CPI inflation accelerated again in August in services categories as well as tariff-exposed goods. The bigger surprise in today’s economic data was a significant increase in initial jobless claims — a concerning warning sign but too tenuous of a data point to change our labor market assessment. Both data points are consistent with our general outlook for moderate stagflation. We continue to expect three consecutive 25-bp rate cuts starting at next week’s FOMC meeting.

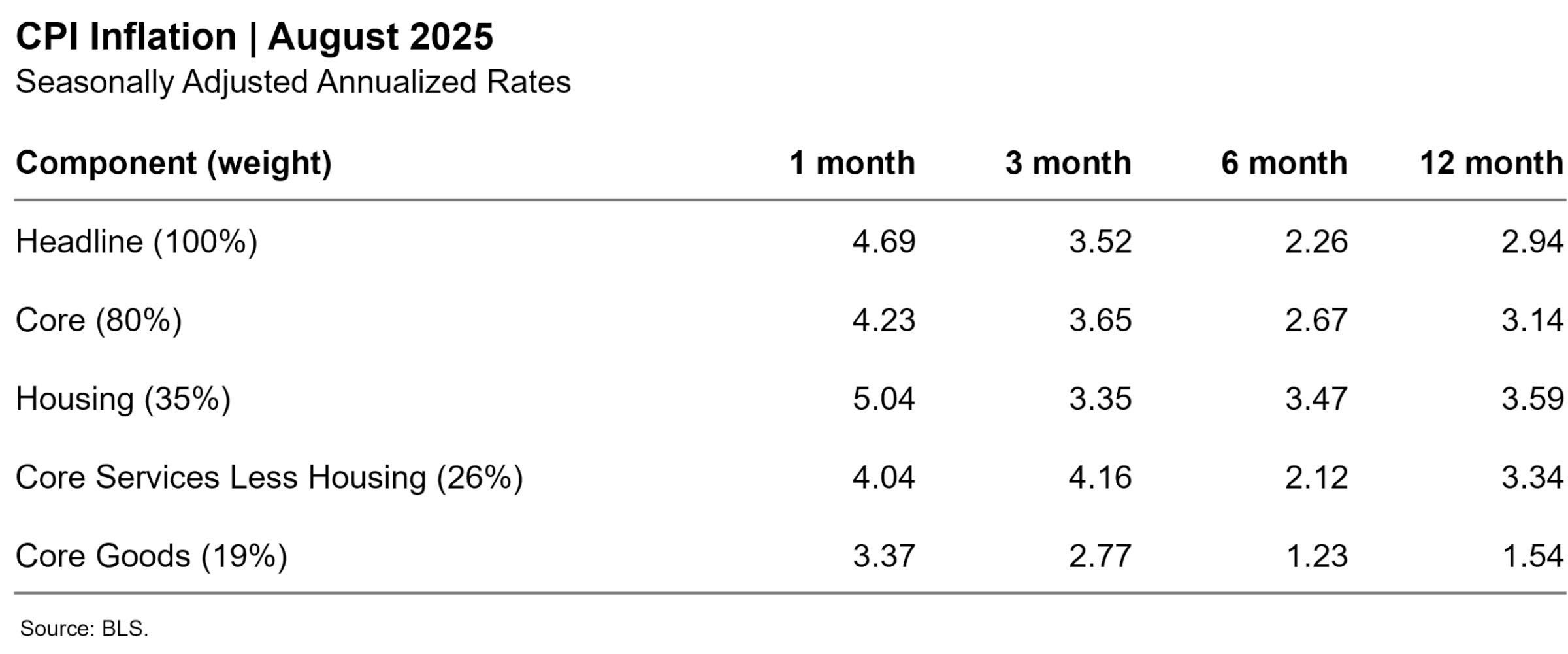

Core CPI increased at a 4.23% annualized rate in August and is running well above target at 3-, 6- and 12-month horizons. Tariff inflation continued to build at the more gradual pace we have now come to expect. Inflation among individual categories most exposed to tariffs was highly volatile with some products (e.g., photographic equipment) experiencing rapid price increases in August and others (e.g., laundry appliances) seeing outright deflation in the month. Nevertheless, aggregate core goods inflation accelerated again in August, leading the 3-month annualized rate to 2.77% — the highest since June 2023. This bumpy and gradual transmission of tariffs to consumer prices is already baked into the Fed’s reaction function and should not impact the near-term path of policy.

More troubling perhaps is the acceleration of core services inflation. President Goolsbee in particular has expressed concern about non-housing services, and will be unhappy to see another elevated print in that category in August. Most surprising was the acceleration of housing inflation to a 5.04% annualized rate in the month. This was partly caused by a large increase in volatile hotel prices but rent and owners’ equivalent rent also accelerated. We expect that this is just a noisy month around a continued trend of housing disinflation, but given its large weight in the index, it is imperative that housing inflation continues falling or at least remains subdued.

