Economic analysis reveals a 14% range in credit risk costs among nine Pension Risk Transfer (PRT) insurance providers.

- A pensioner’s benefit is fixed – they are not compensated for bearing the risk of lower quality insurers.

- With annual PRT transactions of approximately $40b, the disparity puts pensioners at risk of losing as much as $5b per year in the form of uncompensated credit risk.

- Potential remedies include reducing the list of potential providers to those insurers that can more comfortably be grouped as all “safest available” or requiring lower quality insurers to increase benefit amounts by an amount that provides pensioners the appropriate compensation for the credit risk they are forced to accept.

Summary

Choosing an annuity provider for a Pension Risk Transfer (PRT)[1] requires that fiduciaries conduct an in-depth review of the insurance company’s creditworthiness. This process is often referred to as identifying the “safest available annuity” taking language directly from the Department of Labor (DOL). Despite the superlative nature of the word “safest,” fiduciaries in practice generally consider this concept a threshold that, if achieved by more than one insurer, permits more than one acceptable choice.

This approach is reasonable in principle, but we believe in recent years this rubric has been extended to a degree that is questionable. In particular, certain developments in the PRT market make the assessment of the provider’s creditworthiness critical, yet considerably more difficult. Among these developments[2] are:

- Entry of new annuity providers that have not been tested through an economic cycle. Examples include several entities backed by private equity companies. Links to related articles can be found after our conclusion.

- Re-insurance of annuities with off-shore insurance companies that may not be required to set aside as much capital as U.S.-based insurance companies. Some of these re-insurance companies may also be affiliated with or dependent upon the annuity provider, further increasing the risk.

- Providers investing in riskier assets to support the beneficiaries’ payments. This may include less liquid, higher credit risk or more opaque investment structures including structured credit (CLO’s), asset-backed securities, private fixed income placements, subordinated debt, or even the stock of affiliated companies.

Naturally, the qualitative nature of the above can be hotly debated, particularly given the opaqueness and financial engineering often involved. Fortunately, the bond market provides a clear, quantitative measure of an issuer’s default risk – specifically, its credit spread. We use these observable spreads to take a market-based approach in an effort to assist fiduciaries conducting PRT transactions.

Using standard “bond-math,” we translate spread differences between insurers into the implied cost that beneficiaries bear to individual insurance companies. The results surprised us, with the range of credit risk costs reaching as high as 14% – in our opinion, a span that seems too large for all to be considered “safest.” With current annual PRT transactions running around $40b[3], this analysis suggests beneficiaries could be harmed by as much as $5b annually in the form of uncompensated credit risk to lower-quality insurers.

Fiduciary Obligation When Choosing the “Safest Available” Annuity Provider

The selection of an annuity provider in a PRT transaction is a fiduciary act under the Employee Retirement Income Security Act (ERISA) and is largely governed by Interpretive Bulletin 95-1 (commonly referred to as simply “95-1” or the “safest available annuity” criteria, the latter being language directly from the bulletin). The guidance, included in its entirety in Appendix A, expressly states that:

“a fiduciary must evaluate a number of factors relating to a potential annuity provider’s claims paying ability and creditworthiness.”

In particular, items #1 and #3 of the DOL’s delineation focus a fiduciary’s attention on the “quality and diversification” of the insurer’s portfolio and the level of “capital and surplus” of the insurer. Importantly, the Department continues to warn that “Reliance solely on ratings provided by insurance rating services would not be sufficient to meet [the creditworthiness] requirement.”[4]

The Case for a Market-based Measure of 95-1

Though much data is available on insurance company portfolios, capital ratios, lines of business, etc., insurance company balance sheets and legal structures can be exceedingly complex and difficult to penetrate. Recent innovations, like the use of Bermudian reinsurers and sidecars, have only increased this opaqueness.

So, faced with these challenges, how can a fiduciary assess potential PRT providers and meet its duties? 95-1 cleverly references what is commonly referred to as the “prudent expert standard.” Specifically, the guidance:

“requires a fiduciary to act with the care, skill, prudence and diligence under the prevailing circumstances that a prudent person acting in a like capacity and familiar with such matters would use.”

As NISA has always been a more-efficient-markets-than-not sort of firm, looking at market pricing for comparable investments/policies would clearly align well with the prudent expert concept – after all, the market is a competitive environment of a multitude of experts seeking to maximize their risk-adjusted outcomes. In fact, one could argue this market price is singularly sufficient for assessing the credit risk of an insurer, as all other information (rating, capital structure, portfolio quality, etc.) is available to all market participants, and therefore presumably embedded in the price.

