Pension plans have used a variety of Liability Driven Investment (LDI) strategies for years. While an indispensable tool in our mind, traditional LDI strategies address only the interest rate risk within the pension plan. In this brief we introduce a more comprehensive platform, Dynamic LDI. The primary improvement Dynamic LDI strategies offer stems from the dynamic relationship between funded status and asset allocation. The central tenet of the strategy is the “dynamic” reduction in risk as funded status improves.

Although derived from reasonably complex theoretical work, the strategy is nonetheless practical – producing intuitively appealing allocation decisions in response to changing

market conditions. We introduce some practical solutions using stylized examples as well as general guidelines for Dynamic LDI strategies.

Rationale

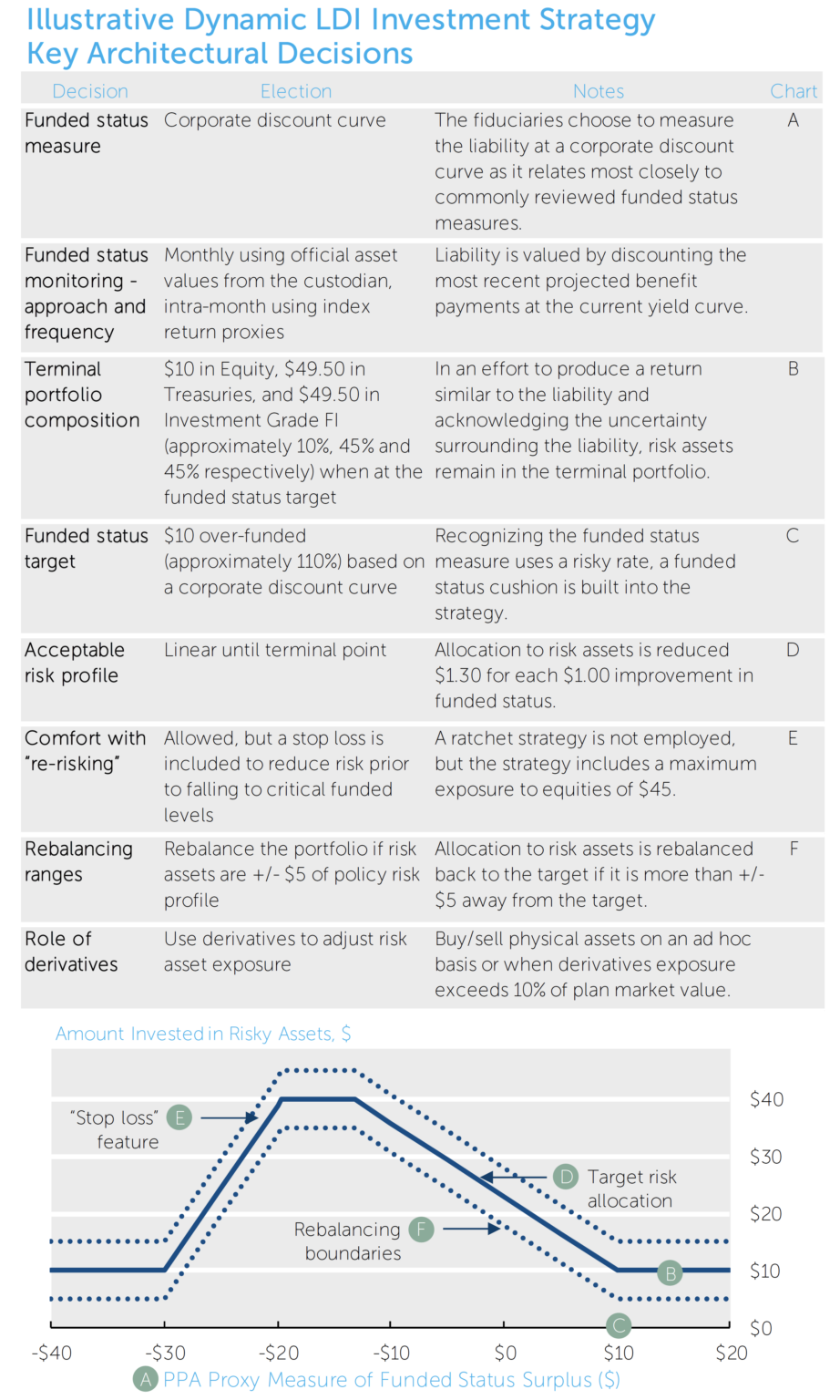

- The limited benefits for participants from a surplus distort the risk/reward balance of holding risk assets. For a pension plan, asset returns that could generate large surpluses in funded status may not adequately compensate for the risk of large deficits. This asymmetry increases as funded status improves, creating an incentive to reduce risk as funded status improves.

- To guide asset allocation, dynamic LDI strategies should use funded status measures based on a risk-free discount rate derived from a portfolio that would be held by a fully funded plan – not other measures (e.g. PPA, FAS) based on portfolios that have default risk.

- Reducing the allocation to risk assets linearly (in dollars) as funded status improves is an effective rule for implementing a Dynamic LDI strategy. Additional considerations can also be integrated into a specific strategy design.

- Consistent with traditional LDI strategies, interest rate risk should only be borne if it improves the risk/reward profile of the portfolio.

- Unhedgeable liability uncertainty can justify allocations to risk assets even when a plan is fully funded.

Key Dynamic LDI Implementation Considerations

The following are key implementation decisions for Dynamic LDI programs:

- Targeted funded status – At what point does the plan reach its minimum risk allocation – the terminal portfolio?

- Terminal portfolio composition – What is the composition of the portfolio once the targeted funded status is reached?

- Acceptable risk profile – What is the initial allocation to risk assets and the pace of the de-risking as funded status improves?

- Comfort with “re-risking” – If funded status deteriorates at some point, should risk assets be increased or, alternatively, should a “ratcheting” strategy be followed?

- Funded status measurement frequency – How frequently should the funded status be measured? How can funded status be estimated between “official” estimates?

- Rebalancing ranges – How do transaction costs and operational considerations affect the desired frequency of adjustments?

- Role of derivatives – Can derivatives be used to provide a more timely and efficient means to dynamically adjust the asset allocation?

Rationale for Dynamic LDI

Dynamic LDI has two primary components: the “dynamic” aspect, and the “LDI”, or liability aspect. The LDI aspect refers to the idea that the risk-free asset for a DB plan is a liability-matching portfolio of default free bonds. The asset allocation decision is therefore simplified to the mix between risk-free portfolio and a risk asset portfolio. The

dynamic aspect explicitly recognizes that 1) responses to changing circumstances can be anticipated, and 2) behavior today should take expected future behavior into account. Thus, it anticipates different outcomes and adjusts decisions today accordingly. While derived from theoretical work, the approach is practical, flexible, and implementable.

