Combining Longevity Annuities and Bonds to Raise Retirement Income

DC participants want the most for their money when choosing a retirement income strategy. While annuities can offer higher income, that value is partially reduced by expenses and the loss of control and liquidity. We quantify these drawbacks and find that the most efficient way to fund retirement spending may be to combine a longevity annuity (e.g., QLAC) with a bond portfolio.

Many of life’s big decisions are the all-or-nothing kind. Taking a job, getting married, or buying a house have no middle ground. Meanwhile, other big decisions can cause angst because they are irreversible (e.g., children, tattoos). Most of us would pay dearly for some flexibility and optionality when we face these forks in the road.

Decisions about retirement income have, until recently, been on this list of difficult choices between extremes. A person who wanted guaranteed income for life could buy an annuity.1 Traditional annuities are often attractive because they offer fixed, lifetime income along with an extra income boost known as the mortality premium (which we explore on the next page). But a traditional annuity means relinquishing control over your assets, a major drawback when considering heirs and unplanned spending needs. The alternative – drawing retirement spending directly from an asset portfolio – provides retirees control and liquidity but leaves them exposed to longevity risk. To annuitize, or not to annuitize has thus been the big question for many people thinking about retirement, with trade-offs that are painful and implications that are irreversible. Understandably, few have annuitized.

Now there is a middle ground: longevity annuities. Following new US Treasury Department rules, longevity annuities can be used in qualified defined contribution plans to provide deferred income many years after retirement starts. By deferring payments until a later age, longevity annuities – such as Qualified Longevity Annuity Contracts (QLACs) as they are known in the DC space – offer protection against outliving your assets but cost only a fraction of a traditional annuity. As a result, the majority of a participant’s wealth remains in their portfolio and under their control. By bundling a liquid bond portfolio to generate income in the earlier retirement years with a QLAC that kicks in later, participants can offload their longevity risk and still have full control over most of their assets as they enter retirement.2 This “bundle strategy” also helps alleviate the concern about having all your eggs in one basket, since only a small fraction of your wealth would be exposed to insurance contracts with concentrated counterparty risk.

This kind of bond-QLAC bundle strategy looks even better when you consider another factor: insurer fees and other frictional costs. As we will explore, these costs impact a longevity annuity differently than a traditional annuity. This different impact means that you can expect a higher income level from a QLAC-based approach than from either of the strategies at the extremes of the spectrum. And when a quantitative estimate of liquidity value is applied, the effective income level of the bundle strategy may even further exceed the traditional annuity or the asset-only approach. In this paper, we quantify the benefits of the bond-QLAC bundle and show that, for some, the retirement income decision may now be a lot easier.

