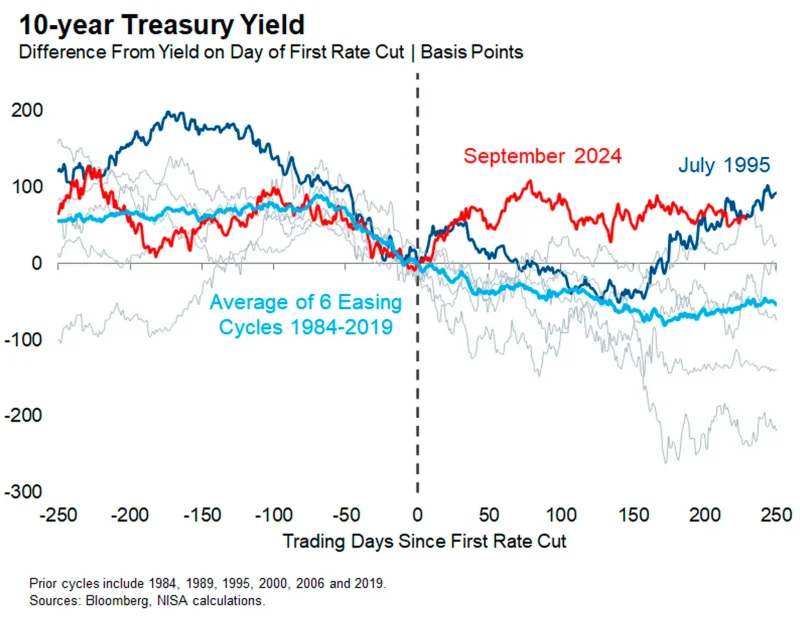

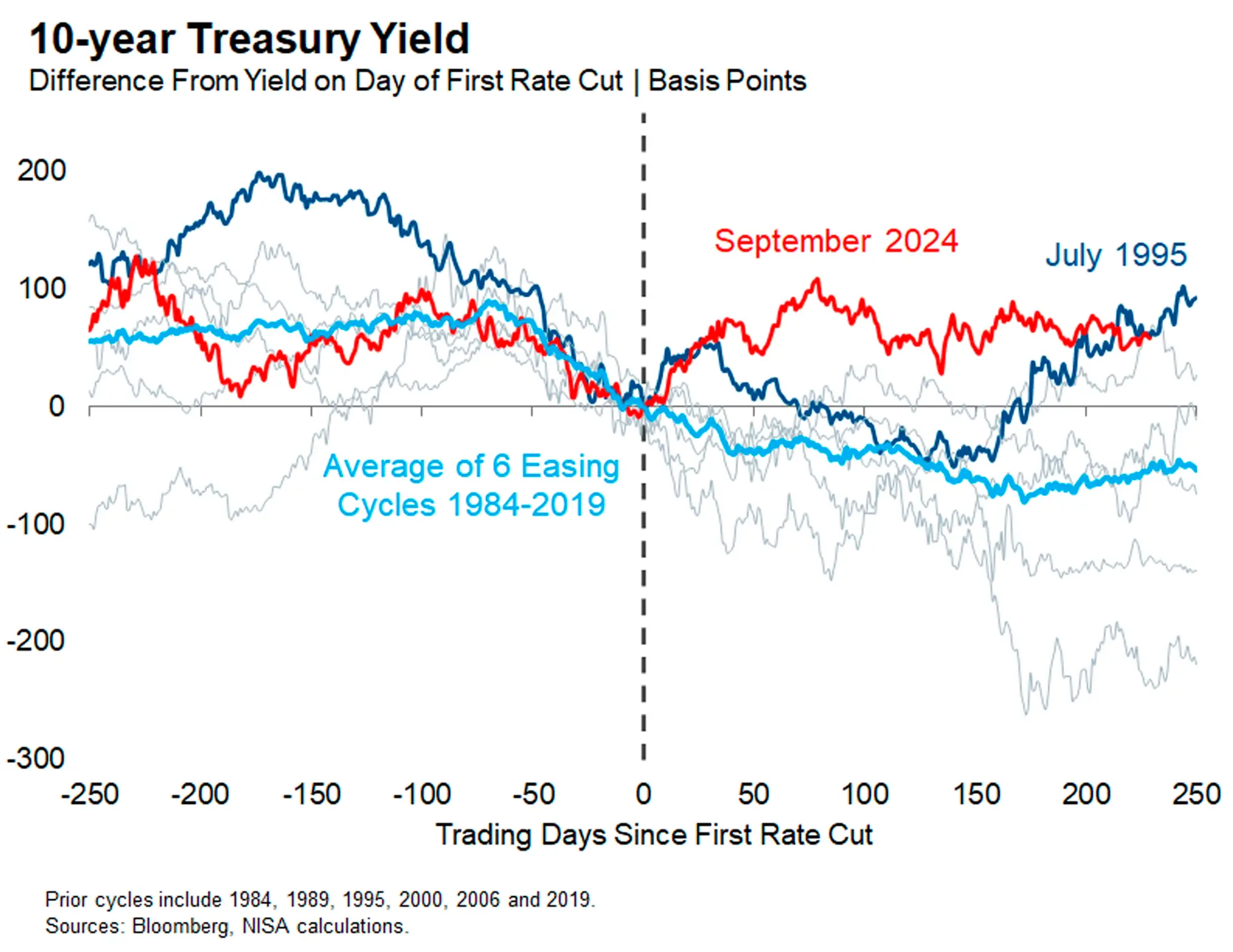

As the Trump administration continues to escalate its pressure campaign against the Federal Reserve, Chairman Powell stuck to the economic script and sent a fairly clear signal at Jackson Hole that the FOMC intends to lower the policy rate at their next meeting in September. Will 10-year yields also decline as the Fed lowers their overnight policy rate? Longer-term yields are more closely tied to the interest rates experienced by companies and consumers (and registered voters for that matter). The answer is probably yes, but it’s not a certainty. The chart below shows how 10-year yields have behaved around the start of prior easing cycles. Specifically, the chart displays the level of the 10-year yield before and after the first rate cut of each easing cycle since 1984, relative to the level on the day of the first rate cut. In the six easing cycles between 1984 and 2019, 10-year yields generally declined before and after the start of each cycle. The September 2024 easing cycle is a notable outlier from this pattern, as is the July 1995 cycle to a lesser extent.

Both the pattern and the exceptions are intuitive. Most of these Fed easing cycles occurred during recessions and delivered cumulative easing of at least 500 bps each. It’s no surprise that longer-term interest rates declined when the overnight interest rate declined by such magnitudes. The easing cycles that began in 1995 and 2024 are exceptions – these were so-called “soft landing” cycles that saw no recession and a smaller magnitude of easing – just 75 and 100 bps of total cuts, respectively. The smaller magnitude of cuts and continued economic growth help explain why longer-term yields did not fall as much as during the recessionary easing cycles.