The Market’s Wide Range of “Creditworthiness”

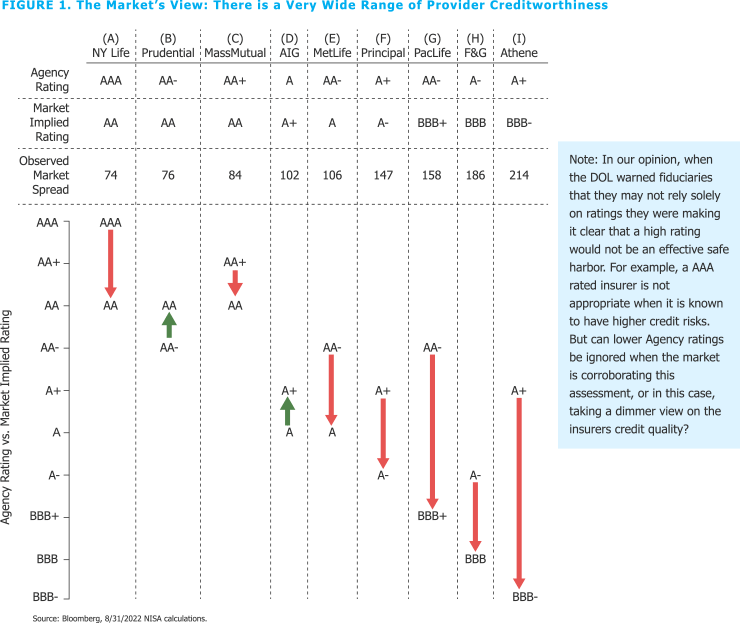

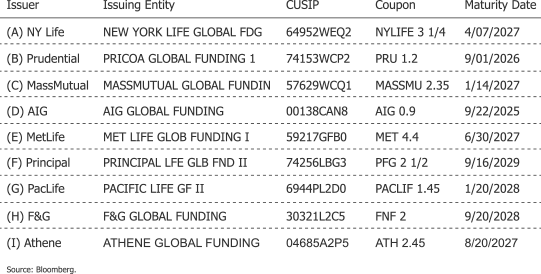

The bond market provides a ready-made measure of creditworthiness – a bond’s spread over U.S. Treasuries. That is, the additional compensation an investor demands to accept the credit risk of holding a bond from a particular issuer vs. the United States government. For example, if “Issuer X” is trading 100 bps[5] over U.S. Treasuries and “Issuer Y” is trading 175 bps over U.S. Treasuries, the market has deemed that Issuer Y is a greater credit risk than Issuer X and, all else equal, demands an additional compensation of 75 bps of return annually. Accordingly, if we examine the traded spread of the bonds of various insurers, we can observe the market’s assessment of their relative credit risk. (Relative seems important as the word “safest” connotes a relative comparison). We report these spreads in Figure 1 for insurers that commonly participate in the PRT market.[6]

It is immediately apparent that the market assigns a wide range of creditworthiness to this group of insurers, with a whopping 140 bps span between the lowest and highest credit risk. But is a 140 bps span a big deal? To help answer this question, we report the agency credit rating of each security.[7] Not surprisingly, there is an inverse relationship between spread and rating – that is, a higher spread is typically associated with a lower rating. We can also use the reported spread to estimate the market’s implied rating for each issuer by comparing the spread of a given issuer to the entire corporate bond market and “assigning” the rating level that most closely matches the bond’s traded spread. The “Market Implied Rating” row in Figure 1 provides this estimate, and again shows a surprisingly large range of effective ratings – a full seven notches from AA to BBB-.

It is important to note that ideally the bonds used in this analysis would be the exact issuing entity of the annuity or an entity that is pari passu to the issuer.[7] Given the intricate nature of many insurers and which entities issue in the public markets, that may not always be possible. Accordingly, we have made our best efforts to do that. Either way, we believe our analysis is instructive and can be adjusted for different issuing entities as needed.[9]

Defining the Economic Credit Risk Loss to Beneficiaries

Spreads are measured in basis points, and basis points seem small. But their seemingly diminutive stature belies the fact that when applied to long-dated promises – bonds, annuities, etc., – they are a really big deal. For example, simple bond math tells us that if a 10-year duration[10] bond’s spread moves by, say 20 basis points, the bond’s value will change by 2% in price.