The Mortality Premium

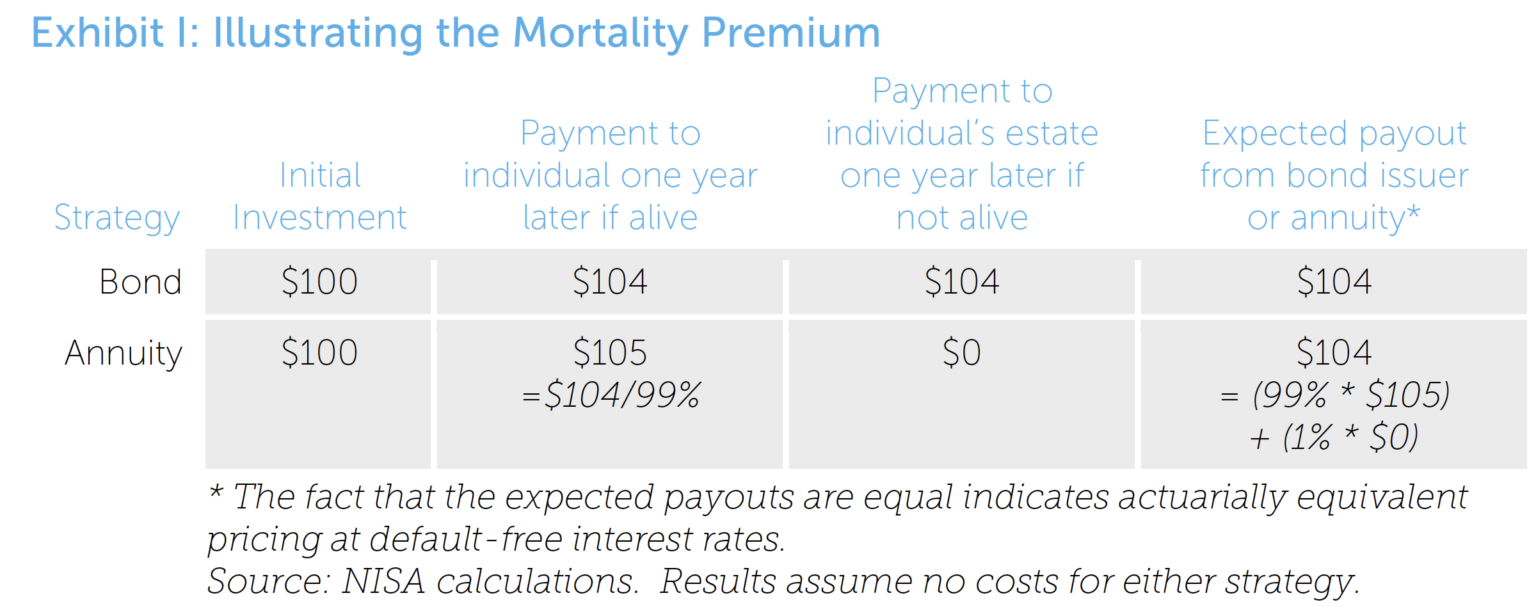

Annuity contracts,3 whether traditional annuities or longevity annuities, are insurance products. Like any insurance contract, value is created by pooling and sharing risk across policyholders. For example, auto insurance premiums paid by those who never have an accident help to pay for those who do. The same concept applies to annuity contracts which create value by using the premiums paid by those who die earlier than expected to provide income for those who live well past their life expectancy.From the perspective of any individual, an annuity can offer them higher income in the years they are alive in exchange for a smaller estate upon their death. This higher income, the so-called “mortality premium”, is easiest to see by comparing the payoff from a bond-based investment strategy to the payoff from an annuity over a single period.

Longevity annuities capture the years with the highest mortality premiums.

Let’s imagine a 65-year-old female is considering different ways to generate income in retirement. Suppose that by buying a bond, she can invest $100 today to receive $104 a year from now (implying the interest rate is 4%). Let’s also assume that she faces a 1% chance of dying within the year, according to actuarial estimates based on her age and other factors. For now we ignore insurer costs and profit and assume “actuarially equivalent” pricing – i.e., pricing based on agreed-upon mortality probabilities with no margin for the insurer. With that assumption, the 1% probability of death suggests that an insurance company would offer a contract paying $105 of income for the same $100 investment, a dollar more than the bond strategy. The insurer can offer this higher income since, if the woman is not alive to collect in a year, she receives nothing. Thus, the annuity’s expected payout, weighted by the probability of each outcome, is no different than the bond strategy even though the insurer has promised a higher income level.

