A bombshell payrolls report for July meaningfully changes our perception of the state of the labor market. The report estimated 73,000 of job gains in July, which was only modestly below expectations, but the shocking figure was 258,000 in downward revisions to the prior two months. That is the largest two-month revisions on record except for April 2020. Job creation in May was revised from 144,000 to 19,000; June from 147,000 to 14,000. Trailing three-month average payroll growth has slowed dramatically from 230,000 in January to an anemic 35,000 today, and we expect the July number will be revised lower.

A quick note on methodologies: initial payrolls releases are revised over the next two months primarily because of late responses to surveys. In normal economic times, the variation between individual survey responses is unrelated to the timing of the response. It is a known feature of the establishment survey that downward revisions are more common during recessions partly because late responses tend to be disproportionately negative. One can imagine that the employers experiencing stress and reducing headcount are more likely to respond late. Most importantly for the forward outlook, the survey response rate increases with each subsequent revision, so the final revision is the most accurate of the three releases. That’s why we have greater confidence in the May figure than the July figure at present.

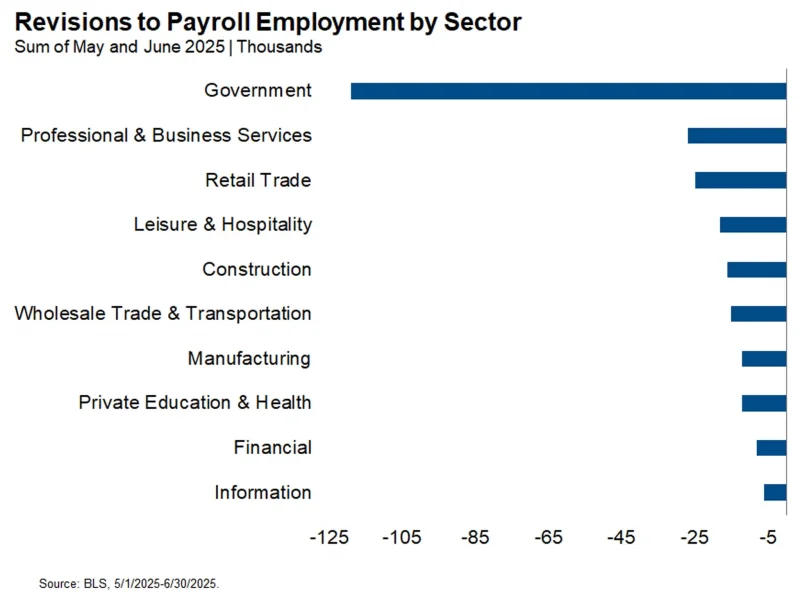

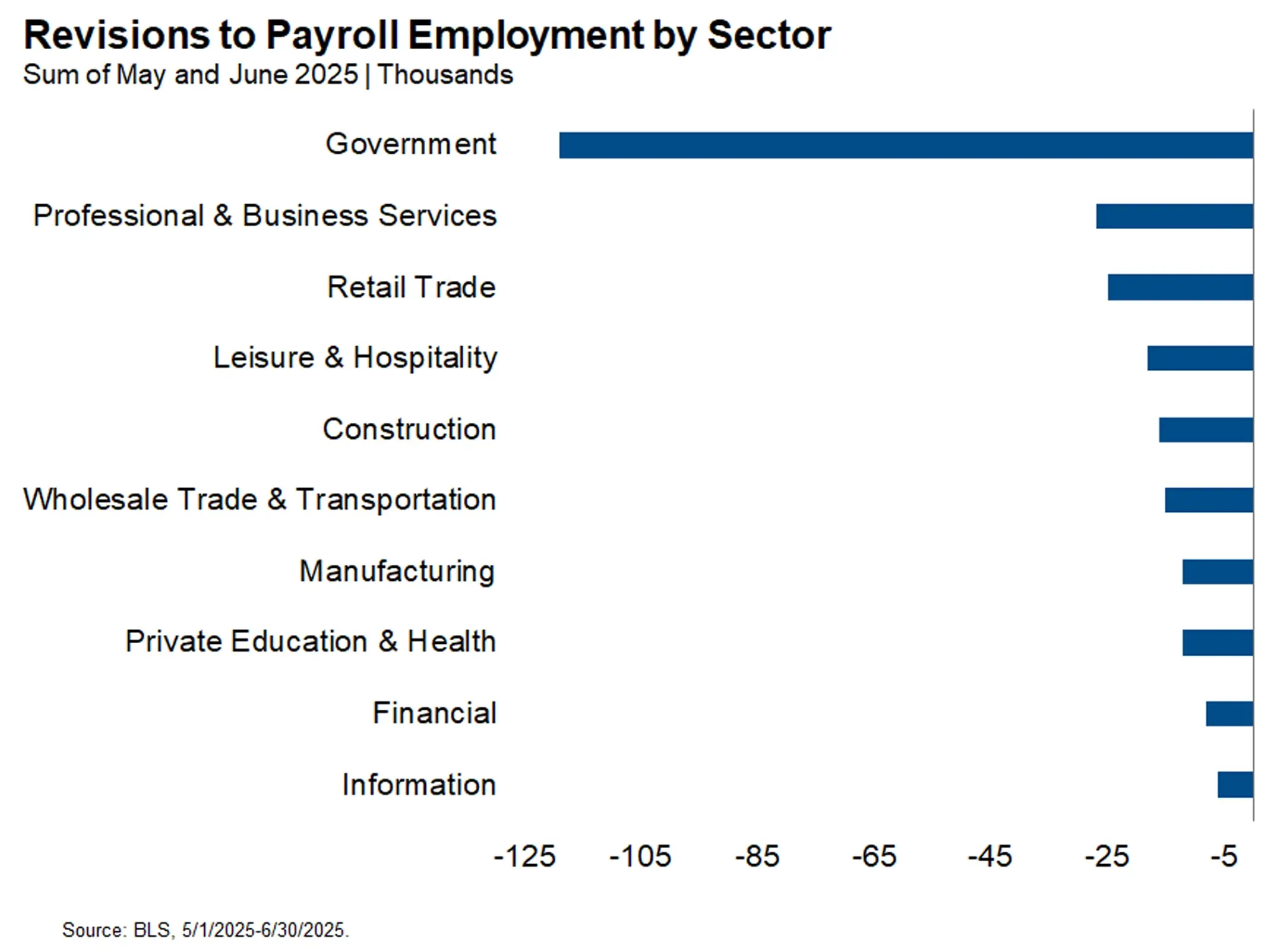

The largest downward revisions were in sectors most exposed to government spending cuts (government, education), tariffs (retail, manufacturing) and reduced immigration (leisure and hospitality, construction). The revisions demonstrate that the Trump administration policies are impacting the labor market more than previously