The Retirement Driven Investing (RDI) Approach to Fixed Income in DC Plans

The Red Herring of Account Balance Stability

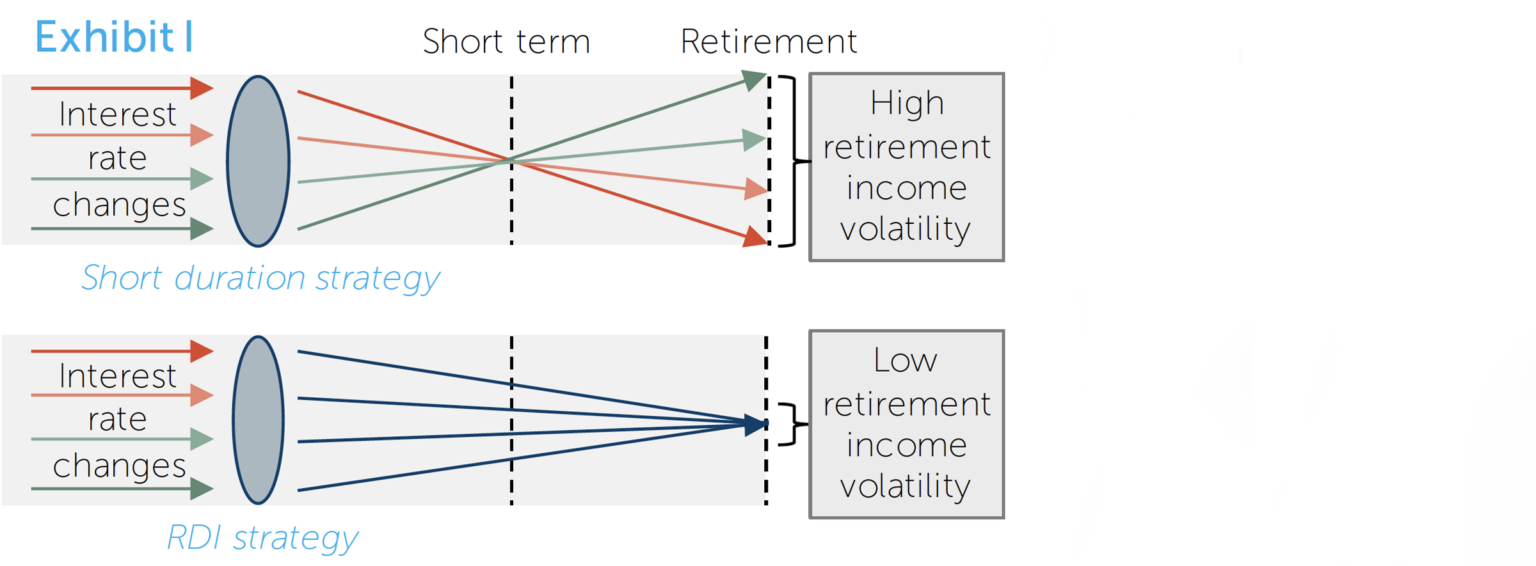

Seven years of her savings have effectively been wiped out by the 1% drop in interest rates.

