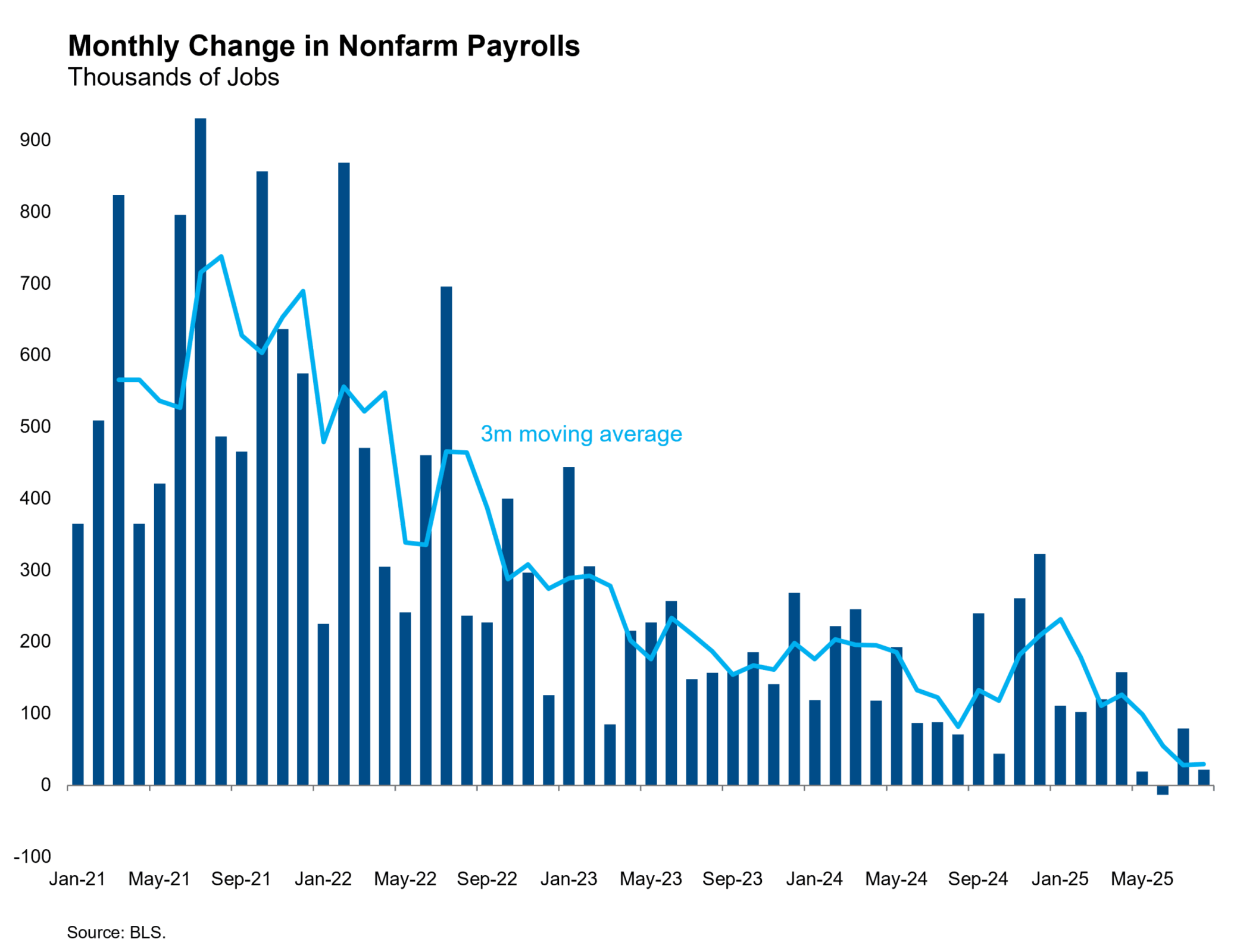

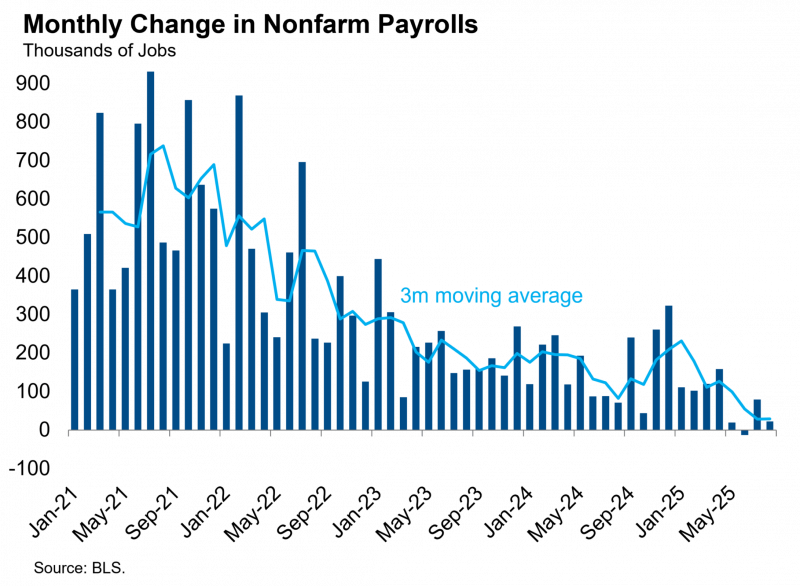

The August payrolls report printed weaker than expected, and the prior two months of job creation were revised lower on net. The June figure received its final revision to -13,000, the first negative print after 53 consecutive months of positive job creation. The July figure was revised higher from 73,000 to 79,000, and the initial release for August showed 22,000 jobs created. This month-by-month pattern leaves open the possibility that job creation troughed in June as the sentiment shock from early April caused employers to temporarily pause hiring before resuming when sentiment rebounded. That’s probably asking for too much precision from the payrolls data, especially since the July and August figures are still subject to revision, but we remain hopeful that job creation will stabilize at a level above zero in the months ahead.

The other possibility is that the labor market is rolling over into a sustained series of negative prints and a recession. We do not see evidence of that outcome in this report. We see instead a continuation of the gradual slowdown that has been underway since late 2021, characterized by a gradual cooling in labor demand and narrowing diffusion of job creation. The healthcare industry created 30,600 jobs in August — all other sectors combined were negative in total. More than half of the 250 private industries in the sample saw net job loss in the month. More recently, this cooling in labor demand has been paired with a reduction in immigrant labor supply. This combination has caused job creation to fall to very weak levels, just 29,000 jobs created on average over the past three months.

This is a low-hiring, low-firing labor market. It’s not a bad labor market if you have a job, but it is if you’re looking for a job. The headline unemployment rate rose again to a cycle high, as did the broader U-6 measure that also captures workers marginally attached to the labor force and those working part time for economic reasons. The average duration of unemployment rose again to a cycle high of 24.5 weeks. Today’s figures are all consistent with the story told by the JOLTS data and unemployment insurance claims data we have previously reported.

They are also consistent with our expectations that the Fed will deliver three consecutive 25-bp rate cuts at their next three meetings in September, October and December. Short rate markets were pricing slightly more than 25 bps for the September meeting, suggesting the consensus sees a greater risk of the Fed cutting by 50 bps than holding at that meeting. We wouldn’t argue with that balance of risks, but at this point we do not think they will cut by 50 at the next meeting. The labor market is weak, but not rolling over. And let’s not forget that core PCE inflation is running at 2.99% annualized over the past six months.