Summary

It is possible to use the assets you will have tomorrow with the assets you have today.

- The mechanics for determining Special Financial Assistance (SFA) amounts made a lock-in date of December 31, 2022, attractive based on fixed income yields that could be attained in the market at that time. We have seen a substantial number of plans lock-in this measurement date.

- Investable interest rates have increased substantially since that time. We believe now may be an opportune time to lock in this windfall.

- Tools like U.S. Treasury futures contracts can allow “pre-investing” at today’s interest rates as plans wait for future SFA assets to arrive.

- While many of the concepts in this Perspectives piece are applicable to plans receiving SFA or multiemployer plans in general, we focus on plans that locked in a December 31, 2022, measurement date.

Introduction

As the SFA process of the American Rescue Plan Act of 2021 (ARPA) plays out, a substantial number of multiemployer pension plans are awaiting a windfall of expected cash from the Pension Benefit Guaranty Corporation (PBGC). The PBGC continues to churn through applications[1] with assistance amounts generally based on interest rates observed in 2022.[2],[3]

Since the December 31, 2022, measurement date, interest rates have risen on the order of 50 bps through November 30, 2023. We estimate that the economic funded status of a typical plan has increased around 3% since then, which can translate to many years of solvency.[4] This presents an opportunity which we believe should not be missed. While extending interest rate exposure is likely to improve solvency conditions in general, plans should strongly consider doing so as soon as practicable to secure today’s interest rates.

The Setup

The lower the interest rates used to calculate SFA funding, the higher the SFA assets will be. Conversely, the higher rates are when SFA assets are received, the more future return can be expected. This increases the likelihood that future benefit payments and expenses will be covered relative to what may be implied by rates used in the SFA application.

The excellent news is that investable interest rates have increased substantially since the typical lock-in date up to this point.[5] This will allow Trustees and advisors to extend the number of years of benefits and expenses they can expect to cover with lower-risk Investment Grade Fixed Income (IGFI) assets rather than having to rely on riskier return-seeking assets (RSA). However, if rates decrease further by the time SFA assets are received and invested, plans may not be as lucky.

In fact, we anticipate that if rates were to remain unchanged as of November 30th, many plans will be able to remain solvent well beyond the 2051 target built into the relief calculation on an expected basis.

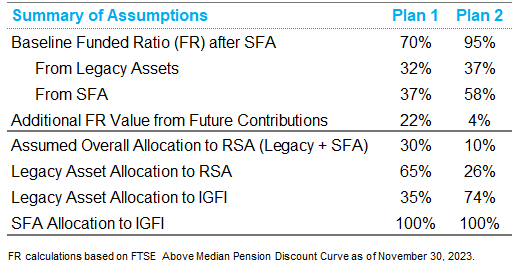

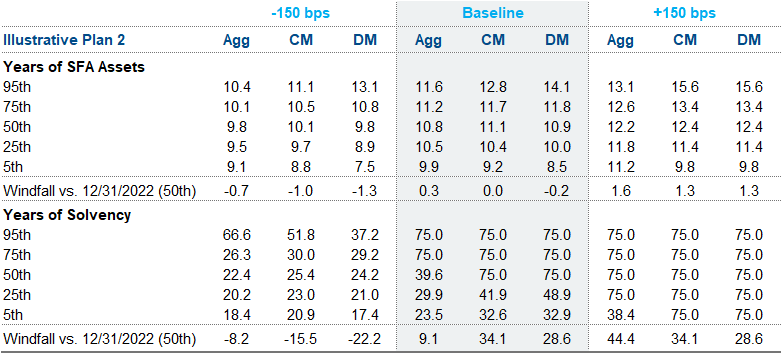

In the below tables and charts, we look at two illustrative plans that are expecting to receive SFA.

We chose these two sample plans as they capture some unique features that may influence outcomes and broader asset allocation strategies. Most specifically, Plan 1 has significant future contributions (and/or withdrawal payments) relative to Plan 2. This results in lower relative SFA funding and therefore perhaps a higher RSA target, which we modeled. They also had reasonably similar funded statuses prior to SFA funding (32% and 37%) but materially different funded statuses (70% and 95%) immediately after SFA contributions. A key takeaway here is the specific plan situation is very important and will impact outcomes and asset allocations.

