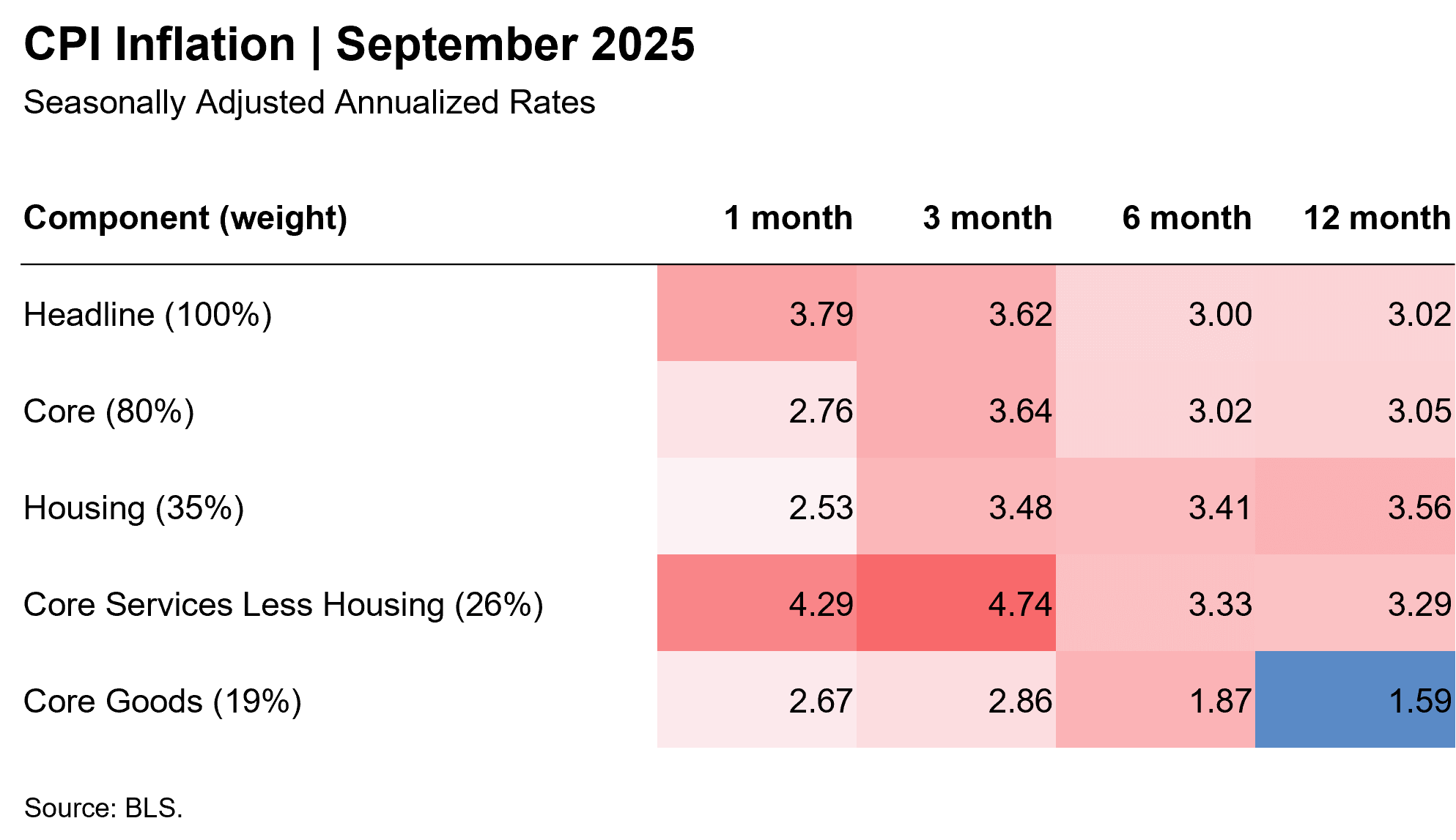

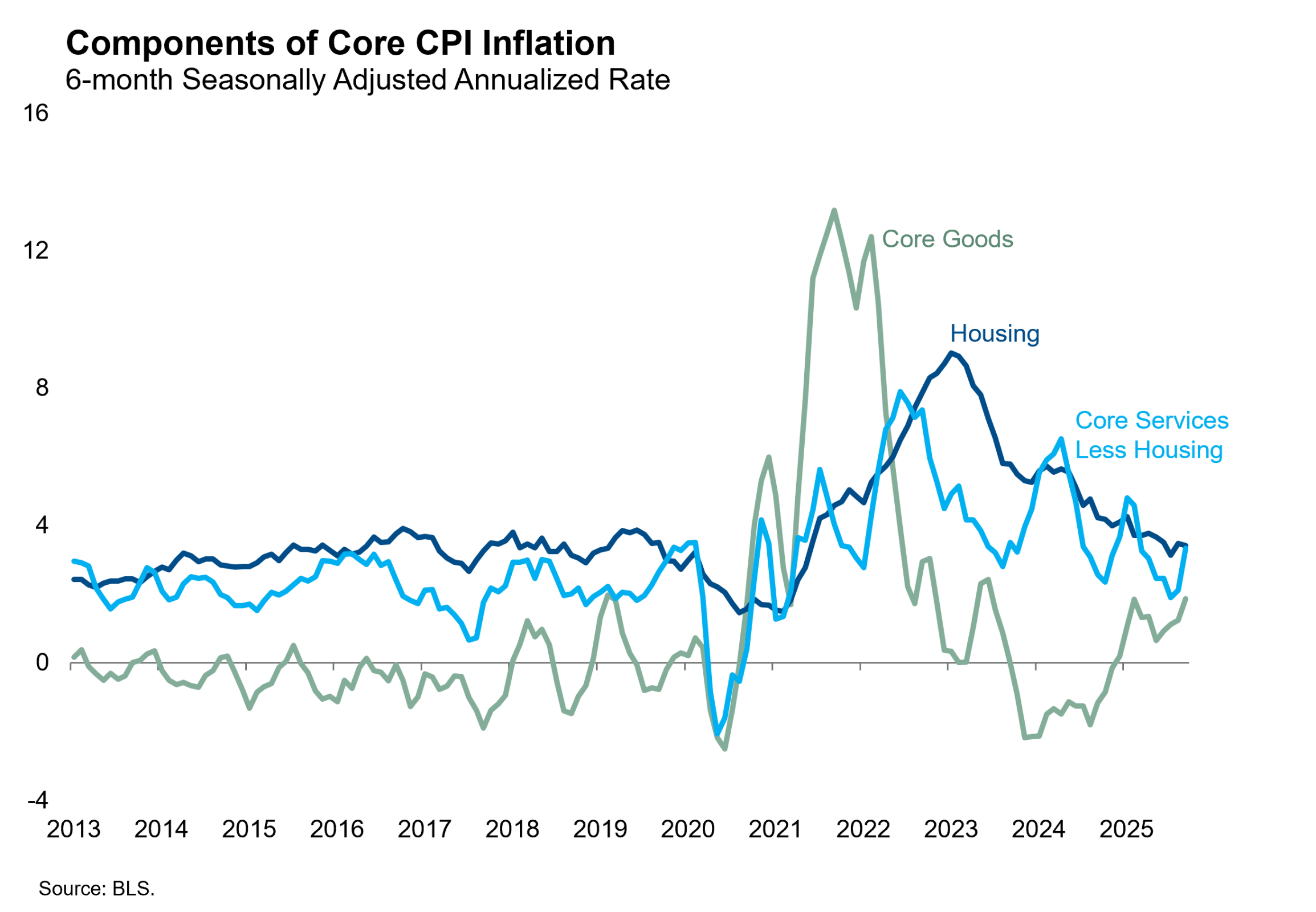

CPI inflation printed below expectations in September, with the core index increasing by 0.227% in the month or 2.76% annualized. This is the slowest monthly pace since May and clears the way for another 25-bp rate cut at this week’s FOMC meeting. A sharp deceleration in housing inflation drove the core print lower despite another elevated print in non-housing services and ongoing tariff-induced inflation in core goods.