While traditional LDI suggests that investment choices should consider the risks of the plan liability, Dynamic LDI goes further and considers the proximity of the objective when determining the size of the risk allocation. For pension plans, a Dynamic LDI strategy removes risk as the plan’s funded status improves by shifting assets to the risk-free asset. (See Appendix for additional discussion.)

Fiduciaries must distill this framework into a manageable investment strategy appropriate for the plan. While a complete analysis of dynamic asset allocation is outside the scope of this brief, a few guiding parameters can help direct the strategy’s construction.

Key Guiding Parameters

Findings from Theoretical Work

Four specific features of theoretical work on dynamic asset allocation frame our discussion:

The ideal hedge asset is the portfolio that achieves the investment objectives with certainty. For most pension plans, this portfolio comprises liability-matching, default-free bonds, or the closest available alternative. For U.S. dollar denominated DB pension funds, US Treasuries are a reasonable choice.

AA quality liability valuation methods are often the catalyst behind the use of corporate bonds in a fully “de-risked” portfolio. Due to their default risk, corporate bonds are a risk asset and should properly be classified as part of the risk portfolio, and ultimately only be included if justified by their risk/reward characteristics. Nonetheless, their high correlation with common discount methodologies may make corporate bonds a more palatable risk asset for plans as they reduce reported funded status volatility compared to alternative risk assets and may help relieve participant anxiety. The Role of Risk Assets: De-Risking Phase and Beyond

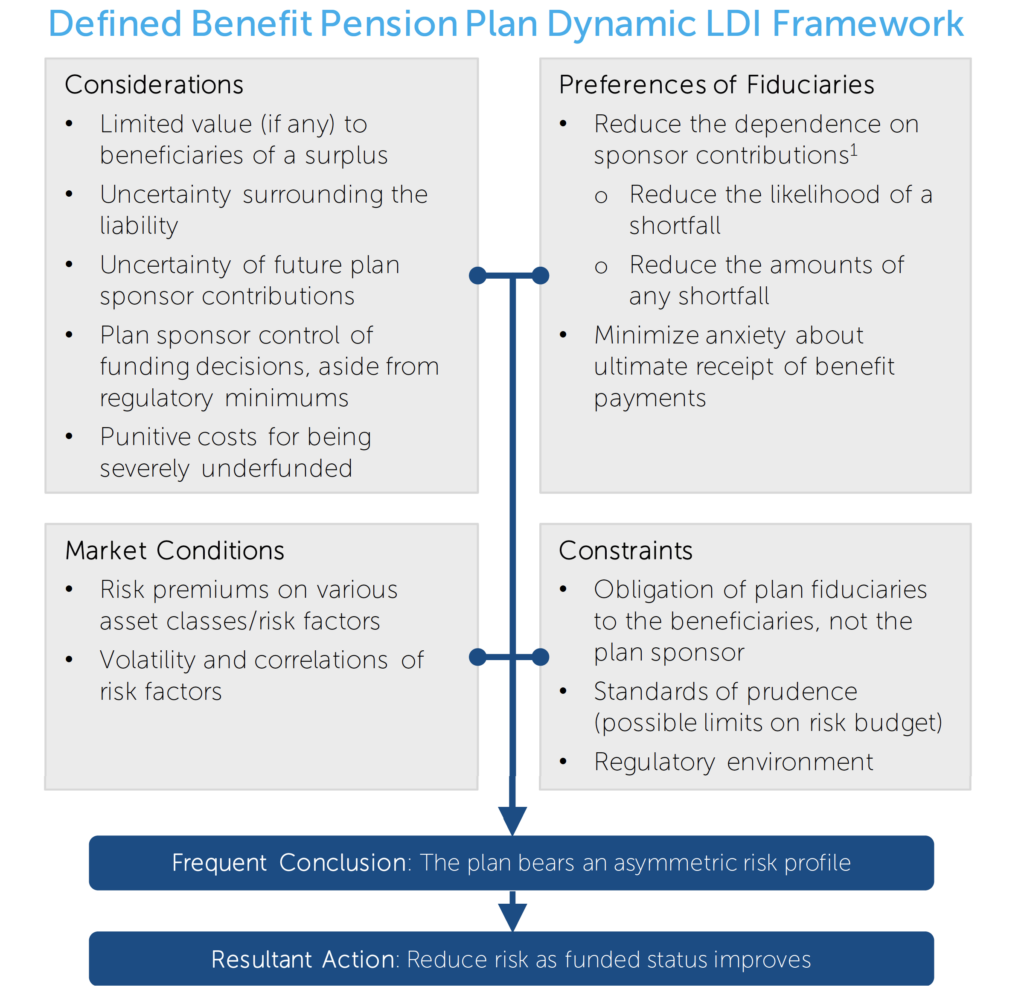

The general framework of a Dynamic LDI strategy reduces risk asset allocations as funded status improves. During the de-risking phase, risk assets are used in hopes of improving the plan’s funded status, and are reduced as the plan becomes fully funded. Even when the funded-status goal is reached, an allocation to risk assets can be justified to the extent there is unhedgeable uncertainty surrounding the liability and/or some beneficiary value to surplus. The size of this policy allocation is related to the degree of uncertainty in the liability and/or the potential value of the plan’s surplus.

Accordingly, longevity risk, future actions of the plan sponsor, and the active portion of the plan are three variables that may influence the size of the allocation to risk assets when a plan is fully funded.

Four specific features of theoretical work on dynamic asset allocation frame our discussion:

- Risk allocation should be zero when fully funded if there is no value to a surplus and the liability is known with certainty.

- If a surplus has some value or the liability has unhedgeable uncertainties, the terminal portfolio may contain some allocation to risk assets.

- Allocation to risk is usually not a function of time left to invest.

- The dollar allocation to risk assets is generally linear as a function of dollar distance from fully funded.

The ideal hedge asset is the portfolio that achieves the investment objectives with certainty. For most pension plans, this portfolio comprises liability-matching, default-free bonds, or the closest available alternative. For U.S. dollar denominated DB pension funds, US Treasuries are a reasonable choice.

AA quality liability valuation methods are often the catalyst behind the use of corporate bonds in a fully “de-risked” portfolio. Due to their default risk, corporate bonds are a risk asset and should properly be classified as part of the risk portfolio, and ultimately only be included if justified by their risk/reward characteristics. Nonetheless, their high correlation with common discount methodologies may make corporate bonds a more palatable risk asset for plans as they reduce reported funded status volatility compared to alternative risk assets and may help relieve participant anxiety. The Role of Risk Assets: De-Risking Phase and Beyond

The general framework of a Dynamic LDI strategy reduces risk asset allocations as funded status improves. During the de-risking phase, risk assets are used in hopes of improving the plan’s funded status, and are reduced as the plan becomes fully funded. Even when the funded-status goal is reached, an allocation to risk assets can be justified to the extent there is unhedgeable uncertainty surrounding the liability and/or some beneficiary value to surplus. The size of this policy allocation is related to the degree of uncertainty in the liability and/or the potential value of the plan’s surplus.

