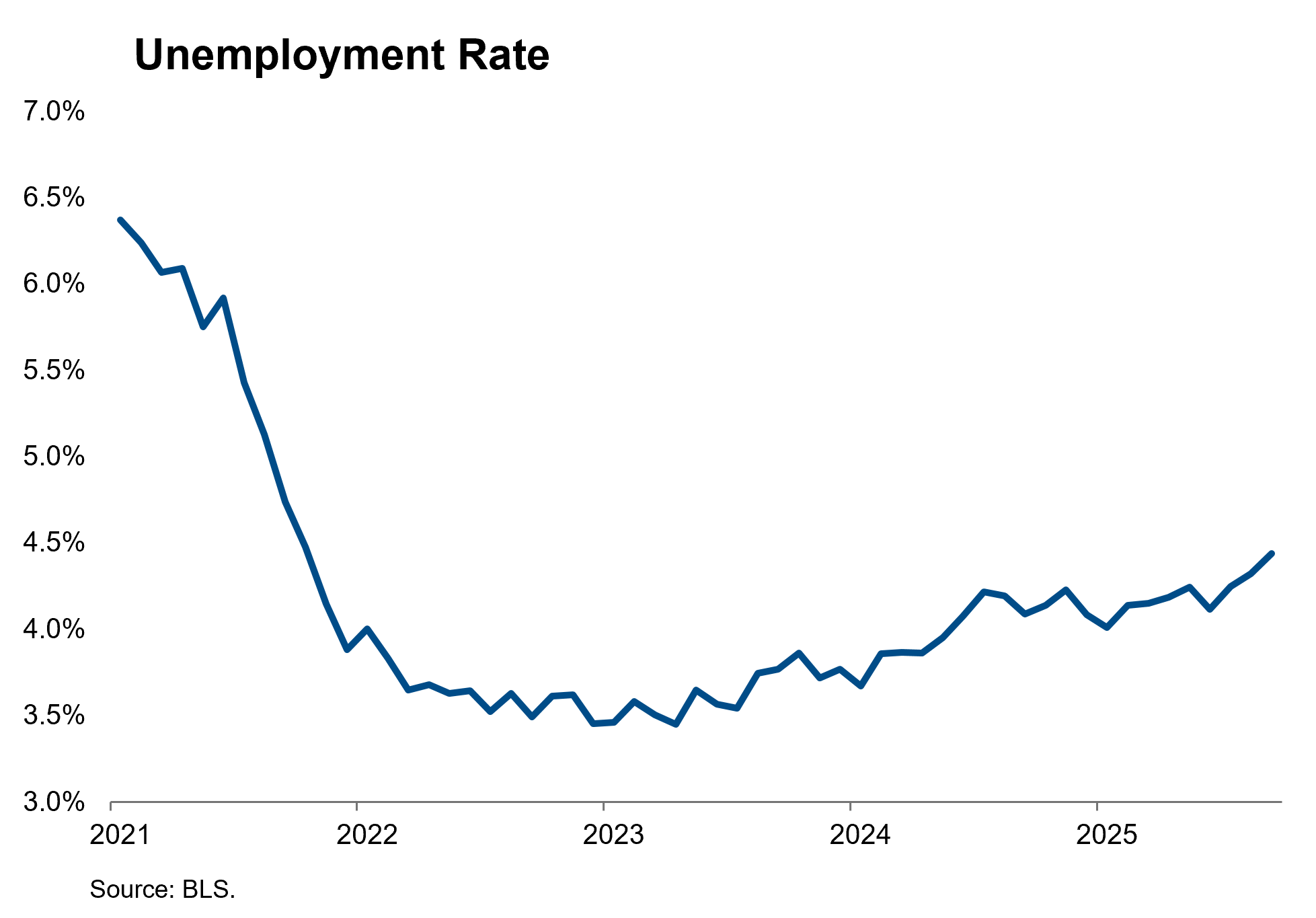

The doves will focus on the household survey, in particular the unemployment rate, which continued its steady march higher to a new cycle high of 4.44% in September. The rise in September was driven primarily by an increase in labor force participation rather than an increase in the number of unemployed, but this was merely reversing the participation decline over the summer. With immigration policy reducing the supply of labor, many FOMC members argue that ratios like the unemployment rate offer a more accurate assessment of labor market strength than the employment level which is biased downward by falling supply.