For each plan, we look at three IGFI strategies:

- Aggregate (Agg): All IGFI is invested in Core Fixed Income, e.g., the Bloomberg U.S. Aggregate. This has a roughly 6-year duration and is, in our experience, a commonly used benchmark.

- Cashflow Matched (CM): The IGFI strategy is largely invested in corporate or credit bonds and designed to match the expected benefit and expense payments from the plan and rebalanced as any contributions and withdrawal payments are received. The earliest cashflows are hedged first.

- Duration Matched (DM): A strategy that invests the IGFI largely in corporate or credit bonds with the same interest rate duration as the total benefit payment and administrative expense cashflow stream.

For the CM and DM strategies, we assume returns are consistent with those implied by changes in the FTSE Above Median Pension Discount Curve for the appropriate duration, with no additional alpha. In practice, we expect there to be additional opportunity beyond what was modeled to take on credit spread premia or to generate alpha in strategies such as these relative to an Agg strategy.

We also look at three interest rate scenarios that may be available upon receipt of SFA assets. The Baseline scenario is based on rates and markets as of November 30, 2023. The other two scenarios explore the impacts of rates moving in parallel +/- 150 bps before implementing one of the above strategies.[6]

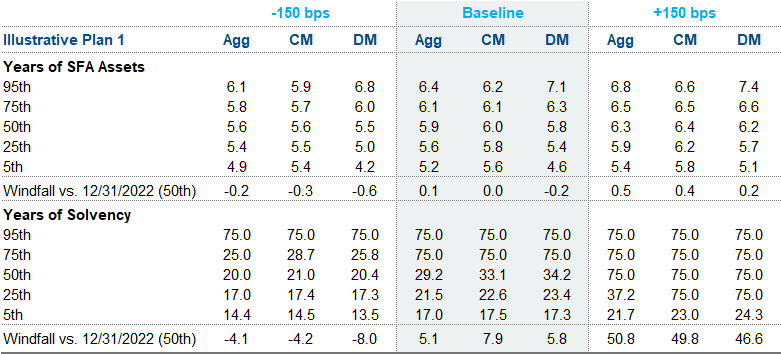

In the Tables below we look at various percentile outcomes for the number of years SFA assets last in isolation or the number of years both Legacy and SFA Assets last, e.g., Years of Solvency. We also compare the 50th percentile (median) outcomes to how those results would have looked as of December 31, 2022. We model the plans out 75 years total.

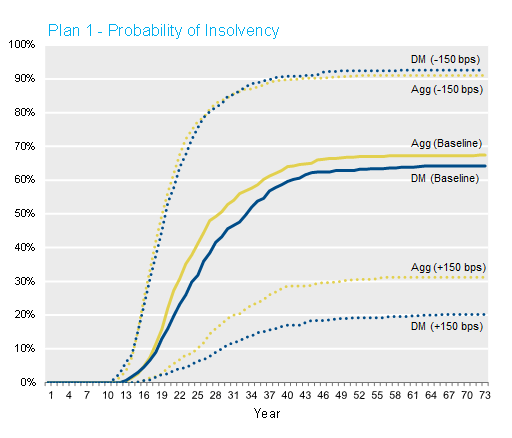

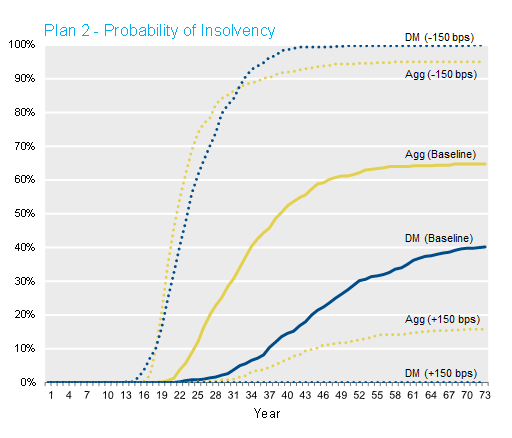

While the profiles of the two plans are different, we point to a few key takeaways:

- Years of Solvency is likely more relevant than the number of years SFA assets last. The strategies which go beyond Agg tend to outperform on a median expected basis and in downside scenarios. However, in environments where rates are far lower than they are today, this may not be the case. This may ultimately be influenced by the shape of the yield curve and expectations or lack thereof of a term premium.

