Many plan sponsors find themselves in the fortunate position of approaching the end of their plan’s glidepath. Favorable market conditions and a contribution nudge from tax reform have made the end state appear on the horizon. This proximity to the finish line is certainly welcome and we expect plans are giving additional thought to what the end-state portfolio will look like.

Two primary “in-plan” hibernation alternatives have emerged: completion and “custom credit” programs.

- Completion programs are the more familiar (and common) strategy. This approach typically retains traditional active managers against published benchmarks and adds a completion manager who uses U.S. Treasuries and interest rate derivatives to keep plan-wide exposures on target across interest rate and yield curve movements.

- “Custom credit” may be a less well known strategy, but has been garnering more interest recently. This strategy uses investment grade credit securities and seeks to hedge the market exposures of a liability without relying on published bond indices. This credit-based alternative offers a degree of precision and finality that may be appealing for an end-state portfolio.

This post highlights the differences between these two strategies and provides some guidance around when one may be preferred over the other.

Completion Portfolios

A typical end-state completion strategy involves an asset allocation with a large weighting to fixed income and a residual allocation to return-seeking assets. On a regular basis, the completion manager will add or remove interest rate exposure such that the total fixed income assets hedge the liability (hence, “completing” the interest rate exposure of the assets to match the liability). This approach allows a plan sponsor to allocate to preferred fixed income managers, maintain a tight liability hedge, and retain perhaps a small (<25%), but important, allocation to return-seeking assets. The completion program predominantly focuses on maintaining the desired general interest rate hedge target and yield curve exposure.

Custom Credit Portfolios

A custom credit strategy takes a different approach. While a completion approach uses one manager to manage the remaining interest rate and yield curve exposure of the liability net of a suite of managers, a custom credit engagement generally will involve only one fixed income manager* (and often only one manager for the plan). The custom credit manager will be tasked with maintaining a general interest rate, spread, and yield curve match across the liability. This manager will work with the plan’s sponsor, actuaries and consultants to analyze the liability and construct a unique portfolio of mostly corporate bonds that reflects the characteristics of the liability. This includes matching the credit quality and overall spread of the liability to the extent possible. When thoughtfully constructed, such a portfolio will generally seek to provide modestly lower tracking error vis-à-vis the liability than more traditional benchmarks. In addition, these portfolios generally avoid the transaction costs associated with additional turnover that are inherent in most published benchmarks.

Some important considerations for sponsors to explore regarding this approach include:

- Lack of a published benchmark – Unlike a completion approach where a majority of the assets are assigned a published benchmark and the completion manager is benchmarked using a formula that isolates interest rate sensitivity, a custom credit portfolio is benchmarked directly to the return on the liability. Such a benchmark, while straightforward, is not fully investable, and even the most well-structured portfolio has tracking error expectations between 1% and 2 % for most liabilities. While a published benchmark proxy can be provided at a client’s request, the official benchmark remains a direct measure of the liability.

- Suitability of the plan’s accounting discount curve – Custom credit portfolios tend to work best when structured based on full universe discount curves. More aggressive (i.e., higher yielding) discount curves result in more aggressive credit portfolios that have higher tracking error primarily due to idiosyncrasies embedded in the discount curve.

- Consistency – If a custom credit approach is adopted, it should be applied to the entire fixed income allocation. The risk reduction attributes of a custom credit portfolio can be lost when other fixed income programs (and/or return-seeking asset allocations) are utilized to be part of the hedge. A benefit to smaller plans from the use of a single manager is the centralized management of interest rate and credit spread risk of the plan. In addition, the custom credit manager seeks to ensure that the overall fixed-income allocation is generally targeting a spread return consistent with the liability.

- Plan Size – One theme of custom credit portfolios is to use securities that pay a liquidity premium in addition to a premium for default (credit) risk. Bonds with higher liquidity premiums tend to be smaller issues. For larger plans, this smaller universe could make a portfolio difficult to construct.

