The FOMC lowered their policy rate by 25 bps yesterday as expected, but Chairman Powell pushed back against market pricing of another cut in December. The FOMC also announced that they would stop reducing the size of their balance sheet on December 1, choosing the cautious course of ending QT early to avoid disruptions to funding markets.

Mild stagflation has divided the FOMC and the hawks made their presence known yesterday by expressing reservations about a third cut in December. Kansas City Fed President Schmid dissented against the cut after acceding to the previous cut in September (which we had interpreted as a show of support for Powell). At an FOMC meeting like October’s with no dot plot, it’s hard for the hawks to voice their objection without formally registering a dissenting vote. But the hawks did so yesterday by prompting Chairman Powell to report that the FOMC meeting was characterized by “strongly differing views about how to proceed in December” and that another cut at the year’s final meeting “is not a foregone conclusion – far from it.”

That language sparked a repricing in short rate markets where the odds of a December cut fell from 100% to 65%. The hawks may not be willing to go along with another cut in December unless there is clear evidence of continued weakness in the labor market. Unfortunately, the shutdown has disrupted the flow of data and will impair data quality for October (and subsequent months if the shutdown continues). The Fed is following second-tier data, but that is a fragile basis for settling a contentious policy debate.

Powell offered dovish comments on inflation, saying that core PCE inflation excluding tariffs is probably in the range of 2.3 to 2.4% and dismissing elevated readings on non-housing services inflation. Those comments demonstrate that Powell himself is in the dovish camp that favors another cut in December. The question is whether he can convince the hawks of the same.

Once Bitten, Twice Shy

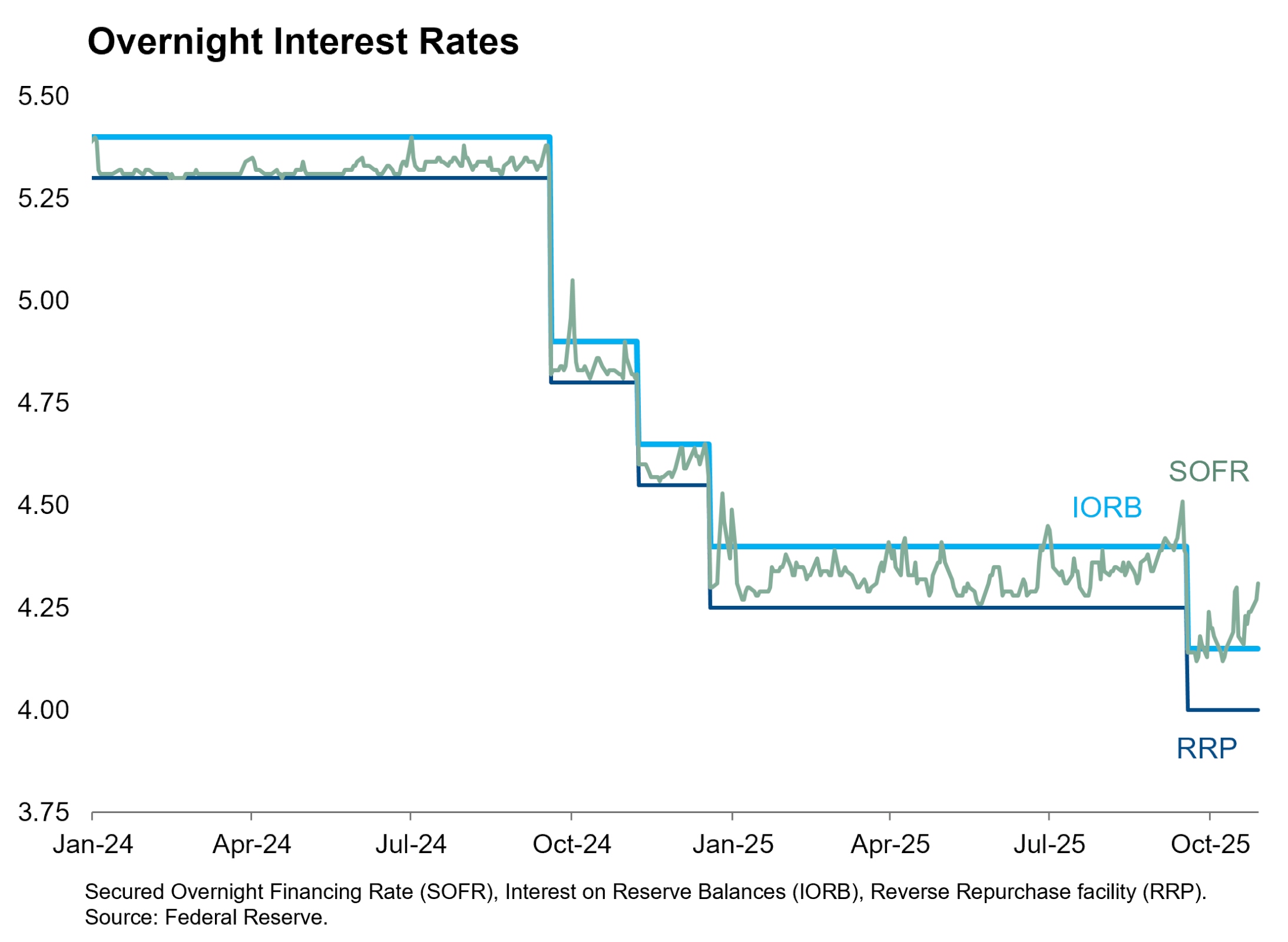

The Fed made the prudent choice by announcing the end of QT yesterday, judging that the benefits of further balance sheet reduction were not worth the risk of repeating the repo market disruptions they caused the first time they ended a QT program in 2019. SOFR has risen relative to the Fed’s administered rates in the last month, but funding market volatility has remained well below the levels seen in 2019.

Yesterday’s announcement will merely hold the balance sheet constant starting December 1. The Fed did not announce any plans to begin growing the balance sheet to accommodate growth in non-reserve liabilities, so reserves will continue shrinking at a very gradual pace in the months ahead. By taking this incremental step on balance sheet normalization, the Fed has shown that they are mindful of recent upward pressure on repo rates but not overly concerned by it. We’ll keep an eye on funding conditions through year end, and the Fed will surely respond to excessive volatility should it arise. But at this point in the process, the Fed has managed their second attempt at QT more adroitly than their first.