The CME Group launched a new product earlier this month — a 20-year Treasury futures contract. This follows the Treasury Department’s recent introduction of a 20-year bond, which has not gone as well as they had hoped. Once this long-duration Treasury derivative develops sufficient liquidity, it should provide liability-driven investors another tool to enhance the accuracy of their interest rate hedges. Based on the history of recent launches of longer-duration Treasury futures contracts, it will likely take a year or two for robust liquidity to develop in the 20-year futures. We are optimistic that the new product will be well received by market participants, but there is no guarantee that the contract will succeed, particularly given the liquidity struggles of the underlying 20-year Treasury security.

Contract Specifications

The contract specifications for the new product were modeled on the Ultra 10-year Treasury futures contract that launched in 2016. The deliverable basket is very narrow, consisting of only the four most recently issued 20-year Treasury bonds with maturities between 19.2 years and 20 years. The Classic Bond and Ultra Bond futures have much wider deliverable baskets, though in practice, the cheapest-to-deliver bonds for these contracts have maturities of 15 and 25 years, respectively. The 20-year futures product, therefore, provides another synthetic Treasury product with a maturity halfway between these two existing contracts.

Role in LDI Portfolios

With a maturity of very close to 20 years and a modified duration of around 16 years, this new product seems well-placed to help LDI clients more precisely hedge their liability cashflows. Investors can construct a similar exposure today with combinations of existing futures contracts, but the addition of another derivative security at the long end of the yield curve should marginally increase the flexibility, and therefore, the efficiency of hedge portfolios. For completion portfolios, this contract will provide an additional lever in the selection of whether to use physical bonds, futures, or over-the-counter instruments leading to potential implementation improvements. The new contract may also lead to additional relative value trading opportunities in our actively-managed Treasury portfolios.

Liquidity outlook

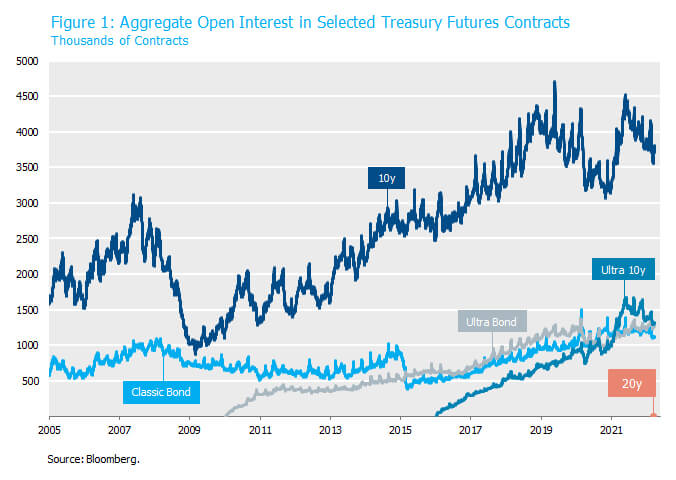

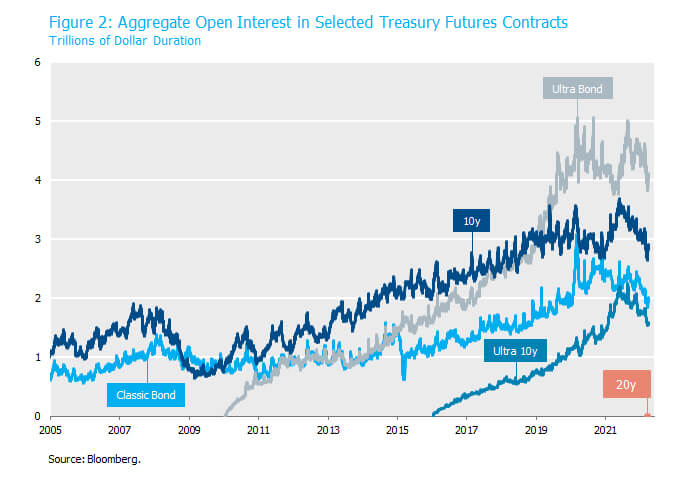

20-year Treasury futures have traded 11,900 contracts since trading commenced on March 7 and built 1,766 contracts of open interest as of March 25. We are hopeful that this new product will follow a similar pattern to the launches of Ultra 10-year Treasury futures and Ultra Bond futures. As shown in Figure 1, open interest in these contracts increased steadily over the first year or two of trading and ultimately succeeded in developing excellent liquidity and depth of market to facilitate low-cost transactions for our clients. Figure 1 actually understates the success of the Ultra Bond contract, which carries roughly three times the duration of the 10-year contract. As you can see in Figure 2, the Ultra Bond contract surpassed the 10-year contract in 2019 to become the Treasury futures contract with the largest dollar duration of open interest and consequently the most interest rate risk outstanding.

The liquidity struggles of the underlying 20-year Treasury bond itself are perhaps the biggest hurdle to widespread adoption of the 20-year futures contract. The Treasury Department introduced the 20-year bond in May 2020 and aggressively ramped up issuance to an annualized pace of $300 billion dollars, equivalent to the annual issuance of the 30-year bond. Once the Fed moved toward tapering asset purchases in the fall of 2021, liquidity in the 20-year bond started to suffer. Bid-ask spreads widened, market depth declined, and off-the-run 20-year securities cheapened relative to Treasuries of similar maturity. Treasury responded by reducing auction sizes of the 20-year bond relative to auction sizes of 10-year and 30-year securities in an attempt to reduce the apparent oversupply and thereby improve relative valuation of the 20-year series. Despite these efforts, the 20-year bond still carries the highest yield among benchmark Treasury bonds, with the 20s30s yield spread having been inverted since October. We expect that Treasury will keep reducing auction sizes in the 20-year security in hopes of improving relative valuations and liquidity conditions. If they succeed in this effort, the 20-year futures contract should benefit by extension.