How Actuarial Assumptions Cloud Perceptions of Annuity Buyout Pricing

Introduction

“We’re settling the retiree obligation with Prudential approximately at par, which is unprecedented.”

- Robert O’Keef, Motorola Solutions’ treasurer, 9/25/20141

“We’re very pleased with the returns on the [annuity buyout] business we’ve written this year. Those returns are thoroughly consistent with our corporate return objectives… of 13% to 14%.”

– Stephen Pelletier, head of Prudential Insurance’s U.S. businesses, 11/06/20142

Buyout Process and Premium

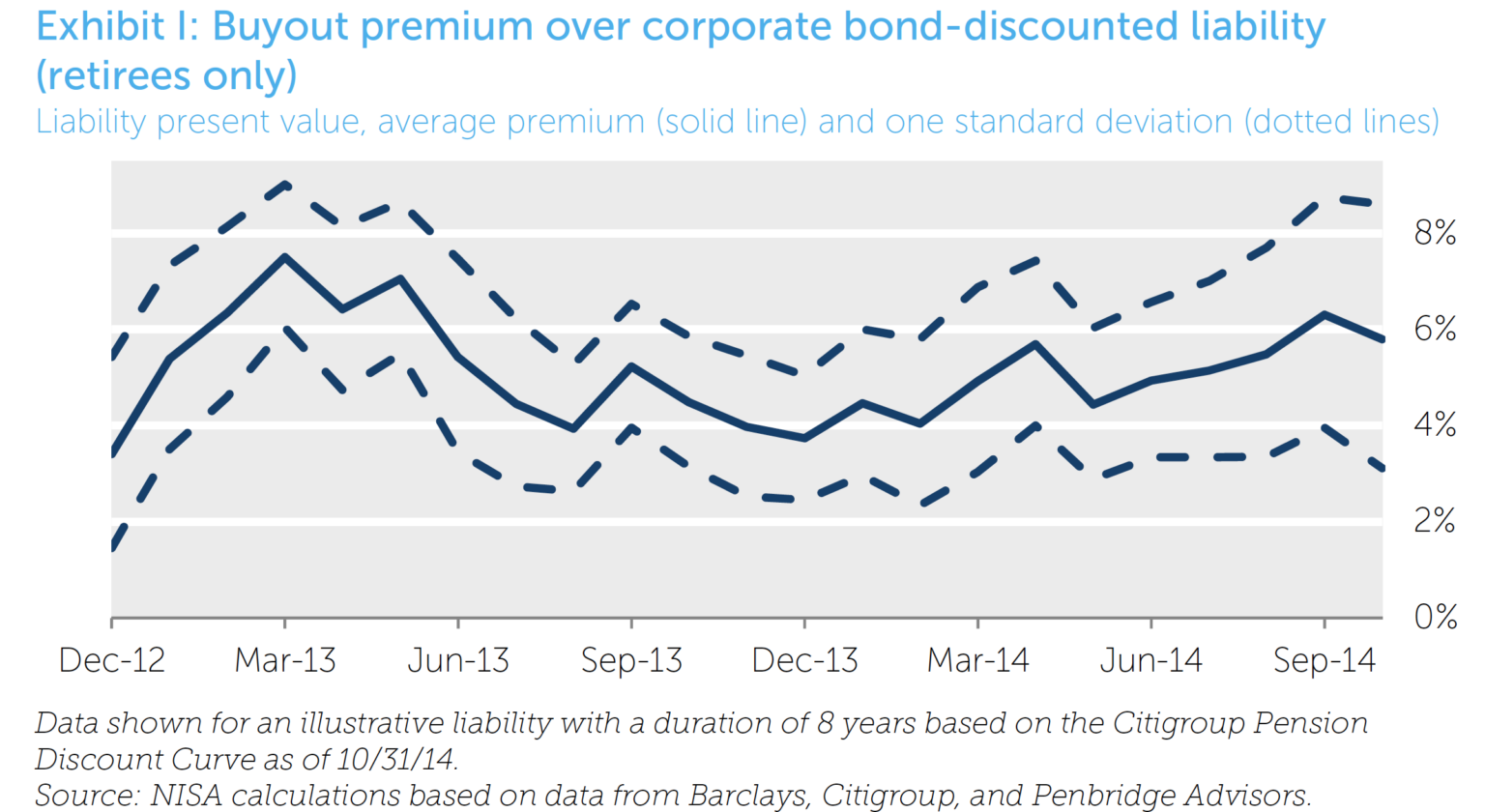

“The statements that you're referencing about par… are all in relation to a plan sponsor's GAAP valuation of its pension liability… We … arrive at our customized view, from the ground up, of the economic risks that we're taking on in a given transaction … based on information that ranges far beyond the Society of Actuaries mortality tables. It includes industry data, it includes our own extensive experience in managing mortality risk, and it includes the — especially in the large case market — the extensive census data that a plan sponsor supplies us on their retirees. So we're very, very confident in the approach that we take in that regard.”