The RDI Portfolio

Calibrating the RDI Portfolio Based on Age

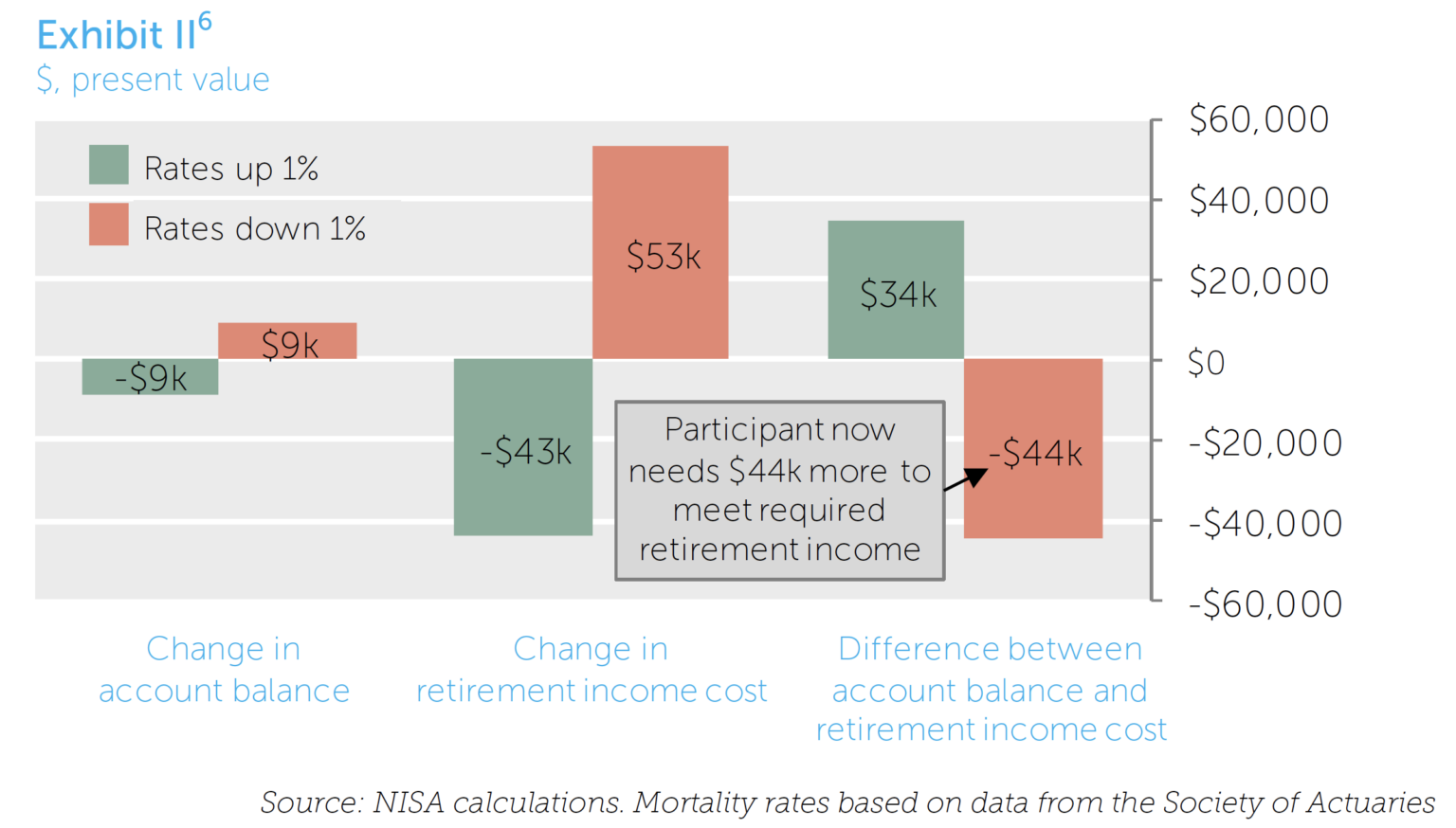

A typical “core” portfolio may fall significantly short of the required duration for hedging retirement income objectives.

RDI Portfolio Implementation

-

Real vs. nominal retirement income: Up to this point, we have not made an explicit assumption about whether retirement income is being measured in real or nominal terms. Economics tells us that retirement savers should seek real income, representing consumption power that is not diluted by inflation. However, to the extent retirement income is intended to meet spending needs that are nominal (e.g., fixed mortgage payments), nominal income may be desirable.

