In this short note we demonstrate, primarily using a few examples and data points, how totally inappropriate it is to seasonally adjust initial unemployment claims during the pandemic and how doing so can lead to very misrepresentative “headline prints.”

Why seasonally adjust claims?

The purpose of seasonal adjusting is to remove distortions that result from holidays, plant re-toolings, retail sector layoffs after the holidays, and other recurring calendar-based events that are effectively “noise” vis-à-vis true labor market conditions.

How is seasonal adjustment operationalized?

The Department of Labor utilizes econometric techniques to assign each of the 52 weeks a factor that captures whether that week is historically above or below the average of all 52 weeks. The factor is multiplied by the actual reported claims to obtain seasonally adjusted claims. If claims are generally high in a given week the factor is less than one; if low the factor is greater than one. The average factor for all 52 weeks is approximately one.

Why is this approach so inappropriate now?

History suggests that claims reported in the fourth week of March are low in comparison to the entire year and as a result that week is multiplied by a factor greater than one. The last week of March 2019, the reported claims of 184 thousand was increased by 27 thousand to obtain a seasonally adjusted 211 thousand (the factor was 1.15 then). The average seasonal adjustment in 2019 was 31 thousand jobs and the largest was 131 thousand. Brace yourself! This year actual claims for the fourth week of March were 6.016 million and the seasonal adjustment added 851 thousand (factor was 1.14) to obtain a seasonally adjusted 6.867 million! For perspective, actual claims have only exceeded 851 thousand once in the last 35 years, in the second week of 2009. You see the problem? Seasonal adjustment grosses up or down actual claims by a given percent.

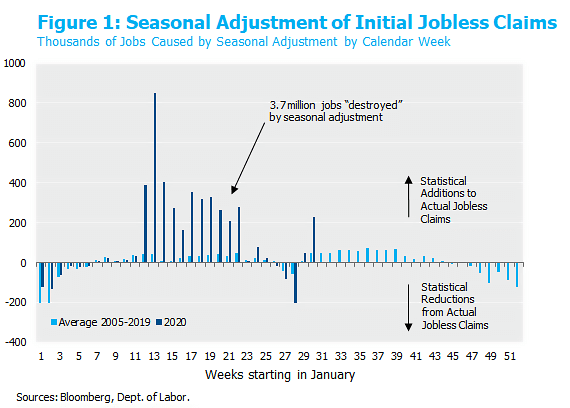

Figure 1 shows how this multiplicative adjustment has distorted the claims data by a much larger number than in recent years. This distortion persisted through the most recent data. In the last three weeks through July 24, the number of actual initial claims declined by 306 thousand while the number of seasonally adjusted claims increased by 126 thousand. The seasonal adjustment actually reversed the sign on the trend in this widely followed high frequency indicator!

More interesting numbers

Through July 23rd cumulative seasonal adjustments to claims has resulted in a net increase of approximately 3.7 million reported claims. Since we believe typical employment seasonality is either irrelevant or insignificant this year, cumulative seasonal adjustments to claims have resulted in an approximately 3.7 million person overstatement of job losses YTD.

Here is an interesting what-if scenario. Suppose the economy had been shut down in January instead of March and the actual claims number for the second week of January was the reported number at the end of March: 6.016 million. Since the factor for that week is 0.61 (remember post-holiday retail layoffs) the seasonally adjusted claims would have been reported as 3.679 million, 2.337 million less than actual claims. Perhaps the headlines would not have been so dire.

Credit is due to our colleague, Dan Scholz, whose insight greatly contributed to this note.

Originally published on July 27, 2020; revised on July 30, 2020.

To download a PDF version, please click here.