Accordingly, longevity risk, future actions of the plan sponsor, and the active portion of the plan are three variables that may influence the size of the allocation to risk assets when a plan is fully funded.

General Architecture of a Dynamic LDI Strategy

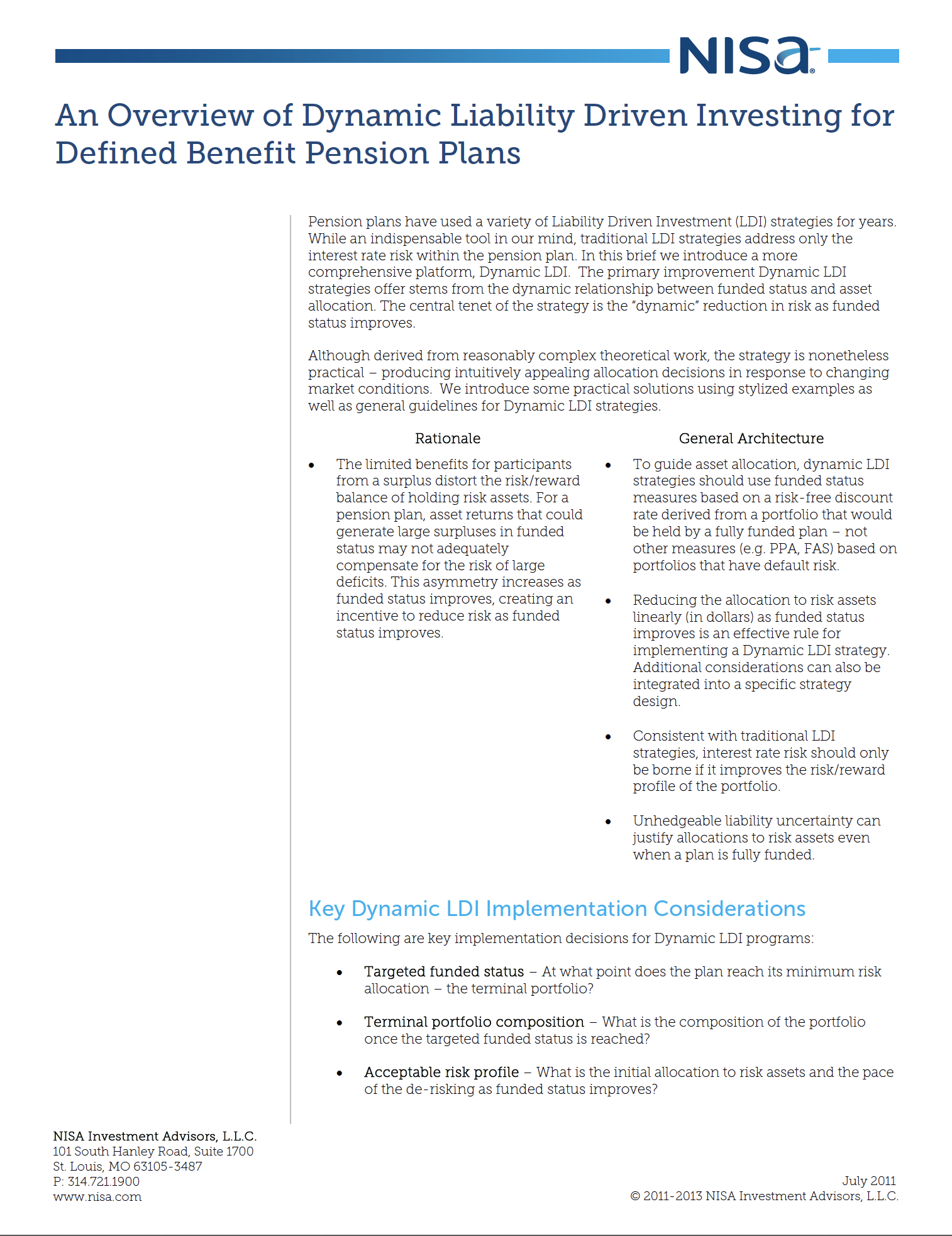

These guiding principles provide the framework for designing practical strategies. To do so, fiduciaries must make the following decisions:

The funded status of the plan should be determined by valuing the liability at risk-free rates. Any other approach (e.g., AA-rated corporate bond yields) does not provide an accurate measure of the plan’s ability to meet its objective of paying all future liabilities with a risk-free portfolio. The inaccuracy stems from the need to bear risk (credit risk in this case) to have any hope of meeting the objective.

If the fiduciaries choose a corporate bond-based discount yield curve and use corporate bonds in the terminal portfolio, the plan should set the target funded status above 100% to recognize the potential losses associated with the “risky” terminal portfolio.

Sometimes overlooked, it is also important to consider including the present value of highly certain future contributions as a de-facto asset of the plan, (e.g. required, near-term, PPA minimum contributions). Often, after including these contributions the plan’s funded status moves so dramatically an accelerated de-risking strategy may be warranted. Funded Status Monitoring – Approach and Frequency

Due to the infrequency of official funded status measurements, fiduciaries must use intra-year proxies to execute a Dynamic LDI strategy. Monthly estimates can be based on the liability valued using a published yield curve and asset values based on month-end custodian valuations. Since intra-month custodial asset values can be unreliable, intra-month funded status estimates can be based on prior month-end values, rolled forward based on proxy index returns. Terminal Portfolio Composition and Funded Status Target

