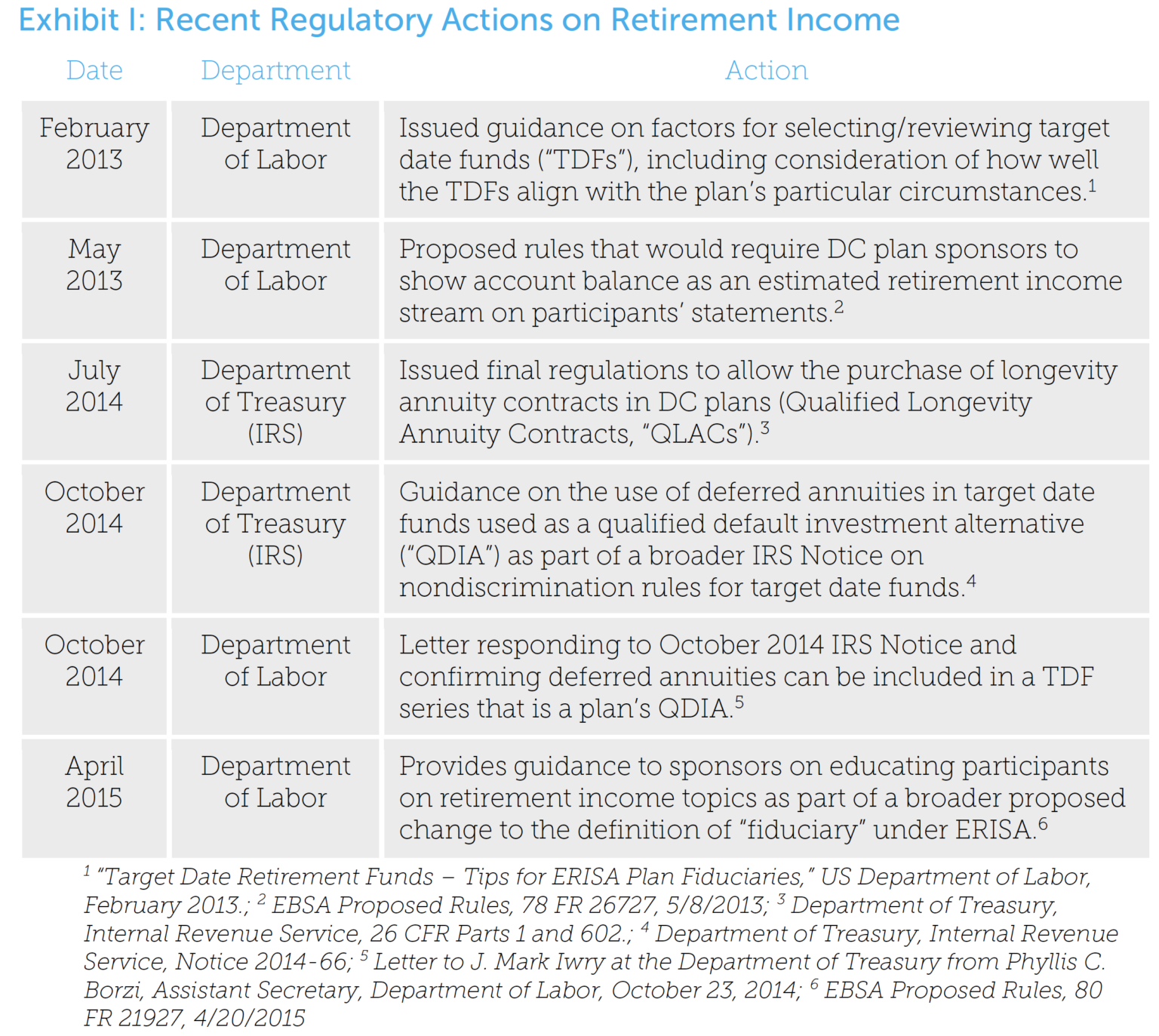

In February of 2013, the Department of Labor (“DoL”) issued guidance that encourages sponsors to consider the use of a custom TDF if it’s more appropriate for their plan and participants. Since not all plans are created equal, sponsors are encouraged not to simply select an off-the-shelf TDF as the plan’s default. While this regulation doesn’t deal with retirement income directly, it has prompted sponsors to examine their existing default options and consider customized investment strategies that focus on retirement income objectives through an open architecture structure.

In May of 2013, the DoL revealed plans to require a new element of participant communication: retirement income equivalence of current and projected account balance. Right now, most participants have no idea how their savings translate into

retirement income, even though the large majority consider guaranteed retirement income a priority.

1 But if the participants see retirement income front and center on statements it would be clear if their retirement savings are actually capable of delivering that income. It could also go a long way towards encouraging most participants to increase their savings rate. Whenever the final rules on the retirement income calculation arrive, we think this could be a game-changer from the participant perspective.

In July of 2014, the Internal Revenue Service (IRS) set forth new regulations that allow longevity annuities in DC plans. Longevity annuities are insurance products that begin payouts in the later years of retirement (e.g., age 85), and can be an efficient way to

protect against the risk of outliving assets with relatively little cost up front.

2 Prior to the new rule, longevity annuities were not allowed due to the required minimum

distribution (RMD) rules. The new rules address this conflict by allowing for the value of the longevity annuity contract to be excluded from the RMD calculations, within certain limits (i.e., the lesser of $125k or 25%).

In October of 2014, as part of a broader notice providing relief from IRS nondiscrimination rules for use of target date funds within defined contribution plans, the Department of Treasury (“Treasury”) provided guidance regarding the use of deferred annuities to avoid violating non discrimination rules. The issue was that, when a plan has a series of TDFs as its default option (the qualified default investment alternative, or

QDIA), it may only be appropriate to include annuity options for older participants in funds with nearer retirement dates. Sponsors were concerned this may be perceived as

age discrimination, but Treasury clarified the issue. The DoL also issued a letter which addressed that Treasury ruling and provided further guidance on the inclusion of deferred annuities in target date funds. The guidance reiterated the existing safe harbor for annuity selection.

In April of 2015, the DoL released its proposed fiduciary rule aimed at protecting investors from conflicted investment advice. In addition to expanded definitions of investment

advice and fiduciary, it proposes that providing education around retirement planning and lifetime income not be considered a fiduciary act. While sponsors have often wanted to help educate participants about the choices and risks they have at retirement, they were often concerned about crossing the fiduciary line. The proposed rule should give sponsors more comfort about where that line is, and give them more leeway to talk about retirement income topics before crossing it.

The proposal broadens and clarifies the topics that the DoL considers education and not investment advice, potentially freeing sponsors to educate participants on these issues and the choices available both in and out of the employer’s plan. The new educational topics include estimates of future retirement income needs, retirement-related risks like longevity and market/interest rate risks, as well as strategies for managing assets in retirement. In its release of the proposed rules, the DoL says that it was motivated to include these new retirement income topics based on its joint examination with

Treasury of lifetime income issues, and hopes that the new guidance improves retirement security for participants.