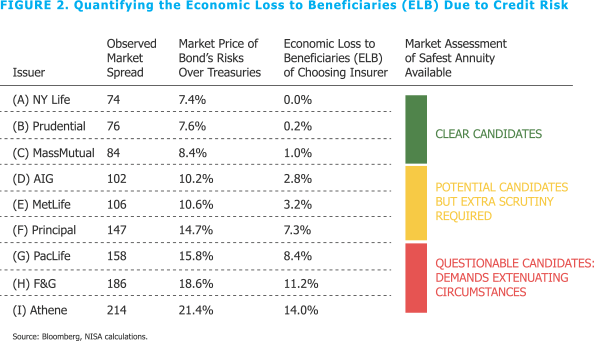

But there is another way to think about a bond spread. If a bond’s spread is multiplied by the duration of that bond, the result is approximately the present value of what an investor demands to be paid for accepting the credit and other risks associated with that bond. We perform this exercise on the insurance issuers in Figure 2.[11]

The disparity of the results in Figure 2 is quite striking. In particular, by the market’s assessment of relative credit risk, the spread between the safest and the least safe is 14%! Recall, a beneficiary’s benefit is fixed. They are not the recipient of the additional spread associated with the riskier entity. Accordingly, we define the:

Economic Loss to Beneficiaries (ELB) due to Credit Risk = Market price of risk for chosen insurer minus market price of risk of safest available insurer.

Moreover, as we move down the list of PRT insurers (ranked by quality), we believe it gets increasingly tenuous to argue a given insurer is indeed “safest available.”

If anything, the estimates in Figure 2 likely understate the relative risks to beneficiaries. The market spread on the bonds is set by the marginal buyer. It is reasonable to assume that the marginal buyer of these portfolios has a very well diversified portfolio where this holding represents a tiny portion of the overall portfolio – capital market theory 101. However, for the typical annuitant, their pension is likely to be a significant portion of their net worth. Accordingly, if they had a choice, they would need to assign an additional charge to each insurer that represents the idiosyncratic risk they are accepting. That charge would of course be a direct function of the risks measured above, further exacerbating the range of creditworthiness.

Using the Economic Loss to Beneficiaries to Aid Annuity Bidding

One natural conclusion from Figure 2 is to exclude insurers that have an Economic Loss to Beneficiaries (ELB) larger than a threshold amount. This approach would be a natural application of the guidance from 95-1.

But fiduciaries could also use the ELB methodology to adjust the bidding process to correct for this range of creditworthiness and therefore include a wider range of bidders. Once again, 95-1 provides useful guidance here:

“The Department recognizes that there are situations where it may be in the interest of the participants and beneficiaries to purchase other than the ‘safest available annuity.’ Such situations may occur where the safest available annuity is only marginally safer, but disproportionately more expensive than competing annuities, and the participants and beneficiaries are likely to bear a significant portion of that increased cost. For example, where the participants in a terminating pension plan are likely to receive, in the form of increased benefits, a substantial share of the cost savings that would result from choosing a competing annuity, it may be in the interest of the participants to choose the competing annuity.” [Emphasis added]

So, let’s begin with an unrealistic example. What if “Insurer I” was actually the lowest bidder, say by 14%? The guidance above would suggest they could be chosen provided:[12] 1. it is deemed insurer A is indeed only “marginally” safer and 2. the beneficiaries receive a “substantial share of the cost savings” in the form of increased benefits.

If we assume 1. is satisfied, then if insurer “I” is required to increase benefits by approximately 14%, they could be awarded the contract. Of course, they would adjust their bid, presumably by the exact amount of the benefit increase, 14%.[13] Curiously, this would make their bid exactly the same as the “safest available.”

This methodology could be taken a bit too far — we are not suggesting every insurer’s bid needs to be adjusted by exactly the spread difference. For example, insurer A and B have a spread difference of 2 bps. This can easily be explained away by bond market differences (e.g., the liquidity of reference bonds) or other 95-1 considerations (e.g., administrative prowess). But larger spread differences need to be accounted for, in our opinion.