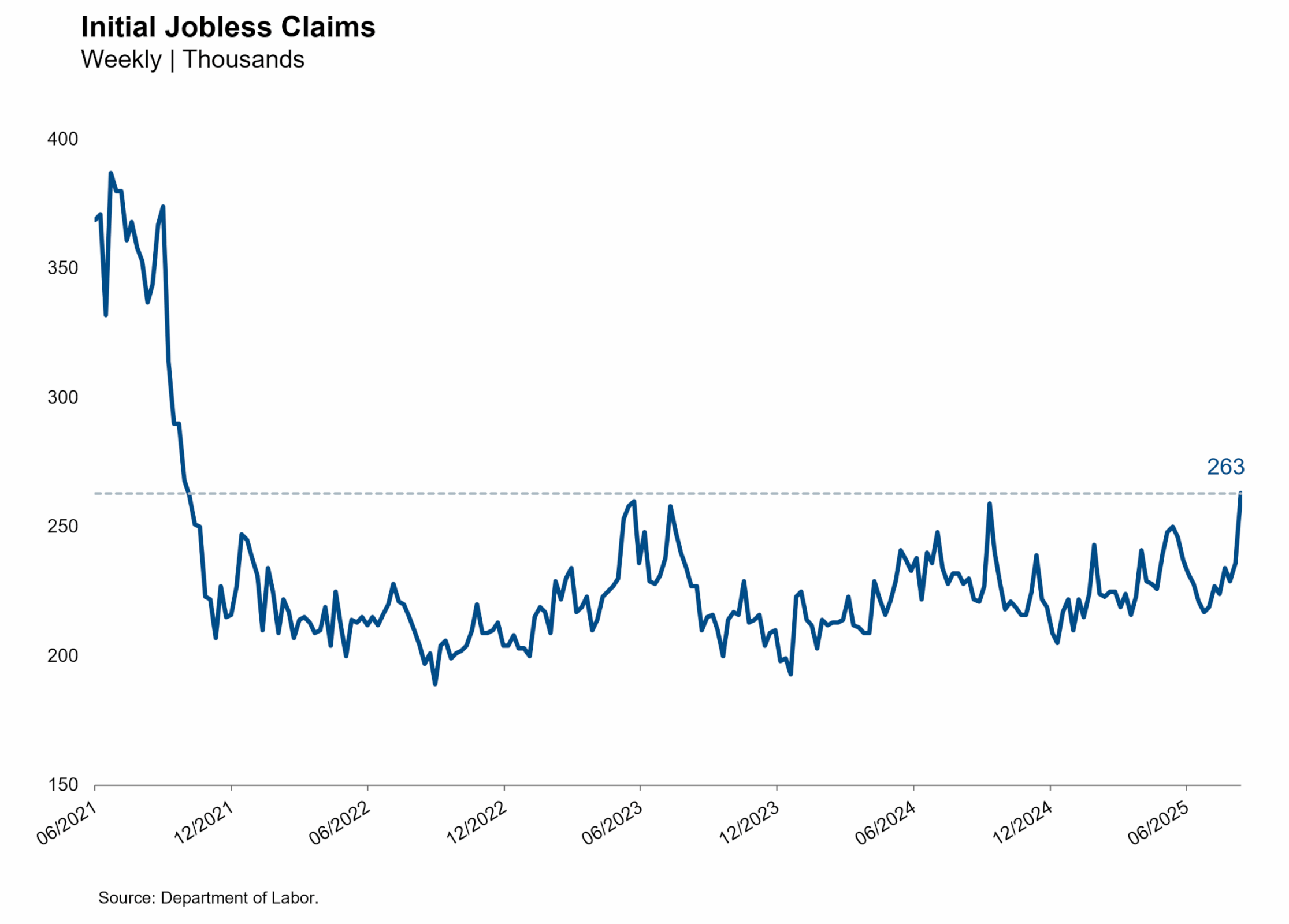

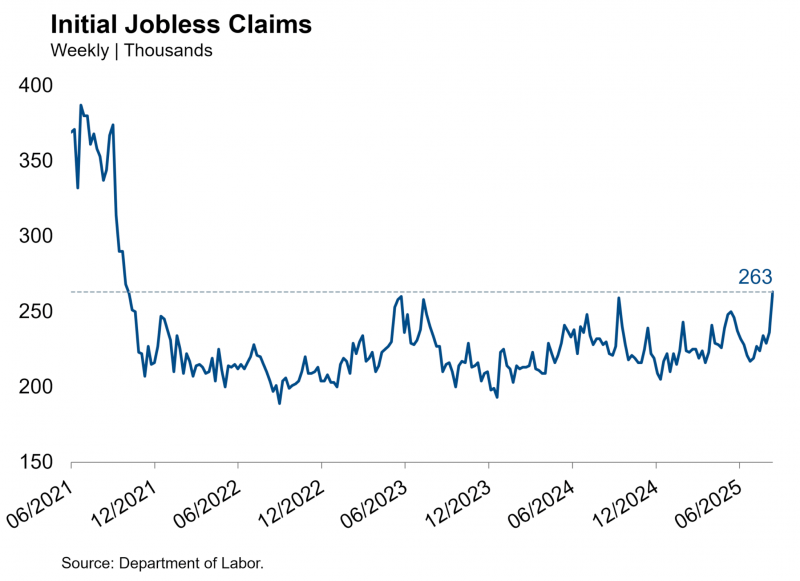

In other data released this morning, initial jobless claims rose by 27,000 to 263,000 for the week ending September 6. This is a new cycle high and the highest print since October 2021. We think this release rather than CPI drove the initial price response in Treasuries this morning, which has since moderated. Financial market economists love initial claims because its weekly frequency can provide an early warning indicator of recessions, but that higher frequency also introduces noise. The signal from this week’s claims data was further clouded by the Labor Day holiday and floods in Texas. We’ll be watching the claims data closely in the weeks ahead to confirm whether today’s figure was merely noise or the start of a layoff cycle that the labor market would be ill equipped to withstand.