Comparing Discount Curves to Bond Market Benchmarks

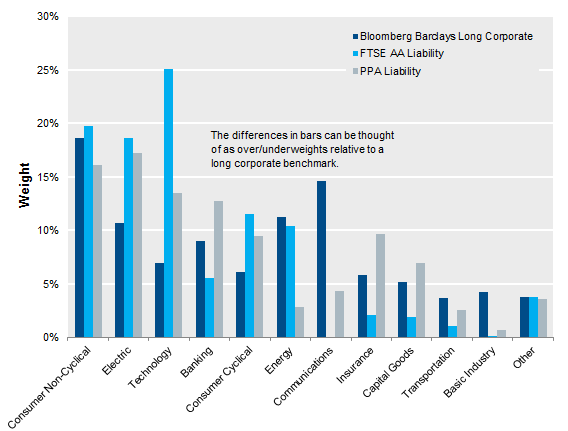

Beyond some of the high-level differences identified above, at a more granular level the underlying discount curves, along with plan cashflows, drive some of the fundamental differences between the two approaches.

To understand the deviations in an actuarial discount curve versus the published bond benchmarks, sector and ticker weights can be compared between the two universes. The figure below illustrates the sector exposures of two publicly available pension discount curves and a common bond benchmark used in LDI programs. This illustration gives a flavor of the structural differences by sector between published benchmarks and liability-based custom credit portfolios. This is due in part to quality differences between published benchmarks and discount curves, but also stem from cash flow pattern differences between liabilities and benchmarks.

Comparison of Approaches

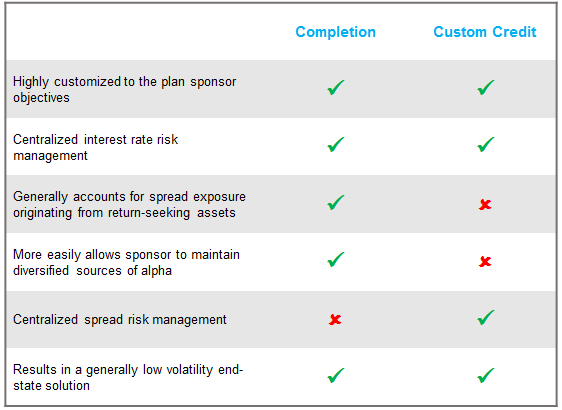

Either traditional completion or custom credit strategies may be an appropriate solution for a plan sponsor depending on their unique situation. For larger plans with more resources, a traditional completion engagement may allow a plan sponsor to effectively manage risks relative to the liability while retaining a wide range of possible managers and maintaining access to a broader investment universe. A traditional completion strategy can also accommodate plans that wish to keep a significant allocation to return-seeking assets or have a higher preference for manager alpha, as part of any strategy.

For plans with more limited resources and those without a need for a material allocation to return-seeking assets, custom credit may be an attractive alternative. A custom credit engagement centralizes the asset-liability risk management of the plan under one roof. By matching the assets to the liabilities this custom credit portfolio results in a strategy that seeks a stable and predictable hibernation solution.

The table below highlights selected similarities and differences between traditional completion strategies and custom credit portfolios:

Additional Considerations

It is important to highlight two end-state strategies that we think can, depending on plan-specific circumstances, have some potential pitfalls:

- In our experience, custom blended benchmarks (i.e., two or more published benchmarks blended together) that are designed to have the same duration as the liability suffer from duration drift due to the evergreen nature of the benchmark indices relative to the liability. This mismatch generally does not become a concern for plans that are under hedged versus their liability as the drift will tend to modestly increase the hedge percentage over time. However, this doesn’t work well for plans that are targeting a precise (often higher) liability hedge. In fact, this drift can incur additional transaction costs that a completion portfolio or custom credit portfolio will seek to avoid by truing up the liability duration on a monthly basis, thus keeping the hedge intact over time.

- Single benchmarks that contain restrictive issuer caps or a constrained credit universe result in additional transaction costs. Most of these costs can be avoided by directly aligning the portfolio to the plan’s investment objective through a custom credit strategy. It is worthwhile to note, however, that modest use of issuer caps is generally not disruptive but become problematic when set too low.

Summary

Plan end-states are very much like each sponsoring entity, unique. Risk tolerances, plan size, and desire for active management all factor into an appropriate hibernation strategy. We believe the two solutions presented here, with some customization for a particular plan, go a long way in addressing the needs of plan sponsors.

*Alternative solutions where a pro-rata slice of the liability is given to each manager may also be applicable.