Like visiting the doctor periodically, it is important for an investor to assess the overall health of her portfolio from time to time. At times, some of the most seemingly mundane parts of the checkup, for example a routine blood test, can be the most important and impactful.

With that in mind, now might be a good time to revisit the “health” of every portfolio’s key organs: asset classes (sometimes referred to as beta exposures). Even for these most elementary of portfolio components, there have been some developments that offer asset owners opportunities to improve the overall fitness of their portfolios.

When an asset owner determines her asset allocation, she makes decisions about how much to allocate to various beta exposures (e.g., equity, fixed income, commodities, etc.). Each of these exposures serves a strategic purpose in the portfolio: capital appreciation for equity, liability hedging or diversification for fixed income, and so on. Once the allocation is determined, the asset owner will then allocate capital to active or passive managers with the goal of achieving the desired exposures.

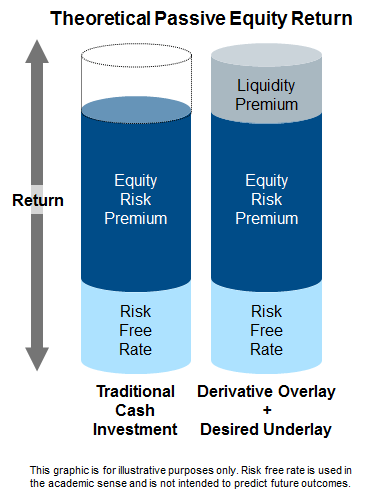

Unfortunately there is a drawback to this seemingly straightforward approach: the exposure the asset owner wants may be accompanied by other exposures she does not. For example, consider a pension plan with a large allocation to passive equity. This plan is a long term investor with no intention of selling equity any time soon. Yet generally speaking, since equities can be sold at a moment’s notice; they are thought of, in fact, as a very liquid investment.1 This liquidity comes at a cost in the form of lower expected return – a foregone “liquidity premium.” Put differently, the asset owner is paying for a feature – liquidity – that she may not intend to use. To be clear, asset owners need liquidity, but our example assumes a “large” equity exposure to indicate that this is likely more liquidity than the asset owner may need. Given the recent migration of many institutional asset owners to passive large cap domestic equity, this is likely a situation most asset owners are currently facing.

If the plan could instead achieve its desired equity exposure while simultaneously managing to an acceptable level of liquidity (or illiquidity), it could theoretically enhance its performance by earning a liquidity premium. The more liquidity a plan is willing to give up, the more it may be able to enhance returns. This may be a particularly attractive source of additional return since, unlike an increase in market beta, the investor is ‘selling’ liquidity to the market that values it more dearly than the investor. The exhibit below illustrates this concept.

This framework for evaluating exposures is key. The question an asset owner needs to answer is, what does she want from a given asset class? Is it simply the beta? Alpha from active management? A targeted amount of liquidity? Or (more likely) a combination of factors? Either way, asset owners don’t need to just accept “prepackaged” asset classes as-is. To the extent they have unique needs and preferences, asset owners can customize the profile of the asset class to meet their objectives.

Thankfully, this is not just a theoretical exercise. While concepts like “portable alpha” have existed for some time, the proliferation and increased ease of use of derivatives has opened the door to alternatives where investments are broken into component parts: an “overlay,” or headline exposure, and a customized “underlay,” or committed capital. Doing so enables asset owners to separate asset classes into their constituent parts and allows them to more freely pick and choose what they want. Utilizing these choices and structuring investments accordingly may enhance returns—a promising development.

Our next post will dive into the mechanics of the overlay/underlay approach and illustrate some of its practical applications, both old and new.

1It is important to note the distinction between liquidity and valuation. A prime example of this distinction occurred in December 2008 – An asset owner may not have liked the price if they were selling stocks, but they could find a buyer readily.