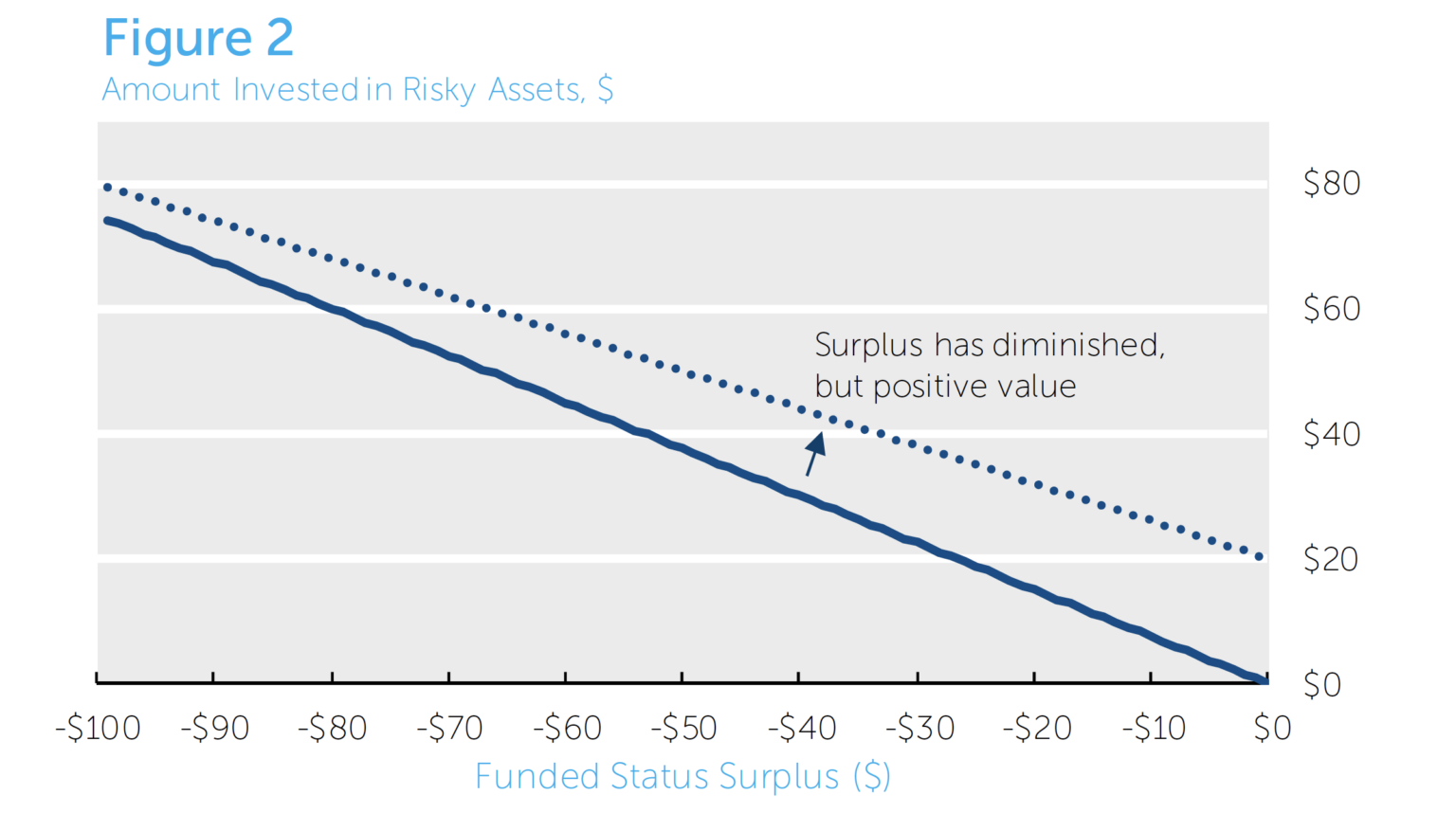

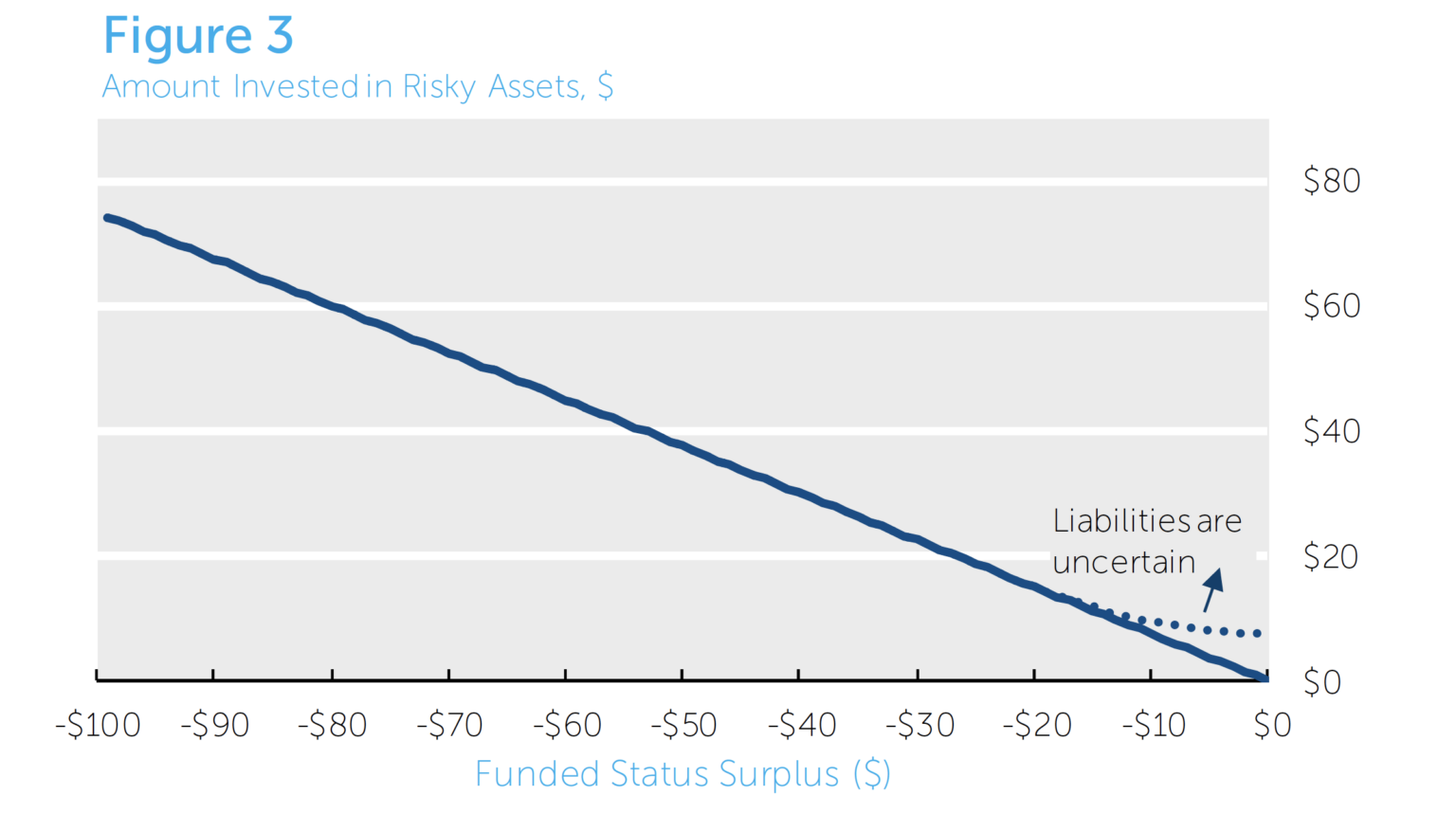

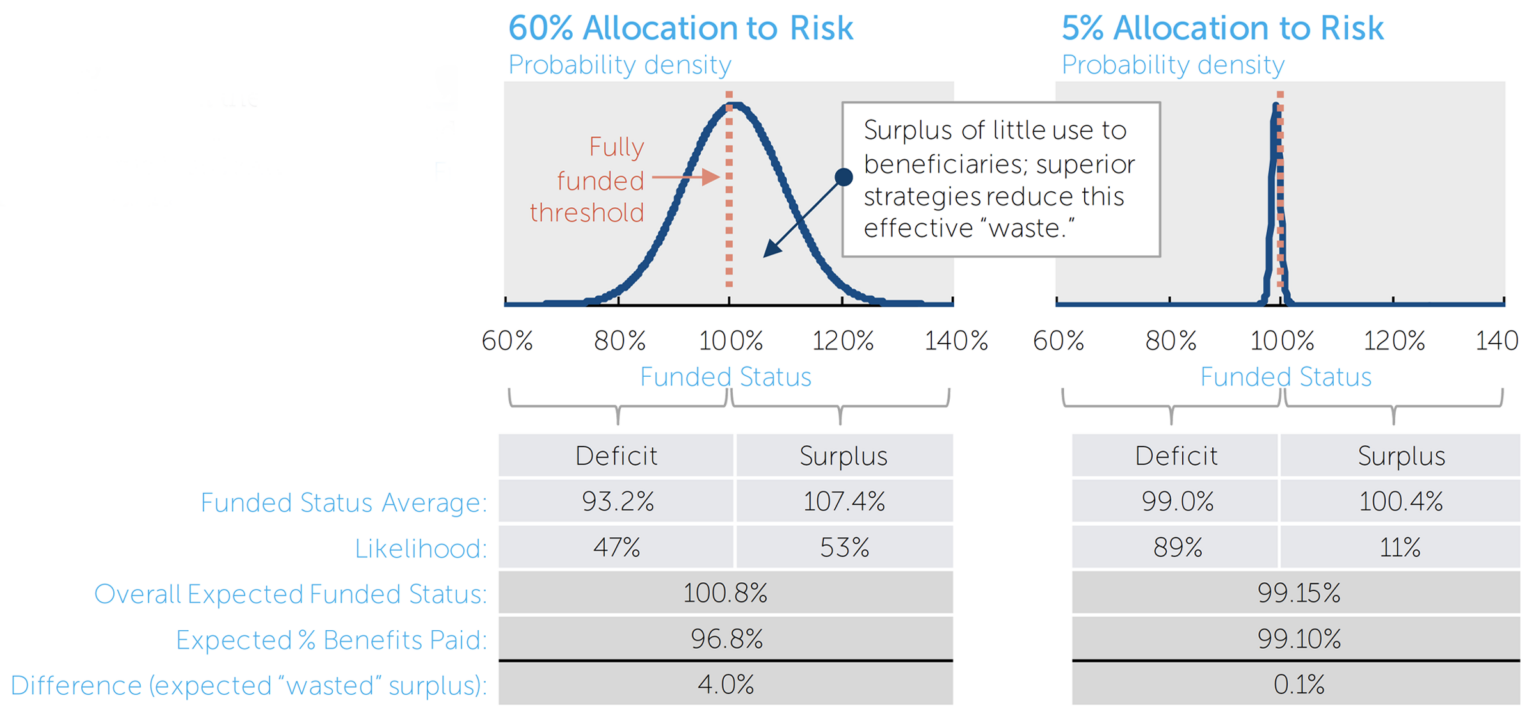

Fiduciaries should consider the terminal portfolio composition and funded status target jointly. The uncertainty surrounding the liability and the value of any surplus drive both the composition of the “end-game” portfolio and the funded status at which that portfolio is fully invested. If the liability is perfectly known and a surplus has no economic value, the fully funded plan should be fully invested in the risk-free asset. Since neither of these assumptions is likely to hold in practice, the terminal portfolio may have some allocation to risk assets. (Figures 2 and 3 show the impact of relaxing these two assumptions.)

- Funded status measure

- Funded status monitoring – approach and frequency

- Terminal portfolio composition and funded status target

- Acceptable risk profile

- Comfort with “re-risking”

- Rebalancing ranges

- Role of derivatives

The funded status of the plan should be determined by valuing the liability at risk-free rates. Any other approach (e.g., AA-rated corporate bond yields) does not provide an accurate measure of the plan’s ability to meet its objective of paying all future liabilities with a risk-free portfolio. The inaccuracy stems from the need to bear risk (credit risk in this case) to have any hope of meeting the objective.

If the fiduciaries choose a corporate bond-based discount yield curve and use corporate bonds in the terminal portfolio, the plan should set the target funded status above 100% to recognize the potential losses associated with the “risky” terminal portfolio.

Sometimes overlooked, it is also important to consider including the present value of highly certain future contributions as a de-facto asset of the plan, (e.g. required, near-term, PPA minimum contributions). Often, after including these contributions the plan’s funded status moves so dramatically an accelerated de-risking strategy may be warranted. Funded Status Monitoring – Approach and Frequency