It is no accident that the extra 1% return is approximately equal to the 1% mortality rate. Indeed, the name “mortality premium” derives from the sharing of that mortality risk that an annuity provides. This extra return to 99% of surviving annuitants is paid by the 1% who were not so fortunate and have contributed their remaining wealth into the pool for the rest. This basic logic extends to annuities that cover longer time horizons. A 65-year old who buys a traditional annuity is effectively buying a package of annual contracts that each offers a different mortality premium based on the mortality probability at each future age.This is where things get interesting, because mortality probability grows over time. Although the mortality rate from age 65 to 66 is quite low, cumulative mortality likelihood increases the further one looks into the future. For example, the probability of our 65-year-old woman surviving to age 90 is only 40%, implying an extremely large mortality premium at such older ages. The fact that the mortality premium is not equally spread across the package of payments of a traditional annuity is a key point when we think about how to optimize retirement income. (Hint: longevity annuities capture the years with the highest mortality premiums.) We discuss the relationship between the mortality premium and age in more detail in the Appendix.

STRATEGIES

Traditional annuity strategy: Buying an immediate, single-life annuity at retirement that offers a fixed, lifetime income stream with no death benefits.

Bond strategy: Drawing retirement income from a bond portfolio from ages 65 to 100. Duration matching the portfolio to future spending needs with an RDI (retirement driven investing) approach keeps retirement income stable as interest rates change.

Bond-QLAC bundle strategy: Bundling a bond portfolio with a longevity annuity (e.g., QLAC). The bond portfolio generates income for the first 20 years of retirement and the QLAC begins payments for life once the bond portfolio runs out. The bond portfolio is RDI duration matched. In our example, 85% of the current balance would be allocated to the bond portfolio while 15% is allocated to the longevity annuity. But for the delayed payments, the QLAC has the same single-life, fixed lifetime payout features as the traditional annuity.