A more realistic example would be that I bids, say 5% below A. Accordingly, one interpretation of clause (d) of 95-1 would be that “I” would need to increase the benefits paid by 5%. We would argue that takes a very limited view of “cost savings” of I’s bid. The cost savings to the plan are indeed 5%. But the “increased costs” that the beneficiaries are “likely to bear” is still the economic cost of 14% vs. the “safest available” bidder based on market credit risk pricing. Importantly, the beneficiaries bearing this risk are not the recipient of the 5% cost savings. So irrespective of the level of “I’s” bid, the appropriate adjustment to the benefits would be approximately 14% (relative to the safest bid) to satisfy clause (d) of 95-1.

Separate Accounts Do Not Equal “Safest Available”

Frequently, PRT transactions are executed via insurance company separate accounts.[14] Again, 95-1 is instructive on this point and says the fiduciary should consider:

“The structure of the annuity contract and guarantees supporting the annuities, such as the use of separate accounts.”

This additional level of protection is an understandable demand from the fiduciaries and is quite commonplace in larger transactions. But does the use of a separate account invalidate the results of Figure 2 and absolve a fiduciary from evaluating the ELB associated with a given insurer? We think not for two reasons:

- The backstop for the separate account is the insurer’s general account assets and associated capital. So, higher credit risk insurers have a lower quality ultimate “[guarantee] supporting the annuities,” per 95-1’s specific guidance. Accordingly, the ELB calculation in Figure 1 is relevant to the assessment of the riskiness of the separate account’s safety, albeit as a measure of contingent risk. That is, the risk to the beneficiaries contingent upon the separate account assets not being able to satisfy the assumed liabilities. Using this assessment of the security provided by the separate account would lead fiduciaries to use an adjusted (i.e., smaller) estimate of the calculated ELB.

- The argument above represents the bare minimum credit risk adjustment in the presence of separate accounts. It stands to reason that an insurer, on average, will build a portfolio in a separate account with a similar credit quality as their general account.[15] If that is approximately the case for each bidding insurer, then the risk measures above apply both to the separate account and the general account. The use of a separate account will indeed improve the credit risk of all the insurers, assuming each is willing to offer that additional safeguard. Calculating the adjusted ELB is outside the scope of this paper, but the results would be ordinally ranked the same as Figure 1, albeit with a smaller range.

Even if the separate account is expected to be higher quality than the insurer’s general account for some reason, how can the fiduciaries be comfortable it will remain so? For example, if “I” suggests to fiduciaries that the separate account credit risk will be more akin to insurers A-C, then perhaps using the ELB calculations as only a contingent measure of risk may be acceptable. But importantly, the separate account insurance contract would need to include investment guidelines that would preclude the insurer from investing in the riskier style associated with its general account. This would be difficult language to draft in a manner that provides high confidence to fiduciaries.

A Brief Word with the Plan Sponsor

We can calculate ELB estimates, make adjustments for separate accounts, etc. But, put simply, the credit spread on any issuer is the market’s assessment of the likelihood of default and the attendant credit losses in that event. Returning our attention to Figures 1 and 2, a sponsor can view these tables as the market’s assessment of the relative likelihood that their past employees and spouses are involved in a credit event with the chosen insurer. While the sponsor does not choose the specific annuity provider, these tables suggest sponsors should carefully appoint the fiduciaries who do so.

Conclusion

Purchasing an annuity for pension beneficiaries is a consequential act that requires the utmost care and due diligence from the fiduciaries involved. We believe that the readily available bond market pricing of credit risk provides fiduciaries with an extremely useful, if not outright necessary, tool to evaluate potential annuity providers. To cavalierly ignore the collective wisdom of the multitude of market participants who seek to price credit risk daily would seem imprudent, in our opinion.

Based on current measures, we find a wide range of default risk as measured by the market – up to 14% – for common PRT providers. For those fiduciaries responsible for identifying the “safest available” insurers per DOL 95-1, we argue this is too large of a range to ignore. Remedies include reducing the list of potential providers to those insurers that can more comfortably be grouped as all “safest available” or requiring lower quality insurers to increase benefit amounts by an amount that provides pensioners the appropriate compensation for the credit risk they are forced to accept. The consequences of not doing so are large. Given the current size of the PRT market, $5b or more is at risk annually to leak from pension beneficiaries in the form of uncompensated credit risk.

Related Articles

“Apollo, KKR, Ares and the Bermudan CLO Arbitrage,” RiskNet 3/14/22.

“Senators Grill Regulators on Private Equity’s Control of Life Insurers,” Life Annuity Specialist 9/9/22.