understood. The establishment survey does not contain any information about immigration, but the separate household survey shows that foreign-born employment has declined by 1.01 million in the first six months of the Trump administration as native-born employment has risen by 2.46 million.

To see the May and June job creation print initially above 140,000 and then revised below 20,000 is far worse than to have them print below 20,000 originally. What we initially thought was a stable-but-vulnerable labor market has been revealed to be a dangerously weak labor market. If July is revised lower to continue the May/June trend, we could soon face the prospect of negative monthly payrolls prints and the specter of recession. It’s too early to jump to that conclusion today. It remains possible that the May/June figures represent the effects of the trough in business sentiment from mid-April. As President Trump de-escalated the trade war over the subsequent weeks and months, business (and financial market) sentiment rebounded in a V-shaped fashion. It is possible that job creation will do the same.

That speculation aside, the information available today calls for a more dovish path of monetary policy than we or the consensus previously expected. Our modal expectation is now that the Fed will deliver a 25-bp cut at their next meeting in September. This won’t be an easy decision for the Fed as they are now facing the stagflation we all feared would arise from negative supply shocks to trade and immigration. We still expect that the next two CPI prints before the September FOMC will show inflation around a 4% annualized rate, but payroll growth this close to zero calls for insurance cuts. This degree of labor market softening also reduces the risk that tariff inflation spills over into a broader wage-price spiral.