For more background on interest rate risk and combining a duration-matched RDI portfolio with a QLAC see our previous papers at www.nisa.com/rdi

Traditional annuity strategy: Buying an immediate, single-life annuity at retirement that offers a fixed, lifetime income stream with no death benefits.

Bond strategy: Drawing retirement income from a bond portfolio from ages 65 to 100. Duration matching the portfolio to future spending needs with an RDI (retirement driven investing) approach keeps retirement income stable as interest rates change.

Bond-QLAC bundle strategy: Bundling a bond portfolio with a longevity annuity (e.g., QLAC). The bond portfolio generates income for the first 20 years of retirement and the QLAC begins payments for life once the bond portfolio runs out. The bond portfolio is RDI duration matched. In our example, 85% of the current balance would be allocated to the bond portfolio while 15% is allocated to the longevity annuity. But for the delayed payments, the QLAC has the same single-life, fixed lifetime payout features as the traditional annuity.

For more background on interest rate risk and combining a duration-matched RDI portfolio with a QLAC see our previous papers at www.nisa.com/rdi

Adding Costs to the Equation

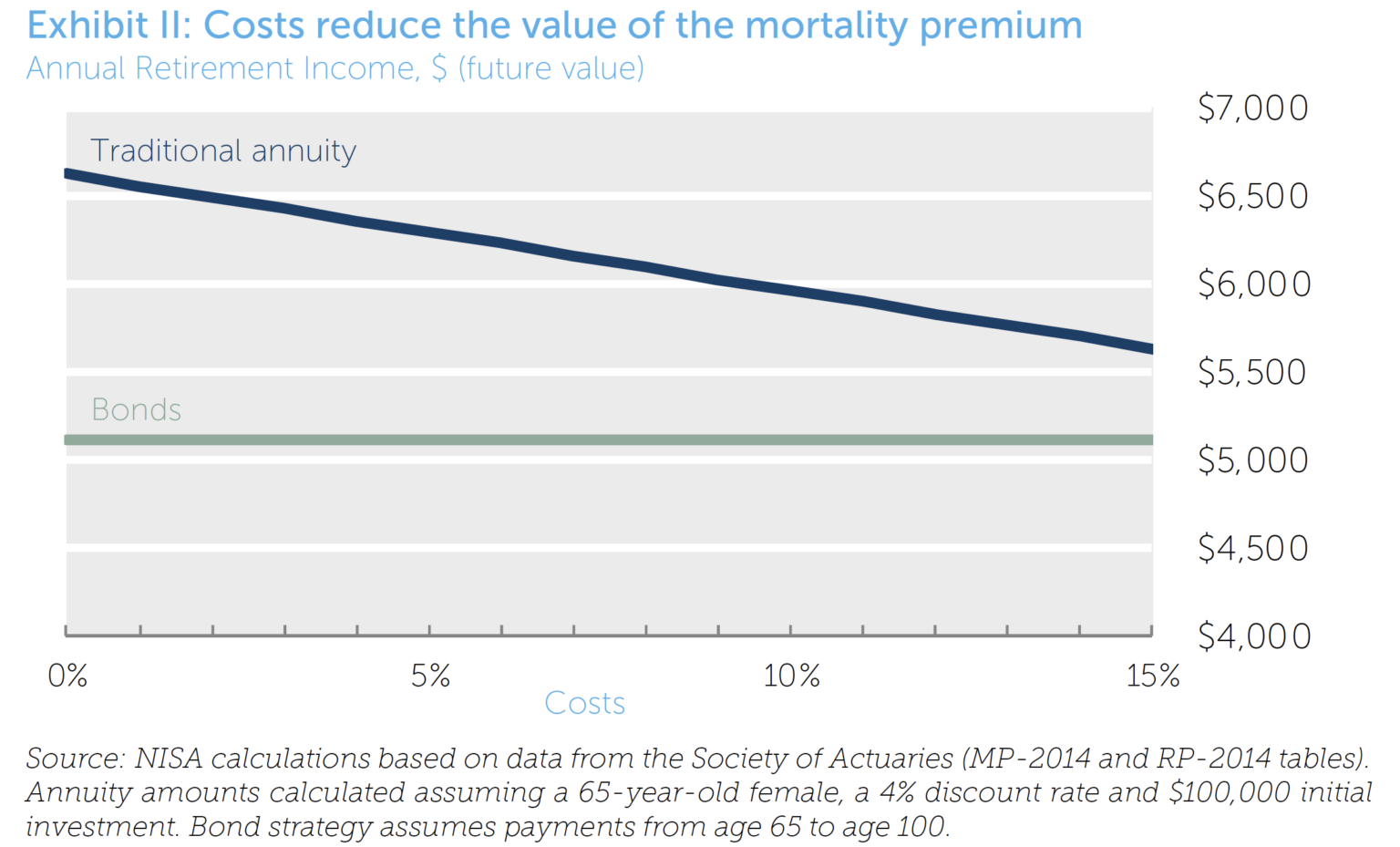

Now let’s make our example more realistic by moving from actuarially equivalent pricing to annuities that include an insurer cost to cover their expenses and profit. We can think of this cost as a percentage reduction in income compared to the income from actuarially equivalent pricing, and Exhibit II shows the impact of a range of costs on retirement income level. We present a wide range of costs, not to say any one cost level reflects current reality, but to account for the fact that different individuals may encounter different costs based on factors like the credit quality of a specific insurer, pricing trends in insurance markets, and so on. Even with costs in this range, the income a retiree receives from a traditional annuity is still higher than the income he or she could generate on their own with the bond-only strategy. This makes sense in light of the extra boost the annuity gets from the mortality premium. And it’s intuitive that as costs increase, the gap between the two strategies narrows, since the bond-only strategy is unaffected while the annuity income is eroded bit by bit.4 The annuity is now dealing with competing forces – its income is initially propped up by the mortality premium, but is pushed down as costs increase.