“Apollo’s Lucrative But Controversial Bet On Insurance,” Financial Times 10/31/18.

Appendix A

Highlighted text is referenced in description above.

2509.95-1 Interpretive bulletin relating to the fiduciary standards under ERISA when selecting an annuity provider for a defined benefit pension plan.

(a) Scope. This Interpretive Bulletin provides guidance concerning certain fiduciary standards under part 4 of title I of the Employee Retirement Income Security Act of 1974 (ERISA), 29 U.S.C. 1104–1114, applicable to the selection of an annuity provider for the purpose of benefit distributions from a defined benefit pension plan (hereafter “pension plan”) when the pension plan intends to transfer liability for benefits to an annuity provider. For guidance applicable to the selection of an annuity provider for benefit distributions from an individual account plan see 29 CFR 2550.404a-4.

(b) In General. Generally, when a pension plan purchases an annuity from an insurer as a distribution of benefits, it is intended that the plan’s liability for such benefits is transferred to the annuity provider. The Department’s regulation defining the term “participant covered under the plan” for certain purposes under title I of ERISA recognizes that such a transfer occurs when the annuity is issued by an insurance company licensed to do business in a State. 29 CFR 2510.3-3(d)(2)(ii). Although the regulation does not define the term “participant” or “beneficiary” for purposes of standing to bring an action under ERISA § 502(a), 29 U.S.C. 1132(a), it makes clear that the purpose of a benefit distribution annuity is to transfer the plan’s liability with respect to the individual’s benefits to the annuity provider.

Pursuant to ERISA section 404(a)(1), 29 U.S.C. 1104(a)(1), fiduciaries must discharge their duties with respect to the plan solely in the interest of the participants and beneficiaries. Section 404(a)(1)(A), 29 U.S.C. 1104(a)(1)(A), states that the fiduciary must act for the exclusive purpose of providing benefits to the participants and beneficiaries and defraying reasonable plan administration expenses. In addition, section 404(a)(1)(B), 29 U.S.C. 1104(a)(1)(B), requires a fiduciary to act with the care, skill, prudence and diligence under the prevailing circumstances that a prudent person acting in a like capacity and familiar with such matters would use.

(c) Selection of Annuity Providers. The selection of an annuity provider for purposes of a pension benefit distribution, whether upon separation or retirement of a participant or upon the termination of a plan, is a fiduciary decision governed by the provisions of part 4 of title I of ERISA. In discharging their obligations under section 404(a)(1), 29 U.S.C. 1104(a)(1), to act solely in the interest of participants and beneficiaries and for the exclusive purpose of providing benefits to the participants and beneficiaries as well as defraying reasonable expenses of administering the plan, fiduciaries choosing an annuity provider for the purpose of making a benefit distribution must take steps calculated to obtain the safest annuity available, unless under the circumstances it would be in the interests of participants and beneficiaries to do otherwise. In addition, the fiduciary obligation of prudence, described at section 404(a)(1)(B), 29 U.S.C. 1104(a)(1)(B), requires, at a minimum, that plan fiduciaries conduct an objective, thorough and analytical search for the purpose of identifying and selecting providers from which to purchase annuities. In conducting such a search, a fiduciary must evaluate a number of factors relating to a potential annuity provider’s claims paying ability and creditworthiness. Reliance solely on ratings provided by insurance rating services would not be sufficient to meet this requirement. In this regard, the types of factors a fiduciary should consider would include, among other things:

(1) The quality and diversification of the annuity provider’s investment portfolio;

(2) The size of the insurer relative to the proposed contract;

(3) The level of the insurer’s capital and surplus;

(4) The lines of business of the annuity provider and other indications of an insurer’s exposure to liability;

(5) The structure of the annuity contract and guarantees supporting the annuities, such as the use of separate accounts;

(6) The availability of additional protection through state guaranty associations and the extent of their guarantees. Unless they possess the necessary expertise to evaluate such factors, fiduciaries would need to obtain the advice of a qualified, independent expert. A fiduciary may conclude, after conducting an appropriate search, that more than one annuity provider is able to offer the safest annuity available.