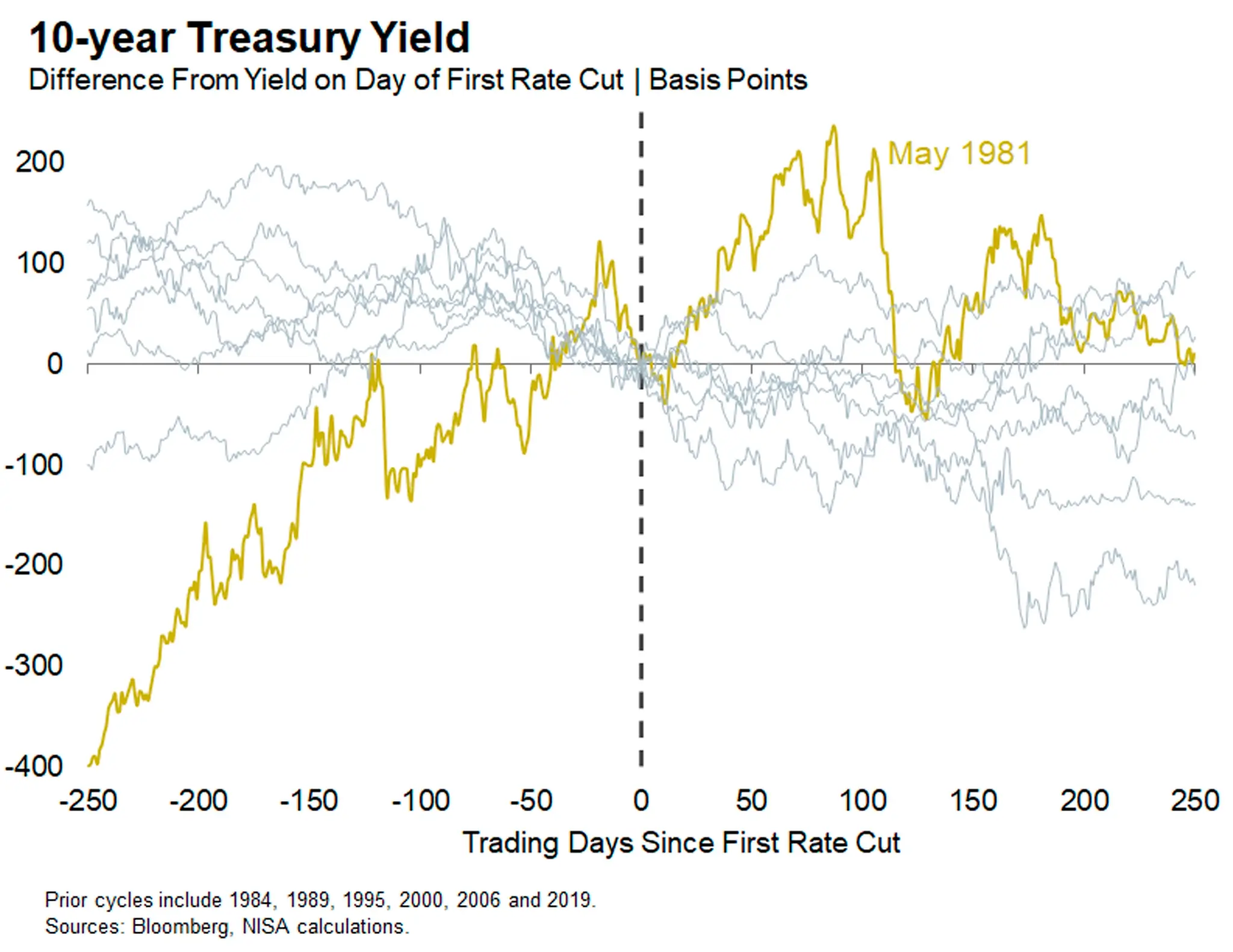

U.S. economic history demonstrates another reason why long-term yields might not decline during an easing cycle, and indeed might rise dramatically. The Great Inflation of the 1970s caused a de-anchoring of inflation expectations as market participants came to doubt the Fed’s commitment to fighting inflation. This episode saw extreme volatility across the yield curve, with the policy rate hitting 20% and the 10-year yield topping 15%. The possibility of returning to those dynamics is so remote that we normally exclude that unique period from the chart above. Here’s how the chart looks if we add the easing cycle that began in May 1981. The difference is stark. The 10-year yield rose by more than 225 bps in the four months after the Fed lowered overnight interest rates by 450 bps, and that’s after rising by nearly 400 bps in the year prior to the first cut.

We still consider a de-anchoring of inflation expectations and this type of interest rate volatility to be a remote possibility. Though President Nixon attempted to exert political pressure on Federal Reserve Chairman Arthur Burns, the Fed’s loss of credibility in the 1970s was primarily self-inflicted. They let inflation run so high for so long that market participants came to doubt their willingness and/or ability to stop it. Their credibility could only be restored through the forceful actions of Chairman Volcker, who stopped inflation by delivering the most extreme policy tightening in the Fed’s history and imposing two deep recessions in the early 1980s. Chairman Volcker persevered despite considerable blowback from citizens and politicians alike, which demonstrated the Fed’s independence and laid the foundation for the decades of disinflationary growth that followed in the Great Moderation.

Chairman Powell frequently cited Volcker’s legacy in 2022 as he delivered the second largest policy tightening in the Fed’s history in response to the pandemic inflation crisis. He had nearly succeeded in restoring price stability earlier this year. He was able to do so without a recession in large part because of the Volcker legacy. Now, President Trump is exerting an unconventional campaign to pressure the Powell Fed to lower their policy rate. Accordingly, he presumably also wants the 1.) 10-year yield to decline, 2.) along with the policy rate, 3.) all in the absence of a recession. The history of Fed easing cycles demonstrates how hard that triumvirate is to deliver, even while inflation expectations remain well anchored.