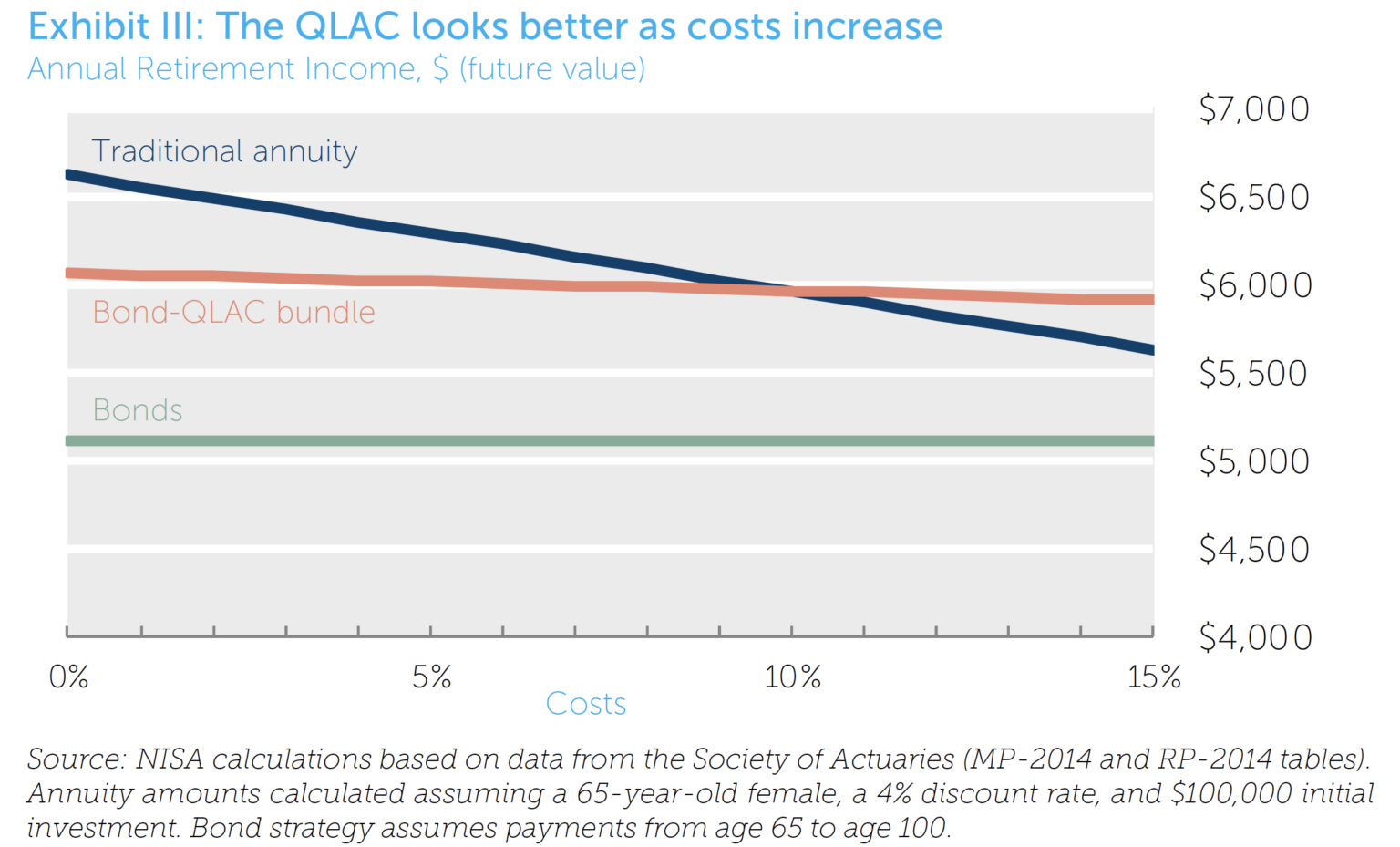

Now let’s consider how the bond-QLAC bundle will plot on this chart. The bundle strategy has two components: 1) a bond portfolio responsible for generating income in the first phase of retirement and 2) a longevity annuity that pays out during the second phase (however long it may last). We will assume the longevity annuity kicks in at age 85.5 Since these payments are deferred so far into the future, only 15% of the current balance is needed to buy the annuity. The remaining 85% remains in the liquid bond portfolio.

Without any costs, we expect the bundle strategy income level to be somewhere between the traditional annuity and bond-only strategies, since a portion of future income benefits from the mortality premium but the rest does not.

As expected, at the 0% cost point the income from the bond-QLAC bundle falls in the middle, since only the income in the later years gets the mortality premium boost. But something interesting happens when costs enter the picture. The bundle strategy’s income level is not nearly as sensitive to increasing costs as the traditional annuity is. The gap between them narrows quickly and by the time we reach a 10% cost assumption, the bundle strategy provides more income than the traditional annuity.

With a longevity annuity, we are selecting only those years where the larger mortality premium overcomes the costs.

To understand why, we need to go back to the relationship between the mortality premium and costs. As we pointed out earlier, the mortality premium is relatively small in the early years, but grows very large in distant years. Meanwhile we assume costs are applied to each year equally.6 If we were to deconstruct a traditional annuity and look at it year by year, we would see that we’re getting a great deal in the later years where the larger mortality premium overcomes the cost. But we’re getting a worse deal in the early years where the cost overcomes the lower mortality premium and net income is lower than what we could get on our own by simply buying a bond.When we use a longevity annuity like a QLAC to cover the more distant retirement years, we are selecting only those years where the larger mortality premium overcomes the costs, while avoiding the earlier years where the opposite is true.7 The result is that, in tangible dollar terms, the bond-QLAC strategy can trump both the traditional annuity and the bond-only strategies as costs increase.