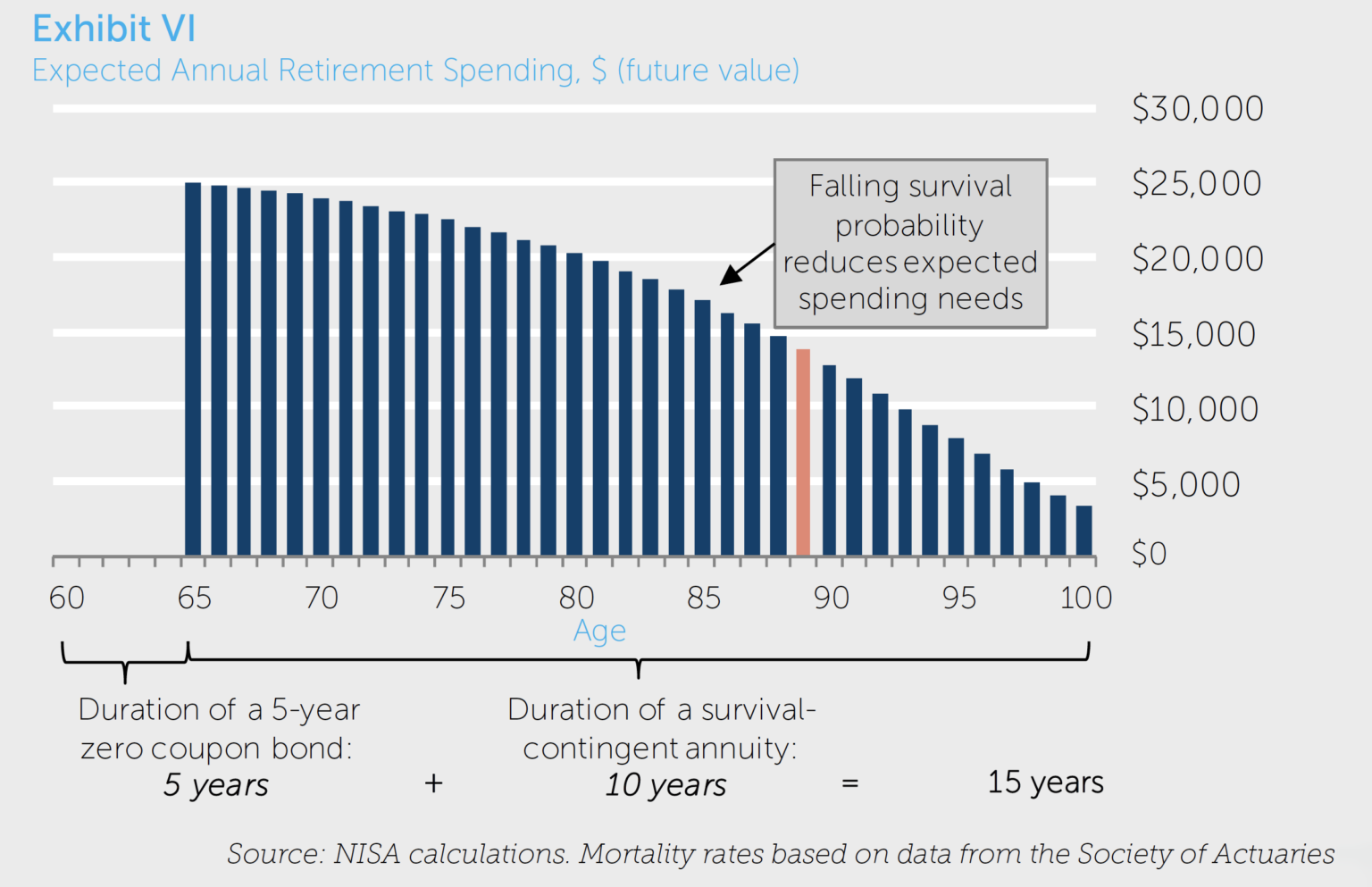

If real retirement income is the objective, then long duration Treasury securities with payoffs linked to inflation (TIPS, or Treasury Inflation-Protected Securities) may be the preferred vehicle for hedging the retirement income goal, and an RDI portfolio can be designed accordingly. In cases where real income is the goal and suitable inflation-linked instruments are not available, an empirical analysis can be done to help determine the relative roles of TIPS and nominal instruments. - Longevity risk: While an RDI portfolio does manage interest rate risk throughout retirement, on its own it does not provide any hedge of longevity risk. The implications of this are significant since if a retiree were to rely directly on disbursements from their portfolio through the retirement years, they bear the risk of outliving those assets, as our later Characterizing the DC Liability section discusses. However, since the calculations of liability size and duration are based on mortality probabilities assuming the participant survives until retirement, it implies that the participant is expected to have the capacity at that time to purchase an annuity product that does provide a lifetime income guarantee.9 This purchase could occur outside the plan, or the plan could directly incorporate different insurance products alongside the RDI portfolio to provide various levels of longevity risk management (e.g., immediate annuities, longevity annuities, contingent deferred annuities).10

- Customization for participant demographics: We have already discussed how age is a central feature in the RDI portfolio’s design, but a sponsor could further customize to incorporate other sources of participant retirement income, further refine mortality assumptions and duration based on demographics, and so on. Sponsors may find this particularly useful in light of the Department of Labor’s recommendation that participant circumstances and demographics be considered when selecting investment options in TDFs.11