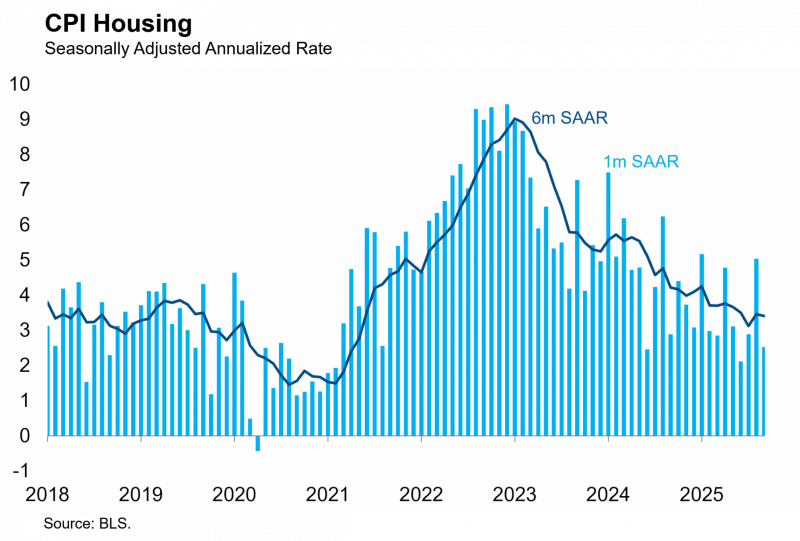

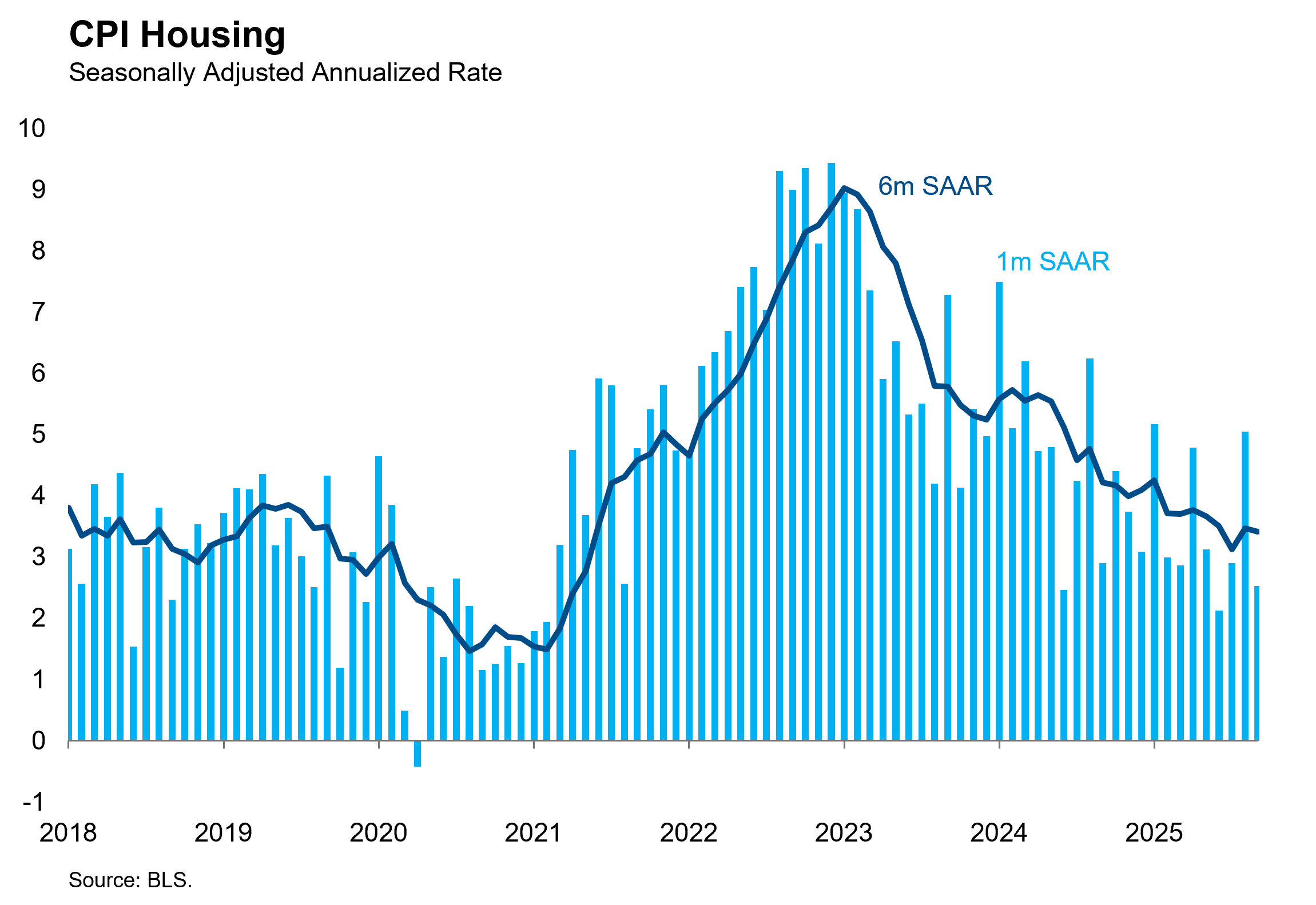

The deceleration in housing confirms our suspicion that the hot print from the prior month was merely noise around the lengthy downtrend rather than a new uptrend. The chart below illustrates that this noisy upside volatility in the monthly measure has been a regular feature of housing disinflation since the peak in 2023, and should be discounted in favor of lower-frequency measures. Our confidence that housing disinflation will persist stems primarily from the BLS methods that embed long lags into the official statistics. We also believe a fresh outbreak of housing inflation is unlikely given the stagnant state of the labor market.

Since housing is the largest component in the CPI basket, at 35% of headline CPI and 44% of core CPI, continued housing disinflation can provide a lot of cover for higher inflation in other categories. Tariffs are contributing to higher inflation in core goods, which over the last six months is running at the hottest pace of the last decade other than the pandemic inflation crisis.

Even though mild stagflation has divided the FOMC, Powell has convinced his colleagues to deliver a series of risk management cuts while they wait for data to confirm their hypothesis that tariff inflation will be transitory. The September CPI print clears the way for another 25-bp cut this week. Our base case remains for one additional cut at the December FOMC meeting, but the hawks may not be willing to go along with that unless they have more data showing continued weakness in the labor market. Unfortunately, the government shutdown has lasted long enough to impair the quality of both labor and inflation data for the month of October. Hopefully, it will be resolved soon so the FOMC can have clean November data when they meet in December.