Adding Implicit Costs: Illiquidity and Control

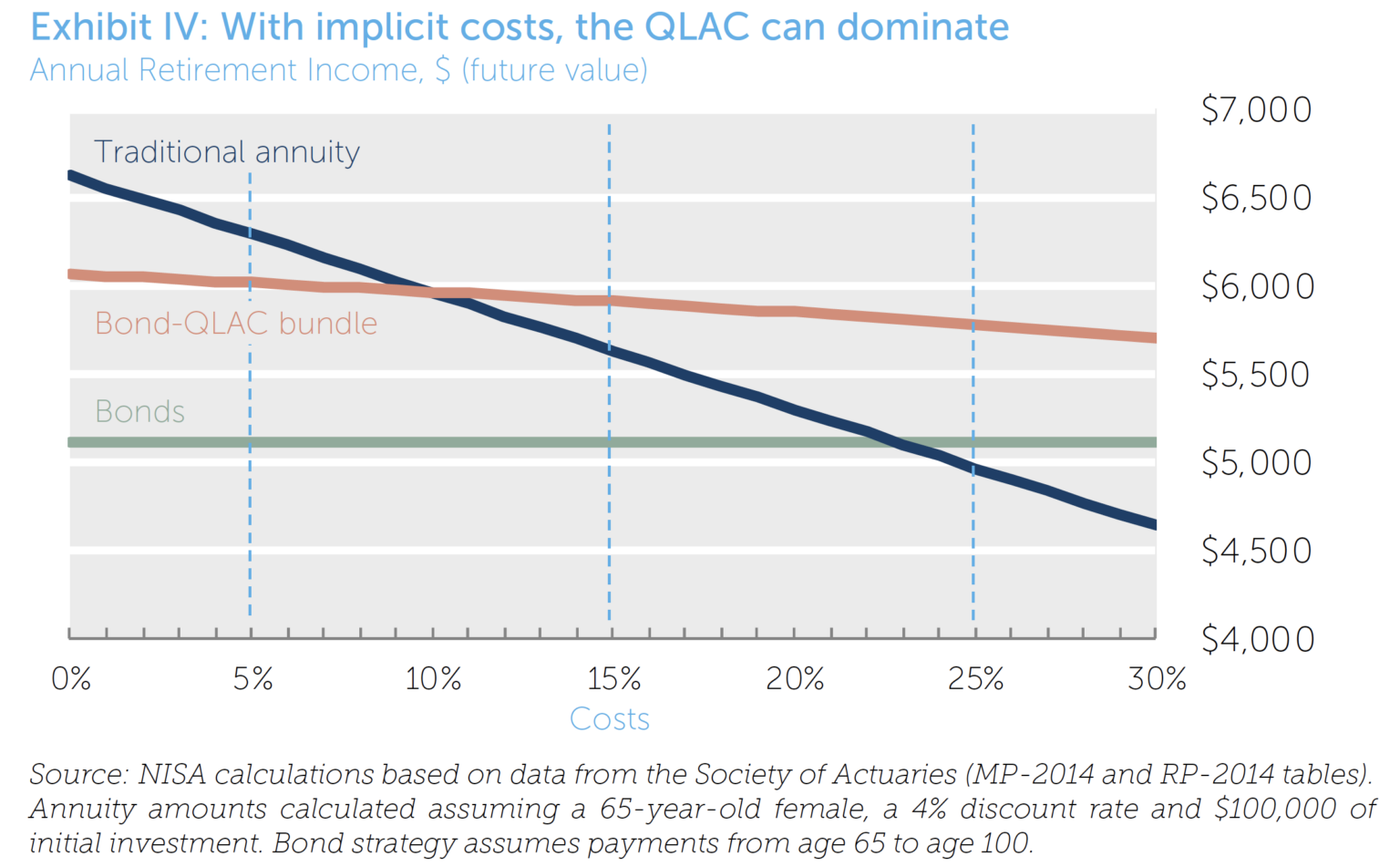

We just saw how explicit expenses can tilt the balance when weighing one retirement income strategy over another. However, participants may also bear another less visible cost – the lost value of flexibility and control. Indeed, the fact that a traditional annuity requires you to give up control over your wealth discourages people who want to pass that wealth on to their heirs from buying traditional annuities, all else equal.8 Control and liquidity may also be important to someone who wants to retain the ability to generate cash for unplanned expenses, or to rethink their investments in the future if market conditions or their risk profile changes. This give-up in liquidity and control can be thought of as an implicit cost to wealth that is annuitized. In other words, when participants place a value on control and flexibility, a dollar of income from a rigid annuity is less valuable than that same dollar of income from a bond. And even though it may be difficult to accurately quantify that value, we can still examine how our various retirement strategies stack up in the presence of this additional cost.9In Exhibit IV we apply the implicit costs the same way we applied explicit annuity expenses, as a flat percentage of annuitized income. Costs can now be thought of as the combination of both components. We show what happens to effective income across a wider range of potential all-in costs that now includes both the explicit costs and the implied costs of illiquidity and lack of control.

Let’s step through a few points along the cost axis to see how things change. At the 5% cost point, we may be talking about a participant who faces 5% in explicit annuity expenses but places absolutely no value on liquidity. The participant would choose the traditional annuity strategy with effective income of about $6,250 a year. Meanwhile the bundle strategy delivers about $6,000 and both strategies clearly outperform the bond approach.Now let’s assume another participant faces similar costs but does have a preference for liquidity and control. To this person, annuitized income is only worth 90 cents on the dollar since it can’t be passed on to children or donated to a charity in the event of an untimely death, nor can it be turned into cash to cover an unplanned expense. To this person, the implied 10% illiquidity cost and expenses of 5% result in an all-in cost of 15%. At this point, the bond-QLAC bundle now offers the highest income. The bundle’s income level is only slightly reduced at this higher cost level, while the traditional annuity has lost its edge due to its higher cost sensitivity.

