It may pay to be a little more cosmopolitan when it comes to your bond portfolio. Yield differences between comparable maturity instruments in different countries can offer opportunities to enhance returns, particularly for longer-term investors. By buying foreign bonds and using currency forwards to lock in future exchange rates, investors may be able to realize gains over what they could otherwise get by investing domestically.*

Consider a Canadian investor planning to buy a zero-coupon Canadian federal security. Instead of just purchasing that bond, say instead he (i) exchanges Canadian dollars into US dollars, (ii) buys a comparable maturity zero-coupon US Treasury bond, and (iii) enters a forward contract to exchange US dollars back into Canadian dollars on the bond maturity date. If he holds the bond until maturity and there is no counterparty (or issuer) default, he knows what amount he will earn, all-in, in Canadian dollars. If the yield on this “synthetic” Canadian bond is greater than what the Canadian bond would offer, he’s found a way to increase his return.

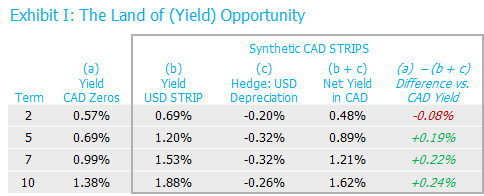

The table below gives a look at the additional yield available to an investor open to investing in such a way. To be sure, the exact type of bond and relative pricing between specific bonds may result in different realized spreads.

Source: Bloomberg. As of 3/31/2016. USD depreciation is based on expected inflation differences relative to CAD as indicated by the forward currency markets. Displayed CAD Zero yields are based on a fitted federal yield curve.

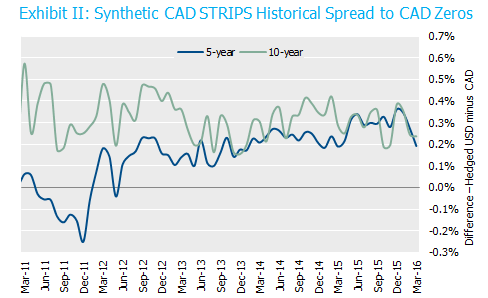

In this example, the yield opportunity has looked persistent through time as well, particularly for 10-year STRIPS.

Source: Bloomberg.

Importantly, it is by holding the investment to maturity that the at-inception spread is earned; prior to maturity, if the spread tightens (widens) the investor may see an unrealized marked-to-market gain (loss).

These border-hopping trades can be utilized not only for government bonds but also for corporate securities. A Canadian investor wanting to gain access to a deeper market while maintaining interest rate exposure in Canadian dollars could combine currency forwards and US corporate bonds. We think this strategy could be particularly relevant for larger Canadian pension plans who are unable to obtain sufficient (or sufficiently desirable) exposure to Canadian corporate bonds. Naturally, this variation results in a different credit basis in the portfolio, but the yield and diversification benefits may justify the tradeoff.

*One important caveat: the difference in yield between foreign and domestic securities needs to be denominated in the domestic currency. We discussed this point in our white paper “Spreading Confusion,” but the main takeaway is that yield comparisons have to be apples-to-apples. Too often the press reports the nominal yield differences between countries without removing inflation expectations.