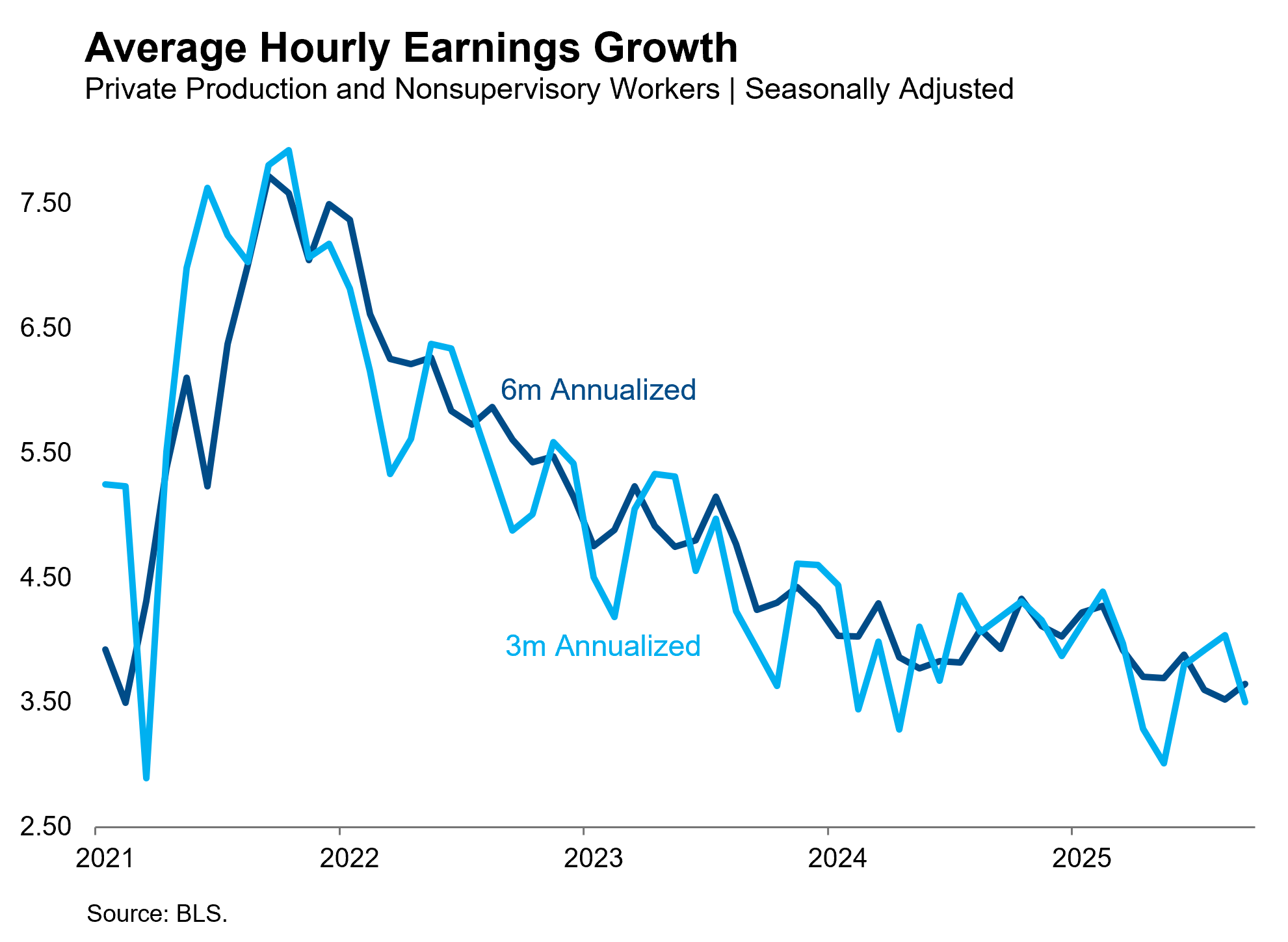

The doves will also take comfort from the average hourly earnings numbers, which show continued gradual disinflation in wages. Even the hawks acknowledge that the risk of a wage-price spiral is very low given the state of the labor market, which softened their resistance to the two previous rate cuts.

While the headline payroll growth number was strong, the sum total of the report reads to us like a continuation of the gradual softening trend that has been underway for more than two years. We are also mindful that federal government payrolls are likely to decline by 150,000 in the fourth quarter as the deferred resignation program takes effect. Today’s release does not clearly resolve the debate about whether to cut in December, and is unfortunately the last jobs report before the meeting. We had expected a third and final cut at the December meeting, but it now seems more likely that the delayed reporting from the BLS will push that cut back to the January meeting. Whether that policy action is delivered in December or January, we expect it will be the last cut of Chairman Powell’s tenure, which concludes at the end of May.