The bundle strategy can lock in materially higher retirement income when explicit and implicit costs are considered.

Lastly, consider a point where all-in costs are 25%, perhaps reflecting a combination of 10% explicit expenses and a 15% illiquidity cost. At this point, the benefit of the bundle is even more pronounced. And the traditional annuity now delivers less effective income than the bond strategy. In other words, the income boost from the mortality premium has now been completely undermined by costs if the participant buys the traditional annuity. Meanwhile the participant can lock in materially higher income with the bundle strategy by annuitizing only the distant years where the mortality premium is large enough to offset higher expenses.Is it crazy to think that people would apply such a high all-in cost to an annuity? Perhaps not, when you consider the low appetite for traditional annuities observed in the market. One possible interpretation is that this low appetite represents a revealed preference for liquid, asset-based strategies over annuities. If so, we may be forced to infer that the all-in cost of annuitized income is at least 25%. If this is the reality, participants should love the bundle strategy for its higher income. (Another very plausible interpretation is that behavioral obstacles reduce the appetite for annuities, despite their economic attractiveness. Once again, the QLAC strategy alleviates many of these obstacles. We plan to delve into this topic in our next paper in this series.)

Conclusion

Longevity annuities could be a game-changer. As participants weigh their retirement income options, they naturally seek a balance between the amount of income they can receive and the illiquidity and lack of control inherent in annuity products. In this framework, we find that strategies based on longevity annuities can be the most efficient way to generate retirement income. A participant who combines a longevity annuity with a bond portfolio can accomplish two major goals at once, 1) create a retirement income stream that can’t be outlived, and 2) retain flexibility to change course and the ability to pass wealth on to heirs in the event of untimely death. Prior to the introduction of longevity annuities, participants were largely forced to choose one or the other – give up control or run the risk of outliving their assets.Beyond this intuitive value, we show how the potential advantage of the longevity annuity (e.g. QLAC) strategy can be quantified. In the presence of real-world costs, we show that a combined bond-QLAC bundle strategy may offer higher income than either a bond portfolio or an annuity on their own.We can think about longevity annuity strategies as a blend of the traditional annuity approach and the asset-based approach. If we go so far as to call them the parents and the new bond-QLAC strategy their offspring, they would most certainly be proud that their child had inherited their best qualities. Participants facing difficult retirement choices, as well as the sponsors that help shape those choices, should be thrilled at the arrival of this new member of the retirement income family.

Institutional investors are invited to contact NISA to discuss customized RDI strategies:

David Eichhorn, CFA

Managing Director, Investment Strategies

314.721.1900

Robert Krebs, CFA

Director, Client Services

314.721.1900

David Eichhorn, CFA

Managing Director, Investment Strategies

314.721.1900

Robert Krebs, CFA

Director, Client Services

314.721.1900

Appendix

What is the right age to start payments from the QLAC?