- The same conclusions hold when looking at the probability of insolvency.

- The entry point for interest rates matters a lot! The baseline scenario is fairly attractive for both plans. To the extent possible, avoiding the range of results available under the -150 bps rates scenario is ideal. This is ultimately true without regard to which IGFI strategy is adopted.

- The upside that may come from rates rising before implementation may be less valuable than the cost associated with rates falling.

Ideally plans could receive the SFA money today to lock in higher interest rates to the extent their desired strategy would dictate. However, there is no magic wand to make that happen. The PBGC is working hard on slogging through all those applications, but it will take time.[7]

The Trick

For plans that acknowledge this reality, they may instead wish there were a way to freeze rates until funding dates. This, we think, is possible.

Investors can hedge against the impact of rate decreases, essentially locking in today’s rates.[8] We think this may be an opportune time for plans awaiting SFA to do exactly this. Those plans can extend the duration of their fixed income assets today. Given those assets may be limited, or likely not meet the full objective, interest rate exposure could be added via interest rate derivatives such as U.S. Treasury futures. While there are practical realities, operational complexities, and other risks to be managed, we believe the potential benefits likely outweigh the perceived costs of managing this interest rate risk.[9]

As shown in the above tables, there has been a windfall in expected outcomes since year-end 2022 for any IGFI strategy. However, it is important to be ready as rates have been and can continue to be highly volatile, which could result in a disappearing act for the current windfall.

Conclusion

It is possible to use the assets you will have tomorrow with the assets you have today. Given the fortuitous spread that has developed between fixed income yields and the yields used on SFA applications, we believe now may be an opportune time to lock in this windfall.

Further, an overall investment strategy that recognizes the impact of changes in interest rates on the ability to make future payments is warranted. Importantly, this may not require a liquidation of legacy assets. Tools like U.S. Treasury futures contracts essentially allow “pre-investing” at today’s interest rates as plans wait for future SFA assets to arrive.

If you would like to assess the potential to secure rates for future SFA funding, the market and operational risks that may be involved, or to evaluate a broader fixed income or asset allocation strategy for a multiemployer pension, please feel free to reach out to NISA.

[1] Note two application types exist. One application allows a plan to lock-in the rates they will be using for determining SFA assets, the other is the formal request for assets. Plans that have locked-in have not necessarily had the opportunity to submit formal applications yet. We will use the term application in the piece to mean either.

[2] We assume a general familiarity with the SFA program, but for more context please refer to our prior Perspectives piece, “Exceeding Solvency Expectations for Multiemployer Pension Plans.”

[3] We see most plans locking in based on 24-month average segment rates applicable for December 2022, leading to a return assumption of 3.77% on SFA assets and 5.85% on legacy assets.

[4] During this time, corporate bond spreads also decreased, so the value of Treasury rates rising is understated here.

[5] This is on top of the fact that, as noted in our prior Perspectives piece, “Exceeding Solvency Expectations for Multiemployer Pension Plans,” actual investable rates were already higher than the 24-month average rates used to set the assumptions, since rates had trended upwards over that period. This was already an excellent situation for SFA recipients and led to an expectation that if nothing changed by the time of funding, a number of plans could already surpass the target 2051 solvency date in a median outcome.

[6] These results are of course based on a substantial number of model assumptions. A few key inputs and concepts are as follows. Our model of risk-free rates is based on the prevailing Treasury curve and covariances implied by prevailing swaption prices. We assume a 4% equity/RSA risk premium. Other factor correlations are based on historical experience.

[7] Beyond the wait for the review process for a given plan to actually begin, PBGC has a 120-day review period for each application and expects payment to be made within 60 days but no later than 90 days after an SFA application is approved or deemed approved.

[8] As noted, the selected hedge program would influence the size of any potential interest rate hedge. This strategy would ideally be designed in recognition of any cashflow and other associated risks which are beyond the scope of this piece. Plans may also have a schedule of increasing rate levels at which they increase this lock.

[9] To the extent a plan believes their application amount could be reduced or denied, that should be accounted for when determining the appropriate hedge amount.