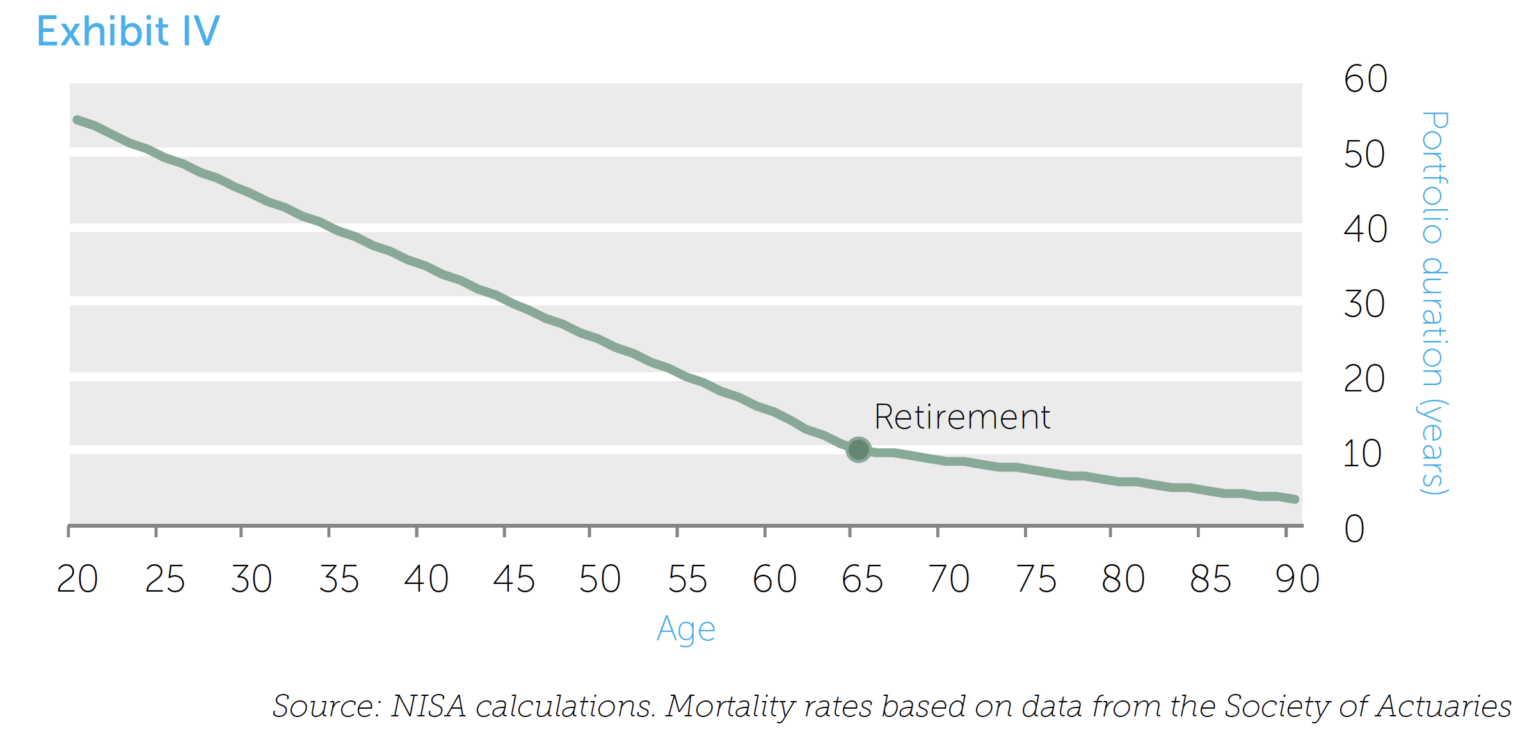

- Constant duration vs. target age duration: An RDI strategy could either be based on a menu of fixed income portfolios with constant durations, or on portfolios with durations that change over time. For example, a target date fund manager or managed account provider could allocate among component portfolios with different fixed durations (e.g., 10-years, 20-years) to maintain the appropriate duration for a particular fund. Alternatively, that fund could rely on a single portfolio designed to follow a path like the one illustrated in Exhibit IV and “age” automatically.

- Total account volatility: Plan sponsors may be wary of intentionally injecting volatility into account balances (and the prospect of explaining that to participants). In reality, this may not be an issue. When an equity allocation exists alongside an RDI portfolio, as may likely be the case, volatility at the combined account level may change very little given the material volatility of equity markets and typically low long-term correlation with long duration bonds. Depending on the circumstances, only a marginal increase in total account volatility may actually result from the switch to a longer duration bond portfolio. It is important to note that this does not somehow undermine the importance of the RDI strategy. The goal of the RDI portfolio is to stabilize its designated portion of retirement income spending, regardless of how the remaining assets are invested.

