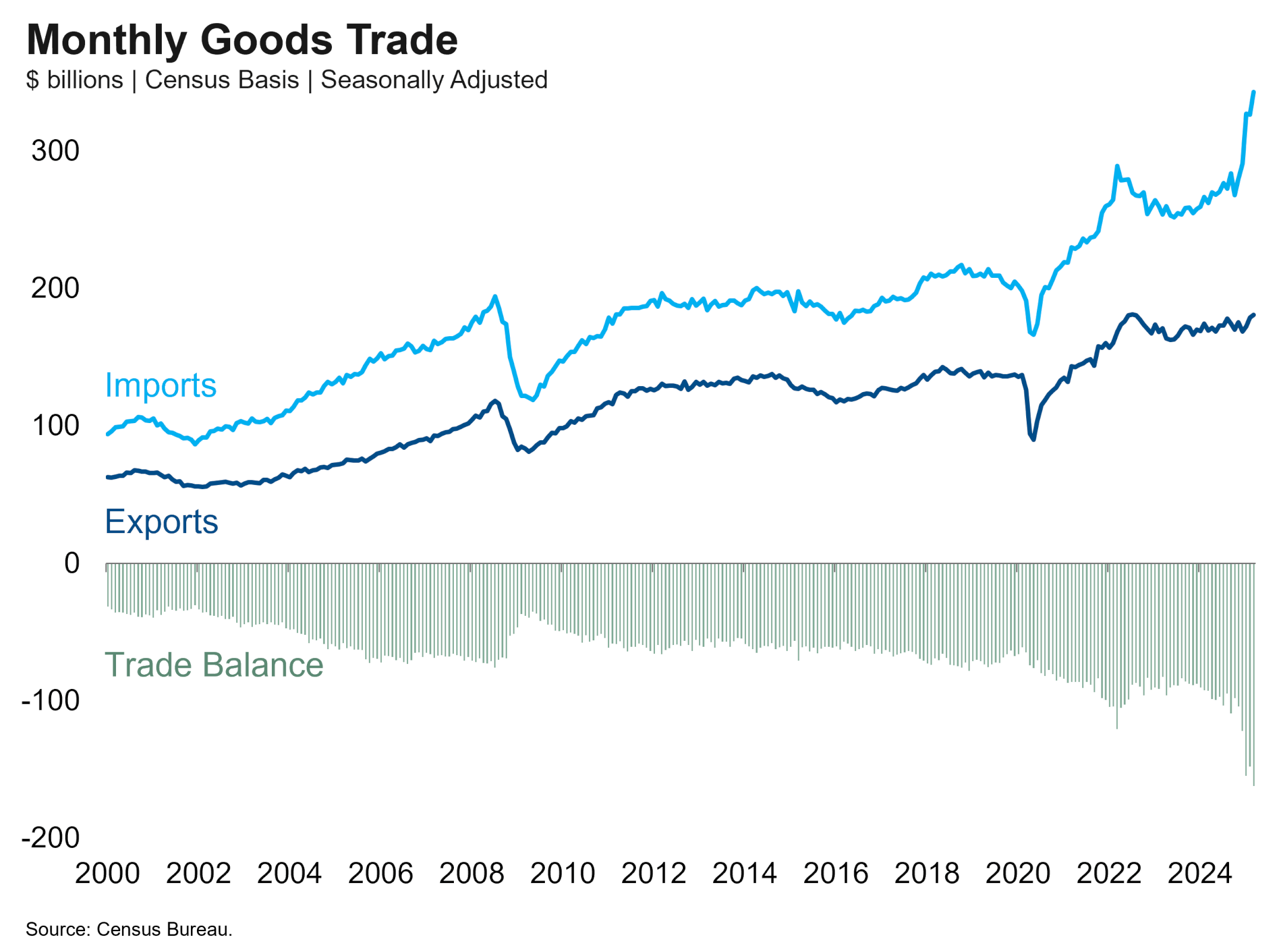

American companies rushed to stockpile imported goods ahead of the Liberation Day tariff announcement, recent trade data show. Goods imports surged to a record high of $343 billion in March, driving the monthly goods trade deficit to a record $162 billion. The import surge that began in December and gathered steam through March was driven by industrial supplies, capital goods, computer accessories and pharmaceuticals. These categories are indicative of tariff frontrunning and are consistent with anecdotal reports and management commentary.

This tariff frontrunning will cloud the economic outlook in the months ahead. Triple-digit tariffs have imposed a de facto embargo between China and the U.S., and we are closely watching west coast port traffic for signs of a sudden stop in Pacific trade. If imports fall in the months ahead, it will be hard to tell if the decline merely represents normalization from the earlier frontrunning or the start of a larger decline in global trade. The import surge also distorted the Q1 GDP figure in a way that is often misunderstood and likely to be revised away. Perhaps we’ll try to clear up some of those misconceptions in a future note.