Due to the infrequency of official funded status measurements, fiduciaries must use intra-year proxies to execute a Dynamic LDI strategy. Monthly estimates can be based on the liability valued using a published yield curve and asset values based on month-end custodian valuations. Since intra-month custodial asset values can be unreliable, intra-month funded status estimates can be based on prior month-end values, rolled forward based on proxy index returns. Terminal Portfolio Composition and Funded Status Target

Fiduciaries should consider the terminal portfolio composition and funded status target jointly. The uncertainty surrounding the liability and the value of any surplus drive both the composition of the “end-game” portfolio and the funded status at which that portfolio is fully invested. If the liability is perfectly known and a surplus has no economic value, the fully funded plan should be fully invested in the risk-free asset. Since neither of these assumptions is likely to hold in practice, the terminal portfolio may have some allocation to risk assets. (Figures 2 and 3 show the impact of relaxing these two assumptions.)

Due to common discounting methodologies (PPA and FAS), the role of corporate bonds is often confused in the terminal portfolio. Since corporate bonds will provide a better hedge of the “reported” liabilities, they are often considered a hedge asset suitable for a terminal portfolio. Similar to the reasoning for using a risk-free curve for measuring

funded status, corporate bonds should be considered a risk asset because they have default risk, and should be included based only on their “asset only” risk/reward characteristics. Importantly, yield does not equal expected return over any holding period for a risky bond.