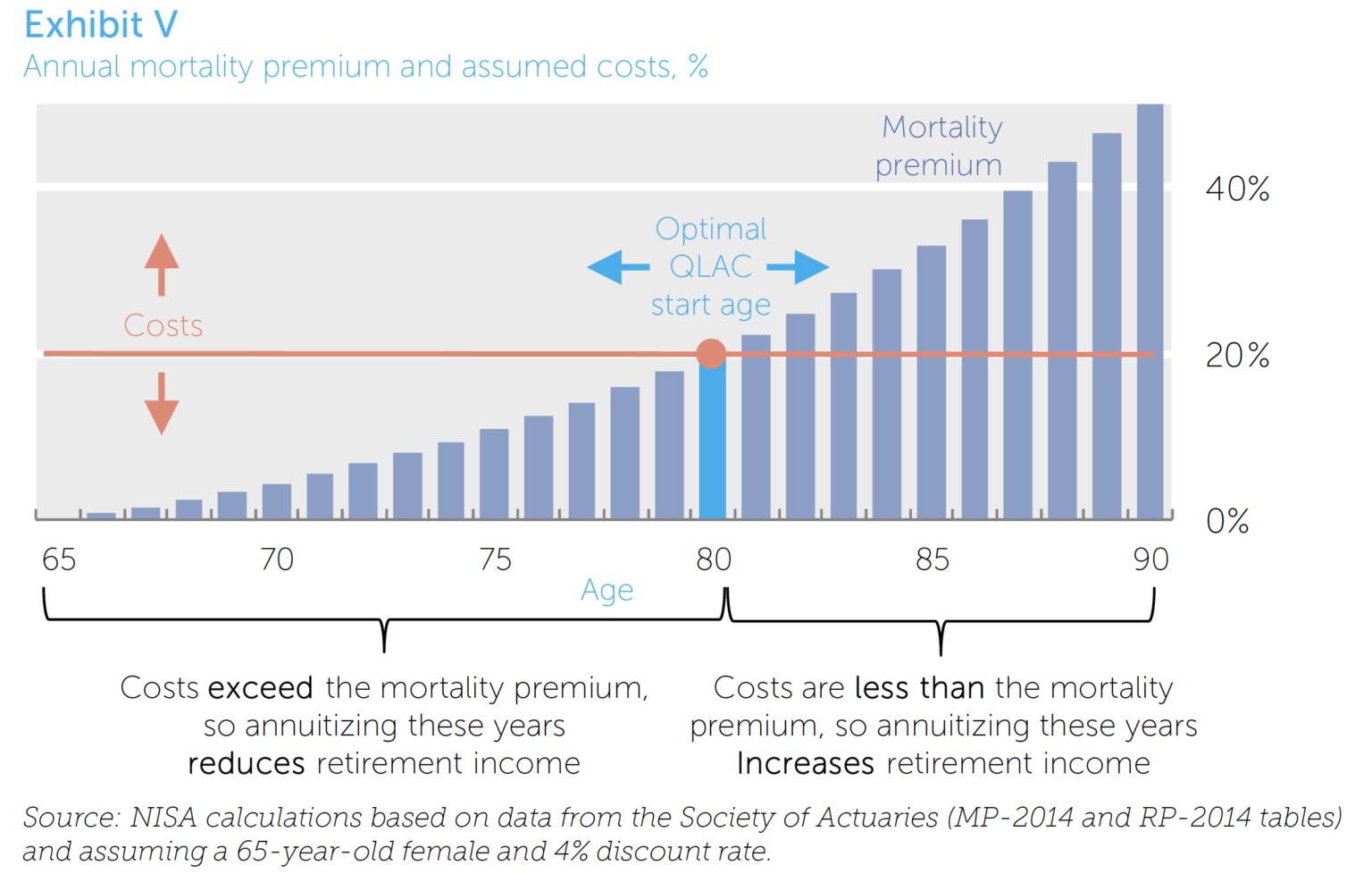

In our examples above, we present a bond-QLAC bundle with annuity payments beginning at age 85. However, by digging deeper into the dynamic between the mortality premium and costs, we may be able to select a better age to start payments from the QLAC that offers higher overall income. We can think of this as an optimization question. Given a cost estimate, what is the QLAC start age that maximizes effective retirement income?We can answer this question by simply finding the age at which that year’s mortality premium is the same size as the annual cost.10 From that year forward, the growing mortality premium will be greater than the flat cost and deliver a net positive benefit in income terms. (For simplicity, we assume costs apply equally at all ages.)

In Exhibit V, we see that when costs (insurance expenses, implied liquidity costs, etc.) are assumed to be 20%, the break-even age is roughly 80. Annuitizing earlier ages means paying more in costs than you receive in mortality premium. Annuitizing from that break-even age and beyond means buying only the years where the mortality premium exceeds costs, and hence has a net positive effect on retirement income. We can also imagine what would happen if costs go up or down. The break-even point would fall at a later or earlier age and suggest a different structure to the bond-QLAC bundle. And we can see that for reasonable cost estimates, a longevity annuity bundle exists that will deliver higher retirement income than a traditional annuity that starts at age 65.

Jeffrey R. Brown, Ph.D

Jeffrey Brown is the William Karnes Professor of Finance and Director of the Center for Business and Public Policy at the University of Illinois. He is also the Associate Director of the NBER Retirement Research Center. He earned his Ph.D. in economics from MIT, and has previously held positions at Harvard University, the White House Council of Economic Advisers, and the President’s Commission to Strengthen Social Security. He has served as a member of the Social Security Advisory Board, the board of the American Risk and Insurance Association, and the advisory board of the Tax Policy Center.Dr. Brown acts as a consultant to NISA in the areas of behavioral economics and retirement income strategies.