– Stephen Pelletier, head of Prudential Insurance’s U.S. businesses, 11/06/20144

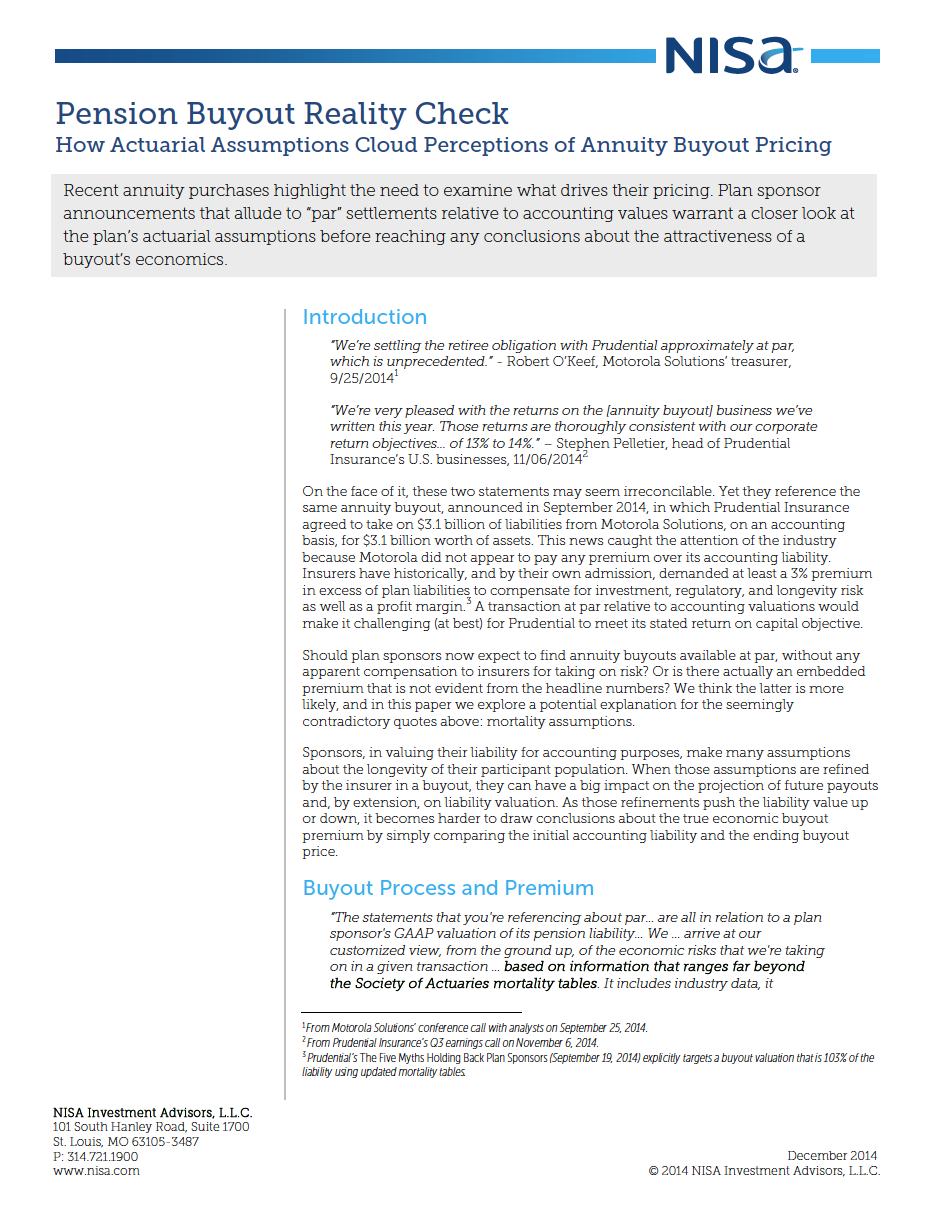

It becomes harder to draw conclusions about the true economic buyout premium by simply comparing the initial accounting liability and the ending buyout price.

Uncovering the Premium

While this annuity buyout would occur at par on paper, the savings to the sponsor would be more accounting optics than economic reality.