Acceptable Risk Profile

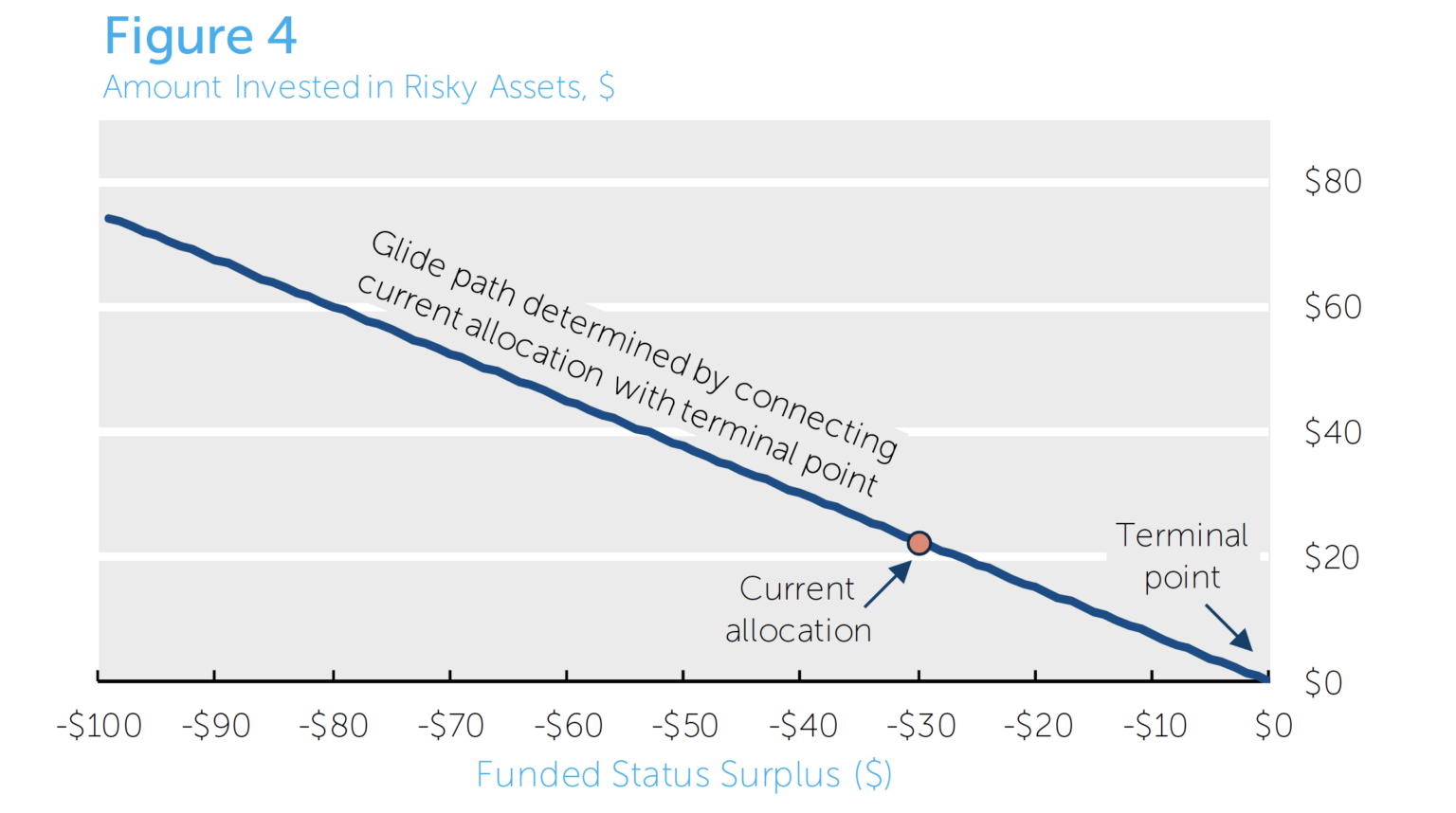

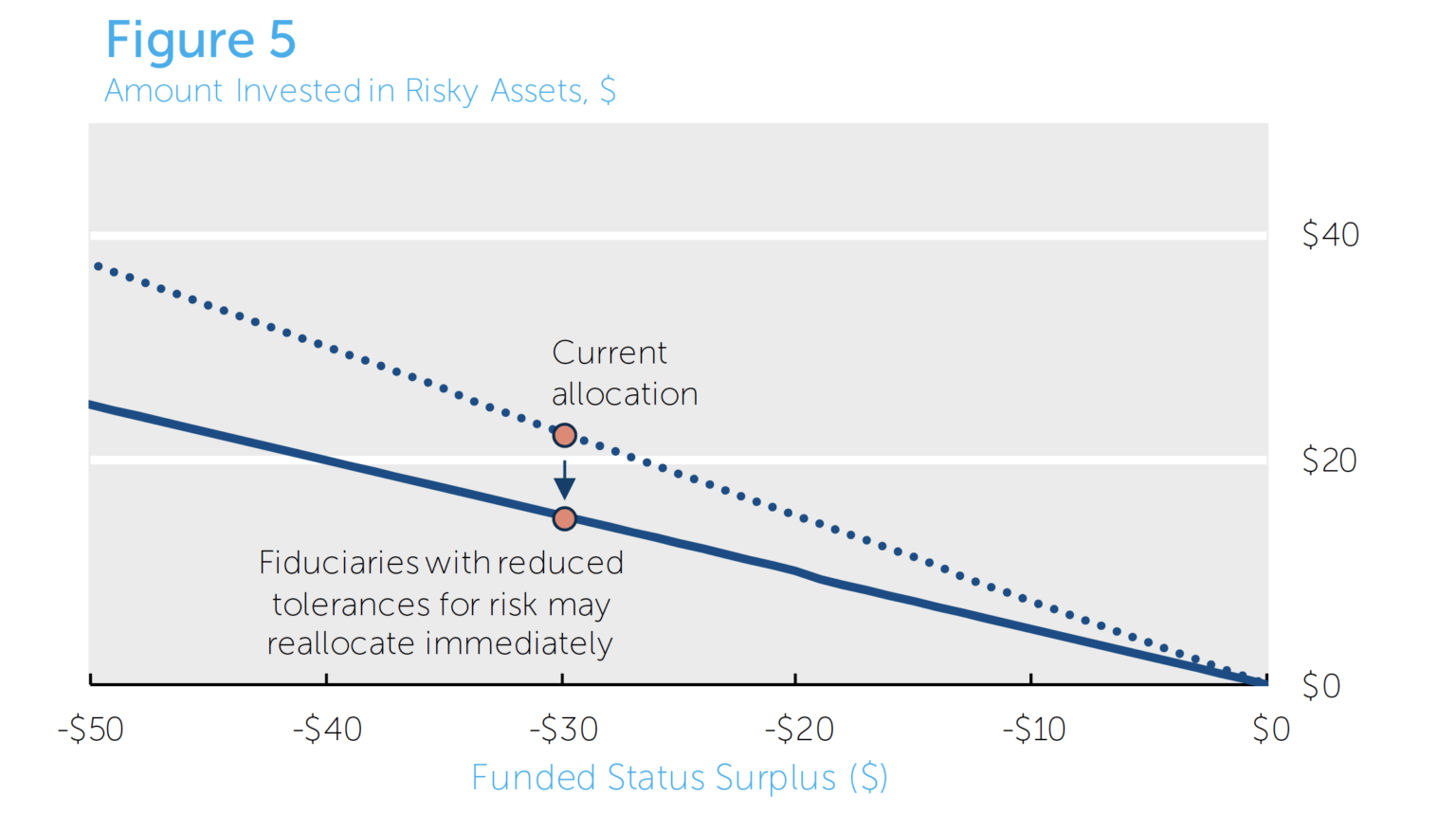

The fiduciaries can adjust the risk profile of their plan by changing the “slope” of the “glide-path” (graphically the linear decline in risk asset allocation as funded status improves). In practice, two approaches are commonly used.

