It is a well-known market truism that the Fed tries to avoid surprising markets with its monetary policy decisions, especially when those decisions result in a rate increase. Indeed, the Fed has not issued a rate hike that was less than 70% priced in since 1994. On the other hand, the central bank has delivered a handful of rate cuts that were less than 50% priced in over that time period, and Federal Open Market Committee (FOMC) transcripts disclose policymakers’ awareness of this “revealed preference” to avoid hawkish surprises. In this context, the coordinated communication of multiple Fed officials last week can only be considered as effectively telegraphing a rate hike at next week’s meeting.

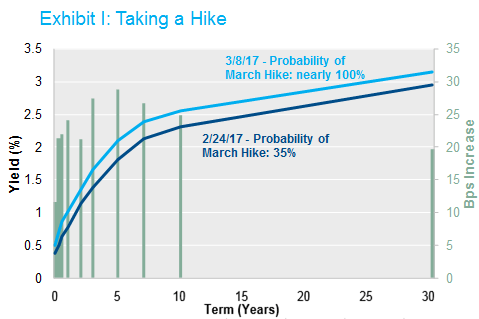

That message was heard loud and clear by the market. The probability of a hike at the March 14-15 FOMC meeting increased from around 35% on February 24 to nearly 100% now – a direct result of a remarkably concerted communications effort that saw 12 out of 16 FOMC participants speak in a five-day period. While it’s not entirely clear what transpired to change the Fed’s thinking after Janet Yellen’s more equivocal Congressional testimony in mid-February, the message from this chorus of Fed speakers was delivered swiftly and bluntly: expect a hike.

The resulting shift in short rates has been dramatic, and the impact has extended all the way out the length of the Treasury yield curve. Exhibit I highlights the 20 to 30 basis point shift higher in yields between February 24 and the close on March 8.

Source: Bloomberg.

To us, it seems that there are two key takeaways from this development.

The first is economic: the Fed, which has been comfortable with employment trends for over a year now, is increasingly confident that it will achieve success on the inflation side of its dual mandate as core PCE inflation reaches 2% on a sustainable basis in the next year or so. Their confidence on this latter point has increased as the risks from economic weakness abroad have receded. They also cite market expectations for fiscal stimulus and the economic optimism from firms and consumers in the wake of President Trump’s election as tilting the balance of risks to the upside. After the February payrolls report this morning proved above expectations, little else from a data perspective stands a chance of derailing a hike next week.

The second conclusion is communicative: this compelling effort has reinforced perceptions of the Fed’s aversion to surprising the market. To the extent that the policymakers intend to communicate their intentions more clearly, NISA will continue to carefully monitor the many speeches, FOMC documents, blog posts, and research papers published by Fed officials.

Assuming a hike in March, attention will focus on the statement, Summary of Economic Projections, and press conference for any hint related to the path of rates over the rest of this year and beyond. Will the Fed continue to project three hikes in 2017, or will the possibility of a fourth hike creep into the discussion? We will also be waiting to hear any additional detail about the timing of the Fed’s plans to start shrinking its balance sheet. Despite the Fed’s relative effectiveness in signaling rate moves, communication failures like the 2013 taper tantrum demonstrate the challenges in explaining unconventional measures like balance sheet policy. As the Fed normalizes away from its crisis-era stance, a simpler and more traditional form of monetary policy should be easier to communicate. That sounds like a good thing to us, but we’ll be keeping an eye on it.