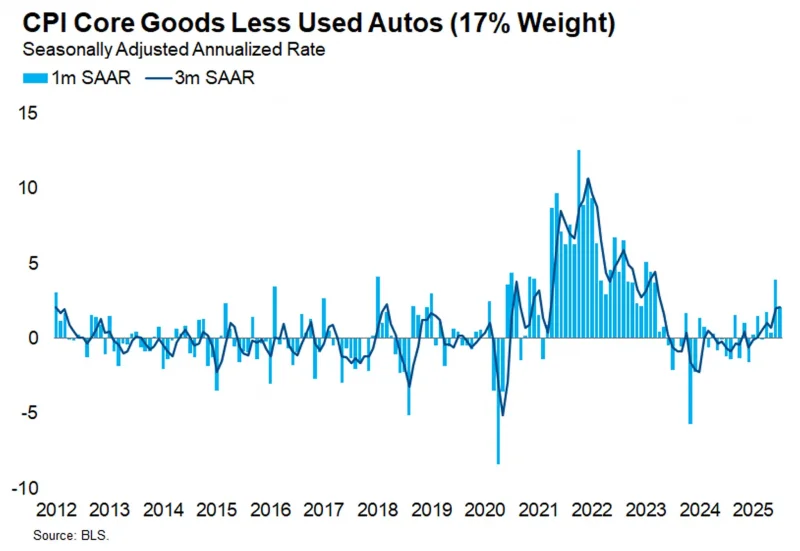

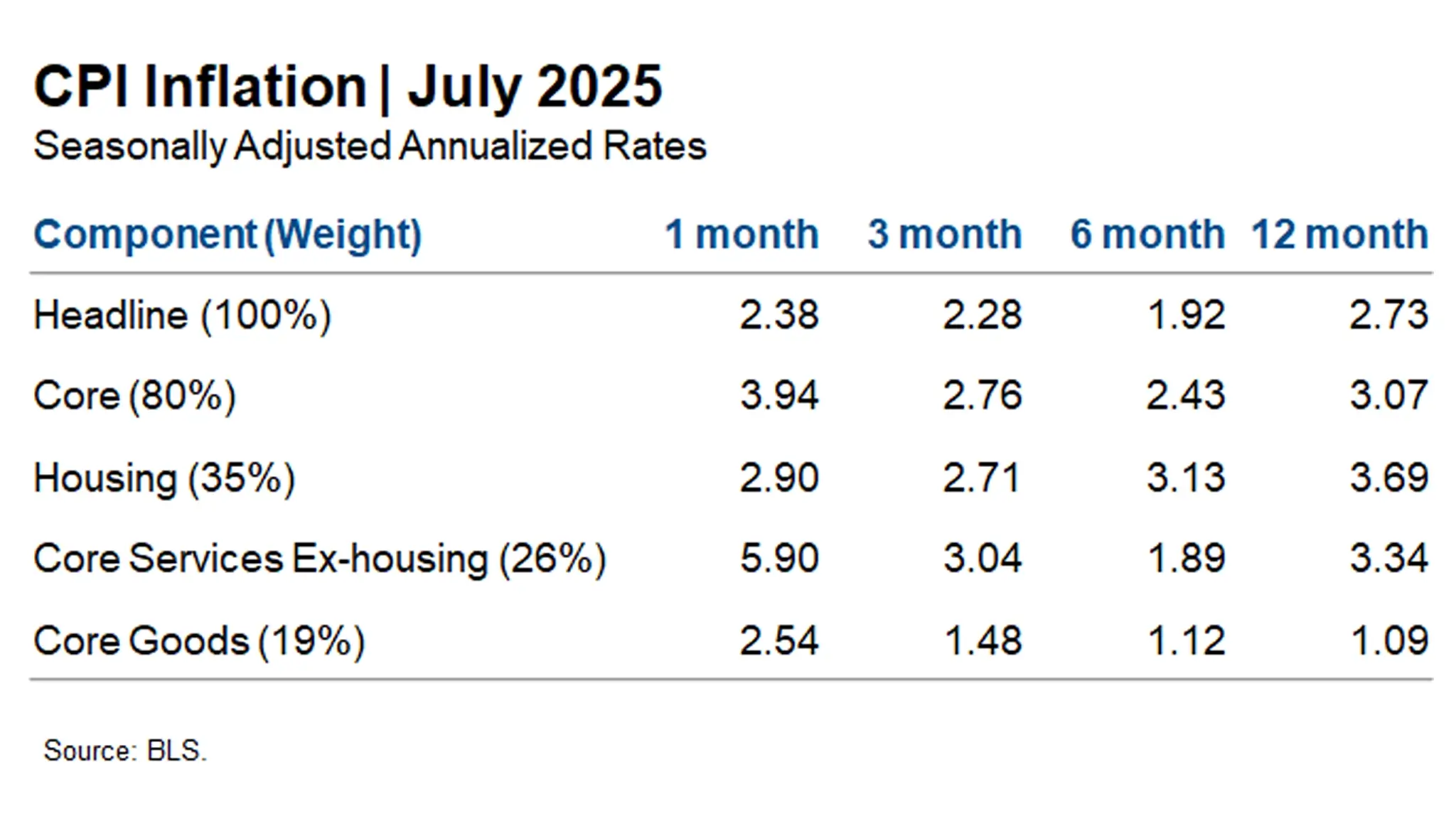

The July CPI report showed another acceleration in the pace of core inflation, to a 3.94% annualized rate in the month. This is the highest monthly pace since January and the second highest in the last 16 months. Tariff-induced inflation is still evident in the data, though at a slightly slower pace than June. Services were the main driver in July. Housing accelerated slightly from June and non-housing services inflation accelerated sharply to a 5.94% annualized rate, also the highest since January and the second highest of the last 16 months.