The fiduciaries can adjust the risk profile of their plan by changing the “slope” of the “glide-path” (graphically the linear decline in risk asset allocation as funded status improves). In practice, two approaches are commonly used.

- The first takes the existing allocation as a “revealed preference” regarding risk tolerance for the current level of funded status. The glide-path is therefore determined by connecting the current funded status/risk asset allocation pair with the terminal point (see figure 4).

- The second approach makes an initial adjustment to the risk asset allocation, and sets the glide-path from this new point. Fiduciaries may use this method if they believe the current risk asset allocation is simply a result of past inertia. For example, given recent improvements in funded status, plans may want to partially de-risk to lock in some of this improvement (see figure 5).

Comfort with “Re-Risking”

While there seems to be widespread acceptance that risk should be reduced as funded status improves, fiduciaries may have mixed views regarding increasing risk if funded status declines – “re-risking.” Theory suggests that the current funded status alone should determine the risk asset allocation. Nonetheless, fiduciaries may prefer a ratchet methodology; a strategy that only moves in one direction. While technically inefficient in theoretical models, much of the potential shortcoming of this approach can be overcome with adjustments to the glide-path. For example, since the ratchet approach makes each de-risking movement more significant (as it won’t be unwound at a later point), a slower overall pace of de-risking can be employed. Rebalancing Ranges

Fiduciaries must determine the appropriate trigger points for de-risking trades. Fortunately, we can use past research on rebalancing strategies to inform these decisions. Rebalancing ranges are determined by, among other issues, the fixed and variable costs of rebalancing, tolerance for tracking error vs. target allocations, and uncertainty surrounding current market value/liability estimates. Fiduciaries can fashion rebalancing program triggers that address their specific circumstances and accommodate the risk/return objective. Role of Derivatives

Derivatives can play an important role in asset rebalancing. Derivatives are a very low transaction cost instrument to adjust exposures. As such, including them allows for tighter rebalancing boundaries (i.e. smaller funded status trigger points.) In addition, the implementation manager can execute derivatives transactions quickly when a threshold has been breached, generally within hours. By contrast, depending on the specific market and form of investment, adjustments to cash securities positions can take days. Finally, to the extent the Dynamic LDI strategy includes “re-risking,” derivatives avoid disrupting active managers with potentially frequent buys and sells.

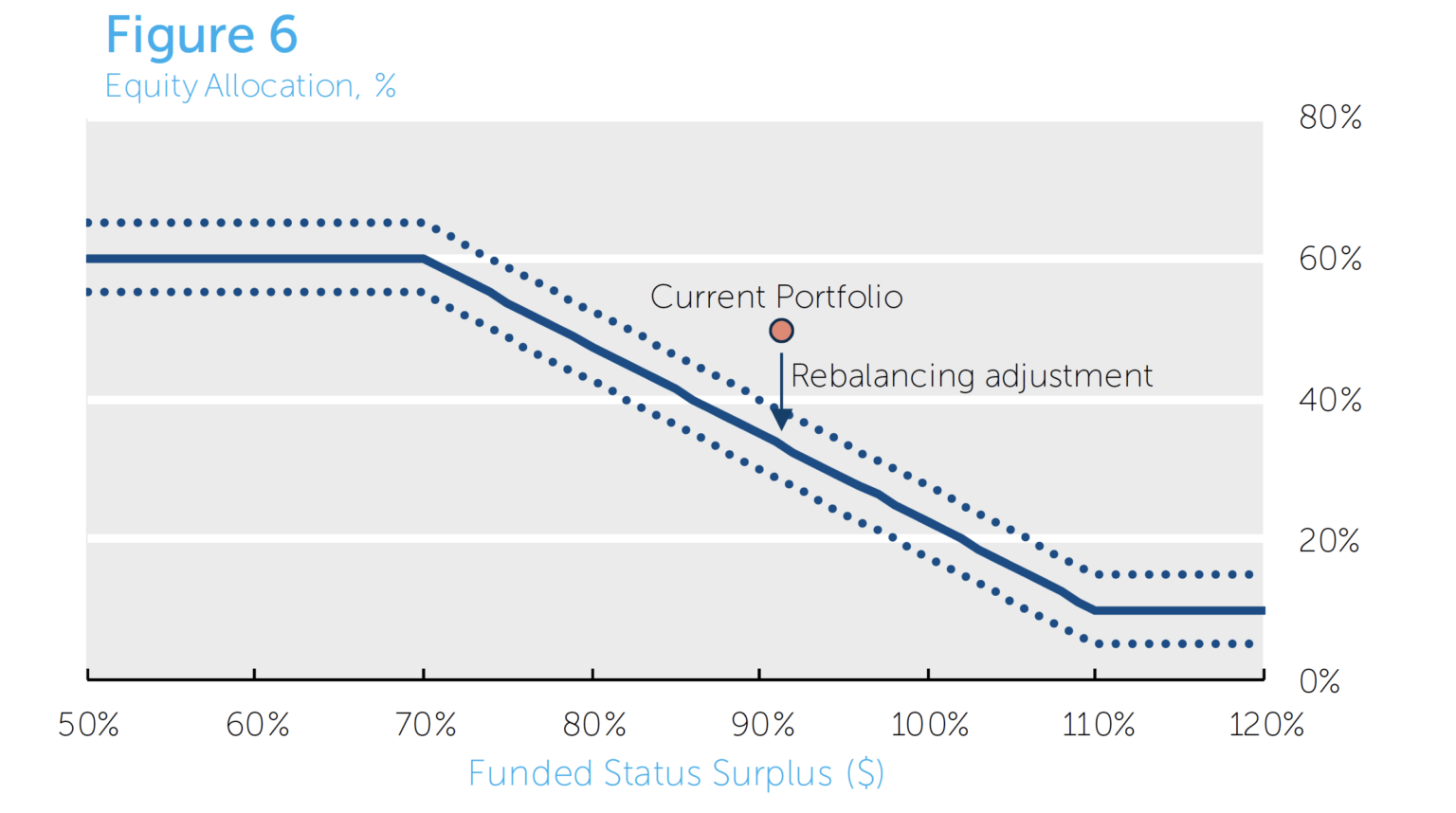

The graph below provides an illustrative example of rebalancing ranges. After the de-risking glide-path is set (solid line), rebalancing ranges around the glide-path are determined (dashed lines). If the actual combination of funded status and risk asset allocation is outside this boundary, a rebalancing trade can be executed with derivatives to return the risk asset allocation to within tolerance. The cash securities can be adjusted later.

