As we approach the next Fed meeting in September, expect more chatter on 1) whether they should ease and 2) what the inverted Treasury yield curve is saying about recession risk. Currently, the yield curve is shaped like a saucer. The highest rate is the 1-month bill, the lowest is the 5-year note, and the 30-year bond is only a few basis points below the front end.

The case for a Fed rate cut is obvious. The enormous fall in European sovereign yields, most into negative territory (mirroring Japan), has unleashed a wave of demand for dollar-denominated bonds from foreign real-money investors. As a result, Treasury yields have fallen over 100 basis points across the curve, except in the very short end where the fed funds rate anchors bill rates. The speed and size of the decline in Treasury yields has created this seemingly anomalous situation where bill rates are the highest yielding Treasury instrument.

What needs to happen? Markets anticipate a total of 100bps in Fed easing over the next year, bringing the fed funds rate to around 1.15%. Normally, expectations for such a large move would suggest the Fed is in a strong stimulatory phase. Not at all, this time. Due to no fault of their own (I have generally been critical of the Fed for much of the last 10 years), the European rates market has put the Fed behind the eight ball with a fed funds rate that is completely out of synch with the rest of the world.

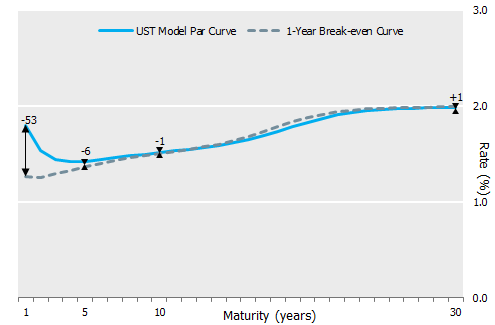

So, the Fed has to ease to restore a semblance of sanity to the yield curve. In fact, with the fed funds rate at 1.15% and bill rates a bit lower, we would most likely have a fairly normal looking curve: upward sloping throughout but fairly flat given benign inflation expectations. This is approximately what forward rates are pricing to occur over the next year, as shown in figure 1 below. The added benefit is it will stifle the media and talking heads on television that insist the inverted yield curve is forecasting a recession.

Sources: Bloomberg, NISA calculations.

One more point is worth noting regarding the significant stimulative effect on our economy from the dramatically lower rates that we have imported from offshore. The over 100bp fall in most borrowing rates this year have only been accompanied by a small decrease in inflationary expectations, implying most of the reduction is in real borrowing costs. Keep in mind this is across the entire maturity spectrum. I expect that this stimulus will far exceed what the Fed could have accomplished had it reduced fed funds proactively rather than reactively.