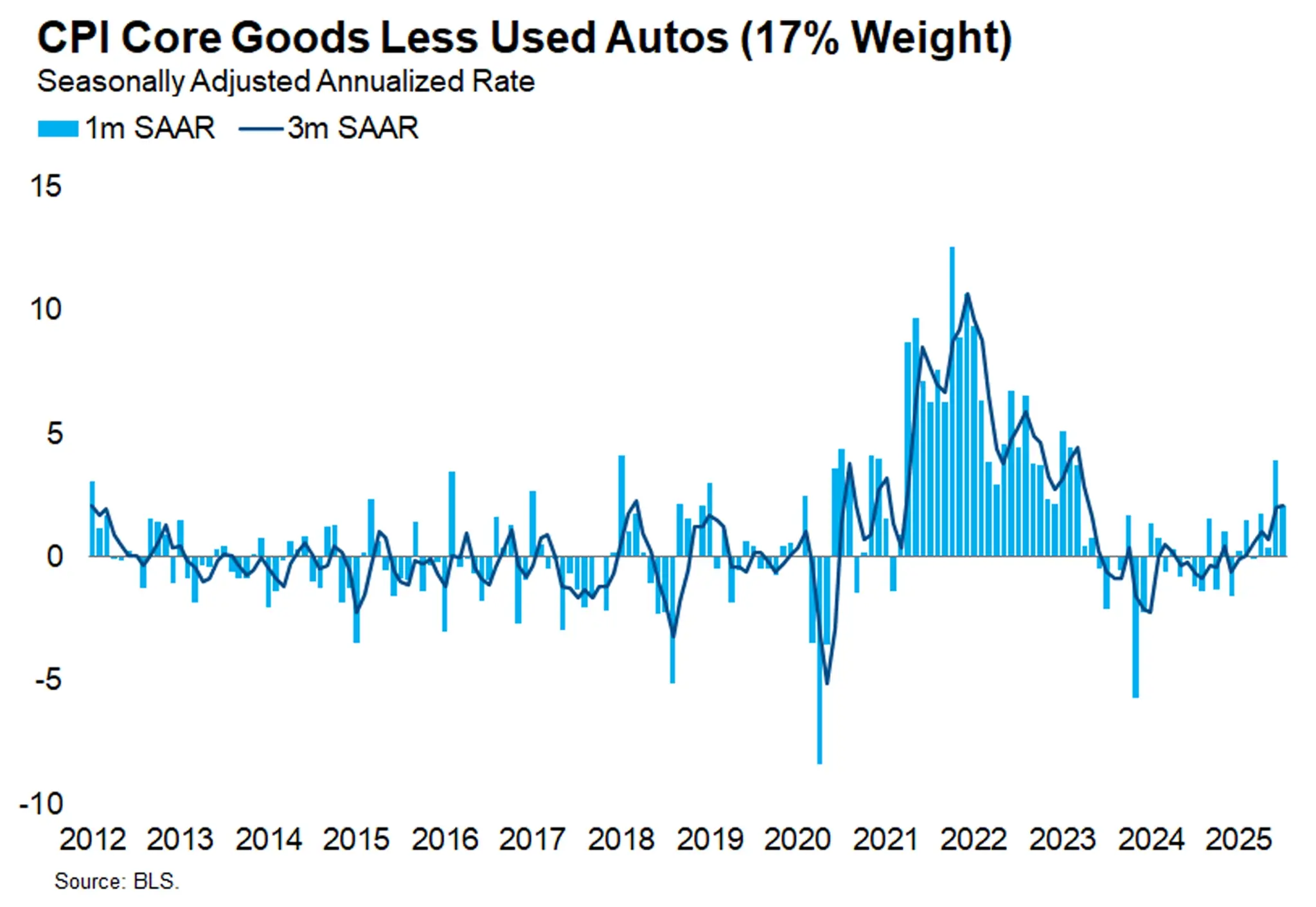

As we continue to watch for signs of tariff inflation, core goods inflation accelerated slightly to a 2.54% annualized rate. If we remove used autos as we did last month (because they are relatively immune from tariff effects), we see that core goods less used autos increased at a 2.06% annualized rate in July. This is far below the pace in June but still the second highest since the recent inflation crisis and well above the pre-pandemic deflation norm. At a 17% weight in the CPI, this is about the broadest measure we have of the consumption basket most impacted by tariffs. If we zoom into smaller categories like toys, appliances, computers and peripherals, we see a more mixed picture on tariff inflation. Some of these components saw prices rise at a slower pace than June, while others saw outright deflation to unwind some of the June inflation. Meanwhile, newly tariff-exposed categories rose quickly, e.g. coffee at a 31% annualized inflation rate in the last two months.

Tariff passthrough continues to be hotly debated among economists. Economic data are noisy but we get CPI one month at a time, and this month’s vintage suggests that the inflationary impact of tariffs will be smaller or arrive later than the June data suggested. This supports our modal expectation that the Fed will deliver three consecutive rate cuts starting in September, though that could slip to two cuts across the three meetings if job creation rebounds strongly. Fed communications since the payrolls report seem to suggest the same, as several FOMC participants reiterated the view that the weaker labor market data call for action before they will be able to gain clarity on the slower-than-expected tariff passthrough. In response to today’s CPI print, short rate markets added 2-4 bps of cuts to the near-term path of monetary policy and are now pricing 60 bps of cuts over the remaining three meetings of 2025. The yield curve continued to steepen and the 2-year vs 30-year yield spread reached a new cycle high of 115 bps.