While there seems to be widespread acceptance that risk should be reduced as funded status improves, fiduciaries may have mixed views regarding increasing risk if funded status declines – “re-risking.” Theory suggests that the current funded status alone should determine the risk asset allocation. Nonetheless, fiduciaries may prefer a ratchet methodology; a strategy that only moves in one direction. While technically inefficient in theoretical models, much of the potential shortcoming of this approach can be overcome with adjustments to the glide-path. For example, since the ratchet approach makes each de-risking movement more significant (as it won’t be unwound at a later point), a slower overall pace of de-risking can be employed. Rebalancing Ranges

Fiduciaries must determine the appropriate trigger points for de-risking trades. Fortunately, we can use past research on rebalancing strategies to inform these decisions. Rebalancing ranges are determined by, among other issues, the fixed and variable costs of rebalancing, tolerance for tracking error vs. target allocations, and uncertainty surrounding current market value/liability estimates. Fiduciaries can fashion rebalancing program triggers that address their specific circumstances and accommodate the risk/return objective. Role of Derivatives

Derivatives can play an important role in asset rebalancing. Derivatives are a very low transaction cost instrument to adjust exposures. As such, including them allows for tighter rebalancing boundaries (i.e. smaller funded status trigger points.) In addition, the implementation manager can execute derivatives transactions quickly when a threshold has been breached, generally within hours. By contrast, depending on the specific market and form of investment, adjustments to cash securities positions can take days. Finally, to the extent the Dynamic LDI strategy includes “re-risking,” derivatives avoid disrupting active managers with potentially frequent buys and sells.

The graph below provides an illustrative example of rebalancing ranges. After the de-risking glide-path is set (solid line), rebalancing ranges around the glide-path are determined (dashed lines). If the actual combination of funded status and risk asset allocation is outside this boundary, a rebalancing trade can be executed with derivatives to return the risk asset allocation to within tolerance. The cash securities can be adjusted later.

If derivatives are used, fiduciaries can make physical adjustments independent of the de-risking strategy. These adjustments can be executed either before or after the derivatives de-risking trades. For example, the Dynamic LDI strategy could use derivatives to quickly reduce risk asset exposure as funded status improves, providing ample time to liquidate the cash positions later. Alternatively, if some investments are illiquid, the fiduciaries can begin selling those at the start of the program. To the extent the sales run ahead of improvements in the plan’s funded status, derivatives can be used to maintain the current risk asset allocation (albeit in possibly different types of risk assets), and unwound when funded status improves.

Conclusion

Dynamic Liability Driven Investing is an evolutionary improvement which, by incorporating a dynamic relationship between funded status and asset allocation, adds a significant dimension to the more traditional LDI strategy. Although it may make intuitive sense to de-risk a defined benefit plan as its status approaches fully funded, plan fiduciaries are faced with numerous architectural decisions when tailoring a program suited to their plan. We hope this brief provides a useful starting point for practical strategy design and implementation.

APPENDIX

Intuition Behind Reduced Risk as Funded Status Improves

Distributions for a 99% funded plan

In this stylized example an allocation to risk is not in the interest of the beneficiaries as it results in significant waste and actually reduces the Expected Percent Benefits Paid from the original 99% funded status.

In this stylized example an allocation to risk is not in the interest of the beneficiaries as it results in significant waste and actually reduces the Expected Percent Benefits Paid from the original 99% funded status.

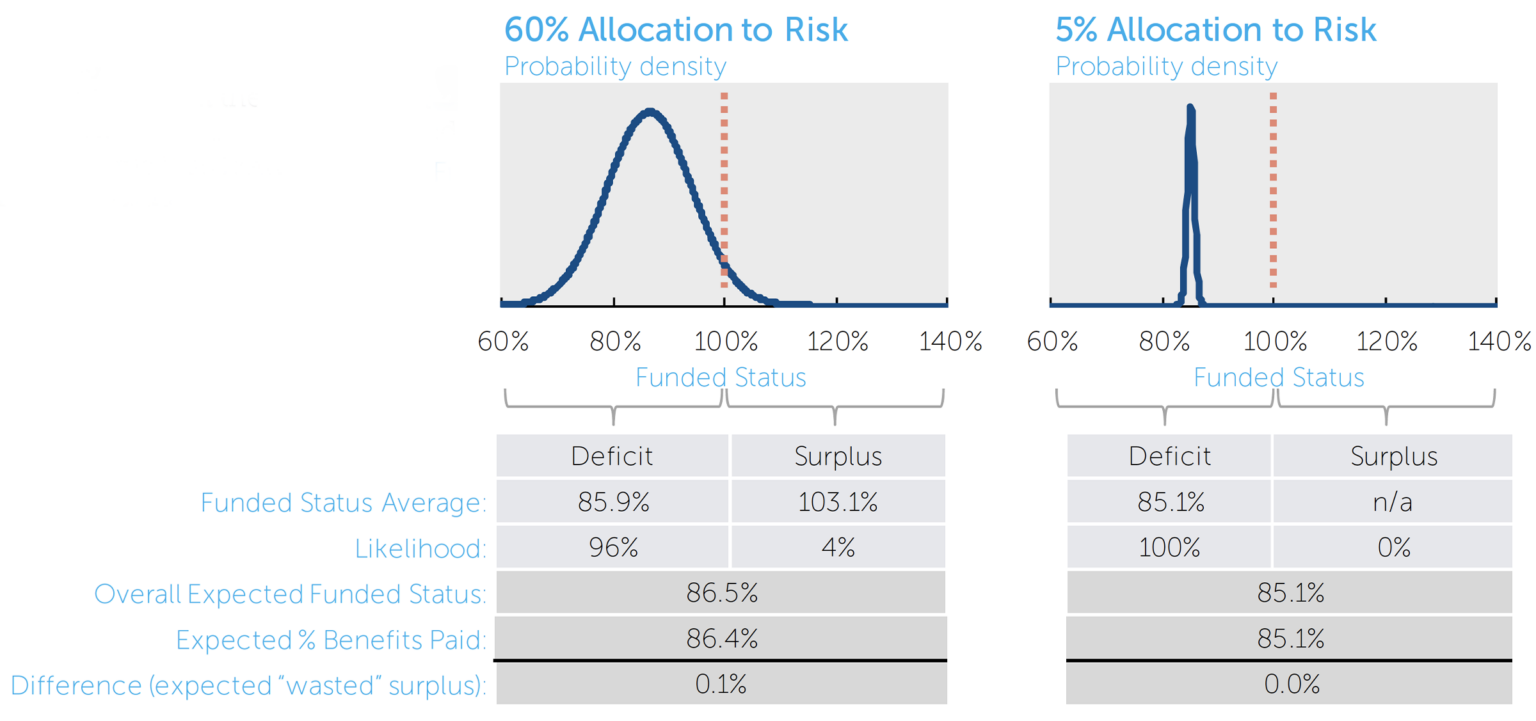

Distributions for an 85% funded plan

In this example the risk allocation may be justified in that it improves the Expected Benefits Paid from the original 85% funded status – almost all the upside of risk asset returns accrues to the beneficiaries.

In this example the risk allocation may be justified in that it improves the Expected Benefits Paid from the original 85% funded status – almost all the upside of risk asset returns accrues to the beneficiaries.

Implications:

- High allocations to risk when well funded can actually decrease the benefits participants can expect.

- This effect becomes greater as funded status improves suggesting a smooth transition out of risk assets as funded status improves.