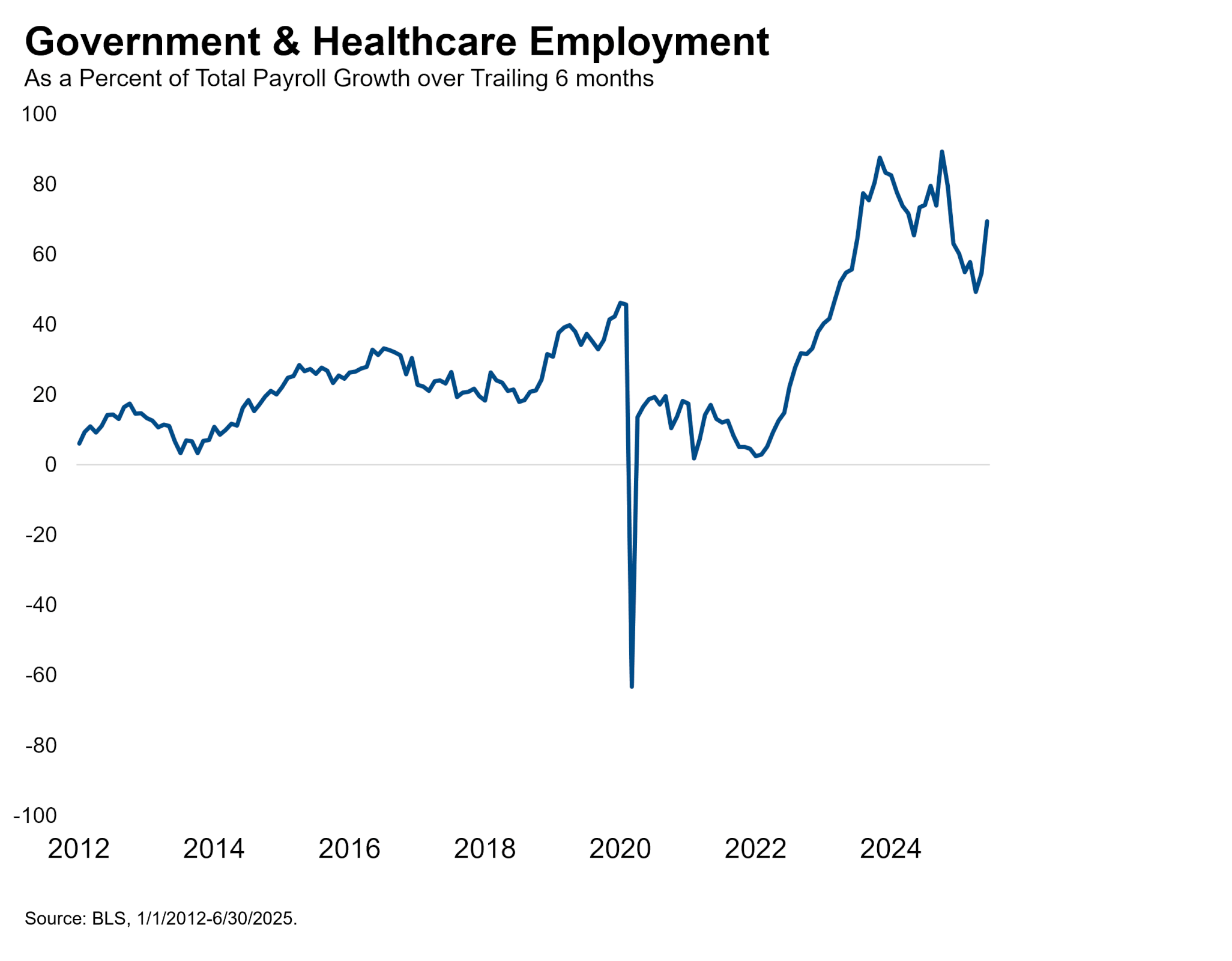

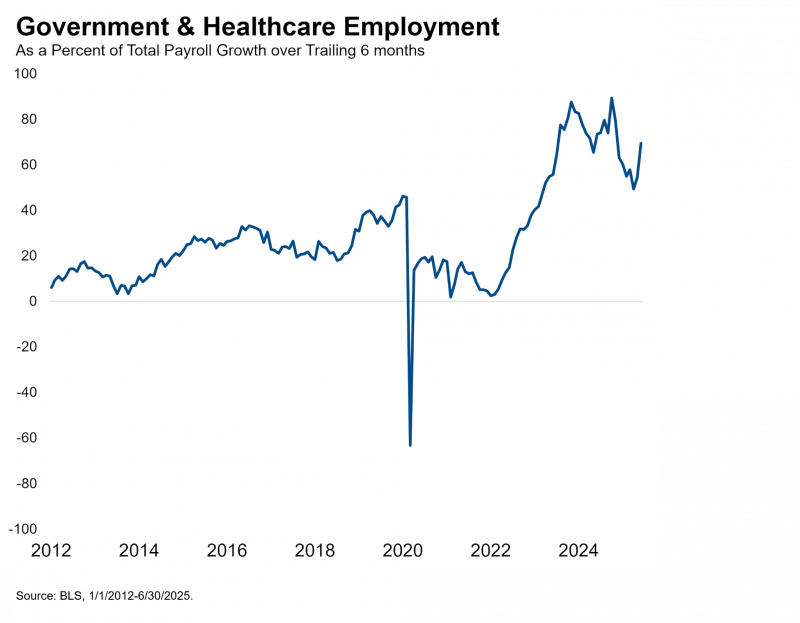

The U.S. economy created an estimated 147,000 jobs in June, well above expectations. The prior two months were revised slightly higher, and the unemployment rate declined from 4.2% to 4.1%. This is a strong print on the headlines. However, the diffusion was exceedingly narrow, with fully 90% of the job creation in June coming from the familiar sectors of government and healthcare, which accounted for 68% of job creation in 2023 and 2024. The diffusion index, which measures the share of the 250 industries in the payrolls sample that saw net job growth in the month, fell back below 50%. Hours declined and wage inflation was subdued. These are not the signs of an upside breakout in labor demand. On the other hand, there is no sign that the labor market is tipping over into a layoff cycle and recession. This month’s report looks to us like a continuation of the low-hiring, low-firing equilibrium that has prevailed since last year.

This continuation should ease the concerns of those who worried about downside risk to the labor market and reduce the urgency for the Fed to cut rates. A July cut is effectively off the table, in our opinion. As long as the labor market remains in this equilibrium, the inflation data will be more important for determining the timing of the first cut. The Fed will get a chance to see three more CPI prints before their September meeting. Those releases will provide much information about the inflationary effects of tariffs. We continue to believe those effects will be material enough to delay the first rate cut until January 2026. Given recent communications from FOMC officials (even leaving aside Waller, whose dovish pivot seems intended at least in part as an audition to succeed Powell), the risk is clearly tilted towards a first cut arriving sooner than January. We may revise our modal expectation to a first cut in 2025, but we’ll wait to see the June CPI print on July 15 before we make that determination.