(d) Costs and Other Considerations. The Department recognizes that there are situations where it may be in the interest of the participants and beneficiaries to purchase other than the safest available annuity. Such situations may occur where the safest available annuity is only marginally safer, but disproportionately more expensive than competing annuities, and the participants and beneficiaries are likely to bear a significant portion of that increased cost. For example, where the participants in a terminating pension plan are likely to receive, in the form of increased benefits, a substantial share of the cost savings that would result from choosing a competing annuity, it may be in the interest of the participants to choose the competing annuity. It may also be in the interest of the participants and beneficiaries to choose a competing annuity of the annuity provider offering the safest available annuity is unable to demonstrate the ability to administer the payment of benefits to the participants and beneficiaries. The Department notes, however, that increased cost or other considerations could never justify putting the benefits of annuitized participants and beneficiaries at risk by purchasing an unsafe annuity.

In contrast to the above, a fiduciary’s decision to purchase more risky, lower-priced annuities in order to ensure or maximize a reversion of excess assets that will be paid solely to the employer-sponsor in connection with the termination of an over-funded pension plan would violate the fiduciary’s duties under ERISA to act solely in the interest of the plan participants and beneficiaries. In such circumstances, the interests of those participants and beneficiaries who will receive annuities lies in receiving the safest annuity available and other participants and beneficiaries have no countervailing interests. The fiduciary in such circumstances must make diligent efforts to assure that the safest available annuity is purchased.

Similarly, a fiduciary may not purchase a riskier annuity solely because there are insufficient assets in a defined benefit plan to purchase a safer annuity. The fiduciary may have to condition the purchase of annuities on additional employer contributions sufficient to purchase the safest available annuity.

(e) Conflicts of Interest. Special care should be taken in reversion situations where fiduciaries selecting the annuity provider have an interest in the sponsoring employer which might affect their judgment and therefore create the potential for a violation of ERISA § 406(b)(1). As a practical matter, many fiduciaries have this conflict of interest and therefore will need to obtain and follow independent expert advice calculated to identify those insurers with the highest claims-paying ability willing to write the business.

Appendix B

The table below lists the specific reference bond for each policy issuing entity. Ideally, we would have chosen a security with an approximate 10-year maturity as that horizon more closely aligns with typical PRT liabilities. Due to a dearth of issuance at that maturity for many of the issuers, we chose instead securities with approximately five years to maturity. Given the typically upward sloping nature of credit curves, we would argue this approach leads to more favorable treatment of lower quality credits.

[1]A pension risk transfer is when a defined-benefit pension plan sponsor seeks to remove some or all of its obligation to pay guaranteed retirement income or post-retirement benefits to plan participants by purchasing annuities from an insurance company.

[4]DOL’s admonishment seems almost prescient, given that the bulletin was issued in 1995. If other regulators had taken a similar approach prior to 2007/2008, perhaps GFC would have played out differently, if at all.

[5]One basis point equals 0.01% of yield, so 100 bps equals 1%.

[6]Insurers chosen are based on “U.S. Pension Risk Transfer (PRT) Update,” AON March 2022, who were identified as mid- or large-market participants and have issued securities at the policy level for the institutional fixed income market.

[7]The reported rating is the median rating of Moody’s, S&P and Fitch.

[8]Data as of 8/31/2022. Source: Bloomberg. See Appendix B for the exact issuing entities and reference bonds.

[9]For example, you could inspect the credit quality of the portfolio beneath the issuing entity under an insurer and compare it to the credit quality of the portfolio under a different issuing entity of the same parent to get a sense of the relative quality, and therefore, spread adjustment needed.

[10]A 10-year duration was chosen as it is 1.) a round number and 2.) a reasonable proxy for the duration of typical settled pension liabilities.

[11]We make a simplifying assumption in this calculation and ignore convexity. Of course, for convexity to matter the yield differential must be quite large, thus reinforcing our point. For context, the convexity impact on Issuer I would be around 1%.

[12] This paper is not legal advice, so there may be additional considerations.

[13]The word “substantial” could be used to argue for an adjustment less than the full ELB, but fiduciaries should be wary to deviate far from this estimate, in our opinion, as any deviation from the estimated credit risk cost represents uncompensated risk to the beneficiaries.

[14]A “separate account” is a separate set of financial statements held by a life insurance company, maintained to report assets and liabilities for specific products that are separated from the insurer’s general account. https://content.naic.org/cipr-topics/separate-accounts

[15] The lower-rated insurance companies must issue in the open market at the spreads reported above. The attraction of the PRT market is in no small part due to their ability to borrow (i.e., buy liabilities) at lower effective spreads because they are deemed similar to higher quality, lower-spread insurers.