Conclusion

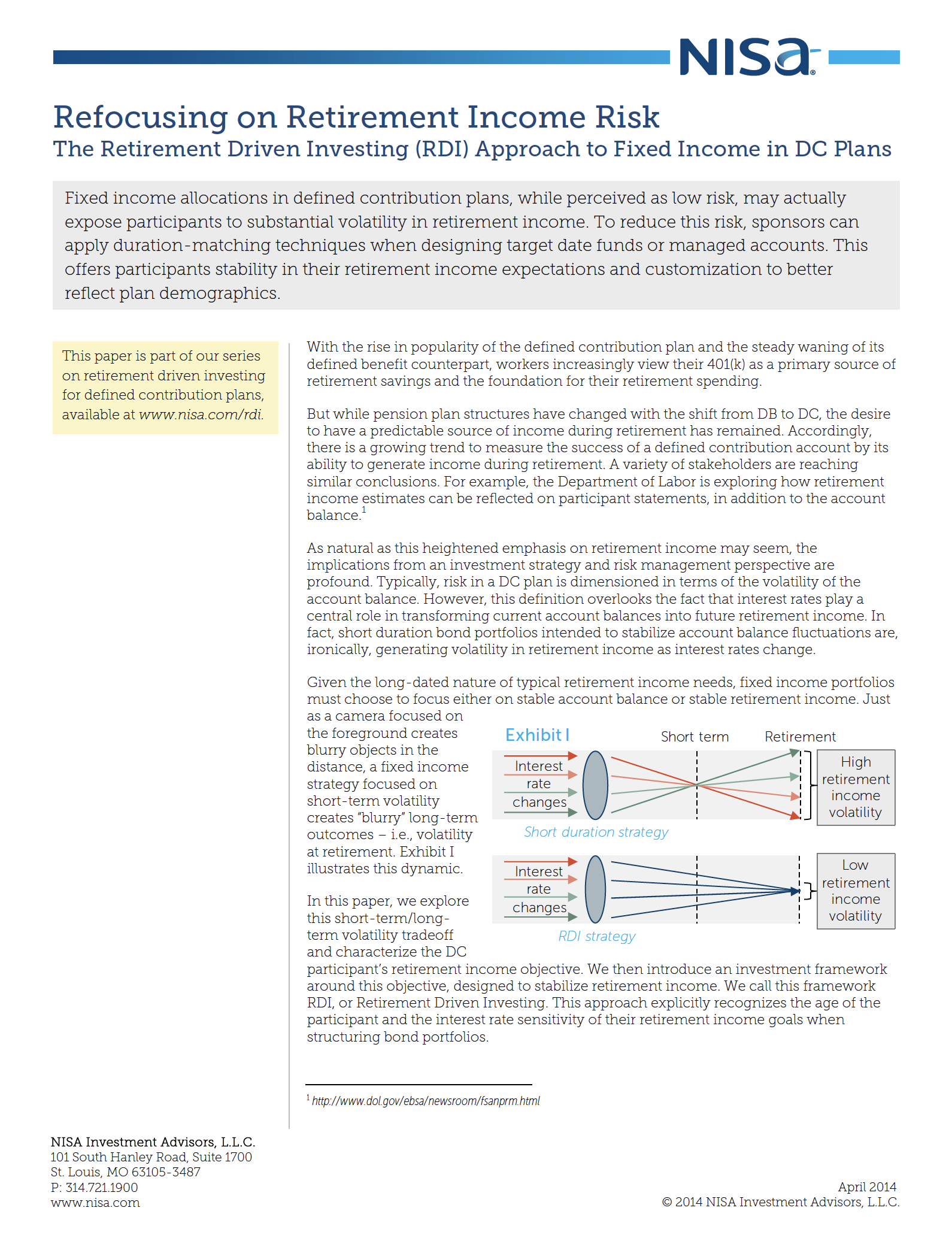

Low volatility bond portfolios may backfire on participants if the goal is stable retirement income.

Since the role and prominence of DC plans in retirement planning has expanded and evolved, so too must the industry’s definition of risk evolve from an “asset-only” to an “asset-liability” perspective. As another step in that evolution, we propose a broad framework called RDI – Retirement Driven Investing – that considers the retirement income objective in investment decision-making. In this paper, we have illustrated how the RDI approach can be applied to fixed income portfolios to mitigate the impact of unexpected interest rate changes on future retirement income.

“What gets measured gets managed,” the saying goes, and we expect that the growing focus on the retirement income metric will lead plan sponsors towards investment strategies that manage risk in terms of the stability of that retirement income. The increasing number of employees who plan to rely on their 401(k) in retirement will benefit from this approach for many years to come.

Managing Director, Investment Strategies

(314) 721-1900 Robert Krebs, CFA

Director, Client Services

(314) 721-1900

Characterizing the DC Liability

Alternative Liability Definitions

Does RDI Require an Annuity Purchase?

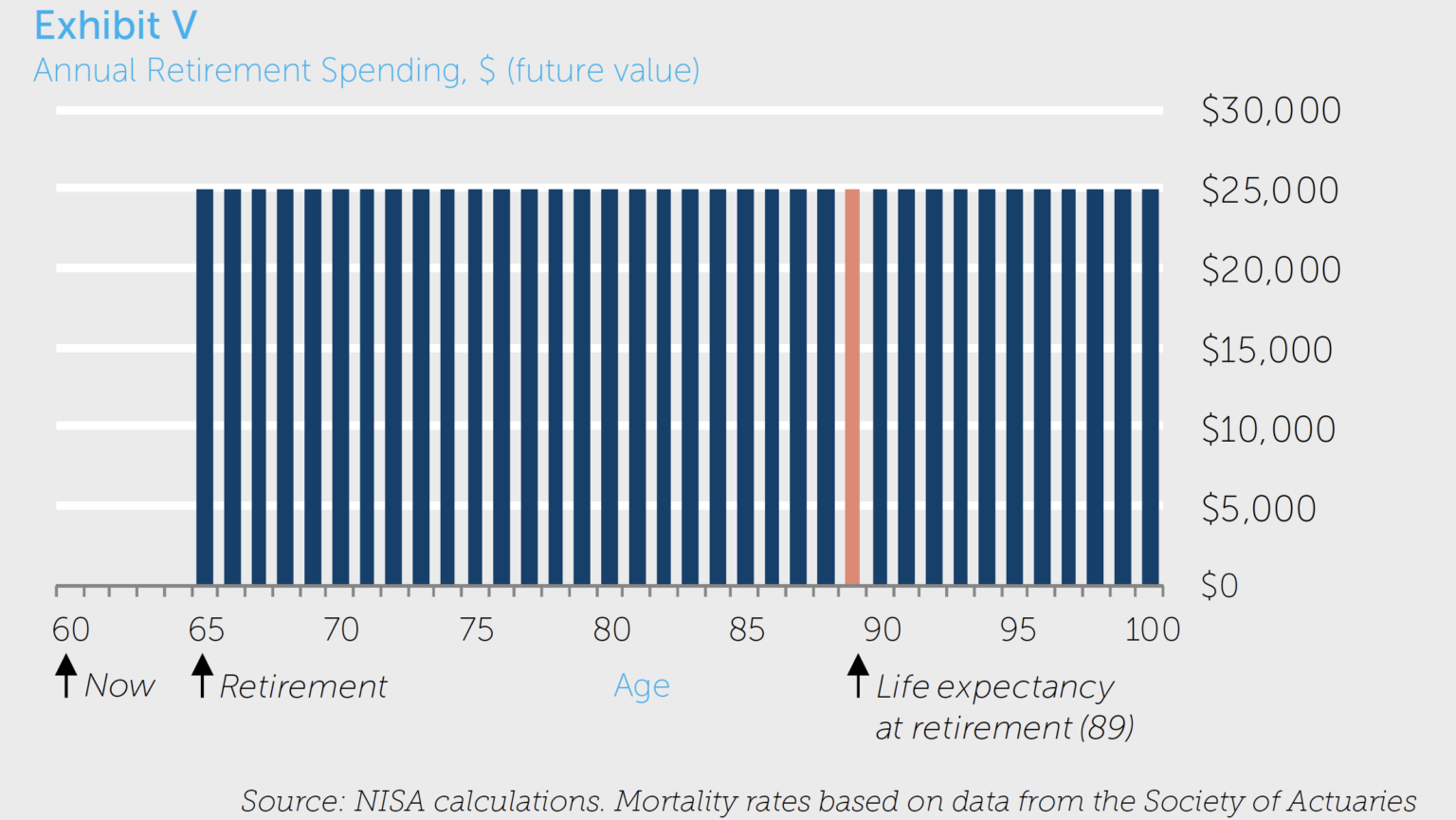

- The cash flows: The purchase of a stream of cash payments for the remainder of their expected life.

- The longevity hedge: Agreeing to forgo those payments if they die prior to their life expectancy in exchange for additional payments in the event they live longer than expected.